Questions

Mini-Case B (6 marks) The Simpsons, owners of a spa on the island of Montreal, have...

Mini-Case B

The Simpsons, owners of a spa on the island of Montreal, have been hard-hit by the pandemic. Before they were forced to close their spa, their take home income, after taxes but before living expenses, was $7,000 a month. The Simpsons spent all of their take-home cash flow and even more, by borrowing on a line of credit (LOC). The day their spa was closed the balance on their LOC was $8,520. Normally they use the LOC to clear the balance on their several credit cards each month. Terms of the LOC include a repayment of 3% of principal every month plus interest charged at a rate of 0.5% per month.

Three years ago the Simpsons took out a $532,000 mortgage to purchase a home in Beaconsfield. Payments are monthly at a rate of 3.6%, compounded semi-annually. The original amortization period was 20 years and they have made 34 payments to date.

The Simpson’s mortgagor has offered them the possibility of suspending payments for the next 4 months. Nevertheless, they will still owe the interest they would have paid on each payment. Furthermore, the future value of the unpaid interest after 4 months will mean that they will have to pay interest on the outstanding interest should they take up this offer.

Part 1 (1 mark)

Excluding the balance on their LOC, what minimum emergency fund should the Simpsons have held to meet unforeseen events? What type of investment would be suitable for such a fund?

|

Calculation of Minimum Emergency Fund Suitable Investment |

Part 2 (1 mark)

How much would the couple have to pay on the LOC for the month following closure of their spa? What impact would not making the payment have on their credit rating? Please explain.

|

LOC Payment Calculation Impact of Non-Payment |

Part 3 (1 mark)

What is the monthly payment on the Simpson’s mortgage? What is the balance after 34 months? Round to the nearest dollar.

|

Calculation of Mortgage Payment and Balance after 34 Months (rounded) |

Part 4

Draw up the Simpson’s mortgage amortization table for the next four months (i.e. for payments 35-38). Their monthly mortgage rate is 0.2978%. Round to the nearest dollar.

|

Month |

$ Beg. Bal. |

$ Pmt. |

$ Interest |

$ Principal |

$ End. Bal. |

|

35 |

|||||

|

36 |

|||||

|

37 |

|||||

|

38 |

Part 5 (1 mark)

How much interest will the Simpsons owe at the end of the 4-month period? (Mortgage payments are made at the end of the month.) Round to the nearest dollar. Remember, they will be obliged to pay interest on their interest.

If they are given the choice of adding this to their mortgage balance or paying it immediately in cash, what would you recommend, and why?

|

Calculation of Total Interest Owed at the end of 4 months Repay or add to the mortgage balance? |

In: Finance

What did the US Government do for GM in regards to their bailout in 2008 that...

What did the US Government do for GM in regards to their bailout in 2008 that has never before been done to bondholders? Look into their union, wages, financial arm, before and after the 2008 financial crisis and GMs bailout?

In: Economics

Now you are employed as the public relations officer of an information technology company . The...

Now you are employed as the public relations officer of an information technology company . The company is going to promote a new product at early in November, 2020. Being the PR officer, your assignment is to propose a press conference for the promotion of the new product at the end of October, 2020.

Your assignment should include:

- Introduction/background of the company (under 100 words)

- Brief description of the new product with news value (under 70 words)

- Illustration of the press conference including the objectives, target audiences and the three stages from preparation to after the event. (about 730 words in essay forms)

- Conclusion (under 100 words)

In: Economics

On October 1, 2018, Farmer Fabrication issued stock options for 180,000 shares to a division manager....

On October 1, 2018, Farmer Fabrication issued stock options for

180,000 shares to a division manager. The options have an estimated

fair value of $5 each. To provide additional incentive for

managerial achievement, the options are not exercisable unless

divisional revenue increases by 5% in four years. Suppose that

Farmer initially estimates that it is not probable the

goal will be achieved, but then after one year, Farmer estimates

that it is probable that divisional revenue will increase by 5% by

the end of 2020.

Required:

1. What is the revised estimate of the total

compensation?

2. What action will be taken to account for the

options in 2019?

3. Prepare the journal entries to record

compensation expense in 2019 and 2020.

In: Accounting

On October 1, 2018, Farmer Fabrication issued stock options for 200,000 shares to a division manager....

On October 1, 2018, Farmer Fabrication issued stock options for

200,000 shares to a division manager. The options have an estimated

fair value of $6 each. To provide additional incentive for

managerial achievement, the options are not exercisable unless

divisional revenue increases by 2% in four years. Suppose that

Farmer initially estimates that it is not probable the

goal will be achieved, but then after one year, Farmer estimates

that it is probable that divisional revenue will increase by 2% by

the end of 2020.

