Questions

Adjusting entries for unearned items typically include which of the following related types of accounts:

QUESTION 11

Adjusting entries for unearned items typically include which of the following related types of accounts:

Revenue and Liability accounts | ||

Revenue and Asset accounts | ||

Expense and Liability accounts | ||

Expense and Asset accounts |

QUESTION 12

Before making adjusting entries you should:

Close permanent accounts | ||

Prepare a Trial Balance | ||

Close temporary accounts | ||

Prepare a balance sheet |

QUESTION 13

To record adjusting journal entries in QuickBooks, select:

Company Center > Journal Entry icon | ||

Accountant Menu > Make General Journal Entries | ||

Banking section of the Home Page > Journal Entry icon | ||

Company section of the Home Page > Journal Entry icon |

QUESTION 14

The order of the steps in the accounting cycle includes:

Adjusted Trial Balance, financial reports, adjusting entries, Trial Balance | ||

Adjusted Trial Balance, adjusting entries, financial reports, Trial Balance | ||

Trial Balance, adjusting entries, Adjusted Trial Balance, financial reports | ||

Trial Balance, financial reports, adjusting entries, Adjusted Trial Balance |

QUESTION 15

To prepare the Trial Balance, select:

Reports Center > Accountant & Taxes | ||

Company Center > Company & Financials | ||

Reports Center > Company & Financials | ||

Company Center > Accountant & Taxes |

QUESTION 16

Adjusting entries for prepaid items typically include which of the following related types of accounts:

Revenue and Liability accounts | ||

Revenue and Asset accounts | ||

Expense and Liability accounts | ||

Expense and Asset accounts |

QUESTION 17

Unearned revenue occurs when:

Customers pay after receiving a service | ||

Customers pay in advance of receiving a service | ||

Customers default and do not pay you what is owed | ||

All of the choices are correct |

QUESTION 18

To print the Adjusted Trial Balance, select:

Reports Center > Accountant & Taxes | ||

Company Center > Company & Financials | ||

Reports Center > Company & Financials | ||

Company Center > Accountant & Taxes |

QUESTION 19

Sales are recorded under cash basis accounting when:

The goods or services are provided regardless of whether the cash is collected from the customers | ||

The bookkeeper has time to record the transactions | ||

The cash is collected from the customers | ||

The costs are incurred to earn the revenue |

QUESTION 20

The Trial Balance:

Lists all the company's accounts and ending balances | ||

Is prepared before and after making adjustments | ||

Verifies the accounting system balances | ||

All of the choices are correct |

In: Accounting

Washington County’s Board of Representatives is considering the construction of a longer runway at the county...

Washington County’s Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the airport to handle the midsize jets used on many domestic flights. Data pertinent to the board’s decision appear below.

| Cost of acquiring additional land for runway | $ | 69,000 | |

| Cost of runway construction | 230,000 | ||

| Cost of extending perimeter fence | 16,967 | ||

| Cost of runway lights | 36,000 | ||

| Annual cost of maintaining new runway | 18,000 | ||

| Annual incremental revenue from landing fees | 35,000 | ||

In addition to the preceding data, two other facts are relevant to the decision. First, a longer runway will require a new snowplow, which will cost $140,000. The old snowplow could be sold now for $13,500. The new, larger plow will cost $10,000 more in annual operating costs. Second, the County Board of Representatives believes that the proposed long runway, and the major jet service it will bring to the county, will increase economic activity in the community. The board projects that the increased economic activity will result in $92,000 per year in additional tax revenue for the county.

In analyzing the runway proposal, the board has decided to use a 10-year time horizon. The county’s hurdle rate for capital projects is 18 percent.

1. Prepare a net-present-value analysis of the proposed long runway.

|

|||||||||||||||||||||||||||||||||

2. Should the County Board of Representatives approve the runway considering NPV?(Yes or No)

3-a. Which of the data used in the analysis are likely to be most uncertain?

(Select which of the following statements (is) are true by selecting an "X".)

|

|||||||||||||||||

3-b. Which of the data used in the analysis are likely to be least uncertain?

