Questions

Given the following information, prepare a Schedule C using 2019 rates. Denise operates her business under...

Given the following information, prepare a Schedule C using 2019 rates.

Denise operates her business under the name "Design by Denise." Her office is located at 2359 Dawnridge Drive, Houston, Texas 77025. The federal EIN for her business is 51- 4867579 and the principal business code is 541400. Denise, who materially participates in her business, has operated it profitably for 3 of the last 4 years and is fully "at risk" with respect to her investment. She also has filed all required Forms 1099.

In accounting for her business, Denise uses the cash method. For 2019, her records show the following income and expenses. She participated in James’s health insurance plan and did not have to pay any premiums.

Gross receipts (not reported on Form 1099) . . . . . . . . . . . . . . . . . . . . . . $90,000

Gross receipts (reported on Form 1099; payer was Bernice Ng’s Furnishings, EIN 68-8752318, nonemployee compensation) . . . . 25,000 Expenses:

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,000

Legal services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,500

Office expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,300

Equipment and machinery rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,800

Office rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,000

Taxes and licenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,400

Subscriptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500

In connection with her business, Denise often travels from her business location to the homes and offices of her clients, where she provides advice and expertise on interior design. During 2019, her written auto log shows that she drove her vehicle (a 2018 Mitsubishi Mirage that she purchased and put in service on May 13, 2017) 22,400 miles for business purposes, 3,800 miles for commuting, and 1,800 miles for personal purposes. Denise did not keep track of all her specific expenditures for the car and she wishes to deduct her auto expenses using the standard mileage rate for 2019. She has written evidence to support her mileage. The business car was available for use during off-duty hours, but she and her spouse also have another vehicle available for personal use.

Also in connection with her business, Denise purchased a Mac computer and HP laser color printer. The computer was purchased for $2,200 on November 10, 2019. The printer was purchased for $5,800 on September 30, 2019. Denise used both the computer and printer for business purposes at her office 85 percent of the time, and personal purposes 15 percent of the time, for which she has written evidence. Denise would like to deduct the maximum allowable amount on each of these assets.

In: Finance

Macroeconomics Chapter 7 Homework

The town of Cleanville lies next to a lake, which the residents of the town use for fishing, boating, and other recreational activities. Last year, two firms, Filth Inc. and Sludge Inc., built factories on the other side of the lake and have been dumping trash into it. Although some of the trash will dissipate naturally, the amount of trash the two firms emit is too much for the lake to handle. Right now, each firm dumps 40 pounds of trash in the lake each year (total of 80 pounds). Environmental scientists in Cleanville estimate that the lake can handle only 30 pounds of trash per year. The table below reports the marginal costs to the two firms of reducing trash.

| Pounds reduced | Filth Inc.’s marginal costs (in $1,000s) | Sludge Inc.’s marginal costs (in $1,000s) |

| 5 | 2 | 7 |

| 10 | 4 | 10 |

| 15 | 6 | 13 |

| 20 | 8 | 16 |

| 25 | 10 | 19 |

| 30 | 12 | 22 |

| 35 | 14 | 25 |

| 40 | 16 | 28 |

The marginal cost numbers tell us how much it would cost to reduce the marginal five pounds of trash. Therefore, Filth Inc.'s marginal cost of reducing the first 5 pounds is $2,000 and the next 5 pounds $4,000. Therefore, the total cost to reduce 10 pounds is $6,000.

Suppose the city council agrees with the scientists' estimates and orders each firm to reduce trash by 25 pounds. The total cost to reduce this amount of trash is $  .

.

Part 2

Suppose that after taking your economics course you visit Cleanville and hear about the city council's solution to reducing the trash. You think to yourself, “Haven’t these people learned some basic economics and the Coase theorem?" You gather some data, crunch some numbers, and go to the next city council meeting. You tell them that they should give each firm three permits. Each permit allows the firm to emit 5 pounds per year. Each firm can therefore emit 15 pounds per year, which means they would have to reduce the amount of trash they emit by 25 pounds.

One of the council members raises his hand and asks, "But that's what our proposal does. How is yours any different?"

You answer, "What makes my proposal different is that we allow the firms to buy or sell these permits." The city council is amazed at your insight and comments how much you learned in your econ class. They realize that after your proposal has been put into place, the total cost of getting rid of the 50 pounds of trash will fall to $  , the lowest total cost possible.

