Questions

Sindh Industrial Relations Act was enacted on 28th March, 2013. This law applies to all persons...

Sindh Industrial Relations Act was enacted on 28th

March, 2013. This law applies to

all persons employed as workers in all establishments/organizations

working in the province

of Sindh. This law, however, does not apply to persons employed by

few establishments/

organizations. List out such

establishments/organizations.

ii) What is the objective of this

law?

iii) Can you distinguish between strike and

lock-out?

iv) Who is Collective Bargaining Agent and what are its

rights?

In: Economics

Windsor Corporation was formed 5 years ago through a public subscription of common stock. Daniel Brown,...

Windsor Corporation was formed 5 years ago through a public

subscription of common stock. Daniel Brown, who owns 15% of the

common stock, was one of the organizers of Windsor and is its

current president. The company has been successful, but it

currently is experiencing a shortage of funds. On June 10, 2021,

Daniel Brown approached the Topeka National Bank, asking for a

24-month extension on two $34,970 notes, which are due on June 30,

2021, and September 30, 2021. Another note of $5,970 is due on

March 31, 2022, but he expects no difficulty in paying this note on

its due date. Brown explained that Windsor’s cash flow problems are

due primarily to the company’s desire to finance a $300,080 plant

expansion over the next 2 fiscal years through internally generated

funds.

The commercial loan officer of Topeka National Bank requested the

following financial reports for the last 2 fiscal years.

|

Windsor Corporation |

||||

|---|---|---|---|---|

| Assets |

2021 |

2020 |

||

|

Cash |

$18,120 | $12,410 | ||

|

Notes receivable |

147,220 | 132,930 | ||

|

Accounts receivable (net) |

130,790 | 124,530 | ||

|

Inventories (at cost) |

104,940 | 49,570 | ||

|

Plant & equipment (net of depreciation) |

1,446,500 | 1,416,510 | ||

|

Total assets |

$1,847,570 | $1,735,950 | ||

| Liabilities and Owners’ Equity | ||||

|

Accounts payable |

$79,360 | $90,220 | ||

|

Notes payable |

75,910 | 61,040 | ||

|

Accrued liabilities |

8,250 | 2,550 | ||

|

Common stock (130,000 shares, $10 par) |

1,296,650 | 1,312,800 | ||

|

Retained earningsa |

387,400 | 269,340 | ||

|

Total liabilities and stockholders’ equity |

$1,847,570 | $1,735,950 | ||

| aCash dividends were paid at the rate of $1 per share in fiscal year 2020 and $2 per share in fiscal year 2021. | ||||

|

Windsor Corporation |

||||

|---|---|---|---|---|

|

2021 |

2020 |

|||

|

Sales revenue |

$2,994,540 | $2,716,340 | ||

|

Cost of goods solda |

1,536,450 | 1,415,660 | ||

|

Gross margin |

1,458,090 | 1,300,680 | ||

|

Operating expenses |

856,120 | 784,640 | ||

|

Income before income taxes |

601,970 | 516,040 | ||

|

Income taxes (40%) |

240,788 | 206,416 | ||

|

Net income |

$361,182 | $309,624 | ||

| aDepreciation charges on the plant and equipment of $99,960 and $101,650 for fiscal years ended March 31, 2020 and 2021, respectively, are included in cost of goods sold. | ||||

(a)

Compute the following items for Windsor Corporation.

(Round answers to 2 decimal places, e.g. 2.25 or

2.25%.)

| 1. | Current ratio for fiscal years 2020 and 2021. | |

|---|---|---|

| 2. | Acid-test (quick) ratio for fiscal years 2020 and 2021. | |

| 3. | Inventory turnover for fiscal year 2021. | |

| 4. | Return on assets for fiscal years 2020 and 2021. (Assume total assets were $1,705,230 at 3/31/19.) | |

| 5. | Percentage change in sales, cost of goods sold, gross margin, and net income after taxes from fiscal year 2020 to 2021. |

In: Accounting

INDICATIONS FOR SURGERY: A 34-year-old female presents with severe abdominal pain. After examination was completed and...