Required:

1. What is the revised estimate of the total

compensation?

2. What action will be taken to account for the

options in 2019?

3. Prepare the journal entries to record

compensation expense in 2019 and 2020.

In: Accounting

Paramel Beverages bottles two soft drinks under licence to Cadaver Ltd. at its Newcastle plant. Bottling...

Paramel Beverages bottles two soft drinks under licence to Cadaver Ltd. at its Newcastle plant. Bottling at this plant is highly repetitive, automated process. Empty bottles are removed from their carton, placed on a conveyor, and cleaned, rinsed, dried, filled, capped and heated (to reduce condensation). The only stock held is direct materials or else finished goods. There is no work in process. The two soft drinks bottled by Paramel Beverages are lemonade and diet lemonade. The syrup for both soft drinks is purchase from Cadaver Ltd. Syrup for the regular brand contains a higher sugar content than the syrup for the diet brand. Paramel Beverages uses a lot size of 1,000 cases as the unit of analysis in its budget. (Each case contains 24 bottles). Direct materials are expressed in terms of lots, where one lot of direct materials is the input necessary to yield one lot (1,000 cases) of beverage. In 2010, the following purchase prices ae forecast for direct materials: Lemonade Diet Lemonade Syrup $1,200 per lot $1,100 per lot Containers (bottles, caps, etc.) $1,000 per lot $1,000 per lot Packaging $800 per lot $800 per lot The two soft drinks are bottled using the same equipment. The equipment is cleaned daily, but it is only rinsed when a switch is made during the day between diet lemonade and 3 lemonade. Diet lemonade is always bottled first each day to reduce the risk of sugar contamination. The only difference in the bottling process for the two drinks is syrup. Summary data used in developing budgets for 2010 are as follows: a Sales • Lemonade, 1080 lots at $9,000 selling price per lot • Diet lemonade, 540 lots at $8,500 selling price per lot b Opening (1 January 2010) stock of direct materials • Syrup for lemonade, 80 lots at $1,100 purchase price per lot • Syrup for diet lemonade, 70 lots at $1,000 purchase price per lot • Containers, 200 lots at $950 purchase price per lot • Packaging, 400 lots at $900 purchase price per lot c Opening (1 January 2010) stock of finished goods • Lemonade, 100 lots at $5,300 per lot • Diet lemonade, 50 lots at $5,200 per lot d Target closing (31 December 2010) stock of direct materials • Syrup for lemonade, 30 lots. • Syrup for diet lemonade, 20 lots. • Containers, 100 lots. • Packaging, 200 lots. e Target closing (31 December 2010) stock of finished goods • Lemonade, 20 lots. • Diet lemonade, 10 lots. f Each lot requires 20 direct manufacturing labour hours at the 2010 budgeted rate of $25 per hour. Indirect manufacturing labour costs are included in the manufacturing overhead budget. g Variable manufacturing overhead is forecast to be $600 per hour of bottling time; bottling time is the time the filling equipment is in operation. It takes 2 hours to bottle 4 one lot of lemonade and 2 hours to bottle one lot of diet lemonade. Fixed manufacturing overhead is forecast to be $1,200,000 for 2010. h Hours of budgeted bottling time is the sole allocation base for all fixed manufacturing overheads. I Administration costs are forecast to be 10% of the cost of goods manufactured for 2010. Marketing costs are forecast to be 12% of sales for 2010. Distributions costs are forecast to be 8% of sales for 2010. Required: Assume Paramel Beverages uses the first in– first out (FIFO) method of costing all stock. On the basis of the preceding data, prepare the following budgets (in units and/or dollars as applicable) for 2010: 7. Closing finished goods stock budget 8. Cost of goods sold budget 9. Marketing cost budget (1 mark) 10. Distribution cost budget (1 mark) 11. Administration cots budget 12. Budgeted profit & loss.

REQUIRED ANS OF POSTED QUS AS IT IS NOT AVAILABLE IN YOUR WEBSITE

In: Accounting

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

| Sales | $ | 6,600,000 |

| Variable costs (50% of sales) | 3,300,000 | |

| Fixed costs | 1,960,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,340,000 |

| Interest (10% cost) | 520,000 | |

| Earnings before taxes (EBT) | $ | 820,000 |

| Tax (35%) | 287,000 | |

| Earnings after taxes (EAT) | $ | 533,000 |

| Shares of common stock | 360,000 | |

| Earnings per share | $ | 1.48 |

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $3.6 million in additional financing. His investment banker has laid out three plans for him to consider:

- Sell $3.6 million of debt at 12 percent.

