Questions

which of the following statements about the loanable funds market is (are) correct? (x) When the...

which of the following

statements about the loanable funds market is (are) correct?

(x) When the supply of loanable funds shifts to the right then the

equilibrium real interest rate decreases and the equilibrium

quantity of loanable funds decreases.

(y) When the demand for loanable funds shifts to the right then the

equilibrium real interest rate increases and the equilibrium

quantity of loanable funds increases.

(z) If the demand for loanable funds shifts to the right and the

supply of loanable funds shifts to the left, then the real interest

rate rises.

A. (x), (y) and (z)

B. (x) and (y) only

C. (x) and (z) only

D. (y) and (z) only

E. (y) only

Which of the following

would be consistent with a decrease in the U.S. real interest

rate?

(x) A French citizen purchases a German bond instead of the U.S.

bond they had intended to purchase.

(y) A U.S. manufacturer decides it can now afford to borrow funds

to expand its production facility.

(z) Jane, a U.S. citizen, deposits more into her savings account at

the local bank and decides against the purchase of a bond from a

Canadian business.

A. (x), (y) and (z)

B. (x) and (y) only

C. (x) and (z) only

D. (y) and (z) only

E. (x) only

which of the following

statements is (are) correct?

(x) In the open economy macroeconomic model of the U.S. economy,

net capital outflow is equal to the quantity of U.S. dollars

supplied in the foreign exchange market.

(y) In the market for foreign currency exchange, the amount of U.S.

net capital outflow desired at each real interest rate represents

the quantity of U.S. dollars supplied for the purpose of buying

foreign assets.

(z) In the market for foreign currency exchange, the amount of U.S.

net exports desired at each real exchange rate represents the

quantity of U.S. dollars demanded for the purpose of buying U.S.

goods and services by foreign residents

A. (x), (y) and (z)

B. (x) and (y) only

C. (x) and (z) only

D. (y) and (z) only

E. (x) only

In: Economics

1a. Assume that unfavorable weather conditions decrease the supply of tomatoes. Noting that tomatoes are the...

1a. Assume that unfavorable weather conditions decrease the supply of tomatoes. Noting that tomatoes are the key ingredient in the production of tomato sauce, and that spaghetti is a complement for tomato sauce, which of the following would you expect?

A The price of tomatoes would increase, the supply of tomato sauce would decrease, and the demand for spaghetti would increase.

B The price of tomatoes would increase, the supply of tomato sauce would decrease, and the demand for spaghetti would decrease.

C The price of tomatoes would increase, the supply of tomato sauce would increase, and the demand for spaghetti would decrease.

D The price of tomatoes would decrease, the supply of tomato sauce would increase, and the demand for spaghetti would increase.

E The price of tomatoes would increase, the supply of tomato sauce would increase, and the demand for spaghetti would increase.

1B Rory has a store in which he sells two goods: castor oil and Snickers bars. He has found that: (a) castor oil is a “bad” (i.e., more is worse than less), and a Snickers bar is a “good” (i.e., more is better than less); and (b) the amount of castor oil consumed is negatively related to consumer income, and the amount of Snickers bars consumed is positively related to consumer income. Based on this information, it can be concluded that

A A Snickers bar is an inferior good.

B The indifference curves for castor oil and Snickers bars have convex shapes.

C The Engel curve for Snickers bars is positively sloped.

D The Engel curve for castor oil is positively sloped.

E Castor oil is a normal good.

1c.Suppose the exchange rate between the U.S. dollar and Canadian dollar changes from 1 U.S. dollar = 1.20 Canadian dollar to 1 U.S. dollar = 1.40 Canadian dollar. As a result of the indicated change in the exchange rate,

A Canadian exports to the U.S. would decrease, and U.S. exports to Canada would decrease.

B Canadian exports to the U.S. would decrease, and U.S. exports to Canada would increase.

C there would be no change in both Canadian exports to the U.S. and U.S. exports to Canada.

D Canadian exports to the U.S. would increase, and U.S. exports to Canada would decrease.

E Canadian exports to the U.S. would increase, and U.S. exports to Canada would increase.

1D A researcher has found that car buyers are less inclined to purchase the “classic edition” of a particular car after they observe that other individuals have already purchased it. This suggests that the “class edition” of the car

A is an economic “bad”.

B is subject to negative network externalities.

C is an inferior good.

D has a positively sloped demand curve.

E is subject to positive network externalities.

