Questions

What is the future value in 18 years of an ordinary annuity cash flow of $2,802...

What is the future value in 18 years of an ordinary annuity cash flow of $2,802 every quarter of a year at the end of the period, at an annual interest rate of 11.84 percent per year, compounded quarterly

In: Finance

A company wants to replay a $117,053 debt making $463 quarterly payment for 21 quarters, then...

A company wants to replay a $117,053 debt making $463 quarterly payment for 21 quarters, then one final payment. If the interest is 14 per year, compounded quarter, how much is the final payment?

In: Economics

Find the present value of an annuity due that pays $1,600.00 at the beginning of each...

Find the present value of an annuity due that pays $1,600.00 at the beginning of each quarter for 4 years, if interest is earned at a rate of 4%, compounded quarterly.

The present value is $___ (Round to 2 decimal places.)

In: Accounting

Find the present value of an annuity due that pays $3000 at the beginning of each...

Find the present value of an annuity due that pays $3000 at the beginning of each quarter for the next 9 years. Assume that money is worth 6.6%, compounded quarterly. (Round your answer to the nearest cent.)

In: Finance

Question: part 1: What happens to the demand for sony color television sets when each of...

Question:

part 1:

What happens to the demand for sony color television sets when each of the following changes occurs?

a) The Price of Zenith color television sets rises. _______________.

b) The Price of sony rises. ____________.

c) Personal income falls (color television are normal goods)._______________.

d) Technological advances result in dramatic Price reductions for Video tape recorders. ________________.

e) Congress is persuaded to impose tariffs on Japanese television sets starting next year.

part 2:

What happens to the supply of random access memory (RAM) chips, a component in the manufacture of personal computers, when each of the following changes occurs?

a) Two huge manufacturing plants begin operation in South Korea? ___________________

b) Scientists discover a new production technology that will lower the cost of making RAM chips? _________________________.

c) The price of silicon, a key ingredient in RAM chip production, rises sharply.? _________________.

d) The Price of RAM increases. __________________.

e) The Market for personal computers turns sour and RAM chip makers now expect RAM chip Prices to fall by 25 percent next quarter, ___________________.

part 3

Question:

"the salaries of chief executive officers (CEOs) are unreasonably high" Critically evaluate this statement.

In: Economics

Attendance at Orlando's newest Disneylike attraction, Lego World, has been as follows Quarter Guests (in thousands)...

| Quarter | Guests (in thousands) | Quarter | Guests (in thousands) |

|---|---|---|---|

| Winter Year 1 | 63 | Summer Year 2 | 125 |

| Spring Year 1 | 89 | Fall Year 2 | 51 |

| Summer Year 1 | 155 | Winter Year 3 | 94 |

| Fall Year 1 | 77 | Spring Year 3 | 161 |

| Winter Year 2 | 65 | Summer Year 3 | 210 |

| Spring Year 2 | 84 | Fall Year 3 | 97 |

In: Other

Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management...

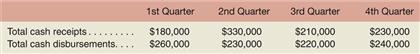

Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows:

The company’s beginning cash balance for the upcoming fiscal year will be $20,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded.

Required:

Prepare the company’s cash budget for the upcoming fiscal year

In: Accounting

1.Suppose we expected the third year’s annual demand for answering machines to be 1,200 units, which...

1.Suppose we expected the third year’s annual demand for answering machines to be 1,200 units, which is 100 per month. We would not forecast each month to have a demand of 100, but we would adjust these based on the seasonal indices as follows.Calculate the seasonal indices.

2) Determine the magnitude of the seasonal ratio of the average quarter centered at that time period.

| Quarterly Sales ($1,000,000s) for Turner Industries | ||||

| Quarter | Year 1 | Year 2 | Year 3 | Average |

| 1 | 108 | 116 | 123 | 115.67 |

| 2 | 125 | 134 | 142 | 133.67 |

| 3 | 150 | 159 | 168 | 159 |

| 4 | 141 | 152 | 165 | 152.67 |

| Average | 131 | 140.25 | 149.5 | 140.25 |

In: Statistics and Probability

The Alpine House, Inc., is a large retailer of snow skis. The company assembled the in...

The Alpine House, Inc., is a large retailer of snow skis. The company assembled the in March 31 Sales $ 1,161.000 Selling price per pair of skis $430 Variable selling expense per pair of skis $ 46 Variable administrative expense per pair of skis $ 19 Total fixed selling expense $140,000 Total fixed administrative expense $100,000 Beginning Merchandise inventory $ 75.000 Ending Merchandise Inventory $115,000 Merchandise Purchase $315,000 1 Prepare a traditional income statement for the quarter ended March 31 2 -Prepare a contribution format format income statement for the quarter ended March 31 3 -What was the contribution margin per unit?

In: Accounting

Bonds, for a federal treasury bill, were issued with a face value of $250,000 and a...

Bonds, for a federal treasury bill, were issued with a face value of $250,000 and a coupon rate of 0.20% per quarter, and payments are quarterly. This bond is bought in the bond market before maturation, and there are only 16 payments remaining. The next payment is due after three months (one quarter), which you collect if you buy this bond now. How much are you ready to pay for this bond today if the next interest payment is due today? As an investor, you wish to earn 1.6% compounded daily.

Hints: Find quarterly effective interest rate for this investor.

Coupon rate can be used to calculate recurrent revenues from this bond which will be coupon rate x face value.

In: Accounting