Questions

Calculation of cost basis of a used machine

A used machine with a purchase price of $41,809, requiring an overhaul costing $9,833, installation costs of $6,615, and special acquisition fees of $32,417, would have a cost basis of

a. $139,539

b. $90,674

c. $51,642

d. $41,809

In: Accounting

An investment has an installed cost of $673.658

An investment has an installed cost of $673.658. The cash flows over the four year life of the investment are projected to be $228,701, $281,182, $219,209, and $190,376.

Requirement 1:

If the discount rate is zero, what is the NPV? (Do not round intermediate calculations.)

Requirement 2:

If the discount rate is infinite, what is the NPV? (Do not round intermediate calculations. Negative amount should be indicated by a minus sign.)

Requirement 3:

At what discount rate is the NPV just equal to zero? (Do not round intermediate calculations. Round your answer to 2 decimal places (e.g. 32.16).)

In: Finance

What is the appropriate cost of capital for the project?

Empress Inc. has issued a bond with a face value of $1,000 and an interest rate of 13% to fund a new project. The bond is secured by the cash flows from the project, which will be $950 with a probability of 60% and $1,200 otherwise. Assume risk neutrality.

What is the appropriate cost of capital for the project?

In: Finance

Consider the following “Total Cost” function:

Consider the following “Total Cost” function:

Total Cost = 4Q3 – 204Q2 + 700Q + 2500

a.) Solve for the “inflection point” of this function ( show your work).

b.) Which Q has the LOWEST “Marginal Cost” ( give a numerical answer; briefly

explain how your answer to a.) is relevant).

In: Economics

Different Cost Classifications for Different Purposes

Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month

Required:

1. With respect to cost classifications for preparing financial statements:

a. What is the total product cost?

b. What is the total period cost?

2. With respect to cost classifications for assigning costs to cost objects:

a. What is total direct manufacturing cost?

b. What is the total indirect manufacturing cost?

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

4. With respect to cost classifications for predicting cost behavior:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold?

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to make the additional unit?

In: Accounting

Cost-push inflation is a situation in which the:

1.

Cost-push inflation is a situation in which the:

short-run aggregate supply curve shifts rightward.

short-run aggregate supply curve shifts leftward.

aggregate demand curve shifts leftward.

aggregate demand curve shifts rightward

2. Which of the following tends to make aggregate demand decrease by more than the amount that consumer spending decreases?

the interest rate effect

the crowding-out effect

the wealth effect

the multiplier effect

3.

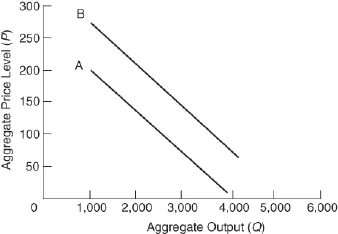

(Figure: Aggregate Demand Shift) Which of the following may be an explanation for the shift in aggregate demand from line A to line B? |

Prices fall and increase real wealth.

Consumer confidence declines and consumption spending falls.

Interest rates fall and boost investments.

Goods and services become less competitive and exports fall.

In: Economics

The cost of reworking defective components is an example of:

The cost of reworking defective components is an example of:

appraisal costs.

prevention costs.

internal failure costs.

external failure costs.

In: Accounting

Cost Approach is NOT applicable in which case?

Cost Approach is NOT applicable in which case?

Select one:

A. Old properties.

B. New construction.

C. Unique property (church or landmark)

D. Insurable value appraisal

In: Finance

_______ cost based mainly on customer service.

Fill in the blanks:

_______ cost based mainly on customer service.

In: Operations Management

If the market price exceeds _______ cost, profit will be _______

If the market price exceeds _______ cost, profit will be _______

In: Economics