Questions

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its

facilities. Its current income statement is as follows:

| Sales | $ | 7,500,000 |

| Variable costs (50% of sales) | 3,750,000 | |

| Fixed costs | 2,050,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,700,000 |

| Interest (10% cost) | 700,000 | |

| Earnings before taxes (EBT) | $ | 1,000,000 |

| Tax (35%) | 350,000 | |

| Earnings after taxes (EAT) | $ | 650,000 |

| Shares of common stock | 450,000 | |

| Earnings per share | $ | 1.44 |

The company is currently financed with 50 percent debt and 50

percent equity (common stock, par value of $10). In order to expand

the facilities, Mr. Delsing estimates a need for $4.5 million in

additional financing. His investment banker has laid out three

plans for him to consider:

- Sell $4.5 million of debt at 9 percent.

- Sell $4.5 million of common stock at $15 per share.

- Sell $2.25 million of debt at 8 percent and $2.25 million of common stock at $20 per share.

Variable costs are expected to stay at 50 percent of sales,

while fixed expenses will increase to $2,550,000 per year. Delsing

is not sure how much this expansion will add to sales, but he

estimates that sales will rise by $2.25 million per year for the

next five years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing.He would like you to analyze the

following:

a. The break-even point for operating expenses

before and after expansion (in sales dollars). (Enter your

answers in dollars not in millions, i.e, $1,234,567.)

b. The degree of operating leverage before and

after expansion. Assume sales of $7.5 million before expansion and

$8.5 million after expansion. Use the formula: DOL = (S −

TVC) / (S − TVC − FC). (Round

your answers to 2 decimal places.)

c-1. The degree of financial leverage before

expansion. (Round your answers to 2 decimal places.)

c-2. The degree of financial leverage for all

three methods after expansion. Assume sales of $8.5 million for

this question. (Round your answers to 2 decimal

places.)

d. Compute EPS under all three methods of

financing the expansion at $8.5 million in sales (first year) and

$10.3 million in sales (last year). (Round your answers to

2 decimal places.)

In: Accounting

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its

facilities. Its current income statement is as follows:

| Sales | $ | 6,400,000 |

| Variable costs (50% of sales) | 3,200,000 | |

| Fixed costs | 1,940,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,260,000 |

| Interest (10% cost) | 480,000 | |

| Earnings before taxes (EBT) | $ | 780,000 |

| Tax (40%) | 312,000 | |

| Earnings after taxes (EAT) | $ | 468,000 |

| Shares of common stock | 340,000 | |

| Earnings per share | $ | 1.38 |

|

|

||

The company is currently financed with 50 percent debt and 50

percent equity (common stock, par value of $10). In order to expand

the facilities, Mr. Delsing estimates a need for $3.4 million in

additional financing. His investment banker has laid out three

plans for him to consider:

- Sell $3.4 million of debt at 10 percent.

- Sell $3.4 million of common stock at $20 per share.

- Sell $1.70 million of debt at 9 percent and $1.70 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales, while

fixed expenses will increase to $2,440,000 per year. Delsing is not

sure how much this expansion will add to sales, but he estimates

that sales will rise by $1.70 million per year for the next five

years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing.He would like you to analyze the

following:

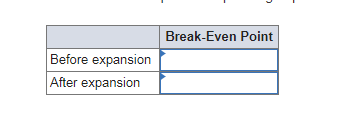

a. The break-even point for operating expenses

before and after expansion (in sales dollars). (Enter your answers in dollars not in

millions, i.e, $1,234,567.)

|

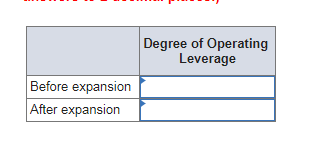

b. The degree of operating leverage before and

after expansion. Assume sales of $6.4 million before expansion and

$7.4 million after expansion. Use the formula: DOL = (S −

TVC) / (S − TVC − FC). (Round your answers to 2 decimal

places.)

|

c-1. The degree of financial leverage before

expansion. (Round your

answers to 2 decimal places.)

|

c-2. The degree of financial leverage for all

three methods after expansion. Assume sales of $7.4 million for

this question. (Round

your answers to 2 decimal places.)

|

d. Compute EPS under all three methods of

financing the expansion at $7.4 million in sales (first year) and

$10.3 million in sales (last year). (Round your answers to 2 decimal

places.)

