Questions

On January 1, 2018 Ellison Co. issued eight-year bonds with a face value of $100,000,000 payable...

On January 1, 2018 Ellison Co. issued eight-year bonds with a face value of $100,000,000 payable semiannually on June 30 and December 31. The bonds are callable at 101. Coupon rate is 8% Market rate is 6%

a) What is the issue price of the bonds

b) Prepare an amortization table using the effective interest rate method for the eight years of the bonds.

c) Prepare the journal entries for the interest payments on June 30, 2018 and December 31, 2018.

d) Assume that the bonds are called on December 31, 2023 at 101. Prepare the journal entry to record the call.

In: Accounting

Aquatic Equipment Corporation decided to switch from the LIFO method of costing inventories to the FIFO...

Aquatic Equipment Corporation decided to switch from the LIFO

method of costing inventories to the FIFO method at the beginning

of 2018. The inventory as reported at the end of 2017 using LIFO

would have been $56,000 higher using FIFO. Retained earnings at the

end of 2017 was reported as $740,000 (reflecting the LIFO method).

The tax rate is 35%.

Required:

1. Calculate the balance in retained earnings at

the time of the change (beginning of 2018) as it would have been

reported if FIFO had been used in prior years.

2. Prepare the journal entry at the beginning of

2018 to record the change in accounting principle.

In: Accounting

Kentucky Inc. Manufactures Soccer balls. The estimated number of soccer balls sold for the first three...

Kentucky Inc. Manufactures Soccer balls. The estimated number of soccer balls sold for the first three months of 2018 are as follows: Month: Sales: June 2,000 July 3,000 August 4,000 The Actual finished goods inventory at the end of May 2018 was 2,000 units. Ending Finished Goods inventory is planned to equal 25% of the next month's sales. Kentucky incorporated will sell the soccer balls for $5.00 each. Septemberl 2018 Sales are projected at 8,500 soccer balls. How many Soccer balls should Kentucky Inc. budget to be produced in July? August? Looking to understand! Not just for the answer

In: Accounting

David raised working capital from local investors by issuing bonds. The bonds, which have a face...

- David raised working capital from local investors by issuing bonds. The bonds, which have a face value of $40,000, were sold on July 1st, 2018. They have a coupon rate of 7.40 percent and pay interest monthly for three years with the first payment due on August 1st, 2018. The last payment, which includes repayment of principal, is July 1st, 2021. David’s investors agreed on an issue price of 106.

Required: Prepare journal entries to record all transactions and adjustments for the year ending December 31, 2018 (record all of the entries in a single sheet).

In: Accounting

Pockets lent $20,000 to Lego Construction on January 1, 2018. Lego signed a three-year, 5% installment...

Pockets lent $20,000 to Lego Construction on January 1, 2018. Lego signed a three-year, 5% installment note to be paid in three equal payments at the end of each year.

Required:

(1.) Prepare the journal entry on January 1, 2018, for Pockets' lending the funds.

(2.) Calculate the amount of one installment payment.

(3.) Prepare an amortization schedule for the three-year term of the installment note.

(4.) Prepare Pockets' journal entry for the first installment payment on December 31, 2018.

(5.) Prepare Pockets' journal entry for the third installment payment on December 31, 2020.

In: Accounting

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018.

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018.

| JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets | ||||||||||||||||

| Assets | Liabilities and Owners’ Equity | |||||||||||||||

| 2017 | 2018 | 2017 | 2018 | |||||||||||||

| Current assets | Current liabilities | |||||||||||||||

| Cash | $ | 6,600 | $ | 15,250 | Accounts payable | $ | 62,400 | $ | 65,750 | |||||||

| Accounts receivable | 26,600 | 29,750 | Notes payable | 26,400 | 31,500 | |||||||||||

| Inventory | 75,800 | 92,250 | ||||||||||||||

| Total | $ | 109,000 | $ | 137,250 | Total | $ | 88,800 | $ | 97,250 | |||||||

| Long-term debt | $ | 50,000 | $ | 40,000 | ||||||||||||

| Owners’ equity | ||||||||||||||||

| Common stock and paid-in surplus | $ | 52,000 | $ | 52,000 | ||||||||||||

| Retained earnings | 209,200 | 310,750 | ||||||||||||||

| Net plant and equipment | $ | 291,000 | $ | 362,750 | Total | $ | 261,200 | $ | 362,750 | |||||||

| Total assets | $ | 400,000 | $ | 500,000 | Total liabilities and owners’ equity | $ | 400,000 | $ | 500,000 | |||||||

