Questions

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled...

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled $2,282,148 as follows.

| Work in process, November 1 | ||||

| Materials | $79,300 | |||

| Conversion costs | 48,600 | $127,900 | ||

| Materials added | 1,590,380 | |||

| Labor | 226,000 | |||

| Overhead | 337,868 |

Production records show that 34,600 units were in beginning work in

process 30% complete as to conversion costs, 661,100 units were

started into production, and 25,300 units were in ending work in

process 40% complete as to conversion costs. Materials are entered

at the beginning of each process.

Determine the equivalent units of production and the unit production costs for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25.)

|

Materials |

Conversion Costs |

|||

| Equivalent Units | ||||

| Cost per unit |

$ |

$ |

eTextbook and Media

Determine the assignment of costs to goods transferred out and in process.

|

Costs accounted for: |

||

|

Transferred out |

$ |

|

|

Work in process, November 30 |

||

|

Materials |

$ |

|

|

Conversion costs |

||

|

Total costs |

$ |

eTextbook and Media

Prepare a production cost report for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25 and other answers to 0 decimal places, e.g. 125.)

|

RIVERA COMPANY |

||||||||

|

Equivalent Units |

||||||||

|

Quantities |

Physical |

|

Conversion |

|||||

|

Units to be accounted for |

||||||||

|

Work in process, November 1 |

||||||||

|

Started into production |

||||||||

|

Total units |

||||||||

|

Units accounted for |

||||||||

|

Transferred out |

||||||||

|

Work in process, November 30 |

||||||||

|

Total units |

||||||||

|

|

|

Conversion |

|

|||||

|

Unit costs |

||||||||

|

Total Costs |

$ |

$ |

$ |

|||||

|

Equivalent units |

||||||||

|

Unit costs |

$ |

$ |

$ |

|||||

|

Costs to be accounted for |

||||||||

|

Work in process, November 1 |

$ |

|||||||

|

Started into production |

||||||||

|

Total costs |

$ |

|||||||

|

Cost Reconciliation Schedule |

||||||||

|

Costs accounted for |

||||||||

|

Transferred out |

$ |

|||||||

|

Work in process, November 30 |

||||||||

|

Materials |

$ |

|||||||

|

Conversion costs |

||||||||

|

Total costs |

$ |

|||||||

In: Accounting

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled...

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled $2,282,148 as follows.

| Work in process, November 1 | ||||

| Materials | $79,300 | |||

| Conversion costs | 48,600 | $127,900 | ||

| Materials added | 1,590,380 | |||

| Labor | 226,000 | |||

| Overhead | 337,868 |

Production records show that 34,600 units were in beginning work in

process 30% complete as to conversion costs, 661,100 units were

started into production, and 25,300 units were in ending work in

process 40% complete as to conversion costs. Materials are entered

at the beginning of each process.

Determine the equivalent units of production and the unit production costs for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25.)

|

Materials |

Conversion Costs |

|||

| Equivalent Units | ||||

| Cost per unit |

$ |

$ |

eTextbook and Media

Determine the assignment of costs to goods transferred out and in process.

|

Costs accounted for: |

||

|

Transferred out |

$ |

|

|

Work in process, November 30 |

||

|

Materials |

$ |

|

|

Conversion costs |

||

|

Total costs |

$ |

eTextbook and Media

Prepare a production cost report for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25 and other answers to 0 decimal places, e.g. 125.)

|

RIVERA COMPANY |

||||||||

|

Equivalent Units |

||||||||

|

Quantities |

Physical |

|

Conversion |

|||||

|

Units to be accounted for |

||||||||

|

Work in process, November 1 |

||||||||

|

Started into production |

||||||||

|

Total units |

||||||||

|

Units accounted for |

||||||||

|

Transferred out |

||||||||

|

Work in process, November 30 |

||||||||

|

Total units |

||||||||

|

|

|

Conversion |

|

|||||

|

Unit costs |

||||||||

|

Total Costs |

$ |

$ |

$ |

|||||

|

Equivalent units |

||||||||

|

Unit costs |

$ |

$ |

$ |

|||||

|

Costs to be accounted for |

||||||||

|

Work in process, November 1 |

$ |

|||||||

|

Started into production |

||||||||

|

Total costs |

$ |

|||||||

|

Cost Reconciliation Schedule |

||||||||

|

Costs accounted for |

||||||||

|

Transferred out |

$ |

|||||||

|

Work in process, November 30 |

||||||||

|

Materials |

$ |

|||||||

|

Conversion costs |

||||||||

|

Total costs |

$ |

|||||||

In: Accounting

Static Budget versus Flexible Budget The production supervisor of the Machining Department for Hagerstown Company agreed...