(Select which of the following statements (is) are true by selecting an "X".)

|

|||||||||||||||||

In: Finance

During the year, Trombley Incorporated has the following inventory transactions. Date Transaction Number of Units Unit...

During the year, Trombley Incorporated has the following inventory transactions.

| Date | Transaction | Number of Units |

Unit Cost |

Total Cost |

| Jan. 1 | Beginning inventory | 16 | $ 18 | $ 288 |

| Mar. 4 | Purchase | 21 | 17 | 357 |

| Jun. 9 | Purchase | 26 | 16 | 416 |

| Nov. 11 | Purchase | 26 | 14 | 364 |

| 89 | $ 1,425 | |||

For the entire year, the company sells 69 units of inventory for $26 each.

1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

| LIFO | Cost of Goods Available for Sale | Cost of Goods Sold | Ending Inventory | ||||||

| # of units | Average Cost per unit | Cost of Goods Available for Sale | # of units | Average Cost per unit | Cost of Goods Sold | # of units | Average Cost per unit | Ending Inventory | |

| Beginning Inventory | |||||||||

| Purchases: | |||||||||

| Mar 04 | |||||||||

| Jun 09 | |||||||||

| Nov 11 | |||||||||

|

Total |

|||||||||

|

3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Weighted-Average Cost per unit" to 2 decimal places.)

| Weighted Average Cost | Cost of Goods Available for Sale | Cost of Goods Sold - Weighted Average Cost | Ending Inventory - Weighted Average Cost | ||||||

| # of units | Average Cost per unit | Cost of Goods Available for Sale | # of units Sold | Average Cost per Unit | Cost of Goods Sold | # of units in Ending Inventory | Average Cost per unit | Ending Inventory | |

| Beginning Inventory | 16 | $288 | |||||||

| Purchases: | |||||||||

| Mar.4 | 21 | 357 | |||||||

| Jun.9 | 26 | 416 | |||||||

| Nov.11 | 26 | 364 | |||||||

| Total | |||||||||

|

In: Accounting

1. Under absorption costing, a company had the following unit costs when 8,000 units were produced. ...

1. Under absorption costing, a company had the following unit costs when 8,000 units were

produced.

|

Direct labor |

$ |

8.50 |

per unit |

|

Direct material |

$ |

9.00 |

per unit |

|

Variable overhead |

$ |

6.75 |

per unit |

|

Fixed overhead ($60,000/8,000 units) |

$ |

7.50 |

per unit |

|

Total production cost |

$ |

31.75 |

per unit |

Compute the total production cost per unit under variable costing if 25,000 units had been produced.

A) $31.75

B) $27.25

C) $26.25

D) $24.25

E) $17.50

2. When evaluating a special order, management should:

A) Only accept the order if the incremental revenue exceeds all product costs.

B) Only accept the order if the incremental revenue exceeds fixed product costs.

C) Only accept the order if the incremental revenue exceeds total variable product costs.

D) Only accept the order if the incremental revenue exceeds full absorption product costs.

E) Only accept the order if the incremental revenue exceeds regular sales revenue.

3. Which of the following best describes costs assigned to the product under the absorption

costing method?

Direct labor (DL)

Direct materials (DM)

Variable selling and administrative (VSA)

Variable manufacturing overhead (VOH)

Fixed selling and administrative (FSA)

Fixed manufacturing overhead (FOH)

A) DL, DM, VSA, and VOH.

B) DL, DM, and VOH.

C) DL, DM, VOH, and FOH.

D) DL and DM.

E) DL, DM, FSA, and FOH.

4. Which of the following best describes costs assigned to the product under the variable

costing method?

Direct labor (DL)

Direct materials (DM)

Variable selling and administrative (VSA)

Variable manufacturing overhead (VOH)

Fixed selling and administrative (FSA)

Fixed manufacturing overhead (FOH)

A) DL, DM, VSA, and VOH.

B) DL, DM, and VOH.

C) DL, DM, VOH, and FOH.

D) DL and DM.

E) DL, DM, FSA, and FOH.