INDICATIONS FOR SURGERY: A 34-year-old female presents with severe abdominal pain. After examination was completed and ultrasound results were reviewed, it was determined that patient had an ectopic pregnancy and surgical intervention was needed. PROCEDURE: Patient was taken to the operating room, and after general anesthesia was induced, she was prepped and draped in the usual sterile fashion. Examination was performed after anesthesia, which showed a normal-sized, nontender uterus, a left adnexal mass, and a fullness in the vagina, all consistent with hyperperitoneum. A 10-mm trocar was inserted directly into the abdomen through a small incision in the umbilicus. Using 3.5 liters of carbon dioxide, a pneumoperitoneum was created. The hemoperitoneum was noticed, and another 10-mm trocar was placed in a small suprapubic incision. Two 5-mm ports were also placed under direct visualization in both the right and left lower quadrants. With an irrigator and aspirator, the hemoperitoneum was reduced. The left fallopian tube was noted to be almost to the point of rupture due to a mass in the tube. The fallopian tube was distended beyond repair; so this needed to be removed. The tube was tied off and removed with its contents through an Endo Catch bag through the 10-mm port. Inspection of the abdomen noted no other problems; adequate hemostasis was noted, and ports were removed. Defects were closed with 0 Vicryl, and the skin was closed with 4-0 Dexon. She was sent to the recovery room in stable condition.

ICD-10-PCS Code Assignment is: ___________ and ____________

In: Nursing

The following information is taken from the 2010 annual report to shareholders of Hewlett-Packard (HP) Co.

The following information is taken from the 2010 annual report to shareholders of Hewlett-Packard (HP) Co.

Required:

a/ What is the balance in HP's allowance for doubtful accounts at the end of the fiscal years 2010 and 2009, respectively?

b/ What kind of account is the provision for doubtful accounts in HP's financial statements? (Note: Provision for doubtful accounts is synonymous with bad debt expense; that is, the charge against income for estimated uncollectible accounts from credit sales in that period)

c/ Using a T-account for the allowance for doubtful accounts, identify the amounts written off during the year 2010.

In: Accounting

Question 3 [14] Consider the following prices and quantities: Price (per kg) &nb

Question 3 [14] Consider the following prices and quantities:

|

Price (per kg) |

Quantities produced |

|||||

|

|

||||||

|

2010 |

2012 |

2015 |

2010 |

2012 |

2015 |

|

|

Beans |

3.95 |

3.89 |

4.13 |

675 |

717 |

436 |

|

Onions |

61.50 |

62.20 |

59.70 |

117 |

115 |

115 |

|

Carrots |

34.80 |

35.40 |

38.90 |

77 |

74 |

82 |

1. Compute and interpret the Paasche’s Quantity Index number for the year 2012 with 2010 as the base year. (7)

2. Compute and interpret the Laspeyres Price Index number for the year 2015 with 2012 as the base year

In: Statistics and Probability

Helix Company purchased tool sharpening equipment in April 1, 2010 for $72,000. The equipment was expected...

Helix Company purchased tool sharpening equipment in April 1, 2010 for $72,000. The equipment was expected to have a useful life of four years, or 9,000 operating hours, and a residual value of $2,700. The equipment was used for 2,400 hours during 2010, 4,000 hours in 2011, 2,000 hours in 2012, and 600 hours in 2013.

Instructions: Determine the amount of depreciation expense for the years ended December 31, 2010, 2011, 2012, and 2013 by each of the following methods:

1. Straight-line

2. The units of activity method

3. Double Declining balance method

In: Accounting

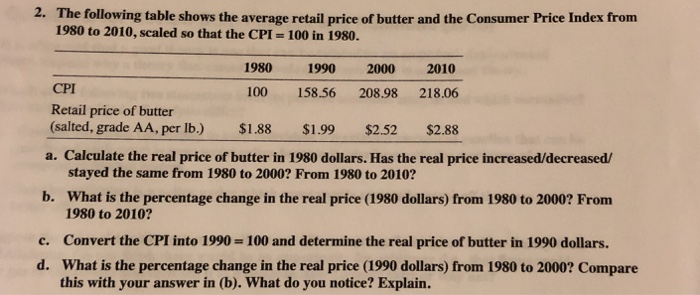

The following table shows the average retail price of butter and the Consumer Price Index from 1980 to 2010

