Questions

B. Summarize the main arguments in O’Brian (1982) and Acemoglu (2006) papers by focusing on the...

B. Summarize the main arguments in O’Brian (1982) and Acemoglu (2006) papers by focusing on the following points:

C. What do the “dependency school” scholars claim about the development of the North and South as to the sources of industrialization and capital accumulation?

D. How does O’ Brian (1982) try to refute the arguments of the dependency school? What is the main source of economic growth in Western Europe according to him? Is Atlantic trade important for economic growth in Western Europe for him? Why or why not?

E. Do you think that the econometric findings of Acemoglu et al (2006) support O’Brian’s conclusions? How do Acemoglu et al (2006) view the importance of Atlantic Trade as far as economic growth in Western Europe is concerned? Discuss.

In: Economics

Cash Received before Revenue is Earned (Deferred Revenue) 1) The Insurance Company in (1) above received...

Cash Received before Revenue is Earned (Deferred Revenue)

1) The Insurance Company in (1) above received the cash paid by Nordstrom. What is the entry to record on the books of the Insurance Company?

Entry on the books of the Insurance Company

2) The Insurance Company provides protection for the next 12 months. What is the entry on a monthly basis?

3) On March 1, a friend gives you a $100 Nordstrom gift card. How does Nordstrom record this entry?4) You redeem your gift card. How does Nordstrom record this entry on March 31?

Expense Incurred before Cash is Paid (Accrued Liability/Accrued Expense)

1) Nordstrom pays a total of $280,000 in wages every other Friday. What is the journal entry on June 14th?

2) Nordstrom owes employees’ wages for the last two days of June and must recognize an expense for the wages earned by employees for those days. Assume the store is open seven days a week and the daily cost is 1/14th of the biweekly amount of $280,000 or 20,000. What is the entry to adjust the records for the last two days of the month (June)?

3) Using information obtained from (1) and (2) above. What entry will be made on the next payday (July 12)?

4) Assume Granger Company takes out a 9%, 90-day, $20,000 loan with its bank on March 1. Granger will repay the principal and interest on May 30. What is the entry on Granger’s books?

5) What is the entry to record 1 month of interest at the end of March? April? 6) What is the entry when Granger repays the principal and interest on May 30?

Revenue Earned before Cash is Received (Accrued Asset/Accrued Revenue)

1) Grant Management Company rents warehouse space to tenants. The contract calls for prepayment of rent for six months at a time. Grant allows one tenant to pay $2,500 in monthly rent anytime within the first ten days of the following month. The entry on Grants books at April 30 is?

2) What is the entry when the tenant pays the rent on May 7?

Exercise 2:

1) ABC purchases a 24 month fire insurance policy on January 1 for 54,000? What is the Journal Entry on January 31?

2) On April 1, GHI Corp took out a 12% 120 day, $10,000 loan at its bank. What is the journal entry on April 30?

In: Accounting

Forecasting A) Dexter Company reported the following 2018 income statement Total revenue $13,256,500 Cost of revenue...

Forecasting

A) Dexter Company reported the following 2018 income statement

|

Total revenue |

$13,256,500 |

|

Cost of revenue |

7,066,300 |

|

Gross profit |

6,190,200 |

|

Selling and administrative expenses |

3,758,200 |

|

Operating income |

2,432,000 |

|

Interest expense |

572,800 |

|

Income before income taxes |

1,859,200 |

|

Income tax expense |

687,905 |

|

Net income |

$ 1,171,295 |

Forecast Dexter’s income statement assuming a 5% increase in sales, a 17% effective tax rate, and a continuation of the 2018 percentage relation to net sales for expenses except for interest where the company projects no change.

B) Snap-On Corp 2018 financial statements include the following:

|

(millions) |

2018 |

2017 |

|

Net sales |

$ 3,430.4 |

$ 3,352.8 |

|

Accounts receivable |

1,159.4 |

1,091.9 |

|

Inventory |

530.5 |

497.8 |

|

Accounts payable |

170.9 |

148.3 |

Forecast accounts receivable, inventory, and accounts payable for 2019 given that sales are expected to grow by 8% in 2019.

In: Accounting

What is the average percentage of time that construction workers and productive according to James Adrian...

What is the average percentage of time that construction workers and productive according to James Adrian (2004)?

