Questions

[The following information applies to the questions displayed below.] In 2021, the Westgate Construction Company entered...

[The following information applies to the questions

displayed below.]

In 2021, the Westgate Construction Company entered into a contract

to construct a road for Santa Clara County for $10,000,000. The

road was completed in 2023. Information related to the contract is

as follows:

| 2021 | 2022 | 2023 | |

| Cost incurred during the year | 2,016,000 | 2,808,000 | 2,613,600 |

| Estimated costs to complete as of year end | 5,184,000 | 2,376,000 | 0 |

| Billings during the year | 2,180,000 | 2,644,000 | 5,176,000 |

| Cash collections during the year | 1,890,000 | 2,500,000 | 5,610,000 |

Westgate recognizes revenue over time according to percentage of completion.

Required:

1. Calculate the amount of revenue and gross

profit (loss) to be recognized in each of the three years.

(Do not round intermediate calculations. Loss amounts

should be indicated with a minus sign.)

| 2021 | 2022 | 2023 | |

| Revenue | 2,800,000 | 3,900,000 | 3,300,000 |

| Gross Profit (Loss) | 784,000 | 1,092,000 | ? |

Steps please..

In: Accounting

KPNG Consulting has five projects to consider. Each will require time in the next four quarters...

KPNG Consulting has five projects to consider. Each will require time in the next four quarters according to the table below

| Project | Time in 1st quarter | Time in 2nd quarter | Time in 3rd quarter | Time in 4th quarter | Revenue $k |

| A | 6 | 9 | 3 | 1 | 240 |

| B | 4 | 13 | 6 | 4 | 120 |

| C | 8 | 0 | 8 | 6 | 150 |

| D | 3 | 3 | 1 | 7 | 60 |

| E | 12 | 3 | 4 | 9 | 250 |

Revenue from each project is also shown. Develop a model whose solution would maximize revenue, meet the time budget of: 28 in the 1st quarter, 20 in the 2nd quarter, 18 in the 3rd quarter and 16 in the 4th quarter; at least three projects; and not do both projects C and D. If project B is chosen, project D must be chosen.

In: Operations Management

A semiprofessional baseball team near your town plays two home games each month at the local...

A semiprofessional baseball team near your town plays two home games each month at the local baseball park. The team splits the concessions 50/50 with the city but keeps all the revenue from ticket sales. The city charges the team $500 each month for the three-month season. The team pays the players and manager a total of $2500 each month. The team charges $10 for each ticket, and the average customer spends $7 at the concession stand. Attendance averages 100 people at each home game.

Part 1. The team earns an average of $________________ in

revenue for each game and $______________ of revenue each

season.

With total costs of $_____________ each season, the team finishes

the season with $________________ of profit.

Part 2 In order to break even, the team needs to sell tickets for each game. Round to the nearest whole number.

In: Economics

13. Which of the following transactions causes a decrease in total liabilities? A. Paying maintenance expenses...

13. Which of the following transactions causes a decrease in total liabilities?

A. Paying maintenance expenses for the current month.

B. Providing services to customers on account.

C. Paying dividends to stockholders.

D. Repay amounts previously borrowed from the bank.

14. Which of the following transactions causes a decrease in stockholders’ equity?

A. Paying advertising expense for the current month.

B. Repaying amount borrowed from the bank.

C. Providing services to customers for cash.

D. Providing services to customers on account.

15. Which of the following is possible for a particular business transaction?

A. Increase assets; decrease liabilities.

B. Decrease assets; increase stockholders’ equity.

C.Decrease assets; decrease liabilities.

D.Decrease liabilities; increase expenses.

20. A debit is used to decrease which of the following accounts?

A. Salaries Expense.

B. Accounts Payable.

C. Dividends.

D. Supplies.

28. Account balances in the general ledger are updated for transactions through the process of:

A. Balancing.

B. Analyzing.

C. Posting.

D. Journalizing.

30. Which of the following is true about a trial balance?

A .Only income statement accounts are shown.

B. Total debit amounts should always equal total credit amounts.

C. Only balance sheet accounts are shown.

D. The trial balance shows the change in all account balances over the accounting period.

35. if a company has an increase in total expenses of $10,000, which of the following is possible?

A. Total liabilities decrease by $10,000.

B.Total assets increase by $10,000.

C. Total stockholders' equity increases by $10,000.

D. Total assets decrease by $10,000.

36. If a company has an increase in total revenues of $10,000, which of the following is possible?

-

Total assets increase by $10,000.

