Questions

Pharoah Company finances some of its current operations by assigning accounts receivable to a finance company....

Pharoah Company finances some of its current operations by

assigning accounts receivable to a finance company. On July 1,

2020, it assigned, under guarantee, specific accounts amounting to

$345,000. The finance company advanced to Pharoah 80% of the

accounts assigned (20% of the total to be withheld until the

finance company has made its full recovery), less a finance charge

of 0.50% of the total accounts assigned.

On July 31, Pharoah Company received a statement that the finance

company had collected $184,000 of these accounts and had made an

additional charge of 0.50% of the total accounts outstanding as of

July 31. This charge is to be deducted at the time of the first

remittance due Pharoah Company from the finance company.

(Hint: Make entries at this time.) On August 31, 2020,

Pharoah Company received a second statement from the finance

company, together with a check for the amount due. The statement

indicated that the finance company had collected an additional

$115,000 and had made a further charge of 0.50% of the balance

outstanding as of August 31.

Make all entries on the books of Pharoah Company that are involved

in the transactions above. (If no entry is required,

select "No Entry" for the account titles and enter 0 for the

amounts. Credit account titles are automatically indented when the

amount is entered. Do not indent manually.)

In: Accounting

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on...

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on March 1, 2016. It acquired financing from the issuance of common stock for $40,000,000 and issuance of 4% bonds that mature in 2026 for $30,000,000. The income statements and balance sheets for the first two years are provided in a separate Excel spreadsheet. All amounts are in thousands.

Required:

The Chief Executive Officer (CEO) is interested in increasing sales and decreasing expenses. You have been requested to prepare a report that provides analysis of the financial statements and recommendations to improve the financial performance of the company. Your report should include the following items:

Calculate the following ratios and provide an analysis of the company based on the ratios: (Show Work)

Days Sales Outstanding=

Profit Margin=

Asset Turnover=

Return on Assets=

Financial Leverage=

|

SILVER CLOUD COMPUTING |

||||

| Income Statements | ||||

| For the Years Ended February 28, 2018 and 2017 | ||||

| fye 2/28/2018 | fye 2/28/2017 | |||

| (in thousands) | (in thousands) | |||

| Sales | $225,000 | $200,000 | ||

| Sales Discounts | 3,375 | 2,500 | ||

| Net Sales | 221,625 | 197,500 | ||

| Wages and Salaries | 73,500 | 70,000 | ||

| Bad Debt Expense | 2,100 | 2,000 | ||

| Depreciation | 20,000 | 20,000 | ||

| Marketing Expense | 33,750 | 30,000 | ||

| Occupancy Expense | 54,000 | 54,000 | ||

| Research & Development | 22,500 | 20,000 | ||

| Total Expenses | 205,850 | 196,000 | ||

| Income from Operations | 15,775 | 1,500 | ||

| Interest Expense | 1,200 | 1,200 | ||

| Income Before Taxes | 14,575 | 300 | ||

| Income Taxes (40%) | 5,830 | 120 | ||

| Net Income | $8,745 |

$180 |

|

SILVER CLOUD COMPUTING |

|||||||

| Balance Sheets | |||||||

| February 28, 2018 and 2017 and February 29, 2016 | |||||||

| At Inception | |||||||

| Feb 28 2018 | Feb 28 2017 | Feb 29 2016 | |||||

| (in thousands) | (in thousands) | (in thousands) | |||||

| Cash | $55,755 | $22,300.00 | $10,000 | ||||

| Accounts Receivable | 18,000 | 16,000 | - | ||||

| Net Computer Equipment | 20,000 | 40,000 | 60,000 | ||||

| Total Assets | $93,755 | $78,300 | $70,000 | ||||

| Accounts Payable | $9,000 | $8,000 | $- | ||||

| Taxes Payable | 5,830 | 120 | - | ||||

| Long-term Debt | 30,000 | 30,000 | 30,000 | ||||

| Common Stock | 40,000 | 40,000 | 40,000 | ||||

| Retained Earnings | 8,925 | 180 | - | ||||

| Total Liabilities & Stockholders Equity | $93,755 | $78,300 |

$70,000 |

In: Accounting

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on...

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on March 1, 2016. It acquired financing from the issuance of common stock for $40,000,000 and issuance of 4% bonds that mature in 2026 for $30,000,000. The income statements and balance sheets for the first two years are provided in a separate Excel spreadsheet. All amounts are in thousands.

