Questions

Bill and Alice Savage, husband and wife and both age 42, have the following transactions during...

Bill and Alice Savage, husband and wife and both age 42, have the following transactions during 2016:

a. They sold their old residence on January 28, 2016, for $380,000. The basis of their old residence, purchased in 2006, was $70,000. The selling expenses were $20,000. On May 17, 2016, they purchased and moved into another residence costing $150,000.

b. On April 28, 2016, they sold for $8,000 stock that Alice had received as a gift from her mother, who had purchased the stock for $10,000 in 2011. Her mother gave Alice the stock on November 15, 2015, when the fair market value was $9,400.

c. On May 24, 2016, Bill sold for $21,000 stock inherited from his father. His father died on June 14, 2015, when the fair market value of the stock was $9,000. Bill's father paid $7,000 for the stock in 2009.

d. On August 11, 2016, they sold a personal automobile for $8,000; basis of the automobile was $20,000 and it was purchased in 2013.

e. They had a carryover and other stock transactions as follows:

| LTCL carryover from 2015 | ($7,000) |

|---|---|

| STCG | $2,000 |

| LTCG | $3,500 |

Bill had a salary of $40,000 and Alice had a salary of $28,000. They have no children. They paid state income taxes of $3,200, sales tax of $400, federal income taxes of $15,000, and property taxes of $1,800. In addition, they contributed $5,600 to their church and paid $4,000 interest on their home mortgage.

Compute bill and Alice's taxable income for 2016.

In: Accounting

Which of the following is not allowed as an itemized deduction? Gambling losses to the...

Which of the following is not allowed as an itemized deduction?

Gambling losses to the extent of gambling winnings

A subscription to the Wall Street Journal to help with personal investment decisions.

All are allowed as itemized deductions.

Interest expense on a $800,000 loan incurred in 2016 to buy a principal residence

Cash donation to a church

Fred and Lucy are married, ages 33 and 32, and together have AGI of $120,000 in 2019. They have four dependents and file a joint return. They pay $5,000 for a high deductible health insurance policy and contribute $2,600 to a qualified Health Savings Account.

During the year, they paid the following amounts for medical care: $9,200 in doctor and dentist bills and hospital expenses, and $3,000 for prescribed medicine and drugs. In October 2019, they received an insurance reimbursement of $4,400 for the hospitalization. They expect to receive an additional reimbursement of $1,000 in January 2020.

Determine the maximum itemized deduction allowable for medical expenses in 2019.

Use 7.5% of AGI not 10% for 2019.

$12,800

$0

$800

$3,800

$9,200

Brad, who would otherwise qualify as Faye’s dependent, had gross income of $9,000 during the year. Faye, who had

AGI of $120,000, paid the following medical expenses this year:

Cataract operation for Brad $ 5,400

Brad’s prescribed contact lenses 1,800

Faye’s doctor and dentist bills 12,600

Prescribed drugs for Faye 2,550

Total $22,350

Faye has a medical expense deduction of:

use 7.5% of AGI again....

$13,350

$10,350

$3,150

$4,940

In: Accounting

ECO - 252 - Macroeconomics 5. Classify each of the following as employed, unemployed, or not...

ECO - 252 - Macroeconomics

5. Classify each of the following as employed, unemployed, or not in the labor force.

a. The government decides to increase the minimum wage. Kirk loses his job as a result and reads through the classifieds for employment offers.

b. The Wildflour, a local bakery, experiences a decrease in sales caused by a slowing down of the economy. Due to the decrease in sales, the bakery lays off their assistant baker, John. John decides to enroll full time in a culinary school to learn new skills.

c. Sharon spent the last 13 years raising her children but she is now ready to go back to work. She started to look for a job but has not found anything yet.

d. Tao is looking for a job. He turned down a couple of offers because they did not let him use the skills he has recently acquired.

e. Alice was laid off from her job at the auto plant because a recession reduced the demand for cars. She immediately starts looking for a job but to keep busy she spends more time volunteering at her local church.

f. Karen, a software engineer, lost her job when the start-up company she was working for went bankrupt. She interviewed at five companies but was not called back. As a result she gave up looking for a job.

g. Jonathan currently works at the Federal Reserve Bank in Kansas City, but has no prospect of being promoted. He begins a job search and is called in his Kansas City office by Boeing based in Seattle.

In: Economics

Please Complete the federal tax return below for 2016. Use Form 1040, Schedule A, Schedule B,...