In: Civil Engineering

Analyzing Accounts and Notes Receivable; Computing Interest, Estimating Value, and Recording Bad Debts Analyze each of...

Analyzing Accounts and Notes Receivable; Computing Interest, Estimating Value, and Recording Bad Debts

Analyze each of the four separate scenarios and answer the requirements.

Note: Round each of your answers to the nearest whole dollar.

1. On December 31, 2020, Helena Company, a California real estate firm, received two $28,000 notes from customers in exchange for services rendered. The 8% note from El Dorado Company is due in nine months, and the 3% note from Newcastle Company is due in five years. The market interest rate for similar notes on December 31, 2020, was 8%. At what amounts should the two notes be reported in Helena’s December 31, 2020, balance sheet?

| Note receivable, El Dorado Company | Answer |

| Note receivable, Newcastle Company | Answer |

2. EPPA, an environmental management firm, issued to Dara, a $14,000, 8%, five-year installment note that required five equal annual year-end payments. This note was discounted to yield a 9% rate to Dara. What is the total amount of interest revenue to be recognized by Dara on this note?

| Total interest revenue | Answer |

3. On July 1, 2020, Lezix Company, a maker of denim clothing, sold goods in exchange for a $140,000, one-year, noninterest-bearing note. At the time of the sale, the market rate of interest was 12% on similar notes. At what amount should Lezix record the note receivable on July 1, 2020?

| Note receivable | Answer |

4. The records of Quest Company included the following accounts (with normal balances).

| Cash sales | $1,680,000 |

| Credit sales | 1,260,000 |

| Balance in accounts receivable, December 31, 2019 | 252,000 |

| Balance in accounts receivable, December 31, 2020 | 280,000 |

| Balance in allowance for doubtful accounts, December 31, 2019 (Cr.) | 4,200 |

| Accounts written off as uncollectible during 2020 | 7,000 |

The company estimates bad debts as 2% of receivables at year-end to be uncollectible.

Prepare the adjusting entry at December 31, 2020, to adjust the allowance for doubtful accounts.

| Date | Account Name | Dr. | Cr. |

|---|---|---|---|

| Dec. 31, 2020 | Answer |

| Answer | Answer |

| Answer |

| Answer | Answer |

In: Accounting

Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four...

Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4, 6-5)

[The following information applies to the questions

displayed below.]

Greg’s Bicycle Shop has the following transactions related to its

top-selling Mongoose mountain bike for the month of March.

Greg's Bicycle Shop uses a periodic inventory system.

| Date | Transactions | Units | Unit Cost | Total Cost | ||||||||||||

| March | 1 | Beginning inventory | 20 | $ | 250 | $ | 5,000 | |||||||||

| March | 5 | Sale ($400 each) | 15 | |||||||||||||

| March | 9 | Purchase | 10 | 270 | 2,700 | |||||||||||

| March | 17 | Sale ($450 each) | 8 | |||||||||||||

| March | 22 | Purchase | 10 | 280 | 2,800 | |||||||||||

| March | 27 | Sale ($475 each) | 12 | |||||||||||||

| March | 30 | Purchase | 9 | 300 | 2,700 | |||||||||||

| $ | 13,200 | |||||||||||||||

For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase.

rev: 04_13_2020_QC_CS-208026

2. Using FIFO, calculate ending inventory and

cost of goods sold at March 31.

|

Ending Inventory |

|

|

Cost of good sold |

3. Using LIFO, calculate ending inventory and

cost of goods sold at March 31.

|

Ending Inventory |

|

|

Cost of good sold |

4. Using weighted-average cost, calculate ending inventory and cost of goods sold at March 31. (Round your intermediate and final answers to 2 decimal places.)

|

Ending Inventory |

|

|

Cost of good sold |

5. Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average cost amounts to 2 decimal places.)

|

Specific Identification |

FIFO |

LIFO |

Weighted- Average cost |

|

|

Sales Revenue |

$ |

$ |

$ |

$ |

|

Gross profit |

$ |

$ |

$ |

$ |

In: Accounting

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. The co. implemented a TQM program in 2005....