Required:

The Chief Executive Officer (CEO) is interested in increasing sales and decreasing expenses. You have been requested to prepare a report that provides analysis of the financial statements and recommendations to improve the financial performance of the company. Your report should include the following items:

Calculate the following ratios and provide an analysis of the company based on the ratios: (Show Work)

Return on Equity=

PPE Turnover=

Total Liabilities to Equity=

Times Interest Earned=

|

SILVER CLOUD COMPUTING |

||||

| Income Statements | ||||

| For the Years Ended February 28, 2018 and 2017 | ||||

| fye 2/28/2018 | fye 2/28/2017 | |||

| (in thousands) | (in thousands) | |||

| Sales | $225,000 | $200,000 | ||

| Sales Discounts | 3,375 | 2,500 | ||

| Net Sales | 221,625 | 197,500 | ||

| Wages and Salaries | 73,500 | 70,000 | ||

| Bad Debt Expense | 2,100 | 2,000 | ||

| Depreciation | 20,000 | 20,000 | ||

| Marketing Expense | 33,750 | 30,000 | ||

| Occupancy Expense | 54,000 | 54,000 | ||

| Research & Development | 22,500 | 20,000 | ||

| Total Expenses | 205,850 | 196,000 | ||

| Income from Operations | 15,775 | 1,500 | ||

| Interest Expense | 1,200 | 1,200 | ||

| Income Before Taxes | 14,575 | 300 | ||

| Income Taxes (40%) | 5,830 | 120 | ||

| Net Income | $8,745 |

$180 |

|

SILVER CLOUD COMPUTING |

|||||||

| Balance Sheets | |||||||

| February 28, 2018 and 2017 and February 29, 2016 | |||||||

| At Inception | |||||||

| Feb 28 2018 | Feb 28 2017 | Feb 29 2016 | |||||

| (in thousands) | (in thousands) | (in thousands) | |||||

| Cash | $55,755 | $22,300.00 | $10,000 | ||||

| Accounts Receivable | 18,000 | 16,000 | - | ||||

| Net Computer Equipment | 20,000 | 40,000 | 60,000 | ||||

| Total Assets | $93,755 | $78,300 | $70,000 | ||||

| Accounts Payable | $9,000 | $8,000 | $- | ||||

| Taxes Payable | 5,830 | 120 | - | ||||

| Long-term Debt | 30,000 | 30,000 | 30,000 | ||||

| Common Stock | 40,000 | 40,000 | 40,000 | ||||

| Retained Earnings | 8,925 | 180 | - | ||||

| Total Liabilities & Stockholders Equity | $93,755 | $78,300 |

$70,000 |

In: Accounting

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on...

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on March 1, 2016. It acquired financing from the issuance of common stock for $40,000,000 and issuance of 4% bonds that mature in 2026 for $30,000,000. The income statements and balance sheets for the first two years are provided in a separate Excel spreadsheet. All amounts are in thousands.

Required:

The Chief Executive Officer (CEO) is interested in increasing sales and decreasing expenses. You have been requested to prepare a report that provides analysis of the financial statements and recommendations to improve the financial performance of the company. Your report should include the following items:

Calculate the following ratios and provide an analysis of the company based on the ratios: (SHOW ALL WORK)

