Questions

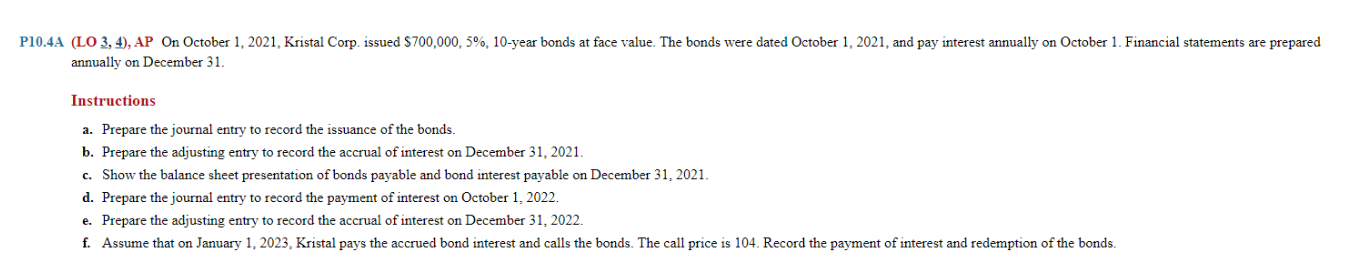

P10.4A (LO 3, 4), AP On October 1, 2021, Kristal Corp. issued $700,000, 5%, 10-year bonds...

In: Accounting

Weightless Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated unit...

Weightless Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows:

| Bath Scale | Gym Scale | |||

| East Region unit sales | 20,500 | 40,600 | ||

| West Region unit sales | 22,100 | 23,200 | ||

| Total | 42,600 | 63,800 | ||

The finished goods inventory estimated for October 1, for the Bath and Gym scale models is 1,700 and 2,100 units, respectively. The desired finished goods inventory for October 31 for the Bath and Gym scale models is 1,200 and 2,300 units, respectively.

Prepare a production budget for the small and large scales for the month ended October 31. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

| Weightless Inc. | ||

| Production Budget | ||

| For the Month Ending October 31 | ||

| Units Bath Scale | Units Gym Scale | |

| Total | ||

| Total units to be produced | ||

In: Accounting

Moon Star Company obtained two notes receivable during the year of 2019. The details of the...

Moon Star Company obtained two notes receivable during the year of 2019. The details of the notes are as follows:

October 3, 2019 Sold goods for $24,000 on account to a customer (Sun Company) and received 8% note. The note was due on October 18, 2019.

December 5, 2019 Received 13% note for $15,000 to replace account receivable from a customer (Strong Company). The note was due on January 5, 2020.

Instructions (35 points):

a. Compute maturity value of the note receivable received on October 3 (Show supporting calculations.)

b. Journalize the collection of the note which was due on October 18, 2019.

c. Journalize the adjusting entry at December 31, 2019 to record accrued interest.

d. Compute total interest revenue earned on the note receivable received on December 5, 2019 (Show supporting calculations.)

e. Journalize the collection of the note which was due on January 5, 2020.

In: Accounting

Al Fara Corporation makes a product with the following standard costs: Direct material: 10 ounces at...

- Al Fara Corporation makes a product with the following standard costs:

|

Direct material: 10 ounces at $1.50 per ounce |

$ 15.00 |

|

Direct labor: 0.6 hours at $30.00 per hour |

18.00 |

|

Variable manufacturing overhead: 0.6 hours at $10.00 per hour |

6.00 |

|

Total standard variable cost per unit |

$27.00 |

|

Budgeted units to be produced |

2,000 |

During October, 1,900 unitswere produced. The company reported the following results concerning this product at the end of October:

|

Material purchased: 18,000 ounces at $2.00 per ounce |

$36,000 |

|

Direct labor: 1,100 hours at $30.50 per hour |

$33,550 |

|

Variable manufacturing overhead costs incurred |

$12,980 |

- Compute the Direct materials price variance (Spending) and quantity variance for the month of October. State if these variances are favorable or unfavorable. (2pts)

- Compute the Direct Labor rate variance (Spending) and labor efficiency variance (quantity) for the month of October. State if these variances are favorable or unfavorable. (1pt)

In: Accounting

Question 2 Moon Star Company obtained two notes receivable during the year of 2019. The details...

In: Accounting

Production Budget Weightless Inc. produces a Bath and Gym version of its popular electronic scale. The...

