Questions

1. Which of the following is not a CPP benefit? a. Retirement pension b. Survivor benefit...

1. Which of the following is not a CPP benefit? a. Retirement pension b. Survivor benefit c. Death benefit d. Allowance for survivor

2. Demi is a Canadian citizen. She has an RRSP account in which she has currently invested $5,000,000 in mutual funds. The real return on her mutual funds is expected to be 7% over the ten years until her retirement. If she doesn’t save any more between now and retirement, how much will her retirement shortfall be if she needs $15,000,000 at retirement? a. $9,835,757 b. $3,000,000 c. $5,164,243 d. She will not have a shortfall.

3. Which of the following statements is not true about retirement savings? a. No tax is paid now on money paid into sheltered savings plans. b. Funds in sheltered savings plans grow before tax. c. No tax is ever paid on money paid into sheltered savings plans. d. Unsheltered savings are bought with after-tax dollars.

4. Marie is deciding if she should retire now at age 61 or wait until age 70. Her health is very good – she expects to live to 90. Which of the following statements is true about her CPP retirement income if she expects to live to age 90 and will be eligible to collect the full retirement benefit at age 65 and is using a discount rate of 3%? a. She should retire now. b. She should wait until age 70. c. It doesn’t make any difference. d. This cannot be assessed without knowing the amount of the full retirement benefit.

5. Which of the following statements about the steady-state financing rate is not true? a. It means CPP rates will not go above 4.95%. b. Up to half of the CPP fund is being actively managed. c. It has been an unfunded pension plan. d. In a few years, the CPP fund will be fully funded like other pension plans.

6. Which of the following statements is not true about OAS? a. It is indexed quarterly. b. It is based on years lived in Canada. c. It is based on income earned while you were working d. It might be collected while living outside Canada.

7. Early retirement means the earliest one can retire and: a. Receive the same total pension income as would be received at age 65. b. Receive an unreduced pension based on the actual number of years of service. c. Collect the full CPP retirement benefit. d. Collect the early OAS benefit.

8. Which of the following statements is not true about CPP contributions for salaried employees? a. They are a tax credit. b. They are tax deductible. c. The effect of an increase in salary on CPP contributions is inconsequential for most people who are doing detailed retirement planning. d. The employer pays an amount equal to that of the employee.

9. Which of the following statements about RPP is not true? a. Most DCPP are in the private sector. b. There are many DBPP in the private sector. c. Employers who provide DBPP may have to make large contributions to ensure the plan is fully funded due to a drop in the stock market. d. The limit on benefits received is the same for DCPP and DBPP.

10. Which of the following statement(s) are correct? a. Defined benefit plans can generate surpluses. b. Defined contribution plans cannot generate surpluses. c. Deferred profit sharing plans are a type of defined contribution plan. d. All of the above are true.

11. Which of the following statements is not true? a. The maximum possible retirement benefit from a DBPP depends on the maximum allowable years of service. b. The maximum possible retirement benefit from a DCPP is the same as for a DBPP. c. There is no maximum benefit for DCPP. d. If a retiree dies, the spouse can receive some of the retiree’s pension benefits.

12. Henry’s company provides him with a defined contribution pension plan. The maximum amount of pension he can receive for each year of service is: a. 2% p.a. times his YMPE b. 2% p.a. times his pensionable earnings c. $1,722.22 d. There is no maximum

13. Which of the following is not true? a. Before age 65, an employee must have actually retired to receive a pension. b. After age 65, an employee can receive both a pension and earned income from the same company. c. A person who is collecting a pension can still make contributions to the plan to increase future benefits. d. A person age 73 who is still working cannot make contributions to a RPP.

14. For a defined benefit pension plan, all of the following are true except: a. Benefits might increase each year to reflect inflation. b. Benefits might be integrated with CPP retirement income. c. Benefits must end when the retiree dies. d. A common-law spouse can receive benefits after the retiree dies.

15. Normal retirement age means: a. An employee cannot retire with a full pension before age 60. b. The age at which an employee can received the full amount for each year of service. c. Age 65. d. There is no minimum number of years of service.

In: Finance

At a time when demand for ready-to-eat cereal was stagnant, a spokesperson for the cereal maker...

At a time when demand for ready-to-eat cereal was stagnant, a

spokesperson for the cereal maker Kellogg’s was quoted as saying, “

. . . for the past several years, our individual company growth has

come out of the other fellow’s hide.” Kellogg’s has been producing

cereal since 1906 and continues to implement strategies that make

it a leader in the cereal industry. Suppose that when Kellogg’s and

its largest rival advertise, each company earns $2 billion in

profits. When neither company advertises, each company earns

profits of $16 billion.

Please help me solve this problem!

If one company advertises and the other does not, the company

that advertises earns $56 billion and the company that does not

advertise loses $4 billion. For what range of interest rates could

these firms use trigger strategies to support the collusive level

of advertising?