Prepare the 2018 common-base year balance sheet for Just Dew It.(Do not round intermediate calculations and round your answers to 4 decimal places, e.g., 32.1616.)

| 2017 | 2017 | 2018 | |

| Assets | |||

| Current assets | |||

| Cash | $6,600 | $15,250 ? | |

| Accounts receivable | 26,600 | 29,750 ? | |

| Inventory | 75,800 | 92,250 ? | |

| Total | $109,000 | $137,250 ? | |

| Fixed assets | |||

| Net plant and equipment | $291,000 | $362,750 ? | |

| Total assets | $400,000 | $500,000 ? | |

| Liabilities and Owners’ Equity | |||

| Current liabilities | |||

| Accounts payable | $62,400 | $65,750 ? | |

| Notes payable | $26,400 | $31,500 ? | |

| Total | $88,800 | $97,250 ? | |

| Long-term debt | $50,000 | $40,000 ? | |

| Owners' equity | |||

| Common stock and paid-in surplus | $52,000 | $52,000 ? | |

| Accumulated retained earnings | 209,200 | 310,750 ? | |

| Total | $261,200 | $362,750 ? | |

| Total liabilities and owners' equity | $400,000 | $500,000 ? |

In: Finance

Let's consider a limited set of climate data, examining temperature differences in 1948 vs 2018

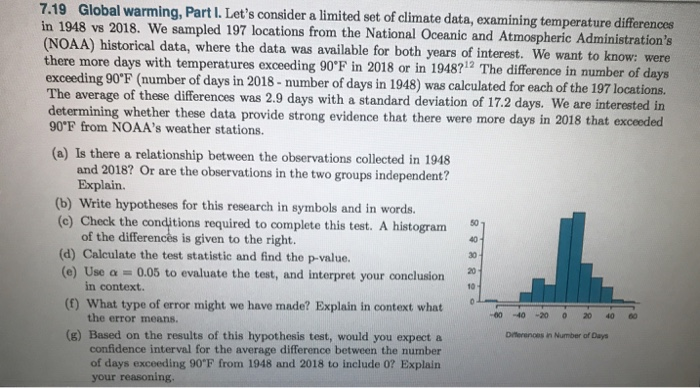

7.19 Global warming, Part I.

Let's consider a limited set of climate data, examining temperature differences in 1948 vs 2018. We sampled 197 locations from the National Oceanic and Atmospheric Administration's (NOAA) historical data, where the data was available for both years of interest. We want to know: were there more days with temperatures exceeding 90°F in 2018 or in 1948?12 The difference in number of days exceeding 90'F (number of days in 2018- number of days in 1948) was calculated for each of the 197 locations. The average of these differences was 2.9 days with a standard deviation of 17.2 days. We are interested in determining whether these data provide strong evidence that there were more days in 2018 that exceeded 90°F from NOAA's weather stations.

(a) Is there a relationship between the observations collected in 1948 and 2018? Or are the observations in the two groups independent? Explain.

(b) Write hypotheses for this research in symbols and in words.

(c) Check the conditions required to complete this test. A histogram of the differences is given to the right.

(d) Calculate the test statistic and find the p-value.

(e) Use a 0.05 to evaluate the test, and interpret your conclusion in context.

(f) What type of error might we have made? Explain in context what the error means.

(g) Based on the results of this hypothesis test, would you expect a confidence interval for the average difference between the number of days exceeding 90°F from 1948 and 2018 to include 0? Explain your reasoning. Dferences in Number of Days

In: Math

Witter House is a calendar-year firm with 410 million commonshares outstanding throughout 2018 and 2019....

Witter House is a calendar-year firm with 410 million common shares outstanding throughout 2018 and 2019. As part of its executive compensation plan, at January 1, 2017, the company had issued 50 million executive stock options permitting executives to buy 50 million shares of stock for $15 within the next eight years, but not prior to January 1, 2020. The fair value of the options was estimated on the grant date to be $3 per option.

