Questions

Ivanhoe Hardware Store completed the following merchandising transactions in the month of May. At the beginning...

Ivanhoe Hardware Store completed the following merchandising

transactions in the month of May. At the beginning of May,

Ivanhoes’ ledger showed Cash of $8,500 and Common Stock of

$8,500.

| May 1 | Purchased merchandise on account from Black Wholesale Supply for $8,500, terms 1/10, n/30. | |

| 2 | Sold merchandise on account for $4,900, terms 2/10, n/30. The cost of the merchandise sold was $3,800. | |

| 5 | Received credit from Black Wholesale Supply for merchandise returned $200. | |

| 9 | Received collections in full, less discounts, from customers billed on May 2. | |

| 10 | Paid Black Wholesale Supply in full, less discount. | |

| 11 | Purchased supplies for cash $900. | |

| 12 | Purchased merchandise for cash $3,500. | |

| 15 | Received $230 refund for return of poor-quality merchandise from supplier on cash purchase. | |

| 17 | Purchased merchandise from Wilhelm Distributors for $2,900, terms 2/10, n/30. | |

| 19 | Paid freight on May 17 purchase $250. | |

| 24 | Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,100. | |

| 25 | Purchased merchandise from Clasps Inc. for $800, terms 3/10, n/30. | |

| 27 | Paid Wilhelm Distributors in full, less discount. | |

| 29 | Made refunds to cash customers for returned merchandise $98. The returned merchandise had cost $86. | |

| 31 | Sold merchandise on account for $1,280, terms n/30. The cost of the merchandise sold was $811. |

Journalize the transactions using a perpetual inventory system.

Post the transactions to T-accounts. Be sure to enter the beginning cash and common stock balances.

Prepare an income statement through gross profit for the month of May 2022.

Calculate the profit margin and the gross profit rate. (Assume operating expenses were $1,380.)

In: Accounting

Silicon Optics has supplied the following data for use in its activity-based costing system: Overhead...

| Silicon Optics has supplied the following data for use in its activity-based costing system: |

| Overhead Costs | |||

| Wages and salaries | $ | 343,000 | |

| Other overhead costs | 194,000 | ||

| Total overhead costs | $ | 537,000 | |

| Activity Cost Pool | Activity Measure | Total Activity | |

| Direct labor support | Number of direct labor-hours | 12,000 | DLHs |

| Order processing | Number of orders | 570 | orders |

| Customer support | Number of customers | 100 | customers |

| Other | This is an organization-sustaining activity | Not applicable | |

|

Distribution of Resource Consumption Across Activities |

||||||||||

| Direct Labor Support | Order Processing | Customer Support | Other | Total | ||||||

| Wages and salaries | 10 | % | 30 | % | 20 | % | 40 | % | 100 | % |

| Other overhead costs | 30 | % | 20 | % | 20 | % | 30 | % | 100 | % |

|

During the year, Silicon Optics completed an order for a special optical switch for a new customer, Indus Telecom. This customer did not order any other products during the year. Data concerning that order follow: |

| Data Concerning the Indus Telecom Order | |||

| Selling price | $ | 270 | per unit |

| Units ordered | 100 | units | |

| Direct materials | $ | 254 | per unit |

| Direct labor-hours | 0.5 | DLH per unit | |

| Direct labor rate | $ | 27 | per DLH |

| Required: | |

| 1. |

Prepare a report showing the first-stage allocations of overhead costs to the activity cost pools. |

|

2. |

Compute the activity rates for the activity cost pools. (Round your answers to 2 decimal places.) |

| 3. |

Compute the overhead costs for the order from Indus Telecom, including customer support costs. (Round your intermediate calculations and final answers to 2 decimal places.) |

| 4. |

Prepare a report showing the customer margin for Indus Telecom. (Negative customer margins should be indicated by a minus sign. Round your intermediate calculations and final answers to 2 decimal places.) |

In: Accounting

Given the following companies sales of 4 brands below Microsoft Apple Alibaba Huawei 41 35 48...

