Questions

Sheridan Company had the following stockholders’ equity accounts on January 1, 2020: Common Stock ($5 par)...

Sheridan Company had the following stockholders’ equity accounts on January 1, 2020: Common Stock ($5 par) $514,500, Paid-in Capital in Excess of Par—Common Stock $181,440, and Retained Earnings $103,110. In 2020, the company had the following treasury stock transactions.

| Mar. 1 | Purchased 5,850 shares at $8 per share. | ||

| June. 1 | Sold 1,120 shares at $12 per share. | ||

| Sept. 1 | Sold 1,320 shares at $11 per share. | ||

| Dec. 1 | Sold 1,180 shares at $6 per share. |

a) Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2020, for net income.

b) Open accounts for (1) Paid-in Capital from Treasury Stock, (2) Treasury Stock, and (3) Retained Earnings. (Post to T-accounts.) (Post entries in the order of journal entries presented in the previous part.)

c) Prepare the stockholder's equity section at Dec 31, 2020

In: Accounting

The cost of equipment purchased by Waterway, Inc., on June 1, 2020, is $102,900. It is...

The cost of equipment purchased by Waterway, Inc., on June 1,

2020, is $102,900. It is estimated that the machine will have a

$10,500 salvage value at the end of its service life. Its service

life is estimated at 7 years, its total working hours are estimated

at 46,200, and its total production is estimated at 616,000 units.

During 2020, the machine was operated 7,200 hours and produced

66,000 units. During 2021, the machine was operated 6,600 hours and

produced 57,600 units.

Compute depreciation expense on the machine for the year ending

December 31, 2020, and the year ending December 31, 2021, using the

following methods. (Round depreciation per unit to 2

decimal places, e.g. 15.25 and final answers to 0 decimal places,

e.g. 45,892.)

|

2020 |

2021 |

|||||

| (a) | Straight-line | $ | $ | |||

| (b) | Units-of-output | $ | $ | |||

| (c) | Working hours | $ | $ | |||

| (d) | Sum-of-the-years'-digits | $ | $ | |||

| (e) | Double-declining-balance (twice the straight-line rate) | $ | $ |

In: Accounting

The cost of equipment purchased by Bramble, Inc., on June 1, 2020, is $92,400. It is...

The cost of equipment purchased by Bramble, Inc., on June 1,

2020, is $92,400. It is estimated that the machine will have a

$8,400 salvage value at the end of its service life. Its service

life is estimated at 7 years, its total working hours are estimated

at 42,000, and its total production is estimated at 600,000 units.

During 2020, the machine was operated 6,900 hours and produced

63,200 units. During 2021, the machine was operated 6,320 hours and

produced 55,200 units.

Compute depreciation expense on the machine for the year ending

December 31, 2020, and the year ending December 31, 2021, using the

following methods. (Round depreciation per unit to 2

decimal places, e.g. 15.25 and final answers to 0 decimal places,

e.g. 45,892.)

|

2020 |

2021 |

|||||

| (a) | Straight-line |

$ |

$ |

|||

| (b) | Units-of-output |

$ |

$ |

|||

| (c) | Working hours |

$ |

$ |

|||

| (d) | Sum-of-the-years'-digits |

$ |

$ |

|||

| (e) | Double-declining-balance (twice the straight-line rate) |

$ |

$ |

In: Accounting

Preparing a Schedule of Cost of Finished Goods Manufactured, Cost of Goods Sold Schedule, and an...

Preparing a Schedule of Cost of Finished Goods Manufactured, Cost of Goods Sold Schedule, and an Income Statement.

Listed below is information related to RRR Co’s manufacturing activities for the month of October 2020.

Ending Balance Beginning Balance

Materials Inventory $197,000 $ 211,000

Work in Process Inventory 59,000 78,000

Finished Goods Inventory 91,000 82,000

During October 2020, RRR Company purchased $105,000 of raw materials and incurred direct labor costs of $77,100. The company applies overhead at a rate of 45% of direct labor cost. General, selling and administrative costs amounted to $36,100, and the company sold 39,400 units of its product at a price of $37.84 each.

Directions:

- Prepare RRR’s schedule of cost of finished goods manufactured for October 2020.

- Determine RRR’s cost of goods sold during October 2020.

- Prepare RRR’s income statement for the month ended October 31,2020 (ignoring interest expense and income taxes)

In: Accounting

a. Make the necessary journal entries for the following transactions:

a. Make the necessary journal entries for the following transactions:

i. On 1 April 2020, Mr Syed has invested $20,000 cash to set up a restaurant business called Nasi Kandar Penang.

ii. On 2 April 2020 Nasi Kandar restaurant purchased cooking utensils costing $8,000 by signing a 2-month, 12%, $8,000 note payable.

iii. On 8 April the restaurant received $3,000 cash from a client as a down payment for an event that is expected to be held on 15 May 2020.

iv. On 9 April Mr Syed paid rental for the business premise for the month of April, $1,000.

v. On the same day, Mr Syed paid $1,200 for a one-year business insurance policy which will expire on 10 March 2021.

b. Post each of the above entry to the respective accounts in the general=al ledger.

c. Prepare a trial balance at 30 April 2020.