, the lowest total cost possible.

Part 3

Let’s see how the drop in total costs will come about. Filth Inc. and Sludge Inc. each start with three permits. If a firm does not buy a permit or sell one of its permits, it would need to reduce trash by 25 pounds. If it sells a permit, it would have to get rid of more trash, and if it buys a permit, it would have to get rid of less.

| Pounds reduced | Filth Inc.’s marginal costs (in $1,000s) | Sludge Inc.’s marginal costs (in $1,000s) |

| 5 | 2 | 7 |

| 10 | 4 | 10 |

| 15 | 6 | 13 |

| 20 | 8 | 16 |

| 25 | 10 | 19 |

| 30 | 12 | 22 |

| 35 | 14 | 25 |

| 40 | 16 | 28 |

Hector Sludge, the owner of Sludge Inc., calls Jordan Filth and tells her he has an offer she can't refuse (a little trash humor): "I will buy one of your permits for $14,000."

In: Economics

When is by-product/scrap cost considered in setting the predetermined overhead rate in a job order costing system? When is cost not considered?

When is by-product/scrap cost considered in setting the predetermined overhead rate in a job order costing system? When is cost not considered?

In: Accounting

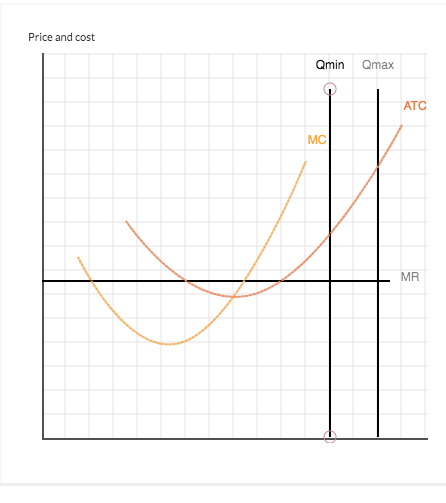

The graph below shows a particular firm's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves

The graph below shows a particular firm's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves, where the market is competitive. Suppose that a new management team is brought in and that this team is initially less concerned about maximizing profits than it is simply about making a profit. What range of production quantities will allow the firm to operate while earning a profit?

Give your answer by dragging the Qmin to Qmax lines into their correct positions. The output will need to lie somewhere betwen those limits.

To refer to the graphing tutorial for this question type, please click here.

In: Economics

Category Cost: Rent Monthly, cost $3000, Utilities Monthly $1100, Insurance Quarterly $1200, Property Taxes, annually $6000,...

Category Cost: Rent Monthly, cost $3000, Utilities Monthly $1100, Insurance Quarterly $1200, Property Taxes, annually $6000, Steel per shelf $9.00, forming per shelf $.25, Labor per shelf $.75 Price charged per shelf $20.00 This company will break even with monthly production of ____ units, and sales of __________

250; $5000

!0,000; $500

$5000; 250

500; $10,000

In: Finance

Date Items Cost Total Cost March 1 10 $120 $1,200 March 4 13 $115 $1,495 March...

Date Items Cost Total Cost

March 1 10 $120 $1,200

March 4 13 $115 $1,495

March 16 20 $105 $2,100

March 28 18 $100 $1,800

Total 61 $6,595

During the month, 20 of the items were sold. Identify which cost flow assumption would achieve the indicated result.

Group of answer choices

Higher net income

FIFO Weighted-Average LIFO

Lower net income

FIFO Weighted-Average LIFO

Higher Inventory on the Balance Sheet

FIFO Weighted-Average LIFO

Lower Inventory on the Balance Sheet

FIFO Weighted-Average LIFO

In: Accounting

Hermione Co. reported the information shown in Table 5-1. Table 5-1 Units Unit Cost Total Cost...

Hermione Co. reported the information shown in Table 5-1.