The following table shows the average retail price of butter and the Consumer Price Index from 1980 to 2010, scaled so that the CPI 100 in 1980.

| 1980 | 1990 | 2000 | 2010 | |

|---|---|---|---|---|

| CPI | 100 | 158.56 | 208.98 | 218.06 |

| Retail price of butter (salted, grade AA, per lb.) | ||||

| $1.88 | $1.99 | $2.52 | $2.88 |

a. Calculate the real price of butter in 1980 dollars. Has the real price increased/decreased/ stayed the same from 1980 to 2000? From 1980 to 2010?

b. What is the percentage change in the real price (1980 dollars) from 1980 to 2000? From 1980 to 2010?

c. Convert the CPI into 1990- 100 and determine the real price of butter in 1990 dollars.

d. What is the percentage change in the real price (1990 dollars) from 1980 to 2000? Compare this with your answer in (b). What do you notice? Explain.

In: Economics

The following data give the average price received by fishermen for several species of fish in...

The following data give the average price received by fishermen for several species of fish in 2000 and 2010. The price is in cents per pound.

| Fish | Year 2000 Price (x) | Year 2010 Price (y) |

|---|---|---|

| COD | 13.1 | 56.0 |

| FLOUNDER | 15.3 | 166.7 |

| HADDOCK | 25.8 | 105.5 |

| MENHADEN | 1.8 | 41.3 |

| PERCH | 4.9 | 104.2 |

| CHINOOK | 55.4 | 236.8 |

| COHO | 39.3 | 135.6 |

| ALBACORE | 26.7 | 84.6 |

| SOFT SHELLED CLAMS | 47.5 | 222.6 |

| LOBSTERS AMERICAN | 94.7 | 374.7 |

| SEA SCALLOPS | 135.6 | 432.6 |

| SHRIMP | 47.6 | 225.4 |

- Create a regression equation for the data.

ˆy=y^= Round to 2 decimal places. - What is the correlation coefficient between the 2000 and 2010

prices.

Round to 2 decimal places. - If a type of fish was 41.3 cents per pound in 2000, how much would you expect to pay for it in 2010?

In: Statistics and Probability

During 2010, Salem Company spent $1,360,000 in research and development costs. As a result of its...

During 2010, Salem Company spent $1,360,000 in research and development costs. As a result of its R&D activities, Salem patented a new product on September 30, 2010. On September 30, 2010, Salem incurred and paid $42,000 of legal costs related to its new patent. The patent had a five-year legal life. Salem only prepares adjusting journal entries once each year as of 12-31 (year-end).

- Prepare the entries Salem made in 2010 related to the R&D activities and the patent.

- Prepare the entries Salem made in 2011 and 2012 related to the patent.

- On September 1, 2013, Salem spent $12,000 to defend its patent rights. Salem’s defense was successful, protecting the patent’s remaining legal life. Prepare the entries Salem made in 2013 related to the patent

In: Accounting

During 2012 the company discovered the following accounting errors 1- the machine has been mistakenly depreciated...

During 2012 the company discovered the following accounting errors 1- the machine has been mistakenly depreciated based on 5 years instead of 6 years. In July 1 2009, XYZ corporation Acquired an equipment on July 1 2009 at cost of $16000 the estimated useful life for the machine 6 years and the residual value $1000. Company use SLM for depreciation. 2- Ending inventory for year 2009 was overstated by $ 1800 3- Ending inventory for year 2010 was understated by $2000 Company subject to income tax rate 40%. Show the dollar amount of the combined effect, if any, and the nature of the effect (overstatement or understatement or correct) of these accounting errors on the reporting value of the following financial statement items as in the following table:

F S items the combined impact on reporting value of FS items NI 2009 Total Assets Dec. 31 2010 Owners Equity Dec. 31 2010 Total Liabilities

|

F S items |

the combined impact on reporting value of FS items |

|

NI 2009 |

|

|

Total Assets Dec. 31 2010 |

|

|

Owners Equity Dec. 31 2010 |

|

|

Total Liabilities |

In: Accounting