Questions

Your company plans to issue bonds later in the upcoming year. But with the economic uncertainty...

Your company plans to issue bonds later in the upcoming year. But with the economic uncertainty and varied interest rates, it is not clear how much money the company will receive when the bonds are issued. The company is committed to issuing 2,500 bonds, each of which will have a face value of $1,000, a stated interest rate of 7 percent paid annually, and a period to maturity of 10 years. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1)

Required:

1. Compute the bond issue proceeds assuming a market interest rate of 7 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value.

2. Compute the bond issue proceeds assuming a market interest rate of 6 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value.

3. Compute the bond issue proceeds assuming a market interest rate of 8 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value.

In: Accounting

The president of State University wants to forecast student enrollment for this academic year based on...

The president of State University wants to forecast student enrollment for this academic year based on the following historical data:

|

Year |

Enrollments |

|

5 years ago |

15,000 |

|

4 years ago |

16,000 |

|

3 years ago |

18,000 |

|

2 years ago |

20,000 |

|

Last year |

21,000 |

What is the forecast for this year using exponential smoothing with alpha = 0.5, if the forecast for two years ago was 16,000?

In: Other

Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management...

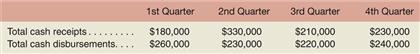

Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows:

The company’s beginning cash balance for the upcoming fiscal year will be $20,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded.

Required:

Prepare the company’s cash budget for the upcoming fiscal year

In: Accounting

Future Motors is expected to pay an annual dividend next year of $3.10 a share.

Future Motors is expected to pay an annual dividend next year of $3.10 a share. Dividends are expected to increase by 1.85 percent annually. What is one share of this stock worth at a required rate of return of 15 percent?

A) $24.01 B) $26.30 C)$24.56 ) $23.57 ) $24.59

In: Finance

Accounts receivable from sales transactions were $51,000 at the beginning of the year and $64,000 at...

Accounts receivable from sales transactions were $51,000 at the beginning of the year and $64,000 at the end of the year. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method is

|

|||

|

|||

|

|||

|

In: Accounting

Tobacco is shipped from North Carolina to a cigarette manufacturer in Cambodia once a year. The...

Tobacco is shipped from North Carolina to a cigarette manufacturer in Cambodia once a year. The reorder point, without safety stock, is 200 kilos. The carrying cost is $20 per kilo per year, and the cost of a stockout is $70 per kilo per year. Given the following demand probabilities during the lead time, how much safety stock should be carried?

Demand During Lead Time(Kilos) Probability

0 ................... .....................................0.1

100 ......................................................0.1

200 ..................................................... 0.2

300 ................... ..................................0.4

400 ................... ..................................0.2

The optimal quantity pf safety stock which minimizes expeted total cost is ____ kilos (enter anwser as a whole number).

In: Other

New Products pays no dividend at the present time. Starting in Year 3, the firm will...

New Products pays no dividend at the present time. Starting in Year 3, the firm will pay a $.25 dividend per share for two years. After that, the company plans on paying a constant $.75 a share annual dividend indefinitely. How much should you pay per share to purchase this stock today at a required return of 13.8 percent?

In: Finance

A company assigned overhead to work in process. At year end, what does the amount of...

A company assigned overhead to work in process. At year end, what does the amount of overapplied overhead mean?

The overhead assigned to work in process is greater than the estimated overhead costs.

The overhead assigned to work in process is less than the estimated overhead costs.

The overhead assigned to work in process is less than the actual overhead.

The overhead assigned to work in process is greater than the overhead incurred.

In: Accounting

The Phillips curve in the short run and long runIn the year 2023, aggregate demand...

The Phillips curve in the short run and long run

In the year 2023, aggregate demand and aggregate supply in the fictional country of Marjan are represented by the curves AD2023AD2023 and AS on the following graph.

Suppose the natural level of output in this economy is $6 trillion.

On the following graph, use the green line (triangle symbol) to plot the long-run aggregate supply (LRAS) curve for this economy.

Economists have forecast that if the government does nothing and the economy continues to grow at the current rate, aggregate demand in 2024 will be given by the ADAADA curve, resulting in the outcome illustrated by point A. If the government pursues an expansionary policy, aggregate demand in 2024 will be given by the ADBADB curve, resulting in the outcome illustrated by point B.

The following table gives projections for the unemployment rates that would occur at point A and point B. Consider what the rate of inflation would be between 2023 and 2024, depending on whether the economy moves from the initial price level of 102 to the price level at outcome A or the price level at outcome B.

Note: Calculate the inflation rate to two decimal points of precision.

Unemployment Rate | Inflation Rate | |

|---|---|---|

| A | 6% | |

| B | 3% |

Based on your answers to the preceding parts, use the black line (plus symbol) to draw the short-run Phillips curve (SRPC) for this economy in 2024. (Note: You will not be graded on any changes you make to this graph.)

-The short-run Phillips curve is line:

A)At the natural rate of unemployment

B)Representing the tradeoff between unemployment and inflation

C)At the natural level of output

Now consider the long-run effects of this policy. Suppose, in particular, that following implementation of the policy, the aggregate demand curve remains at ADBADB. Designate the long-run equilibrium that would follow such a policy as outcome C.

Going back to the first graph, place the grey point (star symbol) at outcome C.

Because output at point C is_______ the natural level of output, the unemployment rate associated with outcome C is _____ the natural rate of unemployment.

Finally, use the green line (triangle symbol) to draw the long-run Phillips curve (LRPC) on the second graph.

This line is _______ line:

A)At the natural rate of unemployment

B)Representing the tradeoff between unemployment and inflation

C)At the natural level of output

LRAS Outcome C PRICE LEVEL AD 2023 100 HA 0 2 14 16 4 6 8 10 12 OUTPUT (Trillions of dollars)

SRPC A- LRPC INFLATION RATE (Percent) 0 1 7 8 2 3 4 5 6 UNEMPLOYMENT RATE (Percent)

In: Economics

Part A At the start of the current year, SBC Corp. purchased 25% of Sky Tech...

Part A

At the start of the current year, SBC Corp. purchased 25% of Sky Tech Inc. for $52 million. At the time of purchase, the carrying value of Sky Tech's net assets was $86 million. The fair value of Sky Tech's depreciable assets was $10 million in excess of their book value. For this year, Sky Tech reported a net income of $86 million and declared and paid $10 million in dividends.

| The total amount of additional depreciation to be recognized by SBC over the remaining life of the assets is: |

None of the above is correct.

$24 million.

$10 million.

$2.5 million.

Part B

At the start of the current year, SBC Corp. purchased 20% of Sky Tech Inc. for $41 million. At the time of purchase, the carrying value of Sky Tech's net assets was $66 million. The fair value of Sky Tech's depreciable assets was $14 million in excess of their book value. For this year, Sky Tech reported a net income of $66 million and declared and paid $14 million in dividends.

| The amount of purchased goodwill is: |

$27 million.

None of the above is correct.

$25 million.

$55 million.

In: Accounting