Static Budget versus Flexible Budget

The production supervisor of the Machining Department for Hagerstown Company agreed to the following monthly static budget for the upcoming year:

| Hagerstown Company Machining Department Monthly Production Budget |

|

| Wages | $208,000 |

| Utilities | 19,000 |

| Depreciation | 32,000 |

| Total | $259,000 |

The actual amount spent and the actual units produced in the first three months in the Machining Department were as follows:

| Amount Spent | Units Produced | |||

| May | $245,000 | 68,000 | ||

| June | 235,000 | 62,000 | ||

| July | 226,000 | 56,000 | ||

The Machining Department supervisor has been very pleased with this performance because actual expenditures for May–July have been significantly less than the monthly static budget of 259,000. However, the plant manager believes that the budget should not remain fixed for every month but should “flex” or adjust to the volume of work that is produced in the Machining Department. Additional budget information for the Machining Department is as follows:

| Wages per hour | $14.00 |

| Utility cost per direct labor hour | $1.30 |

| Direct labor hours per unit | 0.20 |

| Planned monthly unit production | 74,000 |

a. Prepare a flexible budget for the actual units produced for May, June, and July in the Machining Department. Assume depreciation is a fixed cost. If required, use per unit amounts carried out to two decimal places.

| Hagerstown Company | |||

| Machining Department Budget | |||

| For the Three Months Ending July 31 | |||

| May | June | July | |

| Units of production | 68,000 | 62,000 | 56,000 |

| Wages | ? | ? | ? |

| Utilities | ? | ? | ? |

| Depreciation | ? | ? | ? |

| Total | ? | ? | ? |

| Supporting calculations: | |||

| Units of production | 68,000 | 62,000 | 56,000 |

| Hours per unit | ? | ? | ? |

| Total hours of production | ? | ? | ? |

| Wages per hour | ? | ? | ? |

| Total wages | ? | ? | ? |

| Total hours of production | ? | ? | ? |

| Utility costs per hour | ? | ? | ? |

| Total utilities | ? | ? | ? |

| May | June | July | |

| Total flexible budget | ? | ? | ? |

| Actual cost | ? | ? | ? |

| Excess of actual cost over budget | ? | ? | ? |

In: Accounting

Questions 15-20 are based on the following table of cost production at Betty's Bakery Quantity of...

Questions 15-20 are based on the following table of cost production at Betty's Bakery

| Quantity of Cakes | Fixed Cost | Variable Cost | Total Cost | Average Fixed Cost | AverageVariableCost | AverageTotalCost | MarginalCost |

| 1 | $13 | $38 | |||||

| 2 | $28 | ||||||

| 3 | $70 | ||||||

| 4 | $64 | ||||||

| 5 | $110 | ||||||

| 6 | $108 | ||||||

| 7 | $133 | ||||||

| 8 | $185 |

15. What is the fixed cost of production at Betty's Bakery?

a) $12

b) $20

c) $25

d) $51

16. What is the variable cost of producing 5 cakes at Betty's Bakery?

a) $64

b) $85

c) $90

d) $100

17. What is the total cost of producing 2 cakes at Betty's Bakery?

a) $48

b) $53

c) $58

d) $62

18. What is the average variable cost of producing 3 cakes at Betty's Bakery?

a) $14

b) $15

c) $16

d $17

19. What is the average fixed cost of producing 3 cakes at Betty's Bakery?

a) $1.67

b) $2.67

c) $5.33

d) $8.33

20. What is the marginal cost of the second cake at Betty's Bakery?

a) $14

b) $15

c) $28

d) $34

In: Economics

Question One High-Low Method, High—Low Method, Cost Formulas (LO 3) During the past year, the high...

Question One

High-Low Method, High—Low Method, Cost Formulas (LO 3)

During the past year, the high and low use of three different resources for Wilson Trucking occurred in July and April.

The resources are truck depreciation, fuel, and truck maintenance.

The number of kilometres travelled is the driver. The total costs of the three resources and the related number of truck kilometres are as follows:

Resource Truck Kilometres Total Cost ($)

Truck depreciation:

High 46,000,000 2,800,000

Low 32,400,000 2,800,000

Fuel:

High 46,000,000 1,610,000

Low 32,400,000 1,134,000

Truck maintenance:

High 46,000,000 1,797,200

Low 32,400,000 1,413,680

Required:

Use the high-low method to answer the following questions.

- What is the variable rate for truck depreciation? The fixed cost?

- What is the cost formula for truck depreciation?

- What is the variable rate for fuel? The fixed cost?

- What is the cost formula for fuel?

- What is the variable rate for truck maintenance? The fixed cost?

- What is the cost formula for truck maintenance?

- Using the three costs formulas that you developed, predict the cost of each resource in a month with 36,000.000 kilometres travelled.

- Describe the difference between a fixed cost and a variable cost.

In: Finance

Beetroots (Pty) Ltd is a company that buys fresh veggies in bulk and sell it direct...

Beetroots (Pty) Ltd is a company that buys fresh veggies in bulk and sell it direct to the public after packaging it in smaller quantities.

The following cost data is available for six months:

| Month | Kg Veggies | Total cost |

| January | 200 kg | $3 800 |

| February | 500 kg | $8 600 |

| March | 900 kg | $14 300 |

| April | 350 kg | $5 950 |

| May | 780 kg | $12 800 |

| June | 800 kg | $13 200 |

The financial manager is of the opinion that the total cost for the month is related t the quantity of veggies that is packaged (measured in kilograms).