12. Howley Company has the following information for April:

Sales $912,000

VC of goods sold 474,000

FC – mfg. 82,000

VC – selling & adm. 238,000

FC – selling & adm. 54,700

a, Operating Income for Howley during the month of April.

In: Accounting

Complete a Balance Sheet ABC Corporation Income Statement For the Year Ended December 31, 2014 Sales...

|

Complete a Balance Sheet ABC Corporation |

|||

| Income Statement | |||

| For the Year Ended December 31, 2014 | |||

| Sales Revenue | 792,845 | ||

| Less: Operating Expenses | |||

| Wages Expense | 80,350 | ||

| Office Expense | 21,700 | ||

| Utilities Expense | 31,000 | ||

| Advertising Expense | $ 8,400 | ||

| Insurance Expense | 82,000 | ||

| Employee Compensation Expense | 10,000 | ||

| Bad Debt Expense | 25,000 | ||

| Pension Expense | 40,000 | ||

| Depreciation Expense | 33,759 | ||

| Total Operating Expenses | 332,209 | ||

| Income from Operations | 460,636 | ||

| Other Revenue/Expenses | |||

| Rent Revenue | 12,000 | ||

| Interest Income | 19,561 | ||

| Interest Expense | (1,175) | 30,386 | |

| Income before Taxes | 491,021 | ||

| Income Tax Expense | (63,800) | ||

| Net Income | 427,221 | ||

| ABC Corporation | ||

| Adjusted Trial Balance | ||

| December 31, 2014 | ||

| Debit | Credit | |

| Accounts Payable | $ 65,340 | |

| Accounts Receivable | 190,300 | |

| Accumulated Depreciation: Building | $ 5,400 | |

| Accumulated Depreciation: Equipment | 29,359 | |

| Accumulated Other Comprehensive Income | 15,000 | |

| Additional Paid in Capital - Treasury Stock | 21,000 | |

| Advertising Expense | 8,400 | |

| Allowance for Doubtful Accounts | 25,000 | |

| Bad Debt Expense | 25,000 | |

| Bonds Interest Expense | 43,088 | |

| Bonds Payable | 1,600,000 | |

| Building | 150,000 | |

| Cash | 1,270,676 | |

| Common Stock | 101,000 | |

| Depreciation Expense | 33,759 | |

| Dividends | 41,000 | |

| Employee Compensation Expense | 10,000 | |

| Employee Stock Option Outstanding Account | 10,000 | |

| Equipment | 50,000 | |

| Fair value adjustment (Trading) | (8,000) | |

| Income Taxes Expense | 63,800 | |

| Income Taxes Payable | 63,800 | |

| Insurance Expense | 82,000 | |

| Interest Expense | 1,175 | |

| Interest Income | 19,561 | |

| Interest Receivable | 16,000 | |

| Inventory | - | |

| Investment in Bonds of Intuit Corp | 200,000 | |

| Investment in Bonds of Intuit Corp - Discount | 18,615 | |

| Land | 75,000 | |

| Lease Equipment | 43,796 | |

| Lease Liability | 33,293 | |

| LT (Debt) Investments (HTM) | 177,824 | |

| Notes Payable | 236,175 | |

| Office Expense | 21,700 | |

| Patent | 37,500 | |

| Pension Expense | 40,000 | |

| Pension-Related Asset | 10,000 | |

| PIC in Excess of Par - Common Stock | 33,000 | |

| Premium on Bonds Payable | 118,630 | |

| Prepaid Insurance | 17,400 | |

| Purchases | 350,000 | |

| Rent Revenue | 12,000 | |

| Retained Earnings | - | |

| Sales Revenue | 792,845 | |

| Short-term Investments | 167,000 | |

| Treasury Stock | - | |

| Unearned Rent Revenue | 24,000 | |

| Unrealized Holding Gains and Losses | 8,000 | |

| Utilities Expense | 31,000 | |

| Wages Expense | 80,350 | |

| Wages Payable | $ 12,750 | |

| Total | $ 3,236,768 | $ 3,236,768 |

In: Accounting

Which of the following statements is true about productive and allocative efficiency? Productive efficiency and allocative...

