Questions

The Texas State Legislature is considered a part-time or amateur legislature because of its infrequent meeting...

The Texas State Legislature is considered a part-time or amateur legislature because of its infrequent meeting schedule of 140 days every other year. The part-time nature is meant to preserve the idea of a citizen legislature. Meeting biennially has advantages and disadvantages, but it is the system that we have become accustomed to. One of the drawbacks is that many professions do not afford the flexibility of time off to serve in the legislature. Think of your average store clerk, bank teller, or teacher.

Are these professions that allow for the equivalent of 4 months off every other year to serve in the House or Senate?

Additionally, the low wage does not allow for legislators to leave their professions so that they can focus full time on lawmaking. Do you think we need to make any changes to allow more people of different professional backgrounds to serve, or do you think it is fine the way it is? If you think we need to make changes, what changes would you make and why? If the sessionis fine the way it is, justify why.

What changes would you make to open up the legislature or do you believe that we need to keep the time and pay limited. Make sure you explain your answers

In: Economics

(A). Kofi Agyekum is bidding for a project needed by the USA government. Kofi Agyekum will...

(A). Kofi Agyekum is bidding for a project needed by the USA government. Kofi Agyekum will not know if the bid is accepted until three months from now. Kofi Agyekum will need cedi to cover expenses but will be paid by the USA government in dollars if he hired labour for the project. The contract price is US$ 35,000.00. The current spot rate of the cedi to the dollar is GH¢2.00=US$0. 50, while the forward rate is GH¢2.50 = US$0.99. Required: Calculate in cedi the contract sum if the project is undertaken by the Ghanaian firm, (3Marks) (B). Assume that your bankers are in competition with other banks in the City of Kumasi quotes current exchange price as GH¢ 4.5 - $1. The same bank’s quote a year ago was GH¢ 4.00 -$1 Required: Calculate the percentage change in the value of the cedi as at today. (3Marks) (C). The USA dollar has changed at the rate of $2.50 to £1. in the year 2010. In the year 2014, dollar has traded in the UK financial market as $1.50 to £1.00. i. Compute the percentage change in the value of the dollar. (3Marks) ii. Identify and explain two (2) factors that could have accounted for the change in the value of the dollar in 2014. (6Marks)

In: Accounting

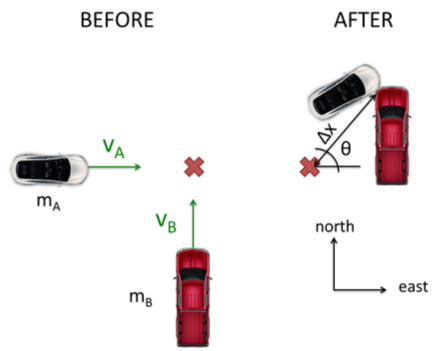

The accident. Given your excellent physics legal advice in Worksheet 2-2, you've been asked to make a judgement on another car accident.

The accident. Given your excellent physics legal advice in Worksheet 2-2, you've been asked to make a judgement on another car accident. In this case, a Tesla with mass ma = 2000 kg travelling due east has collided with a Ford F150 Raptor with mass me = 2500 kg travelling due north. After the collision, it is found that the two vehicles (stuck together) have slid Ax = 7.7 m from the accident site at an angle of 40° north of east (see figure). The car driver claims the accident happened because the truck was speeding; the truck driver claims the car was speeding. The posted speed limit is 35 miles/hour.

(a) Work this problem backwards: Determine from the location of the vehicles what the total speed of the car+truck system was after the collision. Assume a coefficient of kinetic friction of uk = 0.90 between the car tire and road surfaces (hint: this is really an energy problem)

(b) Now determine the speeds of the car and truck before the collision, assuming it was an inelastic collision. Based on these values, was either car speeding? Who is telling the truth?

In: Physics

Show all work to support your final numerical answers, and carefully label all numbers with the...

Show all work to support your final numerical answers, and carefully label all numbers with the appropriate units to receive full credit. Quote all ex-rates with both currency units ($/£) to 4 decimal places. Please do not copy payoff diagrams directly from the lecture notes. Full essays of a paragraph or more are required.

Current one-year interest rate for USD LIBOR: 5.20%

Current one-year interest rate for Sterling (UK) LIBOR: 4.25%

Current spot ex-rate (S): = $1.5200/£

Current one-year forward rate (F) = $1.5428/£

1. (3 points) a. Given the information above, is the British pound selling at a premium or discount? How much (round to two decimal places, e.g. 1.35%)?

b. Is Interest Rate Parity (IRP) holding? Why or why not? Explain in an essay, and show a calculation to support your answer using this IRP formula: ius = iuk +/- %£

c. Given the information above, how could you make arbitrage profits, starting with either $5 million or £5 million? Calculate and report your profits, and explain each calculation in words.

In: Finance

In 2016, United Kingdom voted to leave the European Union. On Marsh 29, 2019 the Brexit...

In 2016, United Kingdom voted to leave the European Union. On Marsh 29, 2019 the Brexit AKA secession from the Union is schedule to take place. The referendum results and the approaching date of the secession have negatively affected business environment in the UK leading to a growth rate slowdown in the Kingdom. Explain how the Brexit ( and the expectation of the Brexit) affect the U.S. economy. Using all the ISLM and ADAS diagrams illustrate the effect of the Brexit on the U.S. economy. Label all curves and axes. Write formulas for each of the curves what could the U.S. Central Bank do to stabilize the economy Illustrate its actions on ISLM and ADAS diagram. List all monetary policy tools (but do not explain how they work). Suppose the Central Bank does not take any actions. What could the U.S government do to stabilize the economy? Illustrate its actions on the ISLM and ADAS graphs (I Suggest drawing a new set of diagrams rather than using ones form (2)).