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. The co. implemented a TQM program in 2005. Following are the quality-related accounting data that have been accumulated for the 5-year period after the program's start.

|

Year |

|||||

|

2006 |

2007 |

2008 |

2009 |

2010 |

|

|

Quality Costs ($1000s) |

|||||

|

Prevention |

3.2 |

10.7 |

28.3 |

42.6 |

50 |

|

Appraisal |

26.3 |

29.2 |

30.6 |

24.1 |

19.6 |

|

Internal Failure |

39.1 |

51.3 |

48.4 |

35.9 |

32.1 |

|

External Failure |

118.6 |

110.5 |

105.2 |

91.3 |

65.2 |

|

Accounting Measures ($1000s) |

|||||

|

Sales |

2700.6 |

2690.1 |

2705.2 |

2310.2 |

2880.7 |

|

Manufacturing Cost |

420.9 |

423.4 |

424.7 |

436.1 |

435.5 |

- Compute the co's total failure costs ratios (=(Internal Failure + External Failure)/(TQC) x 100%) as a % of TQC for each of the 5 years. Does there appear to be a trend? What might be the cause?

- Compute prevention costs (prevention/TQC x 100%) and appraisal cost (appriasal/TQC x 100%), each as a % of TC, during each of the 5 years. What do you guess is the co's quality strategy (e.g., emphasis on being proactive or reactive)?

- Compute quality-sales indices (TQC/Sales) and quality-cost indices (TQC/MfrCost) for each of the 5 years. Can one assess the effectiveness of the co's quality management program from these indices (i.e., are these indices good indicators of effectiveness)?

- List some examples of each quality-related costs - i.e., of prevention, appraisal, and internal and external failure costs - that might result from the production of the parkas.

- The BA Inc produces 20,000 parkas annually. The quality management program implemented improved average percentage of good parkas produced by 2% each year beginning with 83% good quality parkas in 2005. Only 20% of poor quality parkas can be reworked (and made good). Compute the product yield for each of the 5 years.

- Assuming a rework cost of $12/parka, determine the manufacturing cost per good parka for each of the 5 years. What do these results imply about the co's quality management program?

In: Operations Management

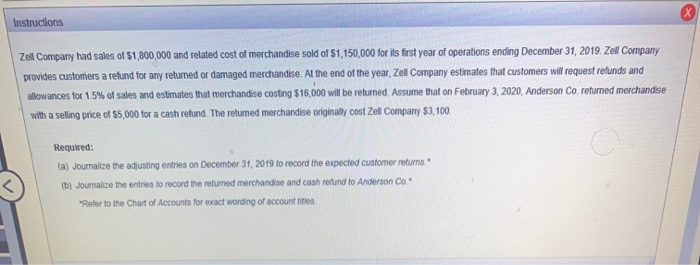

Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 2019.

Instructions

Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 2019. Zell Company provides customers a refund for any returned or damaged merchandise. At the end of the year, Zel Company estimates that customers will request refunds and allowances for 1.5% of sales and estimates that merchandise costing $16,000 will be returned. Assume that on February 3, 2020, Anderson Co. returned merchandise with a selling price of $5,000 for a cash refund. The returned merchandise originally cost Zell Company $3,100

Required:

(a) Journalize the adjusting entries on December 31, 2019 to record the expected customer returns

(b) Journalize the entries to record the returned merchandise and cash refund to Anderson Co

"Refer to the Chart of Accounts for exact wording of accounts

In: Accounting

The 2015 financial statements for the Ernst and Young companies are summarized here: Ernst Company Young...

| The 2015 financial statements for the Ernst and Young companies are summarized here: |

|

Ernst Company |

Young Company |

||||||

| Balance sheet | |||||||

| Cash | $ | 42,000 | $ | 21,800 | |||

| Accounts receivable (net) | 39,800 | 32,800 | |||||

| Inventory | 100,100 | 40,500 | |||||

| Operational assets (net) | 141,000 | 401,100 | |||||

| Other assets | 84,300 | 305,800 | |||||

|

|

|

|

|

|

|

||

| Total assets | $ | 407,200 | $ | 802,000 | |||

|

|

|

|

|

|

|

||

| Current liabilities | $ | 98,800 | $ | 48,100 | |||

| Long-term debt (9%) | 64,100 | 58,500 | |||||

| Capital stock (par $10) | 148,400 | 510,400 | |||||

| Contributed capital in excess of par | 29,500 | 105,500 | |||||

| Retained earnings | 66,400 | 79,500 | |||||

|

|

|

|

|

|

|

||

| Total liabilities and stockholders’ equity | $ | 407,200 | $ | 802,000 | |||

|

|

|

|

|

|

|

||

| Income statement | |||||||

| Sales revenue (1/3 on credit) | $ | 447,900 | $ | 802,000 | |||

| Cost of goods sold | (242,900 | ) | (398,900 | ) | |||

| Expenses (including interest and income tax) | (16,200 | ) | (311,800 | ) | |||