- Sell $3.6 million of common stock at $30 per share.

- Sell $1.80 million of debt at 11 percent and $1.80 million of common stock at $40 per share.

Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to $2,460,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates that sales will rise by $1 million per year for the next five years

Delsing is interested in a thorough analysis of his expansion plans and methods of financing.He would like you to analyze the following:

a. The break-even point for operating expenses before and after expansion (in sales dollars). (Enter your answers in dollars not in millions, i.e, $1,234,567.)

b. The degree of operating leverage before and after expansion. Assume sales of $6.6 million before expansion and $7.6 million after expansion. Use the formula: DOL = (S − TVC) / (S − TVC − FC). (Round your answers to 2 decimal places.)

c-1. The degree of financial leverage before expansion. (Round your answer to 2 decimal places.)

c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $7.6 million for this question. (Round your answers to 2 decimal places.)

d. Compute EPS under all three methods of financing the expansion at $7.6 million in sales (first year) and $10.5 million in sales (last year). (Round your answers to 2 decimal places.)

In: Finance

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its

facilities. Its current income statement is as follows:

| Sales | $ | 6,100,000 |

| Variable costs (50% of sales) | 3,050,000 | |

| Fixed costs | 1,910,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,140,000 |

| Interest (10% cost) | 420,000 | |

| Earnings before taxes (EBT) | $ | 720,000 |

| Tax (40%) | 288,000 | |

| Earnings after taxes (EAT) | $ | 432,000 |

| Shares of common stock | 310,000 | |

| Earnings per share | $ | 1.39 |

The company is currently financed with 50 percent debt and 50

percent equity (common stock, par value of $10). In order to expand

the facilities, Mr. Delsing estimates a need for $3.1 million in

additional financing. His investment banker has laid out three

plans for him to consider:

- Sell $3.1 million of debt at 13 percent.

- Sell $3.1 million of common stock at $20 per share.

- Sell $1.55 million of debt at 12 percent and $1.55 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales,

while fixed expenses will increase to $2,410,000 per year. Delsing

is not sure how much this expansion will add to sales, but he

estimates that sales will rise by $1 million per year for the next

five years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing.He would like you to analyze the

following:

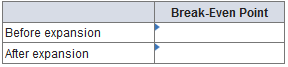

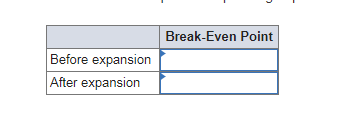

a. The break-even point for operating expenses

before and after expansion (in sales dollars). (Enter your

answers in dollars not in millions, i.e,

$1,234,567.)

Break-Even Point

Before expansion ___________

After expansion ___________

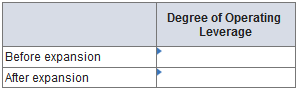

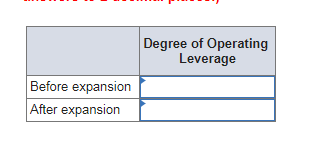

b. The degree of operating leverage before and

after expansion. Assume sales of $6.1 million before expansion and

$7.1 million after expansion. Use the formula: DOL = (S −

TVC) / (S − TVC − FC). (Round

your answers to 2 decimal places.)

Degree of Operating Leverage

Before expansion ________________

After expansion _________________

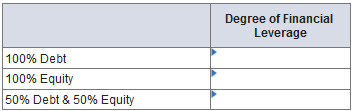

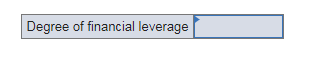

c-1. The degree of financial leverage before

expansion. (Round your answer to 2 decimal places.)

Degree of financial leverage ___________

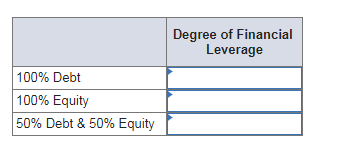

c-2. The degree of financial leverage for all

three methods after expansion. Assume sales of $7.1 million for

this question. (Round your answers to 2 decimal

places.)

Degree of financial leverage

100% debt ___________________

100% equity ___________________

50% debt and 50% equity ________________

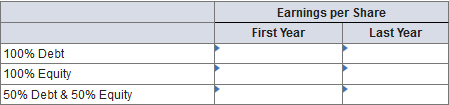

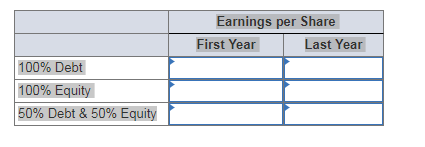

d. Compute EPS under all three methods of

financing the expansion at $7.1 million in sales (first year) and

$10.0 million in sales (last year). (Round your answers to

2 decimal places.)