What happens to the interest rate monetary policy actions? What happens to the interest rate after fiscal policy actions? Explain the intuition for your result

In: Economics

Ricardian Model of Trade – Consider the followin

Ricardian Model of Trade –

Consider the following 2 X 2 Ricardian model of trade:

|

Output per labour-hour |

||

|

Nation |

Wheat (metric tonnes) |

Cloth (metres) |

|

Canada |

6 |

4 |

|

U.K. |

1 |

3 |

- Who has the absolute advantage in wheat? Explain. ( 2 marks)

Canada, because it can produce more wheat

- Who has the absolute advantage in cloth? Explain. ( 2 marks)

Canada. It can produce more cloth.

- Who has the comparative advantage in wheat? Explain ( 2.5 marks)

Canada - 6/4 = 1.5 cloth U.K. 1/3 = 0.33 cloth thus, UK has comparative advantage in wheat as its opportunity cost is lower.

- Who has the comparative advantage in cloth? Explain. ( 2.5 marks)

Canada has comparative advantage in cloth, as its opportunity cost is lower.

- What are the “gains” to Canada and the U.K. if they exchange 6 metric tonnes of wheat for 6 metres of cloth? Express the gains in quantities of goods and labour-hours. ( 3 marks)

From your answer in part (e), one country appears to gain more. Which country and why? (3 marks)

In: Economics

1. Which of the following is considered a negative supply shock? Select one: a. Government-mandated shut-down...

1. Which of the following is considered a negative supply shock?

Select one:

a. Government-mandated shut-down of the retail sector to prevent a spread of a virus

b. A decline in wages

c. An unexpected large increase in the government bond yields

d. An improvement in video-conferencing technology

2. An Australian firm produces software in the UK, its market value will be included in

Select one:

a. Australia’s GDP.

b. neither Australia’s nor UK’s GDP as it is counted towards National Product

c. the UK’s GDP.

d. Both Australia’s and UK’s GDP

3. Economic response to the Coronavirus crisis in Australia included

Select one:

a. increase in the cash rate and a large fiscal stimulus

b. decrease in the exchange rate and a large fiscal stimulus

c. none of the answers is correct

d. decrease in the cash rate and a large fiscal stimulus

4. If the government purchases multiplier equals 2, and real GDP is $14 trillion with potential GDP $15 trillion, then government purchases would need to increase by ________ to restore the economy to potential GDP.

Select one:

a. $500 billion

b. $1 trillion

c. $7.25 trillion

d. $250 billion

In: Economics

The U.S. Commerce Bank in St. Louis is trying to expand its overseas bank lending market....

The U.S. Commerce Bank in St. Louis is trying to expand its overseas bank lending market. Now it has the opportunity to provide a profitable loan to the UK subsidiary of the local HGF Corporation. However, the bank has to obtain 50 Million PS for three months right away to fund the foreign loan, which will be repaid back in Pound Sterling (PS). The CFO has taken an international banking seminar and is aware of the Eurocurrency market that can be utilized to borrow in foreign currency. In light of the data given below for the Eurocurrency interact rates available to the market, the CFO of the bank is now evaluating the funding cost of the following three alternatives: 1. Borrow 3-month money in the Eurocurrency market in pounds sterling 2. Borrow one-month in the Eurocurrency market in Pound sterling and then roll over. 3. Borrow 3-month US dollars, change them into sterling at the spot rate and then hedge the repayment using the purchasing Pound sterling in the forward exchange market. Questions: What is the relative cost of each proposal? Which proposal should the CFO of the Commerce Bank take? Justify!

In: Finance

Trident is a US company that sells goods to crown, a British firm in March for...

Trident is a US company that sells goods to crown, a

British firm in March for Sterling pounds 1,000,000. Payments are

due in three months that is June. Trident cost of capital is 12%.

The following quotes are available:

a. spot exchange rate: $1.7640/pound

b. Three month forward rate: $1.7540/pound

c. UK 3 month borrowing interest rate is 8% p.a (or 2% per

quarter)

d. US 3 month rate is 8% p.a (or 2% per quarter)

e. US 3 month investment rate is 6% p.a (1.5 per quarter)

June put options on the stock exchange of 12,500 pounds, strike

price is $1.75; 1.5% per pound premium, and brokerage cost $25 per

contract.

June put option in the OTC market 1,000,000 pounds; strike price is $1.75; 1.5% premium. Trident foreign exchange adviser forecasts that the spot rate in 3 months will be $1.76/pound.

REQUIRED

i. Remain unhedged position

ii. Hedge in the forward market

iii. Hedge in the money market

iv. Hedge in the capital market

In: Finance

Problem 1 (Hedging) A US exporter expects to receive £1 million in 2 months for her...

Problem 1 (Hedging)

A US exporter expects to receive £1 million in 2 months for her exports to the UK. The current exchange rate is US$2.30/£. She is worried that the pound might depreciate over the next 2 months and wants protection against its decline but she also want to benefit from a possible rise in £ over the next 2 months. Put options and call options on the £, with 2-month maturity are available.

-

What should she do?

-

Suppose the 2-month put options exercisable at US$2.50/£ are trading at US$0.01. What would be her cash revenue, given your answer in part a), if at the 2 month end the spot exchange rate turns out to be

-

US$2.00/£

-

US$3.00/£

-

-

What would be her minimum cash revenue, no matter what the spot rate at the end of 2 months turn out to be?

-

What would be the upfront cost (fee) for undertaking the appropriate options contract?

-

What would she do if the expected £1 million at the 2-month end are not received and what would be her loss if that happens?

In: Finance