-

Total liabilities increase by $10,000.

-

Total stockholders' equity decreases by $10,000.

A. I only

B. II only

C. III only

D. II or III

he payment for utilities of the current month would be recorded as

Multiple Choice

A. Debit Cash; Credit Utilities Payable.

B. Debit Utilities Expense; Credit Utilities Payable.

C. Debit Utilities Expense; Credit Cash.

D. Debit Utilities Payable; Credit Cash

43. Providing services to customers on account for $100 is recorded as

| a. | Accounts Receivable | 100 | |

| Service Revenue | 100 | ||

| b. | Cash | 100 | |

| Accounts Receivable | 100 | ||

| c. | Service Revenue | 100 | |

| Accounts Receivable | 100 | ||

| d. | Service Expense | 100 | |

| Accounts Payable | 100 |

Multiple Choice

A.Option a

B. Option b

C. Option c

D. Option d

In: Accounting

Please prepare a trial balance using the information given. You have been hired as an accountant...

|

Please prepare a trial balance using the information given. You have been hired as an accountant for NFT Consulting Inc. This business was created when some friends decided to make use of their newly minted college degrees and go into business together. The business was created on November 1, 2017. The company will have a fiscal year end of October 31st. The initial formation transactions and early purchases for NFT Consulting Inc. resulted in the balances that are included in the first 2 columns of the Worksheet. (see the worksheet tab) |

|

| During November, the first month of operations, the following transactions occurred: | |

| Date | Event |

| 1-Nov | Paid $7,200 for 12 months rent on office space |

| 2-Nov | Purchased office furniture for $8,950. |

| 3-Nov | Purchased $11,354 of additional office supplies on account. |

| 8-Nov | Borrowed 20,000 from the bank for operating cash. The note has a 3% interest rate (simple interest) and is to be paid back in 4 years |

| 15-Nov | Received $10,800 from Fortuna Inc. for work to be performed over the next 12 months. |

| 20-Nov | Paid $1,560 for utilities. |

| 21-Nov | Performed services for various customers for $13,200 cash and another $18,100 on account. |

| 25-Nov | Paid $8,650 for purchases of supplies previously made on account. |

| 27-Nov | Paid salaries to employees totaling $5,200 for 1 week. |

| 30-Nov | Collected $12,300 as payment for amounts previously billed. |

| 30-Nov | Dividends of $3,000 were declared and paid. |

| At the end of November, the following additional information is available to help determine what adjustments are needed: | |

| 30-Nov | One month of the prepaid rent has been used up |

| 30-Nov | Supplies on hand are $8,150. |

| 30-Nov | One month of interest has accrued on the note payable for the bank loan. |

| 30-Nov | One month of the services for the Fortuna Inc. has been performed (see above). |

| 30-Nov | Salaries of $5,200 are paid every Friday (for a 5 day work week). November 30, 2017 was a Thursday. |

| 30-Nov | Additional work for customers of $9,580 has been performed during the last week of November but not yet billed |

| 30-Nov | Depreciation expense for the computer equipment is $140 and for the office furniture is $120 |

| Worksheet - NFT Consulting Inc | ||||||||||

| BEGINNING | NUMBERS | November | ENTRIES | UNADJUSTED TRIAL BALANCE | ADJUSTMENTS | ADJUSTED TRIAL BALANCE | ||||

| ACCOUNT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT |

| Cash | 221,400 | |||||||||

| Accounts Receivable | ||||||||||

| Supplies | 8,650 | |||||||||

| Prepaid Rent | ||||||||||

| Land | 40,000 | |||||||||

| Computer Equipment | 38,600 | |||||||||

| Accumulated Depreciation, Comp Equip | ||||||||||

| Office Furniture | ||||||||||

| Accumulated Depreciation, Off Furn | ||||||||||

| Accounts Payable | 8,650 | |||||||||

| Salaries Payable | ||||||||||

| Interest Payable | ||||||||||

| Unearned Revenue | ||||||||||

| Long-term Notes Payable | ||||||||||

| Common Stock | 300,000 | |||||||||

| Retained Earnings | ||||||||||

| Dividends | ||||||||||

| Service Revenue | ||||||||||

| Salaries Expense | ||||||||||

| Rent Expense | ||||||||||

| Supplies Expense | ||||||||||

| Maintenance Expense | ||||||||||

| Utilities Expense | ||||||||||

| Interest Expense | ||||||||||

| Depreciation Expense, Comp Equip | ||||||||||

| Depreciation Expense, Office Furniture | ||||||||||

| 308,650 | 308,650 | |||||||||

In: Accounting

Exercise 21-3 Thome and Crede, CPAs, are preparing their service revenue (sales) budget for the coming...