Earnings per share

First Year Last Year

100% debt _________________________________

100% Equity _________________________________

50%debt and 50% equity ______________________________

In: Finance

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its

facilities. Its current income statement is as follows:

| Sales | $ | 7,500,000 |

| Variable costs (50% of sales) | 3,750,000 | |

| Fixed costs | 2,050,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,700,000 |

| Interest (10% cost) | 700,000 | |

| Earnings before taxes (EBT) | $ | 1,000,000 |

| Tax (35%) | 350,000 | |

| Earnings after taxes (EAT) | $ | 650,000 |

| Shares of common stock | 450,000 | |

| Earnings per share | $ | 1.44 |

The company is currently financed with 50 percent debt and 50

percent equity (common stock, par value of $10). In order to expand

the facilities, Mr. Delsing estimates a need for $4.5 million in

additional financing. His investment banker has laid out three

plans for him to consider:

- Sell $4.5 million of debt at 9 percent.

- Sell $4.5 million of common stock at $15 per share.

- Sell $2.25 million of debt at 8 percent and $2.25 million of common stock at $20 per share.

Variable costs are expected to stay at 50 percent of sales,

while fixed expenses will increase to $2,550,000 per year. Delsing

is not sure how much this expansion will add to sales, but he

estimates that sales will rise by $2.25 million per year for the

next five years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing.He would like you to analyze the

following:

a. The break-even point for operating expenses

before and after expansion (in sales dollars). (Enter your

answers in dollars not in millions, i.e, $1,234,567.)

b. The degree of operating leverage before and

after expansion. Assume sales of $7.5 million before expansion and

$8.5 million after expansion. Use the formula: DOL = (S −

TVC) / (S − TVC − FC). (Round

your answers to 2 decimal places.)

c-1. The degree of financial leverage before

expansion. (Round your answers to 2 decimal places.)

c-2. The degree of financial leverage for all

three methods after expansion. Assume sales of $8.5 million for

this question. (Round your answers to 2 decimal

places.)

d. Compute EPS under all three methods of

financing the expansion at $8.5 million in sales (first year) and

$10.3 million in sales (last year). (Round your answers to

2 decimal places.)

In: Accounting

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

| Sales | $ | 5,500,000 |

| Variable costs (50% of sales) | 2,750,000 | |

| Fixed costs | 1,850,000 | |

| Earnings before interest and taxes (EBIT) | $ | 900,000 |

| Interest (10% cost) | 300,000 | |

| Earnings before taxes (EBT) | $ | 600,000 |

| Tax (40%) | 240,000 | |

| Earnings after taxes (EAT) | $ | 360,000 |

| Shares of common stock | 250,000 | |

| Earnings per share | $ | 1.44 |

The company is currently financed with 50 percent debt and 50

percent equity (common stock, par value of $10). In order to expand

the facilities, Mr. Delsing estimates a need for $2.5 million in

additional financing. His investment banker has laid out three

plans for him to consider:

Sell $2.5 million of debt at 13 percent.

Sell $2.5 million of common stock at $20 per share.

Sell $1.25 million of debt at 12 percent and $1.25 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales, while

fixed expenses will increase to $2,350,000 per year. Delsing is not

sure how much this expansion will add to sales, but he estimates

that sales will rise by $1.25 million per year for the next five

years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing. He would like you to analyze the

following:

a. The break-even point for operating expenses

before and after expansion (in sales dollars). (Enter your

answers in dollars not in millions, i.e, $1,234,567.)

Before expansion:

After expansion:

b. The degree of operating leverage before and

after expansion. Assume sales of $5.5 million before expansion and

$6.5 million after expansion. Use the formula: DOL = (S ?

TVC) / (S ? TVC ? FC). (Round

your answers to 2 decimal places.)

Before expansion:

After expansion:

c-1. The degree of financial leverage before

expansion. (Round your answers to 2 decimal places.)

Degree of financial leverage:

c-2. The degree of financial leverage for all

three methods after expansion. Assume sales of $6.5 million for

this question. (Round your answers to 2 decimal

places.)

100% Debt:

100% Equity:

50% Debt & 50% Equity:

d. Compute EPS under all three methods of

financing the expansion at $6.5 million in sales (first year) and

$10.5 million in sales (last year). (Round your answers to

2 decimal places.)

100% Debt:

100% Equity:

50% Debt& 50% Equity:

In: Finance