Please Complete the federal tax return below for 2016. Use Form 1040, Schedule A, Schedule B, and Form 2441 to complete this return. You can print these forms off of the IRS website by going to irs.gov and searching for the forms. Take a screenshot of each form. Please only answer if you have the completed forms...........Lucy and Ricky Van have one child, Leroy, who is 5 years old. The Vans reside at 1234 Huckleberry Street, Kathleen, GA 31047. Ricky’s Social Security number is 577-11-3322, Lucy’s is 477-98-4735, and Leroy’s is 589-22-1142. Lucy and Ricky’s earnings and withholdings are: Ricky: Earnings from Dell Company (office manager) $30,000 Federal Income Tax withheld $3,000 State Income Tax withheld $1,200 Lucy: Earnings from Rite Aid (Pharmacy Tech) $24,000 Federal Income Tax withheld$2,500 State Income Tax withheld$800 The other income includes interest from BB&T Savings of $1,600. Other information and expenditures are: Interest: On home mortgage$12,000 Credit card$1,000 Taxes: Property Tax on personal residence $1,600 State income tax paid for previous year$300 Contribution to church$500 Medical insurance premiums$500 Medical and dental expenses$3,000 Income tax preparation fee paid$200 Payment of union dues$250 Child Care for Leroy$3,600 CGTC Childcare Development Center

In: Accounting

Part1 Margen is single and has taxable income before the QBI deduction of $173,300. Margen owns...

Part1

Margen is single and has taxable income before the QBI deduction of $173,300. Margen owns a sole proprietorship (not a professional service) that produced net ordinary income of $180,000 and subject to self-employment tax of $21,300. The business paid total W-2 wages of $74,000 and the total unadjusted basis of property held by the business is $120,000. How much is Margen’s QBI deduction?

Part2

a. Mourezky gave some long-term real estate to a church. The property was worth $33,000 and had a basis of $10,000. Mourezky’s adjusted gross income was $60,000 and Mourezky made cash contributions of $9,000. How much is Mourezky’s charitable deduction?

b. Casey made several contributions to Casey’s alma mater during the current year as follows:

Cash $ 4,200

A painting that Casey has owned five years for display

in the library (basis, $1,280), FMV 9,500

Stock held for 10 months as an investment (basis, $900), FMV 1,200

Assuming Casey’s AGI is $30,000, how much is Casey’s charitable contribution deduction?

Part3

Josephine is single and paid the following taxes during 2020:

State income taxes withheld from wages $ 4,375

Refund of 2019 state income taxes - 45

State and local sales taxes paid 3,125

State and local real property taxes paid 5,275

State auto registration ($375 was based on the value) 525

How much is Josephine’s federal deduction for state and local taxes?

In: Accounting

Please refer to the USA. irs.gov for any refernce Form 1040. William A. Gregg, a high...

Please refer to the USA. irs.gov for any refernce

Form 1040. William A. Gregg, a high school educator, and Mary W. Gregg, a microbiologist, are married and file a joint income tax return for 2019. Neither William nor Mary is over 50 years old, and both have excellent sight. They provide the sole support of their three children: Barry, Kimberly, and Rachel (all under age 17). The following information is from their records for 2019:

salaries and wages, William. . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . 54,000

Federal income tax withheld. . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . 5,000

Salaries and wages, Mary . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . 60,000

Federal income tax withheld. . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . 6,000

Interest income—Home Savings and Loan. . . . . . . . . . . . . . .

. . . . . . . . . . . . . . 690

Interest income—City Bank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 220

Tax-exempt interest income—State of Texas Bonds . . . . . . . .

. . . . . . . . . . . . . . 1,400

Itemized deductions as follows:

Hospitalization insurance . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . 320

Unreimbursed fees of doctors, hospitals, etc. . . . . . . . . . . .

. . . . . . . . . . . . . 740

Unreimbursed prescription drugs . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . 310

Real estate taxes on residence . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . 6,300

State income taxes paid . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . 2,700

State sales taxes paid . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . 720

Interest paid on original home mortgage . . . . . . . . . . . .

. . . . . . . . . . . . . . . .18,430

Charitable contribution—Faith Church. . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . 4,000

Charitable contribution—State University. . . . . . . . . . . .

. . . . . . . . . . . . . . . .200

Quarterly estimated federal taxes paid. . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . 3,500

Calculate the 2019 Federal income tax and the tax due (or refund) for the Greggs assuming they file a joint return. Form 1040, along with Schedules A and B, may be completed. Supply fictitious information for the address and Social Security numbers. (Note: Use 2019 tax forms since the 2020 forms may not be available.)