Exercise 21-3 Thome and Crede, CPAs, are preparing their service revenue (sales) budget for the coming year (2017). The practice is divided into three departments: auditing, tax, and consulting. Billable hours for each department, by quarter, are provided below. Department Quarter 1 Quarter 2 Quarter 3 Quarter 4 Auditing 2,540 1,930 2,200 2,740 Tax 3,330 2,510 2,110 2,780 Consulting 1,730 1,730 1,730 1,730 Average hourly billing rates are auditing $83, tax $95, and consulting $103. Prepare the service revenue (sales) budget for 2017 by listing the departments and showing for each quarter and the year in total, billable hours, billable rate, and total revenue. THOME AND CREDE, CPAs Sales Revenue Budget Quarter 1 Quarter 2 Dept. Billable Hours Billable Rate Total Rev. Billable Hours Billable Rate Total Rev. Auditing $ $ $ $ Tax Consulting Totals $ $ THOME AND CREDE, CPAs Sales Revenue Budget Quarter 3 Quarter 4 Dept. Billable Hours Billable Rate Total Rev. Billable Hours Billable Rate Total Rev. Auditing $ $ $ $ Tax Consulting Totals $ $ THOME AND CREDE, CPAs Sales Revenue Budget Year Dept. Billable Hours Billable Rate Total Rev. Auditing $ $ Tax Consulting Totals $

In: Accounting

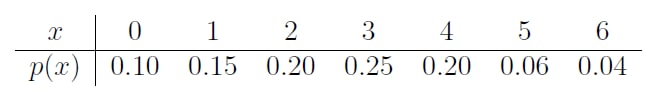

Discrete R.V and Probability Distribution

A mail-order computer business has six telephone lines. Let X denote the number of lines in use at a specified time. Suppose the pmf of X is as given in the accompanying table.

Calculate the probability of each of the following events.

(a) At most three lines are in use.

(b) Fewer than three lines are in use.

(c) At least three lines are in use.

(d) Between two and five lines, inclusive, are in use.

(e) Between two and four lines, inclusive, are not in use.

(f) At least four lines are not in use.

In: Statistics and Probability

In any given year, one in three Americans over the age of 65 will experience a...

In any given year, one in three Americans over the age of 65 will experience a fall. If you have three living grandparents over the age of 65, and assuming that the probability of a fall for each grandparent is independent:

a. What is the probability that none of the three grandparents will experience a fall? Provide your answer as a decimal between 0 and 1. Hint: Your sample size is 3, what is the number of successes.

b. What is the probability that one or more grandparents will experience a fall? Provide your answer as a decimal between 0 and 1.

In: Math

The following data set shows the ages of the Best Actress and Best Actor award at...

The following data set shows the ages of the Best Actress and Best Actor award at a given awards show for various years:

| Actress Age | Actor Age |

|---|---|

| 33 | 64 |

| 31 | 64 |

| 36 | 54 |

| 23 | 35 |

| 34 | 36 |

| 29 | 67 |

| 27 | 49 |

| 25 | 60 |

| 36 | 45 |

| 31 | 49 |

| 29 | 56 |

| 22 | 67 |

| 30 | 51 |

| 37 | 31 |

| 37 | 38 |

Using a Sign Test, test the claim that there is no median difference between the ages of Best Actress and Best Actor award winners.

Find the null and alternative hypothesis.

H0:H0: Select an answer The median age of actresses is more than the median age of actors. The median of the differences is NOT zero. The median of the differences is zero. The median age of actresses is less than the median age of actors.

H1:H1: Select an answer The median of the differences is zero. The median age of actresses is more than the median age of actors. The median of the differences is NOT zero. The median age of actresses is less than the median age of actors.

If we consider + to represent when the female was older than the male, then how many of each sign is there?

Positive Signs:

Negative Signs:

Total Signs:

What is the p-value? (Round to three decimal places.)

At a 0.025 significance, what is the conclusion about the null? Select an answer Reject the null hypothesis. Fail to reject the null hypothesis. Fail to support the null hypothesis. Support the null hypothesis.