In: Economics

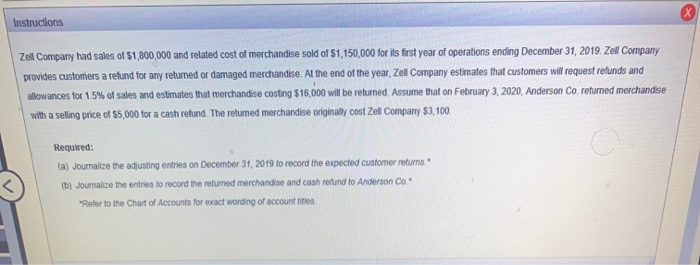

Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 2019.

Instructions

Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 2019. Zell Company provides customers a refund for any returned or damaged merchandise. At the end of the year, Zel Company estimates that customers will request refunds and allowances for 1.5% of sales and estimates that merchandise costing $16,000 will be returned. Assume that on February 3, 2020, Anderson Co. returned merchandise with a selling price of $5,000 for a cash refund. The returned merchandise originally cost Zell Company $3,100

Required:

(a) Journalize the adjusting entries on December 31, 2019 to record the expected customer returns

(b) Journalize the entries to record the returned merchandise and cash refund to Anderson Co

"Refer to the Chart of Accounts for exact wording of accounts

In: Accounting

Qualitative Characteristics Foundational Principles Relevance (Feedback & Predictive) Economic entity Representational Faithfulness: complete, neutral, free from...

|

Qualitative Characteristics |

Foundational Principles |

|

Relevance (Feedback & Predictive) |

Economic entity |

|

Representational Faithfulness: complete, neutral, free from bias |

Control |

|

Comparability (consistency) |

Revenue recognition and realization |

|

Verifiability |

Matching |

|

Timeliness |

Periodicity |

|

Understandability |

Monetary Unit |

|

Going Concern |

|

|

Historical Cost |

|

|

Fair Value |

|

|

Full Disclosure |

ONLY ONE ANSWER FOR EACH.

|

|

|

|

|

|

|

|

|

In: Accounting

Company X has issued a total of 1000 shares as of 2020.1.30, comprising 700 common shares,...

Company X has issued a total of 1000 shares as of 2020.1.30, comprising 700 common shares, 100 non-debt preferred shares and 200 redeemable preferred shares.

1. What is the capital of this company?(the reason and calculation process together)

Company X repaid redeemable preferred shares in cash on March 1 and merged the shares 2:1 on April 1.

2. What is the capital as of April 2? ( the reason and calculatuon process together)

Company C carried out a paid-in capitsl increase wirh the payment deadline of April 15. A took over 60 shares by subscription to the same paid-in capital increase, and transferred 60 shares that were acquires to B on April 14 due to the urgent need for money.

3. After the settlement of accounts in 2020, who will receive the dividends?

In: Accounting

OCloud Corporation’s suite of software products and services provides secure and scalable solutions for global companies....

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

In: Accounting

OCloud Corportation's suite of software products and services provides secure and scalable solutions for global companies....

OCloud Corportation's suite of software products and services provides secure and scalable solutions for global companies. The following is an extract from the company's 2020 and 2019 comparative income statements and statement of financial position. The market price of OCloud's common shares was $41.12 and $38.20 on June 30, 2020, and June 30, 2019, respectively. OCloud declared dividends per common share of $0.476 and $0.412 for 2020 and 2019, respectively.

OCLOUD CORPORTATION

Years Ended June 30, 2020 and 2019

(in thousands)

| Comparative Income Statement | 2020 | 2019 |

| Total revenues | $2,276,557 | $1,828,767 |

| Total cost of revenues | 766,850 | 569,174 |

| Total operating expenses | 1,169,419 | 874,972 |

| Net Income | $1,009,546 | $300,221 |

| Statement of Financial Position | 2020 | 2019 |

| Total assets | $7,490,691 | $5,175,412 |

| Total liabilities | 3,960,177 | 3,762,299 |

| Common share capital | 1,436,263 | 821,380 |

| Total shareholders' equity | $3,530,514 | $1,413,113 |

| Weighted average number of common shares outstanding | 253,195 | 242,375 |

Calculate the return on shareholders' equity for OCloud in 2020. Note that OCloud's articles of incorporation authorize only common shares. The average return for the shares listed on the Toronto Stock Exchange in a comparable period was 19.8%. (Round answer to 1 decimal place)