Given the following companies sales of 4 brands below

|

Microsoft |

Apple |

Alibaba |

Huawei |

41 35 48 40 45 52 |

32 37 46 53 41 43 |

35 30 24 26 28 31 |

33 27 36 35 27 25 |

-

c) Use the analysis of variance to calculate the F-test

-

d) Make a statistic decision about the Null hypothesis

In: Statistics and Probability

Larkspur Corporation had the following tax information. Year Taxable Income Tax Rate Taxes Paid 2015 $294,000...

Larkspur Corporation had the following tax

information.

|

Year |

Taxable Income |

Tax Rate |

Taxes Paid |

|||||||

| 2015 | $294,000 | 32% | $94,080 | |||||||

| 2016 | 319,000 | 27% | 86,130 | |||||||

| 2017 | 396,000 | 27% | 106,920 | |||||||

In 2018, Larkspur suffered a net operating loss of $487,000, which

it elected to carry back. The 2018 enacted tax rate is 26%.

Prepare Larkspur’s entry to record the effect of the loss

carryback.

In: Accounting

You are 45 years old and you have $150,000 in your retirementaccount. You want to...

You are 45 years old and you have $150,000 in your retirement account. You want to have 3 million by the time you are 60. A) How much do you need earn on your investments on a monthly basis to have $3,000,000 by age 60. B) if you contribute $400 per month in the next 15 years what rate of return are you seeking for?

In: Finance

Adam is planning to retire after eight years, so he decided to make an annual contribution of $11,000 to his saving account at the end of each year for the next six years.

Adam is planning to retire after eight years, so he decided to

make an annual contribution of $11,000 to his saving account at the

end of each year for the next six years. If the saving account

earns 1.9% interest annually, how much can be withdrawn at the end

of year eight?

hint: the saving account will continue to earn interest on the current money in it even after stopping to contribute to it.

In: Finance

A partnership has liquidated all assets but still reports the following account balances: The partners split...

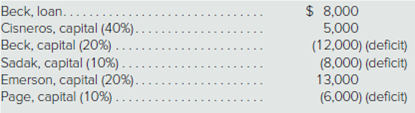

A partnership has liquidated all assets but still reports the following account balances:

The partners split profits and losses as follows: Cisneros, 40 percent; Beck, 20 percent; Sadak, 10 percent; Emerson, 20 percent; and Page 10 percent.

Assuming that all partners are personally insolvent except for Sadak and Emerson, how much cash must Sadak now contribute to this partnership?

In: Accounting

Suppose that you just turned 25 years old and that you wish toreceive an annual...

Suppose that you just turned 25 years old and that you wish to receive an annual annuity of $76,697 for 30 years (end of each year age 65-95). How much would you have to contribute annually at the end of each year ages 25-60 , if you then let the funds vest until age 65 with no further contributions? Your EAR is 5.2%.

In: Finance

President Trump passed an executive bill, banning Chinese airplanes from landing in America, and Chinese Post...

President Trump passed an executive bill, banning Chinese airplanes from landing in America, and Chinese Post Graduate students from studying in America. As Chinese tourists and students contribute greatly to the US economy, how do you think this law by President trump will affect US productivity and economic growth? Comment particularly on human capital, physical capital, technology, natural resources, and labour

In: Economics

SUBJECT: Gerontological Nursing 1. What are the common age-related changes of respiratory system in older adult?...

SUBJECT: Gerontological Nursing

1. What are the common age-related changes of respiratory system in older adult?

2. In selected respiratory conditions: Give nursing management and medication

.a. Chronic Obstructive Pulmonary Disease

b. Lung cancer

c. Pneumonia

3. What self-imposed and environmentally imposed risks to younger adults can contribute to the development of respiratory conditions in later life?

In: Nursing