Financial Leverage

Return on Equity

PPE (property Plant& Equipment) Turnover

Total Liabilities to Equity

Times Interest Earned

| SILVER CLOUD COMPUTING | ||||

| Income Statements | ||||

| For the Years Ended February 28, 2018 and 2017 | ||||

| fye 2/28/2018 | fye 2/28/2017 | |||

| (in thousands) | (in thousands) | |||

| Sales | $225,000 | $200,000 | ||

| Sales Discounts | 3,375 | 2,500 | ||

| Net Sales | 221,625 | 197,500 | ||

| Wages and Salaries | 73,500 | 70,000 | ||

| Bad Debt Expense | 2,100 | 2,000 | ||

| Depreciation | 20,000 | 20,000 | ||

| Marketing Expense | 33,750 | 30,000 | ||

| Occupancy Expense | 54,000 | 54,000 | ||

| Research & Development | 22,500 | 20,000 | ||

| Total Expenses | 205,850 | 196,000 | ||

| Income from Operations | 15,775 | 1,500 | ||

| Interest Expense | 1,200 | 1,200 | ||

| Income Before Taxes | 14,575 | 300 | ||

| Income Taxes (40%) | 5,830 | 120 | ||

| Net Income | $8,745 | $180 |

| SILVER CLOUD COMPUTING | |||||||

| Balance Sheets | |||||||

| February 28, 2018 and 2017 and February 29, 2016 | |||||||

| At Inception | |||||||

| Feb 28 2018 | Feb 28 2017 | Feb 29 2016 | |||||

| (in thousands) | (in thousands) | (in thousands) | |||||

| Cash | $55,755 | $22,300.00 | $10,000 | ||||

| Accounts Receivable | 18,000 | 16,000 | - | ||||

| Net Computer Equipment | 20,000 | 40,000 | 60,000 | ||||

| Total Assets | $93,755 | $78,300 | $70,000 | ||||

| Accounts Payable | $9,000 | $8,000 | $- | ||||

| Taxes Payable | 5,830 | 120 | - | ||||

| Long-term Debt | 30,000 | 30,000 | 30,000 | ||||

| Common Stock | 40,000 | 40,000 | 40,000 | ||||

| Retained Earnings | 8,925 | 180 | - | ||||

| Total Liabilities & Stockholders Equity | $93,755 | $78,300 | $70,000 | ||||

In: Accounting

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on...

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on March 1, 2016. It acquired financing from the issuance of common stock for $40,000,000 and issuance of 4% bonds that mature in 2026 for $30,000,000. The income statements and balance sheets for the first two years are provided in a separate Excel spreadsheet. All amounts are in thousands.

Required:

The Chief Executive Officer (CEO) is interested in increasing sales and decreasing expenses. You have been requested to prepare a report that provides analysis of the financial statements and recommendations to improve the financial performance of the company. Your report should include the following items:

Prepare common sized financial statements for both years and provide comments on the differences between the years.Are there any areas of concern?

Calculate the following ratios and provide an analysis of the company based on the ratios:

Days Sales Outstanding

Profit Margin

Asset Turnover

Return on Assets

Financial Leverage

Return on Equity

PPE Turnover

Total Liabilities to Equity

Times Interest Earned

| fye 2/28/2018 | fye 2/28/2017 | |||

| (in thousands) | (in thousands) | |||

| Sales | $ 225,000 | $ 200,000 | ||

| Sales Discounts | 3,375 | 2,500 | ||

| Net Sales | 221,625 | 197,500 | ||

| Wages and Salaries | 73,500 | 70,000 | ||

| Bad Debt Expense | 2,100 | 2,000 | ||

| Depreciation | 20,000 | 20,000 | ||

| Marketing Expense | 33,750 | 30,000 | ||

| Occupancy Expense | 54,000 | 54,000 | ||

| Research & Development | 22,500 | 20,000 | ||

| Total Expenses | 205,850 | 196,000 | ||

| Income from Operations | 15,775 | 1,500 | ||

| Interest Expense | 1,200 | 1,200 | ||

| Income Before Taxes | 14,575 | 300 | ||

| Income Taxes (40%) | 5,830 | 120 | ||

| Net Income | $ 8,745 | $ 180 | ||

| SILVER CLOUD COMPUTING | ||||||||

| Balance Sheets | ||||||||

| February 28, 2018 and 2017 and February 29, 2016 | ||||||||

| At Inception | ||||||||

| Feb 28 2018 | Feb 28 2017 | Feb 29 2016 | ||||||

| (in thousands) | (in thousands) | (in thousands) | ||||||

| Cash | $ 55,755 | $ 22,300.00 | $ 10,000 | |||||

| Accounts Receivable | 18,000 | 16,000 | - | |||||

| Net Computer Equipment | 20,000 | 40,000 | 60,000 | |||||

| Total Assets | $ 93,755 | $ 78,300 | $ 70,000 | |||||

| Accounts Payable | $ 9,000 | $ 8,000 | $ - | |||||

| Taxes Payable | 5,830 | 120 | - | |||||

| Long-term Debt | 30,000 | 30,000 | 30,000 | |||||

| Common Stock | 40,000 | 40,000 | 40,000 | |||||

| Retained Earnings | 8,925 | 180 | - | |||||

| Total Liabilities & Stockholders Equity | $ 93,755 | $ 78,300 | $ 70,000 | |||||

In: Accounting

A company is developing a new high performance wax for cross country ski racing. In order...

A company is developing a new high performance wax for cross country ski racing. In order to justify the price marketing wants, the wax needs to be very fast.Specifically, the mean time to finish their standard test course should be less than 55 seconds for a former Olympic champion. To test it, the champion will ski the course 8 times. The champion's times (selected at random) are 51.4, 63.3, 51.2, 54.3,49.4,49.4,50.8,and 40.3 seconds to complete the test course. Should they market the wax? Assume the assumptions and conditions for appropriate hypothesis testing are met for the sample. Use 0.05 as the P-value cutoff level. Calculate the t statistic-round to three decimal places The P value is-round to three decimal places?