In: Accounting

List A: Can ask in an interview What professional societies do you belong to? Why did...

List A: Can ask in an interview

What professional societies do you belong

to?

Why did you leave your previous employer?

What kind of people do you enjoy working

with?

Where do you see yourself in five years?

List B: Can NOT ask in an interview

Are you married or do you live with someone?

Are you a citizen of the USA?

Have you ever been arrested?

Are you planning a family soon?

What church do you attend?

Where were you born?

Given that you are a wheelchair user, how do you think

you will be able to do this work?

Are there any religious holidays on which you can't be

available to work?

Have your wages ever been garnished?

When did you graduate from college?

Do you have any physical limitations?

How tall are you?

What was the date of your most recent physical

examination?

Did you belong to a fraternity or sorority?

List C: Depends

What is your salary history?

2. Answer each question in List A.

3. Select five questions from List B. Identify which

specific legally protected EEO category against which that question

might be considered discrimination. Why? For what reason?

3. Discuss a question or questions that you have been

asked in a job interview of which you were unsure or felt that it

might be discriminatory against a legally protected group of which

you are a member. How best to answer the question?

In: Operations Management

Other things the same, if the exchange rate changes from 30 Thai bhat per dollar to...

Other things the same, if the exchange rate changes from 30 Thai bhat per dollar to 25 Thai bhat per dollar, then the dollar has

|

|||

|

|||

|

|||

|

In: Economics

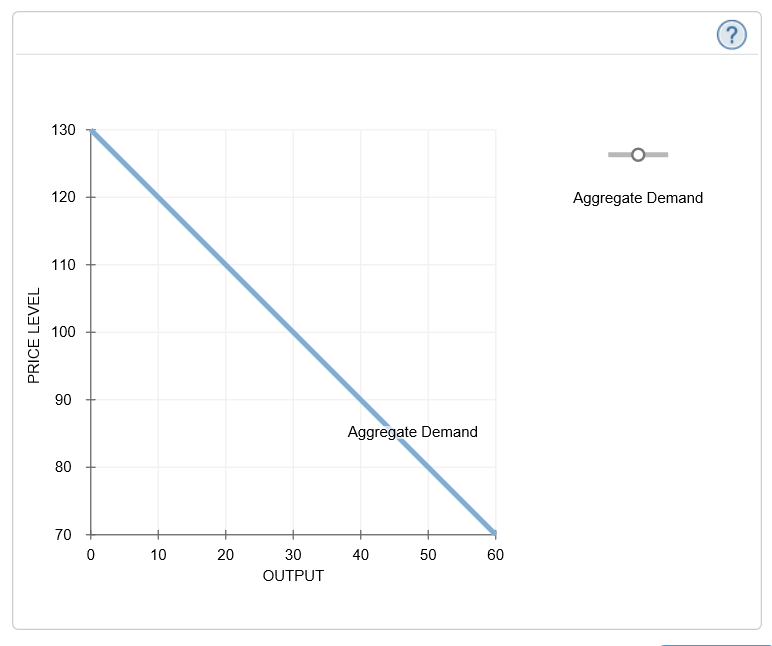

6. Changes in taxes The following graph shows the aggregate demand curve. Shift the aggregate demand...

6. Changes in taxes

The following graph shows the aggregate demand curve.

Shift the aggregate demand curve on the graph to show the impact of a tax cut.

Suppose the governments of two different economies, economy X and economy Y, implement a permanent tax cut of the same size. The marginal propensity to consume (MPC) in economy X is 0.75 and the MPC in economy Y is 0.8. The economies are identical in all other respects.

The tax cut will have a larger impact on aggregate demand in the economy with the (larger MPC/ smaller MPC)

In: Economics

1.) A physician changes the battery for a single chamber permanent pacemaker pulse generator inserted one...

1.) A physician changes the battery for a single chamber permanent pacemaker pulse generator inserted one year-ago and repairs (and reconnects) the existing transvenous lead. How should these services be reported?

2.) Immediately prior to performing a single coronary artery bypass graft procedure, the same physician harvested a vein from the left arm to be used for the graft. What add-on, if any, would be reported for the harvesting of the vein?

3.) A physician performed a coronary artery bypass graft procedure involving two grafts – a venous graft to the right coronary artery and a separate venous graft to the left anterior descending artery. How should these services be reported?

In: Nursing