What is the conclusion about the claim? Select an answer Support the claim that there is no difference in median age. There is insufficient evidence to support the claim that there is no difference in median age. Fail to reject the claim that there is no difference in median age Reject the claim that there is no difference in median age.

Let's now perform a mean-matched pairs test to test the claim that there is no mean difference between the age of males and females. For the context of this problem, d=x2−x1d=x2-x1 where the first data set represents actress (female) ages and the second data set represents male (actor) ages. We'll continue to use a significance of 0.025. You believe the population of difference scores is normally distributed, but you do not know the standard deviation.

H0: μd=0H0: μd=0

H1:μd≠0H1:μd≠0

| Actress Age | Actor Age |

|---|---|

| 33 | 64 |

| 31 | 64 |

| 36 | 54 |

| 23 | 35 |

| 34 | 36 |

| 29 | 67 |

| 27 | 49 |

| 25 | 60 |

| 36 | 45 |

| 31 | 49 |

| 29 | 56 |

| 22 | 67 |

| 30 | 51 |

| 37 | 31 |

| 37 | 38 |

What is the critical value for this test? t=±t=± (Round to three decimal places.)

What is the test statistic for this sample? t=t= (Round to three decimal places.)

What is the p-value? (Round to three decimal places.)

Conclusion about the null: Select an answer Reject the null hypothesis. Fail to support the null hypothesis. Support the null hypothesis. Fail to reject the null hypothesis.

Conclusion about the claim: Select an answer Support the claim that there is no mean difference in the ages. There is insufficient evidence to support the claim that there is no mean difference in the ages. Fail to reject the claim that there is no mean difference in the ages. Reject the claim that there is no mean difference in the ages.

How were these two tests similar?

How were these two tests different?

In: Statistics and Probability

1. Test the claim that the mean GPA of night students is significantly different than the...

1. Test the claim that the mean GPA of night students is

significantly different than the mean GPA of day students at the

0.1 significance level.

The null and alternative hypothesis would be:

|

H0:pN≤pDH0:pN≤pD H0:pN≥pDH0:pN≥pD H0:μN≥μDH0:μN≥μD H0:μN≤μDH0:μN≤μD H0:μN=μDH0:μN=μD H0:pN=pDH0:pN=pD |

The test is:

right-tailed

left-tailed

two-tailed

The sample consisted of 12 night students, with a sample mean GPA

of 3.13 and a standard deviation of 0.04, and 10 day students, with

a sample mean GPA of 3.15 and a standard deviation of 0.08.

| test statistic = | |

| [three decimal accuracy] | |

| p-value = | |

| [three decimal accuracy] |

Based on this we:

- Fail to reject the null hypothesis

- Reject the null hypothesis

2. Heart rates are determined before and 30 minutes after a

Kettleball workout. It can be assumed that heart rates (bpm) are

normally distributed. Use the data provided below to test to

determine if average heart rates prior to the workout are

significantly lower than 30 minutes after a Kettleball workout at

the 0.10 level of significance. Let μ1μ1 = mean before

workout.

|

Select the correct Hypotheses:

|

H0:μ1≥μ2H0:μ1≥μ2 H0:μ1≤μ2H0:μ1≤μ2 H0:μd≥0H0:μd≥0 H0:μd≤0H0:μd≤0 H0:μ1=μ2H0:μ1=μ2 H0:μd=0H0:μd=0 |

| Test Statistic, ttest = | |

| [three decimal accuracy] | |

| p-value = | |

| [three decimal accuracy] |

Conclusion:

- Fail to Reject H0H0

- Reject H0H0

Interpret the conclusion in context:

- There is not enough evidence to suggest the mean bpm before a Kettleball workout is lower than 30 minutes after the workout.

- There is enough evidence to suggest the mean bpm before a Kettleball workout is lower than 30 minutes after the workout.

3. Heart rates are determined before and 30 minutes after a

Kettleball workout. It can be assumed that heart rates (bpm) are

normally distributed. Use the data provided below to test to

determine if average heart rates prior to the workout are

significantly lower than 30 minutes after a Kettleball workout at

the 0.02 level of significance. Let μ1μ1 = mean before

workout.

|

Construct the appropriate confidence interval for the given level

of significance.

| ( | , | ) | |

| [three decimal accuracy] | [three decimal accuracy] |

In: Statistics and Probability