Instruction: Enter your response as a percentage

rounded to the nearest whole number.

i ≤ percent

In: Economics

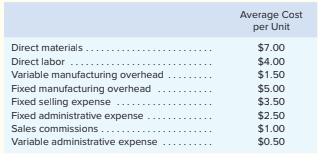

Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows:

Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows:

Required:

1. Assume the cost object is units of production:

a. What is the total direct manufacturing cost incurred to make 20,000 units?

b. What is the total indirect manufacturing cost incurred to make 20,000 units?

2. Assume the cost object is the Manufacturing Department and that its total output is 20,000 units.

a. How much total manufacturing cost is directly traceable to the Manufacturing Department?

b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department?

3. Assume the cost object is the company’s various sales representatives. Furthermore, assume that the company spent $50,000 of its total fixed selling expense on advertising and the remainder of the total fixed selling expense comprised the fixed portion of the company’s sales representatives’ compensation.

a. When the company sells 20,000 units, what is the total direct selling expense that can be readily traced to individual sales representatives?

b. When the company sells 20,000 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives?

4. Are Kubin’s administrative expenses always going to be treated as indirect costs in its internal management reports?

In: Accounting

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are red, $55; white, $85; and blue, $110. The per unit variable costs to manufacture and sell these products are red, $40; white, $60; and blue, $80. Their sales mix is reflected in a ratio of 5:4:2 (red:white:blue). Annual fixed costs shared by all three products are $150,000. One type of raw material has been used to manufacture all three products. The company has developed a new material of equal quality for less cost. The new material would reduce variable costs per unit as follows: red, by $10; white, by $20; and blue, by $10. However, the new material requires new equipment, which will increase annual fixed costs by $20,000.

| 1. |

Assume if the company continues to use the old material, determine its break-even point in both sales units and sales dollars of each individual product. (Round up your composite units to whole number. Omit the "$" sign in your response.)

|

In: Accounting

On January 1, 2016, Cayce Corporation acquired 100 percent of Simbel Company for consideration transferred with...

On January 1, 2016, Cayce Corporation acquired 100 percent of Simbel Company for consideration transferred with a fair value of $141,300. Cayce is a U.S.-based company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts for its investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is attributable to undervalued land on Simbel’s books. Simbel had no retained earnings at the date of acquisition. Following are the 2017 financial statements for the two operations. Information for Cayce and for Simbel is in U.S. dollars ($) and Egyptian pounds (£E), respectively.

| Cayce Corporation |

Simbel Company |

||||||

| Sales | $ | 228,800 | £E | 882,900 | |||

| Cost of goods sold | (108,200 | ) | (463,300 | ) | |||

| Salary expense | (22,600 | ) | (81,200 | ) | |||

| Rent expense | (8,800 | ) | (49,600 | ) | |||

| Other expenses | (26,400 | ) | (64,400 | ) | |||

| Dividend income—from Simbel | 18,700 | 0 | |||||

| Gain on sale of building, 10/1/17 | 0 | 48,000 | |||||

| Net income | $ | 81,500 | £E | 272,400 | |||

| Retained earnings, 1/1/17 | $ | 336,000 | £E | 147,400 | |||

| Net income | 81,500 | 272,400 | |||||

| Dividends | (42,000 | ) | (68,000 | ) | |||

| Retained earnings, 12/31/17 | $ | 375,500 | £E | 351,800 | |||

| Cash and receivables | $ | 112,600 | £E | 165,800 | |||

| Inventory | 99,800 | 336,600 | |||||

| Prepaid expenses | 30,000 | 0 | |||||

| Investment in Simbel (initial value) | 141,300 | 0 | |||||

| Property, plant & equipment (net) | 455,600 | 473,000 | |||||

| Total assets | $ | 839,300 | £E | 975,400 | |||

| Accounts payable | $ | 68,000 | £E | 59,400 | |||

| Notes payable—due in 2020 | 162,200 | 145,400 | |||||

| Common stock | 138,000 | 258,000 | |||||

| Additional paid-in capital | 95,600 | 160,800 | |||||

| Retained earnings, 12/31/17 | 375,500 | 351,800 | |||||

| Total liabilities and equities | $ | 839,300 | £E | 975,400 | |||

During 2016, the first year of joint operation, Simbel reported income of £E 181,000 earned evenly throughout the year. Simbel declared a dividend of £E 33,600 to Cayce on June 1 of that year. Simbel also declared the 2017 dividend on June 1.

On December 9, 2017, Simbel classified a £E 11,800 expenditure as a rent expense, although this payment related to prepayment of rent for the first few months of 2018.

