Questions

Read about the Germ Plasm theory. Propose any experiment that would act as a proof or...

Read about the Germ Plasm theory. Propose any experiment that would act as a proof or germ plasm theory of inheritance.

In: Biology

#11-16. For each study described, state whether it will experimental or observational. If observational, identify which...

#11-16. For each study described, state whether it will experimental or observational. If observational, identify which type specifically (retrospective cohort, prospective cohort, case-control, cross-sectional, ecological). Briefly explain how you can tell.

-

We plan to distribute a questionnaire to all UNLV faculty, students and staff ages 40 and 60. In that questionnaire, we will ask if they suffer from kidney disease, and if they take regular medications including BZDs. We than assess how many people with kidney disease take BZDs and how many people without KC take BZDs.

-

We select a group of 1,000 middle-aged volunteers without kidney disease who are likely to suffer from insomnia/anxiety. We assign them randomly into two groups. Group 1 is told to live their lives as normal and take any meds proscribed by their doctor. Group 2 is told not to use BZDs for 2 years, and doctors prescribe Group 2 with natural alternatives to BZDs. After those 2 years, we follow them up and check to see who developed kidney disease in each group, and compare the groups.

-

We will get the age-adjusted incidence rates of kidney disease in 30 different countries and compare those with the rates of BZD consumption per capita (total usage in country/total population of that country). We will then check to see if there is a correlation between the BZD consumption and kidney disease.

-

In 2010, we examined the medical records of 2,000 patients ages 53+ associated with Kaiser Permanente (large health care organization) who did NOT have kidney disease in 2005. Then, we look back in the records to see who took BZDs from 2000-2005. After that, we look to see who developed kidney disease from 2006 until 2008. We compared the rates of kidney disease among those who took the BZDs and those who didn’t.

-

We plan to select a large healthy group of 4000 50-year old people from the general population and give them a questionnaire to fill out. One of the questions concerns the use of BZDs. We are going to follow them for 5 years and compare how many developed kidney disease among those who said yes to BZD consumption and among those who said no to BZD consumption.

-

We will select 200 patients with kidney disease and 600 patients without kidney disease. We will then access their prescription records to see if they used BZDs regularly when they were aged 40-50 years of age.

In: Nursing

1)name five non infectious digestive system diseases 2)name five non infectious urinary system diseases 3)name five...

In: Anatomy and Physiology

Number of Shares Outstanding (000's) 300 Share Price as of 12/31/2017 $11 Share Price as of...

Number of Shares Outstanding (000's) 300

Share Price as of 12/31/2017 $11

Share Price as of 12/31/2016 $9

Tax Rate 40%

Total Dividends Paid In 2017 (000's) $ 60

Capital Expenditures in 2017 (000's) $70

Net Income 2016 $171

Net income 2017 $189

Sold old equipment for $20,000 with an original cost of $25,000 and A/D of $10,000

- Find total stakeholder return ( Dividends + SPA) for year ended 2016 and 2017

In: Finance

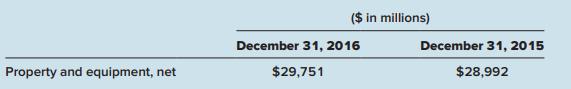

Norfolk Southern Corporation, one of the nation’s premier transportation companies, reported the following amounts in the asset section of its balance sheets for the years ended December 31, 2016 and 2015:

Norfolk Southern Corporation, one of the nation’s premier transportation companies, reported the following amounts in the asset section of its balance sheets for the years ended December 31, 2016 and 2015:

In addition, information from the 2016 statement of cash flows and related notes reported the following items ($ in millions):

Depreciation.........................................................$1,030

Additions to property and equipment..........1,887

Sales price of property and equipment..........130

Required:

For what amount was the sales price above book value of property and equipment sold for the year ended December 31, 2016?

In: Accounting

MBI, Inc., had sales of $6 million for fiscal 2016. The company's gross profit ratio for...

MBI, Inc., had sales of $6 million for fiscal 2016. The company's gross profit ratio for that year was 31.2%.

a. Calculate the gross profit and cost of goods sold for MBI, Inc. for fiscal 2016.

b. Assume that a new product is developed and that it will cost $1,634 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2016.

c. From a management viewpoint, what would you do with all this information?

In: Accounting

Ex 14-12 Entries for installment note transactions ObJ. 4 On January 1, 2016, Bryson Company obtained...

Ex 14-12 Entries for installment note transactions ObJ. 4 On January 1, 2016, Bryson Company obtained a $147,750, four-year, 7% installment note from Campbell Bank. The note requires annual payments of $43,620, beginning on December 31, 2016. a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4. b. Journalize the entries for the issuance of the note and the four annual note payments. c. Describe how the annual note payment would be reported in the 2016 income statement.

In: Accounting

a.) Define GDP. b.) What are three reasons why GDP in the United States has increased...

a.) Define GDP.

b.) What are three reasons why GDP in the United States has increased over time?

c.) Consider a country with a simple economy that produces two goods: apples and bananas. Data is collected in two years: 2016 and 2017.

2016:

Price of Apples: $2 Quantity of Apples: 10

Price of Bananas: $3 Quantity of Bananas: $20

2017:

Price of Apples: $4 Quantity of Apples: $30

Price of Bananas: $6 Quantity of Apples: $60

Complete nominal GDP in this country in 2016 and 2017.

In: Economics

Question 1 Multi Media Ltd. completed the following transactions: September 14, 2016: Provided services to Inga...

Question 1

Multi Media Ltd. completed the following transactions:

September 14, 2016: Provided services to Inga Corporation on account, $3,000, terms 30 days.

November 1, 2016: Accepted a one-year, 12% note from Inga Corporation to settle its account.

December 31, 2016: Accrued interest on the note from Inga Corporation (round to the nearest dollar).

November 1, 2017: Received amount due from Inga Corporation.

Required:

Record entries for the above transactions.

In: Accounting

On April 29, 2016, Quality Appliances purchased equipment for $282,000. The estimated service life of the...

|

On April 29, 2016, Quality Appliances purchased equipment for $282,000. The estimated service life of the equipment is six years and the estimated residual value is $21,000. Quality's fiscal year ends on December 31. |

| Required: |

|

Calculate depreciation for 2016 and 2017 using each of the three methods listed. Quality calculates partial year depreciation based on the number of months the asset is in service. (Do not round intermediate calculations.)

|

In: Accounting