In 2018, Witter House began granting employees stock awards rather than stock options as part of its equity compensation plans and granted 25 million restricted common shares to senior executives at January 1, 2018. The shares vest four years later. The fair value of the stock was $20 per share on the grant date. The average price of the common shares was $20 and $25 during 2018 and 2019, respectively.

The stock options qualify for tax purposes as an incentive plan. The restricted stock does not. The company's net income was $260 million and $270 million in 2018 and 2019, respectively. Its income tax rate is 40%.

Required:

1. Compute basic and diluted earnings per share for Witter House in 2018.

2. Compute basic and diluted earnings per share for Witter House in 2019.

(For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places (i.e., 10,000,000 should be entered as 10.00).)

In: Finance

Gidi Professional Institute is constructing a Tuition Center at Aboabo that will take about 18 months...

Gidi Professional Institute is constructing a Tuition Center at Aboabo that will take about 18 months to complete. The company commenced construction on 2 January 2018.

The following payments were made during the year: GH¢‘000

31 January 40,000

31 March 90,000

- June 20,000

- October 40,000

30 November 50,000

The first payment on 31 January was funded from the company’s pool of debts. However, the company succeeded in raising Medium-Term Loan Notes for an amount of GH¢160,000,000 on 31 March 2018 at a simple interest rate of 9 percent per year, calculated and payable monthly in arrears.

These funds were specifically used for the construction. Excess funds were temporarily invested at 6 percent monthly in arrears and payable in cash. The pool of debts was again used for a GH¢40,000,000 payment on 30 November 2018 which could not be funded from the Medium-Term Loan Notes. The construction project was temporarily halted for three weeks in May 2018 when substantial technical and administrative work was carried out.

The following amounts of debts were outstanding at the reporting date of 31 December 2018:

|

GH¢’000 |

|

|

Medium-Term Loan Notes |

160,000 |

|

Bank Overdraft |

240,000 |

10% 7-year Notes 1/10/2018 with simple interest payable annually at 31 Dec 1,800,000

For the bank overdraft, the weighted average amount outstanding during the year was GH¢150,000,000 and the total interest charged by the bank amounted to GH¢6,760,000 for the year.

Required

Calculate the total amount of interest to be capitalised

In: Accounting

The comparative balance sheets for 2018 and 2017 are given below for Surmise Company. Net income...

The comparative balance sheets for 2018 and 2017 are given below

for Surmise Company. Net income for 2018 was $52 million.

|

SURMISE COMPANY Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) |

||||||||

| 2018 | 2017 | |||||||

| Assets | ||||||||

| Cash | $ | 67 | $ | 72 | ||||

| Accounts receivable | 75 | 78 | ||||||

| Less: Allowance for uncollectible accounts | (8 | ) | (3 | ) | ||||

| Prepaid expenses | 3 | 2 | ||||||

| Inventory | 158 | 150 | ||||||

| Long-term investment | 45 | 20 | ||||||

| Land | 70 | 70 | ||||||

| Buildings and equipment | 288 | 200 | ||||||

| Less: Accumulated depreciation | (94 | ) | (80 | ) | ||||

| Patent | 10 | 12 | ||||||

| $ | 614 | $ | 521 | |||||

| Liabilities | ||||||||

| Accounts payable | $ | 4 | $ | 13 | ||||

| Accrued liabilities | 1 | 5 | ||||||

| Notes payable | 20 | 0 | ||||||

| Lease liability | 80 | 0 | ||||||

| Bonds payable | 50 | 90 | ||||||

| Shareholders’ Equity | ||||||||

| Common stock | 55 | 50 | ||||||

| Paid-in capital—excess of par | 247 | 205 | ||||||

| Retained earnings | 157 | 158 | ||||||

| $ | 614 | $ | 521 | |||||

Prepare the statement of cash flows of Surmise Company for the year ended December 31, 2018. Use the indirect method to present cash flows from operating activities because you do not have sufficient information to use the direct method. You will need to make reasonable assumptions concerning the reasons for changes in some account balances. A spreadsheet or T-account analysis will be helpful. (Hint: The right to use a building was acquired with a seven-year lease agreement. Annual lease payments of $8 million are paid at January 1 of each year starting in 2018.)

In: Accounting