In: Accounting

The cost of equipment purchased by Sheffield, Inc., on June 1, 2020, is $100,800. It is...

The cost of equipment purchased by Sheffield, Inc., on June 1, 2020, is $100,800. It is estimated that the machine will have a $8,400 salvage value at the end of its service life. Its service life is estimated at 7 years, its total working hours are estimated at 46,200, and its total production is estimated at 660,000 units. During 2020, the machine was operated 7,080 hours and produced 64,900 units. During 2021, the machine was operated 6,490 hours and produced 56,600 units. Compute depreciation expense on the machine for the year ending December 31, 2020, and the year ending December 31, 2021, using the following methods. (Round depreciation per unit to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 45,892.) 2020 2021 (a) Straight-line $ $ (b) Units-of-output $ $ (c) Working hours $ $ (d) Sum-of-the-years'-digits $ $ (e) Double-declining-balance (twice the straight-line rate) $ $

In: Accounting

On 1 March 2020, Black Ltd was registered and offered 500 000 ordinary shares to the...

On 1 March 2020, Black Ltd was registered and offered 500 000

ordinary shares to the public at an issue price of $6, payable as

follows:

$3 on application

$2 on allotment

$1 on final call

The share issue was successful, and all the allotment money was

received by the due date. The final call was made on 1 November

with money due by 30 November. All money was received on the due

date except for the holder of 15 000 shares who failed to meet the

final call.

On 7 December 2020, as provided for in the constitution, the

directors decided to forfeit these shares. They were reissued, on

15 December 2020, as paid to $6 for $5.6 cash. Costs of forfeiture

and reissue amounted to $4 000 and was paid on the same day. The

balance of the Forfeited Shares account was returned to the former

shareholder on 31 December 2020.

Prepare the journal entries to record the transactions of ABC Ltd for the events outlined above.

In: Accounting

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp

Construction Contract Accounting as per Percentage-of-Completion Method & Completed Contract Method.

Problem Four: Long-Term Contract

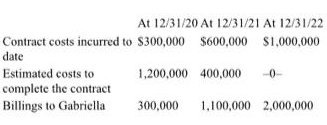

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp. for a total contract price of S2,000,000. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gabriella for 2020, 2021, and 2022.

Required:

a. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

b. Using the completed-contract method, how much profit or loss will be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

In: Accounting

On January 1, 2018, a machine was purchased for $117,500. The machine has an estimated salvage...

On January 1, 2018, a machine was purchased for $117,500. The machine has an estimated salvage value of $10,400 and an estimated useful life of 5 years. The machine can operate for 119,000 hours before it needs to be replaced. The company closed its books on December 31 and operates the machine as follows: 2018, 23,800 hrs; 2019, 29,750 hrs; 2020, 17,850 hrs; 2021, 35,700 hrs; and 2022, 11,900 hrs.

(a)

Compute the annual depreciation charges over the machine’s life assuming a December 31 year-end for each of the following depreciation methods. (Round answers to 0 decimal places, e.g. 45,892.)

| 1. | Straight-line Method |

$ |

||

| 2. | Activity Method | |||

| Year | ||||

| 2018 |

$ |

|||

| 2019 |

$ |

|||

| 2020 |

$ |

|||

| 2021 |

$ |

|||

| 2022 |

$ |

|||

| 3. | Sum-of-the-Years'-Digits Method | |||

| Year | ||||

| 2018 |

$ |

|||

| 2019 |

$ |

|||

| 2020 |

$ |

|||

| 2021 |

$ |

|||

| 2022 |

$ |

|||

| 4. | Double-Declining-Balance Method | |||

| Year | ||||

| 2018 |

$ |

|||

| 2019 |

$ |

|||

| 2020 |

$ |

|||

| 2021 |

$ |

|||

| 2022 |

$ |

In: Accounting

Carla Vista Corp. agreed to lease property from Sunland Corp. effective January 1, 2020, for an...

Carla Vista Corp. agreed to lease property from Sunland Corp. effective January 1, 2020, for an annual payment of $25,592, beginning January 1, 2020. The property is made up of land with a fair value of $104,000 and a two-storey office building with a fair value of $170,000 and a useful life of 25 years with no residual value. The implicit interest rate is 9%, the lease term is 25 years, and title to the property is transferred to Carla Vista at the end of the lease term. Prepare the required entries made by Carla Vista Corp. on January 1, 2020, and at its year end of December 31, 2020. Both Carla Vista and Sunland use ASPE.

(Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275.)

In: Accounting