The exchange rates for 1 £E are as follows:

| January 1, 2016 | $ | 0.300 |

| June 1, 2016 | 0.290 | |

| Weighted average rate for 2016 | 0.288 | |

| December 31, 2017 | 0.280 | |

| June 1, 2017 | 0.275 | |

| October 1, 2017 | 0.273 | |

| Weighted average rate for 2017 | 0.274 | |

| December 31, 2017 | 0.270 | |

|

US DOLLARS |

||

A. Translation Worksheet

| account |

Egyptian Pounds |

Exchange Rate | Dollars |

B. consolidation worksheet

| account | cayce $ | simbel $ | debit | credit | consolidated balances |

In: Accounting

Consider the following preferences and election problem. Let us assume that a president has to be...

Consider the following preferences and election problem. Let us assume that a president has to be elected. 4 candidates want to become a president, who are representing different political ideologies: A is a left-wing candidate, B is a social-democrat, C is a right-liberal candidate and D is a right-wing candidate. 20% of the voters (group left) preference A≻B≻C≻D, 30% of the voters (group social democrats) have the preference B≻A≻C≻D, 10% of the voters (group right-liberal) preference C≻B≻A≻D, 40% of the voters (group right) have preference D≻C≻B≻A. Please note the sign “ ≻ “ means “preferred to.”. In total we have 100 voters.

A What is the election outcome if a pure plurality voting system is applied? How many votes does the winner receives?

B Who will be elected if the Instant Runoff voting system is applied? Who will be the first and second ranked candidate in the first election round? How much votes will the winner get in the second round?

C. Who will win if the system of unanimity is applied?

D. Who will win, if the point-count voting is applied? Please note, the voters have to rank their preferences for the first 3 candidates like, the most preferred candidate get 3 points, the second ranked candidate gets 2 points and the third ranked candidate gets 1 point. The fourth preferred candidate get zero points. How many points will be distributed in total and how much points will the winner receive?

In: Statistics and Probability

In the US, fluoride is added to drinking water. In 2015, the US Department of Health...

In the US, fluoride is added to drinking water. In 2015, the US Department of Health [12] lowered the recommended amount of fluoride in drinking water. Fluoride is added to drinking water to help prevent tooth decay, but too much fluoride can lead to fluorosis (white stains in the enamel of the teeth). A particular city wants to check whether their drinking water meets the specifications made by the department of health. The department of health recommends that there should be 0.7 milligrams of fluoride per liter of water. Suppose we collect a random sample of 40 different liters of water and find the the average amount of fluoride per liter of water is 0.775 milligrams with standard deviation 0.2 milligrams. Conduct a hypothesis test using α = .01. Make sure to state the null and alternative hypotheses, state the appropriate test statistic, set up the rejection region, find the P-value for this test, make your conclusion using both the rejection region method and the P-value, and state your conclusion in the context of the problem. Also, find a 99% confidence interval for the true average amount of fluoride per liter of water and use this interval to make a conclusion about the test of hypothesis.

In: Statistics and Probability

A US electronics firm has a plant in the US and another in China. The production...

A US electronics firm has a plant in the US and another in China. The production function is the same in both plants q = L1 2 K 1 2 (notice that marginal product of labor is MPL = 1 2L− 1 2 K 1 2 = 1 2 q L and marginal product of capital is MPK = 1 2L1 2 K− 1 2 = 1 2 q K ). The US prices are w = r = 9. In China the firm faces the same cost of capital r∗ = 9 but the wage rate is lower, w∗ = 4.

A.Show the total, average and marginal product of labor with this production function if capital is fixed at K = 100

B.

C.Represent in a diagram the cost minimizing choice of factors to produce q = 100 in each country

D.Write the equilibrium proportions of the factors that the firm is going to use in each country.

E. Write the expressions for cost, obtain the relationships factorsoutput and deduce the cost functions for both countries. Calculate the cost of producing q = 100 units in each country.

There is no question b

In: Economics

Suppose that the US Federal Reserve Board was able to confirm that the US economy is...

Suppose that the US Federal Reserve Board was able to confirm that the US economy is in the brink of a recession, operating at a GDP level (Y1) that is well below its full-employment capacity (YF). Your tasks are:

5.1. Name one monetary policy, and specify the policy tool to use, that the Fed could make to help boost the economy.

5.2.Using the AD-AS theory, show and EXPLAIN the expected short run and long run effect of this policy on the US economy. Other things are assumed constant. Explain which curves shift and why. Label curves clearly. Identify the new equilibrium in the short-run and the long-run.

In: Economics

Suppose that you are an analyst for the ABC Company, a large consulting firm with offices...

Suppose that you are an analyst for the ABC Company, a large consulting firm with offices around the world. The company wants to build a new knowledge management system that can identify and track the expertise of individual consultants anywhere in the world on the basis of their education and the various consulting projects on which they have worked. Assume that this is a new idea that has never before been attempted in ABC or elsewhere. ABC has an international network, but the offices in each country may use somewhat different hardware and software. ABC management wants the system up and running within a year.

- Given the situation, what methodology would you recommend that ABC Company use? Why?

- Support or Oppose the above statements with arguments

In: Computer Science