Production Budget

Weightless Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows:

| Bath Scale | Gym Scale | |||

| East Region unit sales | 18,400 | 34,700 | ||

| West Region unit sales | 19,900 | 20,900 | ||

| Total | 38,300 | 55,600 | ||

The finished goods inventory estimated for October 1, for the Bath and Gym scale models is 1,500 and 2,600 units, respectively. The desired finished goods inventory for October 31 for the Bath and Gym scale models is 1,100 and 2,800 units, respectively.

Prepare a production budget for the small and large scales for the month ended October 31. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

| Weightless Inc. | ||

| Production Budget | ||

| For the Month Ending October 31 | ||

| Units Bath Scale | Units Gym Scale | |

| Total | ||

| Total units to be produced | ||

In: Accounting

Schedule of Cash Payments Excel Learning Systems Inc. was organized on September 30, 2016. Projected selling...

Schedule of Cash Payments

Excel Learning Systems Inc. was organized on September 30, 2016. Projected selling and administrative expenses for each of the first three months of operations are as follows:

October$124,400

November116,900

December106,400

Depreciation, insurance, and property taxes represent $27,000 of the estimated monthly expenses. The annual insurance premium was paid on September 30, and property taxes for the year will be paid in June. The company expects that 69% of the remainder of the expenses will be paid in the month in which they are incurred, with the balance to be paid in the following month.

Prepare a schedule indicating cash payments for selling and administrative expenses for October, November, and December.

Excel Learning Systems Inc.

Schedule of Cash Payments for Selling and Administrative Expenses

For the Three Months Ending December 31, 2016

OctoberNovemberDecember

October expenses:

Paid in October$

Paid in November$

November expenses:

Paid in November

Paid in December$

December expenses:

Paid in December

Total cash payments$$$

In: Accounting

Khaled Industries, a defense contractor, is developing a cash budget for October, November, and December. (i)...

Khaled Industries, a defense contractor, is developing a cash budget for October, November, and December.

(i) Khaled’s sales in August and September were

$100,000 and $200,000 respectively. Forecasted Sales for October,

November, and December are as below: October - $400,000 November -

$300,000 December - $200,000

30% of the firm’s sales have been for cash, 50% have been collected

after 1 month, and the remaining 20% after 2 months. Bad-debt

expenses (uncollectible accounts) have been negligible. In

December, Khaled will receive a $30,000 dividend from stock in a

subsidiary.

(ii) Khaled has also gathered the relevant information

for the development of a cash disbursement schedule. Purchases will

represent 70% of sales - 40% will be paid immediately in cash, 60%

is paid the month following the purchase. The firm will also expend

cash on rent, wages and salaries every month of $52,000.

Prepare a Cash Budget for October, November and December.

In: Accounting

The following transactions occurred during the month of October for Bella Boutique. Oct. 1 Sold merchandise...

The following transactions occurred during the month of October

for Bella Boutique.

|

Oct. 1 |

Sold merchandise on credit for $2,000, terms 2/10, n/30. The items sold had a cost of $1,500. |

|

3 |

Purchased merchandise for cash, $720. |

|

4 |

Purchased merchandise on credit for $1,600, terms 3/20, n/30. |

|

5 |

Issued a credit memorandum for $1,000 to a customer who returned merchandise purchased July 20. The returned items had a cost of $510. |

|

10 |

Received payment for merchandise sold October 1. |

|

15 |

Received a credit memorandum from the seller for the return of faulty merchandise purchased on October 4 for $600. |

|

18 |

Paid freight charges of $200 for merchandise ordered last month. (FOB shipping point) |

|

23 |

Paid for the merchandise purchased October 4 less the portion that was returned. |

Required:

Prepare the general journal entries to record these

transactions.

In: Accounting

On June 1, 2020, the Crocus Company began construction of a new manufacturing plant. The plant...

On June 1, 2020, the Crocus Company began construction of a new

manufacturing plant. The plant was completed on October 31, 2021.

Expenditures on the project were as follows ($ in

millions):

| July 1, 2020 | 54 |

| October 1, 2020 | 22 |

| February 1, 2021 | 30 |

| April 1, 2021 | 21 |

| September 1, 2021 | 20 |

| October 1, 2021 | 6 |

On July 1, 2020, Crocus obtained a $70 million construction loan

with a 6% interest rate. The loan was outstanding through the end

of October, 2021. The company's only other interest-bearing debt

was a long-term note for $100 million with an interest rate of 8%.

This note was outstanding during all of 2020 and 2021. The

company's fiscal year-end is December 31.

What is the amount of interest that Crocus should capitalize in

2021, using the specific interest method? (Enter your answers to

nearest whole dollar amount.)

$7,283,000.

$7,117,000

$8,740,000.

$7,248,000.

In: Accounting