Table 5-1

|

Units |

Unit Cost |

Total Cost |

Units Sold |

|

|

Beginning inventory (Jan. 1) |

4 |

$400 |

$1,600 |

|

|

Sale (Mar. 1) |

3 |

|||

|

Purchase (Apr. 15) |

4 |

405 |

1,620 |

|

|

Sale (June 22) |

3 |

|||

|

Purchase (Oct. 11) |

2 |

425 |

850 |

|

|

Total Units in ending inventory |

10 4 |

$4,070 |

6 |

10. Refer to Table 5-1. Assume that Hermione uses perpetual LIFO. The cost of the ending inventory is:

A. $1,700.

B. $1,670.

C. $1,655.

D. $1,600.

11. Refer to Table 5-1. Assume that Hermione uses perpetual weighted average costing. The average cost of a unit sold on June 22 is:

A. $400.

B. $402.50.

C. $404.

D. $405.

12. Refer to Table 5-1. Assume that Hermione uses perpetual FIFO. The entry to record the March 1 credit sale at a sale price of $800 per unit would include all of the following EXCEPT a:

A. credit to Inventory, $2,400.

B. debit to Cost of Goods Sold, $1,200.

C. debit to Accounts Receivable, $2,400.

D. credit to Sales Revenue, $2,400.

13. Refer to Table 5-1. Assume that Hermione uses periodic FIFO. The cost of goods sold for the period is:

A. $2,470.

B. $2.410.

C. $1,660.

D. $1,600.

In: Accounting

Quantity Total Revenue Marginal Revenue Total Cost Marginal Cost Fixed Costs ATC Average Fixed Costs Average...

|

Quantity |

Total Revenue |

Marginal Revenue |

Total Cost |

Marginal Cost |

Fixed Costs |

ATC |

Average Fixed Costs |

Average Variable Costs |

|

0 |

0 |

- |

10 |

- |

10 |

- |

- |

- |

|

1 |

8 |

24 |

14 |

24 |

||||

|

2 |

16 |

34 |

10 |

17 |

||||

|

3 |

24 |

42 |

8 |

14 |

||||

|

4 |

32 |

49 |

7 |

12.25 |

||||

|

5 |

40 |

57 |

8 |

11.4 |

||||

|

6 |

48 |

67 |

10 |

11.17 |

||||

|

7 |

56 |

81 |

14 |

11.57 |

||||

|

8 |

64 |

99 |

18 |

12.38 |

||||

|

9 |

72 |

123 |

24 |

13.67 |

-

1b. At a price of $14, what is the profit-maximizing number the firm should produce each day? (note: Do not necessarily just look at economic profit. Look at marginal revenue and marginal cost. Pick the one where MR=MC).

2. 1f. What is the ATC associated with the profit-maximizing number you chose in 1b (and 1d)? (round to the nearest penny)

3. 2b. At a price of $10, What is the profit-maximizing number the firm should produce each day? (Again, do not necessarily just look at economic profit. Look at marginal revenue and marginal cost.)

4. 2c. What is the ATC associated with the profit-maximizing number you chose in 2b? (round to the nearest penny)

5. 2f. What are the total variable costs associated with the profit-maximizing number you chose in 2b? (round to the nearest penny)

In: Economics

Part one: Calculate cost per unit. (Round answer to 2 decimal places) Weighted-average cost per unit...

Part one: Calculate cost per unit. (Round answer to 2 decimal places) Weighted-average cost per unit

Part two: Calculate ending inventory, cost of goods sole, and gross profit under each of the following methods: LIFO, FIFO, and Average Cost.

Part three: Calculate gross profit rate under each of the following methods: LIFO, FIFO, and Average-cost (Round answers to 1 decimal place)

You are provided with the following information for Cheyenne

Inc. for the month ended June 30, 2019. Cheyenne uses the periodic

method for inventory.

|

Date |

Description |

Quantity |

Unit Cost or |

|||||

|---|---|---|---|---|---|---|---|---|

| June | 1 | Beginning inventory | 39 | $ 39 | ||||

| June | 4 | Purchase | 137 | 43 | ||||

| June | 10 | Sale | 112 | 72 | ||||

| June | 11 | Sale return | 16 | 72 | ||||

| June | 18 | Purchase | 58 | 45 | ||||

| June | 18 | Purchase return | 8 | 45 | ||||

| June | 25 | Sale | 63 | 77 | ||||

| June | 28 | Purchase | 31 | 49 | ||||

In: Accounting

Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods.

Penn Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1:

Required

Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods.

In: Accounting