Which of the following statements is true about productive and allocative efficiency?

Productive efficiency and allocative efficiency can only occur together; neither can occur without the other.

Productive efficiency can only occur if there is also allocative efficiency.

Society can achieve either productive efficiency or allocative efficiency, but not both simultaneously.

Realizing allocative efficiency implies that productive efficiency has been realized.

Select which of the statements below aretrue.

Both pure and monopolistically competitive firms do not need to advertise their products so that they may minimize their ATC.

Natural monopolies can achieve minimum ATC.

Under regulatory marginal cost pricing, firms earn normal profits, but no more.

Economic profits are treated as a cost of production.

None of the other answers are true.

A purely competitive firm is currently producing 100 units of output and selling at $40 price. Its cost structure at the existing operation level is:

AFC = $10

AVC = $25

MC =$35

This firm

is earning an economic profit = $500.

is losing $1500.

should shut-down in the short run.

should cut back on its current level of production.

none of the other answers are correct.

The most microeconomic topic below is

French inflation rates.

aggregate unemployment in Russia.

Mexican economic growth.

the level of Volkswagan profit.

the American money supply and central bank policies.

America's national debt

Which statement is true?

A firm's explicit costs are the opportunity costs of using the resources that it already owns to make the firm's own product rather than selling those resources to outsiders for cash.

If demand is elastic, a decrease in price will increase total revenue.

Average revenue is the total amound the seller receives from the sale of a product in a praticular time period.

Marginal cost reaches its minimum point just as marginal product reaches its minimum point as well.

Diseconomies of scale explain the downward sloping part of the long-run ATC curve.

In the most competitive of industries, the surviving firms will earn huge economic profit over the longer run.

Marginal revenue

exceeds price for monopoly firms.

is perfectly inelastic for purely competitive firms.

is equivalent to average revenue for purely price discriminating firms.

is rising under conditions of oligopoly.

measures the slope of the average revenue curve.

is positive at the level of maximum total revenue.

In: Economics

On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Accounts...

On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances:

| Accounts | Debit | Credit | |||||

| Cash | $ | 23,900 | |||||

| Accounts Receivable | 5,300 | ||||||

| Supplies | 3,200 | ||||||

| Land | 51,000 | ||||||

| Accounts Payable | $ | 3,300 | |||||

| Common Stock | 66,000 | ||||||

| Retained Earnings | 14,100 | ||||||

| Totals | $ | 83,400 | $ | 83,400 | |||

During January 2021, the following transactions occur:

| January | 2 | Purchase rental space for one year in advance, $6,300 ($525/month). | ||

| January | 9 | Purchase additional supplies on account, $3,600. | ||

| January | 13 | Provide services to customers on account, $25,600. | ||

| January | 17 | Receive cash in advance from customers for services to be provided in the future, $3,800. | ||

| January | 20 | Pay cash for salaries, $11,600. | ||

| January | 22 | Receive cash on accounts receivable, $24,200. | ||

| January | 29 | Pay cash on accounts payable, $4,100. |

The following information is available on January 31.

- Rent for the month of January has expired.

- Supplies remaining at the end of January total $2,900.

- By the end of January, $3,275 of services has been provided to customers who paid in advance on January 17.

- Unpaid salaries at the end of January are $5,730.

Solve Service Revenue, Retained Earning for Jan 31 and retained earning for jan 31. Create income statemenent and balance sheet