Required:

1.1 Compile a cost formula (cost function) by making use of the High-Low method.

1.2 Compile a cost formula (cost function) by making use of the Least-Square method (Simple Regression Analysis). SHOW ALL CALCULATIONS

1.3 Explain why there is a difference between the cost formula according to the High-Low method and the cost formula according to the Least-Square method, and advise the best method to use.

1.4 Calculate the budgeted cost for July and August according to both cost formulas if the expected quantity of veggies that will be packaged is 950kg and 1 020kg respectively.

In: Accounting

1. According to most estimates, the size of the "underground" economy in the United States could...

1. According to most estimates, the size of the "underground" economy in the United States could be as large as

a. The “above-ground” economy

b. The economy of China

c. 10% of GDP

d. The state of Rhode Island

2. The GDP per capita tells us

a. The amount of output each person would get if the economic pie were sliced evenly.

b. The amount of output each worker would get if the economic pie were sliced evenly.

c. The ratio of the maximum amount of output any person gets to the minimum amount of output each person gets.

d. The median amount of output each person gets, adjusted for inequality.

3. In the early 1940s, military planners needed to know the size of the economy so they could determine

a. The size of the tax base in the case of war

b. How many tanks and planes the economy could produce

c. The military budget for the next five years

d. Whether military spending was too large

4. Government social benefits paid to individuals are

a. Known as transfer payments, and are counted as part of government consumption and investment

b. Known as transfer payments, and are typically used to fund personal consumption

c. Known as output of government, and are counted as pert government consumption and investment

d. Known as output of government, and are typically used to fund personal consumption

5. GDP is defined as the dollar value of __________ in a given year.

a. The total output of the economy

b. All outputs used in the economy

c. All intermediate and final goods produced in the economy

d. The total purchases made in the economy

6. In GDP calculations, the work of stay-at-home parents is

a. Counted only for equivalent hours

b. Not counted

c. Counted as intermediate inputs

d. Counted at 50%

7. Government consumption includes all

a. Salaries paid to factory workers

b. Fuel for nuclear submarines

c. Cola served in a company cafeteria

d. Pencils bought by a private university

8. Imports enter the calculation of GDP

a. With a positive sign

b. With a negative sign

c. As an addition to changes in private inventories

d. Through the personal consumption category

9. Which of the following is NOT an element of the underground economy?

a. Off the books babysitting

b. Illegal drug deals

c. Commissioned salespeople

d. Cash only under the table businesses

10. If gross domestic purchases are ________, then net exports are ________.

a. Greater than gross domestic product; greater than net imports

b. Equal to zero; also equal to zero

c. Greater than gross domestic product; positive

d. Less than gross domestic product; positive

11. Gross domestic product does NOT include

a. Personal consumption

b. Intermediate inputs

c. Residential investment

d. Net exports

12. If a foreign car manufacturer builds a plant in the United States, the new plant will

a. Increase U.S. GDP by the amount produced

b. Have no effect on GDP because it is a foreign company

c. Decrease U.S. GDP by the amount produced because of foreign ownership

d. Increase U.S. GDP by the net exports of the company

In: Economics

Which of the following costs is an example of a cost that remains the same in...

Which of the following costs is an example of a cost that remains the same in total as the number of units produced changes?

In: Accounting

Exercise 8-5 (Video) Schopp Corporation makes a mechanical stuffed alligator that sings the Martian national anthe...

Exercise 8-5 (Video)

Schopp Corporation makes a mechanical stuffed alligator that sings the Martian national anthem. The following information is available for Schopp Corporation's anticipated annual volume of 484,000 units.

| Per Unit | Total | |

|---|---|---|

| Direct materials | $6 | |

| Direct labor | $13 | |

| Variable manufacturing overhead | $16 | |

| Fixed manufacturing overhead | $2,904,000 | |

| Variable selling and administrative expenses | $12 | |

| Fixed selling and administrative expenses | $1,452,000 |

The company has a desired ROI of 25%. It has invested assets of $27,104,000.

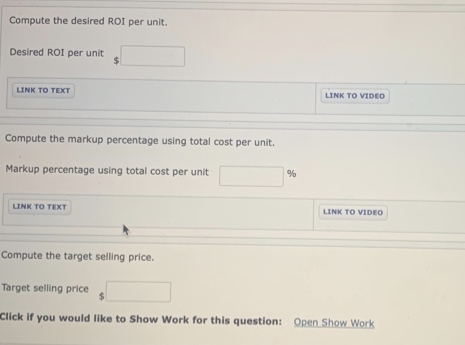

Compute the total cost per unit. Total cost per units $_______

Compute the desired ROI per unit. Desired ROI per units $ _______

In: Accounting

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on...

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

| Total machine-hours | 32,300 | |

| Total fixed manufacturing overhead cost | $ | 581,400 |

| Variable manufacturing overhead per machine-hour | $ | 2.00 |

Recently, Job T687 was completed with the following characteristics:

| Number of units in the job | 10 | |

| Total machine-hours | 40 | |

| Direct materials | $ | 630 |

| Direct labor cost | $ | 1,260 |

If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to:

In: Finance