Return on shareholders' equity:___%

Calculate earnings per share for the years 2020 and 2019 (Round answers to 2 decimal places)

2020 2019

Earnings per share $ per share $ per share

Calculate the dividend payout ratio and the dividend yield for 2020 and 2019. (Round answers to 1 decimal place)

2020 2019

Dividend payout ratio % %

Dividend yield % %

In: Accounting

RAMBLE CORPORATION Statement of Financial Position December 31 Assets 2020 2019 Cash $78,000 $34,800 Accounts receivable...

| RAMBLE CORPORATION Statement of Financial Position |

||||||

| December 31 | ||||||

| Assets | 2020 | 2019 | ||||

| Cash | $78,000 | $34,800 | ||||

| Accounts receivable | 104,400 | 70,800 | ||||

| Inventory | 159,600 | 97,200 | ||||

| FV-OCI investments in shares | 75,600 | 100,800 | ||||

| Land | 78,000 | 123,600 | ||||

| Equipment | 468,000 | 516,000 | ||||

| Accumulated depreciation—equipment | (140,400 | ) | (103,200 | ) | ||

| Goodwill | 148,800 | 207,600 | ||||

| Total | $972,000 | $1,047,600 | ||||

| Liabilities and Shareholders’ Equity | ||||||

| Accounts payable | $14,400 | $61,200 | ||||

| Dividends payable | 18,000 | 38,400 | ||||

| Notes payable | 264,000 | 402,000 | ||||

| Common shares | 318,000 | 150,000 | ||||

| Retained earnings | 345,600 | 340,800 | ||||

| Accumulated other comprehensive income | 12,000 | 55,200 | ||||

| Total | $972,000 | $1,047,600 | ||||

Additional information:

| 1. | Net income for the fiscal year ending December 31, 2020, was $22,800. | |

| 2. | In March 2020, a plot of land was purchased for future construction of a plant site. In November 2020, a different plot of land with original cost of $103,200 was sold for proceeds of $114,000. | |

| 3. | In April 2020, notes payable amounting to $168,000 were retired through the issuance of common shares. In December 2020, notes payable amounting to $30,000 were issued for cash. | |

| 4. | FV-OCI investments were purchased in July 2020 for a cost of $18,000. By December 31, 2020, the fair value of Bramble’s portfolio of FV—OCI investments decreased to $75,600. No FV—OCI investments were sold in the year. | |

| 5. | On December 31, 2020, equipment with an original cost of $48,000 and accumulated depreciation to date of $14,400 was sold for proceeds of $25,200. No equipment was purchased in the year. | |

| 6. | Dividends on common shares of $38,400 and $18,000 were declared in December 2019 and December 2020, respectively. The 2019 dividend was paid in January 2020 and the 2020 dividend was paid in January 2021. Dividends paid are treated as financing activities. | |

| 7. | A loss on impairment was recorded in the year to reflect a decrease in the recoverable amount of goodwill. No goodwill was purchased or sold in the year. |

(a)

Prepare a statement of cash flows using the indirect method for

cash flows from operating activities.

| RAMBLE CORPORATION Statement of Financial Position |

||||||

| December 31 | ||||||

| Assets | 2020 | 2019 | ||||

| Cash | $78,000 | $34,800 | ||||

| Accounts receivable | 104,400 | 70,800 | ||||

| Inventory | 159,600 | 97,200 | ||||

| FV-OCI investments in shares | 75,600 | 100,800 | ||||

| Land | 78,000 | 123,600 | ||||

| Equipment | 468,000 | 516,000 | ||||

| Accumulated depreciation—equipment | (140,400 | ) | (103,200 | ) | ||

| Goodwill | 148,800 | 207,600 | ||||

| Total | $972,000 | $1,047,600 | ||||

| Liabilities and Shareholders’ Equity | ||||||

| Accounts payable | $14,400 | $61,200 | ||||

| Dividends payable | 18,000 | 38,400 | ||||

| Notes payable | 264,000 | 402,000 | ||||

| Common shares | 318,000 | 150,000 | ||||

| Retained earnings | 345,600 | 340,800 | ||||

| Accumulated other comprehensive income | 12,000 | 55,200 | ||||

| Total | $972,000 | $1,047,600 | ||||

Additional information:

| 1. | Net income for the fiscal year ending December 31, 2020, was $22,800. | |

| 2. | In March 2020, a plot of land was purchased for future construction of a plant site. In November 2020, a different plot of land with original cost of $103,200 was sold for proceeds of $114,000. | |