|

||||||||||||||||

In: Accounting

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its

facilities. Its current income statement is as follows:

| Sales | $ | 5,300,000 |

| Variable costs (50% of sales) | 2,650,000 | |

| Fixed costs | 1,830,000 | |

| Earnings before interest and taxes (EBIT) | $ | 820,000 |

| Interest (10% cost) | 260,000 | |

| Earnings before taxes (EBT) | $ | 560,000 |

| Tax (30%) | 168,000 | |

| Earnings after taxes (EAT) | $ | 392,000 |

| Shares of common stock | 230,000 | |

| Earnings per share | $ | 1.70 |

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $2.3 million in additional financing. His investment banker has laid out three plans for him to consider:

- Sell $2.3 million of debt at 11 percent.

- Sell $2.3 million of common stock at $25 per share.

- Sell $1.15 million of debt at 10 percent and $1.15 million of common stock at $40 per share.

Variable costs are expected to stay at 50 percent of sales,

while fixed expenses will increase to $2,330,000 per year. Delsing

is not sure how much this expansion will add to sales, but he

estimates that sales will rise by $1.15 million per year for the

next five years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing.He would like you to analyze the

following:

a. The break-even point for operating expenses before and after expansion (in sales dollars). (Enter your answers in dollars not in millions, i.e, $1,234,567.)

| Break Even Point | ||

| Before expansion | ||

| After expansion | ||

b. The degree of operating leverage before and

after expansion. Assume sales of $5.3 million before expansion and

$6.3 million after expansion. Use the formula: DOL = (S −

TVC) / (S − TVC − FC). (Round

your answers to 2 decimal places.)

|

Degree of Operating Leverage |

||

| Before expansion | ||

| After expansion | ||

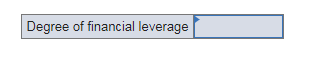

c-1. The degree of financial leverage before

expansion. (Round your answers to 2 decimal

places.)

Degree of financial leverage____?

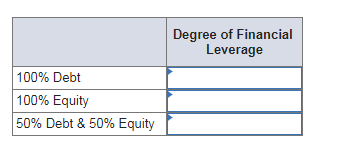

c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $6.3 million for this question. (Round your answers to 2 decimal places.)

|

Degree of Financial Leverage |

||

| 100% Debt | ||

| 100% Equity | ||

| 50 % Debt 50 % Equity | ||

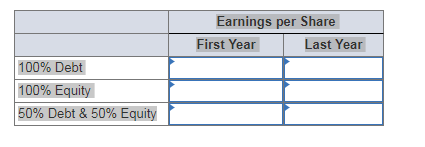

d. Compute EPS under all three methods of financing the expansion at $6.3 million in sales (first year) and $10.3 million in sales (last year). (Round your answers to 2 decimal places.)

| Earnings per Share | ||||

| First Year | Last Year | |||

| 100% Debt | ||||

| 100% Equity | ||||

| 50 % Debt 50 % Equity | ||||

In: Finance

DELSING CANNING COMPANY IS CONSIDERING AN EXPANSION OF ITS FACILITIES. ITS CURRENT INCOME STATEMENT IS AS...

DELSING CANNING COMPANY IS CONSIDERING AN EXPANSION OF ITS FACILITIES. ITS CURRENT INCOME STATEMENT IS AS FOLLOWS:

SALES............................................................................

7,100,100

VARIABLE COSTS (50% OF

SALES).............................3,550,000

FIXED

COSTS.................................................................2,010,000

EBIT.................................................................................1,540,000

INTEREST (10%

COST)....................................................620,000

EBT.....................................................................................920,000

TAX

(30%)..........................................................................276,000

EAT.....................................................................................644,000

SHARES COMMON

STOCK..............................................410,000

EPS...........................................................................................1.57

The company is currently financed with 50% debt and 50% equity

(common stock, par value of $10). In order to expand the

facilities, Mr. Delsing estimates a need for $4.1 million in

additional financing. His investment banker has laid out three

plans for him to consider:

1) Sell $4.1 million of debt at 11%

2) Sell $4.1 million of common stock at $20 per share

3) Sell $2.05 million of debt at 10% and $2.05 million of common

stock at $25 per share.