In: Statistics and Probability

Jericho Vehicles is considering making a bid for a mobile rocket-launching system for the U.S. military....

Jericho Vehicles is considering making a bid for a mobile rocket-launching system for the U.S. military. However, the company has almost no experience in producing this type of vehicle. In an effort to develop a learning curve for the production of this new mobile weapon system,

In: Operations Management

Research a U.S.-based company that operates globally. Explain the key elements of the company’s operations, business...

Research a U.S.-based company that operates globally.

- Explain the key elements of the company’s operations, business structure, and market position.

- Illustrate specific microeconomic, macroeconomic, and international economic factors that influence the management’s strategies and drive the company’s success.

In: Accounting

Set up - You were hired in the role of accounting lead a couple of years...

Set up - You were hired in the role of accounting lead a couple of years ago by a privately held company.

You report directly to the CEO. The company sells its products through a dealer distribution network.

Revenue is booked at the time shipment occurs. Under standard practice, revenue will be booked as of

the last day of the month if the shipment will occur within 1 or 2 days of the new month. On occasion,

revenue may be booked if the product is ready for shipment but the dealer/customer does not wish to

take shipment due to a holiday or vacation schedule. (So, if the shipment does not occur only because it

is inconvenient for the dealer/customer to receive it, the customer is charged a nominal “warehousing”

fee and revenue will be recognized in such situations; shipment will occur as soon as it’s convenient for

the dealer/customer to receive the shipment upon their return to the workplace.) Since the company is

privately held, it does not require a financial audit but it does receive an annual financial review by an

independent CPA firm.

The Issue - At quarter end, you receive a call from your boss instructing you to book a $100,000 sale,

sending the invoice to a dealer/customer. On April 4, you send the invoice dated the last day of the

month (3/31) and you give the dealer/customer an additional 30 days to pay since the product had not

yet shipped as of April 4. The dealer/customer replies that as of April 5, he still does not have a

purchase order for the $100,000 sale but hopes to get one soon. In addition, if he cannot get the

purchase order, he hopes to get a purchase order elsewhere for basically the same products for a

hopefully similar price.

In addition, at the end of 2017, there was an order to be secured by a letter of credit. The CEO wants the

almost $100,000 sale in 2017. You let the CEO know you’re hesitant to book this in 2017 since the order

has not shipped and no letter of credit has been sent yet. There are also tax ramifications (i.e., the

company will fare better booking the sale in 2018 due to the more favorable tax treatment of

corporations under the new tax legislation). The CEO replies that before he decides, he wants to see

how the numbers shake out. He decides he wishes the revenue to appear in 2017.

There were some other bookings of revenues with various dealer/customers in quarter 1 totaling

approximately $150,000, for which letter of credit documentation had not yet been received. The

dealer/customers had not yet authorized shipment because the required documentation had not yet

cleared all channels (it was not due to holiday/vacation reason inconvenience), but the CEO said to

consider these transactions “warehoused” and book the revenue.

In addition to the fact that the review of 2017 is still ongoing, the company is looking to sell

approximately 20% of its stock to a publicly traded company. The 2017 financials have been provided to

the potential buyer (marked “unreviewed”) and the potential buyer has been asking for the quarter 1

results of 2018.

Get with your group. What is your view of the entire situation? What do you do? Be sure to pay

attention to rules/regs that lead you to feel there is an ethical problem here.

1. Determine the facts of the situation. This involves determining the "who, what, where, when, and how."

2. Identify the ethical issue and the stakeholders. Stakeholders may include shareholders, creditors, management, employees, and the community.

3. Identify the values related to the situation. For example, in some situations confidentiality may be an important value that may conflict with the right to know.

4. Specify the alternative courses of action.

5. Evaluate the courses of action specific in step 4 in sterms of their consistency with the values identified in step 3. This step may or may not lead to a suggested course of action.

6. Identify the consequences of each possible course of action. If step 5 does not provide a course of action, assess the consequences of each possible course of action for all of the stakeholders involved.

7. Make your decision and take any indicated action.

In: Finance

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp

Construction Contract Accounting as per Percentage-of-Completion Method & Completed Contract Method.

Problem Four: Long-Term Contract

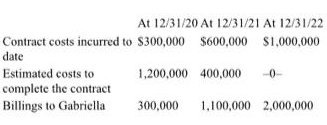

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp. for a total contract price of S2,000,000. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gabriella for 2020, 2021, and 2022.

Required:

a. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

b. Using the completed-contract method, how much profit or loss will be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

In: Accounting