| No | Date | Account Title | Debit | Credit |

|---|---|---|---|---|

| 1 | Jan 02 | Prepaid Rent | 6,300 | |

| Cash | 6,300 | |||

| 2 | Jan 09 | Supplies | 3,600 | |

| Accounts Payable | 3,600 | |||

| 3 | Jan 13 | Accounts Receivable | 25,600 | |

| Service Revenue | 25,600 | |||

| 4 | Jan 17 | Cash | 3,800 | |

| Deferred Revenue | 3,800 | |||

| 5 | Jan 20 | Salaries Expense | 11,600 | |

| Cash | 11,600 | |||

| 6 | Jan 22 | Cash | 24,200 | |

| Accounts Receivable | 24,200 | |||

| 7 | Jan 29 | Accounts Payable | 4,100 | |

| Cash | 4,100 | |||

| 8 | Jan 31 | Rent Expense | 525 | |

| Prepaid Rent | 525 | |||

| 9 | Jan 31 | Supplies Expense | 3,900 | |

| Supplies | 3,900 | |||

| 10 | Jan 31 | Deferred Revenue | 3,275 | |

| Service Revenue | 3,275 | |||

| 11 | Jan 31 | Salaries Expense | 5,730 | |

| Salaries Payable | 5,730 | |||

| 12 | Jan 31 | Service Revenue | ||

| Retained Earnings | ||||

| 13 | Jan 31 | Retained Earnings | ||

| Salaries Expense | 17,330 | |||

| Rent Expense | 525 | |||

| Supplies Expense | 3,900 |

In: Accounting

Adger Corporation is a service company that measures its output based on the number of customers...

|

Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for May as shown below: |

|

Fixed Element per Month |

Variable Element per Customer Served |

Actual Total for May |

||||

| Revenue | $ | 5,700 | $ | 209,500 | ||

| Employee salaries and wages | $ | 64,000 | $ | 1,100 | $ | 106,400 |

| Travel expenses | $ | 560 | $ | 19,000 | ||

| Other expenses | $ | 43,000 | $ | 40,700 | ||

|

When preparing its planning budget the company estimated that it would serve 35 customers per month; however, during May the company actually served 40 customers

|

|||||||||||||

| 3. |

What is Adger’s employee salaries and wages spending variance for May?

4.What is Adgers travel expenses spending variance for May?

5. What is Adger's other expenses spending variance for May?

6. What amount of revenue would be inculded in Adger's planning budget for May?

7. What amount of employee salaries and wages would be inculded in Adger's planning budget for May?

8. What amount of travel expenses would be inculded in Adger's planning budget for May?

9. What amount of other expenses would be included in Adger's planning budget for May?

10. What exctiving Variance would Adger report in May with respect to its revenue?

11. What activity Variances would Adger report with respect to each of its expenses?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

4. The Laffer curve Government-imposed taxes cause reductions in the activity that is being taxed, which...

4. The Laffer curve

Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections.

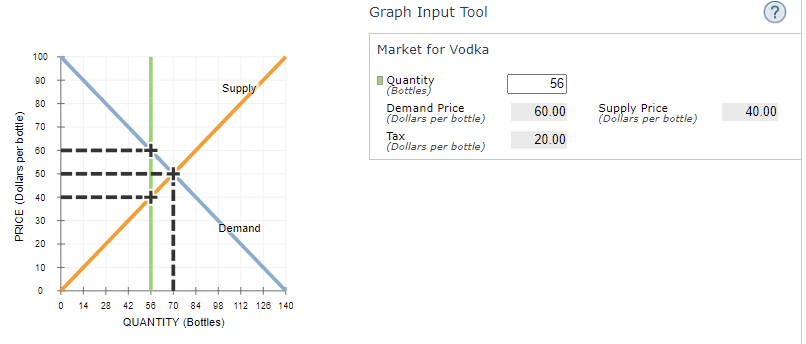

To understand the effect of such a tax, consider the monthly market for vodka, which is shown on the following graph.

Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

Suppose the government imposes a $ 20-per-bottle tax on suppliers.

At this tax amount, the equilibrium quantity of vodka is _______ bottles, and the government collects $_______ in tax revenue.