|

|

|

|

|

|

|

||

| Net income | $ | 188,800 | $ | 91,300 | |||

|

|

|

|

|

|

|

||

| Selected data from the 2014 statements | |||||||

| Accounts receivable (net) | $ | 18,100 | $ | 38,400 | |||

| Inventory | 94,300 | 45,300 | |||||

| Long-term debt | 62,000 | 49,000 | |||||

| Other data | |||||||

| Per share price at end of 2015 (offering price) | $ | 22 | $ | 20 | |||

| Average income tax rate | 40 | % | 40 | % | |||

| Dividends declared and paid in 2015 | $ | 33,600 | $ | 149,500 | |||

|

The companies are in the same line of business and are direct competitors in a large metropolitan area.Both have been in business approximately 10 years, and each has had steady growth. The management of each has a different viewpoint in many respects. Young is more conservative, and as its president has said, “We avoid what we consider to be undue risk.” Neither company is publicly held. Ernst Company has an annual audit by a CPA but Young Company does not. |

| Required: |

| 1. |

Complete a schedule that reflects a ratio analysis of each company. (Round your answers to 2 decimal places. Enter percentage answers rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

Case 6-1 Chobani Chobani LLC, is a producer and marketer of Greek yogurt. The company was founded...

Case 6-1 Chobani

Chobani LLC, is a producer and marketer of Greek yogurt. The company was founded in 2005 by Hamdi Ulukaya, an immigrant from Turkey, who recognized the lack of options for high-quality yogurt in the United States. The company is headquartered in Norwich, New York, and it employs approximately 2,000 employees. It operates two manufacturing plants—its original facility in central New York and a second new state-of-the-art facility in Twin Falls, Idaho.

The mission of the company is “To provide better food for more people. We believe that access to nutritious, delicious yogurt made with only natural ingredients is a right, not a privilege. We believe every food maker has a responsibility to provide people with better options, which is why we’re so proud of the way our food is made.” Chobani’s core values are integrity, craftsmanship, innovation, leadership, people, and giving back.

The company’s beginning in 2005 occurred when Hamdi Ulukaya discovered a notice about an old Kraft yogurt factory in South Edmeston that was closed. He decided to obtain a business loan in order to purchase it. Between 2005 and 2007, Ulukaya worked with four former Kraft employees and yogurt master Mustafa Dogan to develop the recipe for Chobani Greek Yogurt. Between 2007 and 2009, the company started to sell its yogurt in local grocery stores including Stop and Shop and ShopRite. By 2010, Chobani Greek yogurt became the best selling Greek yogurt in the United States. The company pursued global expansion by entering Australia in 2011 and the United Kingdom in 2012. In 2013, the company opened its international headquarters in Amsterdam, and Hamdi Ulukaya was named the Ernst and Young World Entrepreneur of the Year.

Chobani has achieved its success in large part due to its ability to innovate in its product lineup. For example, in 2016, it launched a new line of yogurt drinks, more flavors of its Flip mix-in product, and even a concept café in Manhattan.

The company also created a food incubator program that is designed to provide resources, expertise (e.g., brand and marketing, packaging and pricing), and funding to small, young companies that have promising ideas for new natural foods that they aspire to develop.

Although Hamdi Ulukaya has been extremely successful in his founding and establishment of Chobani, he has recognized that there are some key lessons learned from his experience as the head of a young but very successful and industry-leading company. These include the importance of hiring people with functional experience such as marketing, supply chain, logistics, operations, and quality control, as they were essential to the smooth operation of the company. In addition, remembering to respect the competition and not to underestimate it is critical, as Chobani’s two main competitors, Dannon and Yoplait, launched their own Greek yogurt lines, and they were able to win back some of Chobani’s market share over time.

Discussion

1. Start with a brief (1-2 paragraphs) summary of the case.

2. List the management issues short term & longer term you see in the case.

3.Propose a solution to fix the major current problem and a longer term course of action to prevent the problem.

In: Operations Management