| 3. | In April 2020, notes payable amounting to $168,000 were retired through the issuance of common shares. In December 2020, notes payable amounting to $30,000 were issued for cash. | |

| 4. | FV-OCI investments were purchased in July 2020 for a cost of $18,000. By December 31, 2020, the fair value of Bramble’s portfolio of FV—OCI investments decreased to $75,600. No FV—OCI investments were sold in the year. | |

| 5. | On December 31, 2020, equipment with an original cost of $48,000 and accumulated depreciation to date of $14,400 was sold for proceeds of $25,200. No equipment was purchased in the year. | |

| 6. | Dividends on common shares of $38,400 and $18,000 were declared in December 2019 and December 2020, respectively. The 2019 dividend was paid in January 2020 and the 2020 dividend was paid in January 2021. Dividends paid are treated as financing activities. | |

| 7. | A loss on impairment was recorded in the year to reflect a decrease in the recoverable amount of goodwill. No goodwill was purchased or sold in the year. |

(a)

Prepare a statement of cash flows using the indirect method for

cash flows from operating activities.

In: Accounting

The U.S. economy is mired in the worst economic downturn since the Great Recession of 2008/2009....

The U.S. economy is mired in the worst economic downturn since the Great Recession of 2008/2009. The decline in U.S. GDP in the first three months of this year was nearly the equal of that during the Great Recession. Real output is expected to fall by six times as much in the second quarter of 2020.

The Federal Reserve Board pledged to provide the liquidity needed to prop up the failing economy. The Fed has bought treasury bills and mortgage-backed securities in large lots. And many economists supported the Fed’s actions.

A. Classical economists who looked at the demand side of the economy (as described in Froyen ch. 6 and ch. 7) have been especially supportive of the Fed’s decision. Using a money market diagram, an investment schedule, and an IS/LM diagram illustrate and explain why these classical economists expected the Fed’s actions to be highly effective.

B. At same time, both Keynesian economists (as described in Froyen ch. 6 and ch. 7) and classical economists who place their emphasis on the supply-side of the economy (as described in Froyen ch. 3 and ch. 4) are far more doubtful that the Fed’s actions would effectively bring an end to the current economic crisis.

Explain and illustrate why these Keynesian economists believed that the Fed’s actions by themselves are likely to be ineffective (again using a money market diagram, an investment schedule and an IS/LM diagram).

Then explain and illustrate why classical economists who put their emphasis on the supply-side of the economy also expected that the Fed’s action would be ineffective and are already voicing their concerns about the possible return of inflation.

C. Finally explain and illustrate what these two sets

of critics (classical supply-siders and Keynesians) would do

differently or in addition to the Fed’s actions.

In: Economics

Measures of Disease Frequency (Chapter 2) In 2009, President Obama launched a nationwide initiative to end...

Measures of Disease Frequency (Chapter 2)

In 2009, President Obama launched a nationwide initiative to end homelessness in the U.S. by 2020. The homeless are a vulnerable population with limited access to health care and poor health outcomes. In order to allocate sufficient federal and local resources to eliminate homelessness, U.S. cities conduct an annual survey to estimate the number of homeless persons living within major cities. The City of Boston’s Emergency Shelter Commission (ESC) conducted a survey of homelessness on the night of January 25, 2017. Volunteers counted the number of homeless persons living on the streets, in emergency shelters for individuals or families, in domestic violence programs, in residential mental health or substance abuse programs, transitional housing, and in specialized programs.

1. Which of the following best describes the homeless population in the City of Boston?

a. Dynamic population

b. Fixed population

2. Which of the following describes the homeless population that took part in the ESC survey on January 25th?

a. Dynamic population

b. Fixed population

3. The 2015 Homeless Census counted 3,456 homeless persons in Boston. The 2016 homeless census counted 3,384 homeless persons in Boston. The size of the population in Boston was 665,984 in 2015 and 673,184 in 2016. From 2015-2016, did the burden of homelessness:

a. Increase

b. Decrease

c. Stay the same (2015: .52%, 2016 0.50%)

d. Cannot determine from this information

4. What do you consider to be the biggest limitation in the homeless survey and why?

a. Time of year (winter)

b. Survey conducted one time annually, not more frequently

c. Survey unlikely captured all homeless persons

d. Survey captures prevalence, not incidence of homelessness

In: Math