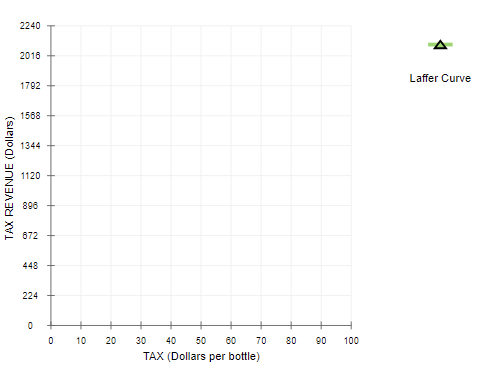

Now calculate the government's tax revenue if it sets a tax of $ 0, $ 20, $ 40, $ 50, $ 60, $ 80, or $ 100 per bottle. (Hint: To find the equilibrium quantity after the tax, adjust the "Quantity" field until the Tax equals the value of the per-unit tax.) Using the data you generate, plot a Laffer curve by using the green points (triangle symbol) to plot total tax revenue at each of those tax levels.

Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.

Suppose the government is currently imposing a $ 40-per-bottle tax on vodka.

True or False: The government can raise its tax revenue by increasing the per-unit tax on vodka.

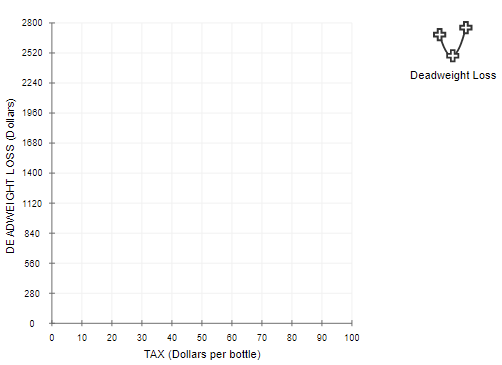

Consider the deadweight loss generated in each of the following cases: no tax, a tax of $ 40 per bottle, and a tax of $ 80 per bottle.

On the following graph, use the black curve (plus symbols) to illustrate the deadweight loss in these cases. (Hint: Remember that the area of a triangle is equal to 1/2 × Base × Height. In the case of a deadweight loss triangle found on the graph input tool, the base is the amount of the tax and the height is the reduction in quantity caused by the tax.)

As the tax per bottle increases, deadweight loss _______ .

In: Economics

Problem 7-9 Dixie Showtime Movie Theaters, Inc., owns and operates a chain of cinemas in several...

Problem 7-9

Dixie Showtime Movie Theaters, Inc., owns and operates a chain of cinemas in several markets in the southern U.S. The owners would like to estimate weekly gross revenue as a function of advertising expenditures. Data for a sample of eight markets for a recent week follow.

Market |

Weekly Gross Revenue ($100s) |

Television Advertising ($100s) |

Newspaper Advertising ($100s) |

|

| Mobile | 101.3 | 4.9 | 1.4 | |

| Shreveport | 52.9 | 3.1 | 3.2 | |

| Jackson | 75.8 | 4.2 | 1.5 | |

| Birmingham | 127.2 | 4.5 | 4.3 | |

| Little Rock | 137.8 | 3.6 | 4 | |

| Biloxi | 102.4 | 3.5 | 2.3 | |

| New Orleans | 236.8 | 5 | 8.4 | |

| Baton Rouge | 220.6 | 6.8 | 5.9 | |

| (a) | Use the data to develop an estimated regression with the amount of television advertising as the independent variable. |

| Let x represent the amount of television advertising. | |

| If required, round your answers to three decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300) | |

| = + x | |

| Test for a significant relationship between television advertising and weekly gross revenue at the 0.05 level of significance. What is the interpretation of this relationship? | |

| The input in the box below will not be graded, but may be reviewed and considered by your instructor. | |

| (b) | How much of the variation in the sample values of weekly gross revenue does the model in part (a) explain? |

| If required, round your answer to two decimal places. | |

| % | |

| (c) | Use the data to develop an estimated regression equation with both television advertising and newspaper advertising as the independent variables. |

| Let x1 represent the amount of television advertising. | |

| Let x2 represent the amount of newspaper advertising. | |

| If required, round your answers to three decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300) | |

| = + x1 + x2 | |

| (d) | How much of the variation in the sample values of weekly gross revenue does the model in part (c) explain? |

| If required, round your answer to two decimal places. | |

| % |

In: Statistics and Probability