Variable costs are expected to stay at 50% of sales, while fixed expenses will increase to $2,510,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates sales will rise by $2.05 million per year for the next 5 years.

Delsing is interested in a thorough analysis of his expansion plans and methods of financing. He would like you to analyze the following:

a. The break-even point for operating expenses before and after expansion (in sales dollars). ENTER YOUR ANSWERS IN DOLLARS NOT IN MILLIONS, I.E. $1,234,567.

| BREAK-EVEN POINT | |

| BEFORE EXPANSION | |

| AFTER EXPANSION |

b. The degree of operating leverage before and after

expansion. Assume sales of $7.1 million before expansion, and $8.1

million after expansion. Use the formula

DOL = (S - TVC) / (S - TVC - FC). ROUND YOUR ANSWERS TO 2

DECIMAL PLACES.

| DEGREE OF OPERATING LEVERAGE | |

| BEFORE EXPANSION | |

| AFTER EXPANSION |

c. The degree of financial leverage before expansion. ROUND YOUR ANSWERS TO 2 DECIMAL PLACES.

d. The degree of financial leverage for all three methods after expansion. Assume sales of $8.1 million for this question. ROUND YOUR ANSWERS TO 2 DECIMAL PLACES.

| DEGREE OF FINANCIAL LEVERAGE | |

| 100 % DEBT | |

| 100% EQUITY | |

| 50% DEBT & 50% EQUITY |

e. Compute EPS under all three methods of financing the expansion at $8.1 million in sales (first year) and $11.0 million in sales (last year). ROUND ANSWERS TO 2 DECIMAL PLACES.

| EPS | ||

| FIRST YEAR | LAST YEAR | |

| 100% DEBT | ||

| 100% EQUITY | ||

| 50% DEBT & 50% EQUITY | ||

In: Accounting

Rules for Question: All interest rates herein are expressed with continuous compounding. In case you...

Rules for Question:

All interest rates herein are expressed with continuous compounding.

In case you need to make assumptions, please clearly state them. Only reasonable

assumptions are acceptable. Assumptions that violate finance principles are not to be

made.

For numerical questions, simply calculating the numbers out will not be sufficient.

Please also provide me with the reasons for your calculations. Correct thinking

processes are much more important than correct numbers. Therefore, regardless of

whether or not your numbers are correct, no marks will be given if (a) no explanation

of your calculations is provided; or (b) the explanation provided is incorrect. On the

other hand, even if your numbers are incorrect, partial marks will be given if your

thinking process is correct.

Please note that marks can only be given based on what you write. Therefore, I request

that you attempt to convey your ideas to me as clearly as possible. I will not make a

guess as to what you intend to mean if you do not make it obvious and clear.

When your answers involve taking positions in securities or lending/borrowing, please

mention all the relevant details

such as

the timing of the transactions, the side of the

contracts (e.g., long or short forward), the length of the contracts (e.g., 6-month

futures), the exercise prices (in case of options) and the interest rates (in case of lending

or borrowing).

Question:

-

(3 points) You were recently offered a job (i.e., a 5-year contract) with a gold producer. The company is offering a choice between two compensation schemes. Under the first scheme, you will get a salary of $100,000 per year, with the first payment occurring at the end of the first year. Under the second scheme, you will get 50 ounces of gold per year, with the first payment occurring at the end of the first year. The current price of gold is $1,900 per ounce, and gold analysts expect the price to increase at the rate of 4% per year. The risk-free rate is 2% p.a., while the storage cost for gold is 0.1% p.a. Which compensation scheme will you choose?

In: Finance

Tesco Exits South Korea Tesco was founded in 1919 by Jack Cohen (Cohen), who invested his...

Tesco Exits South Korea

Tesco was founded in 1919 by Jack Cohen (Cohen), who invested his serviceman’s gratuity of £30 in a grocery stall. The first private label product introduced by Cohen was Tesco Tea. The name Tesco was a combination of the initials of the tea supplier TE Stockwell, and the first two letters of Cohen’s name. Tesco opened its first store in 1929 in Edgware, London. In 1947, Tesco Stores (Holdings) Limited was floated on the Stock Exchange with a share price of 25 pence and the first supermarket was opened in 1956 in Maldon, Essex, England. The first superstore was opened in 1968 in Crawley, West Sussex. In the 1960s, Tesco went on an expansion spree and acquired several store chains. The Retail Price Maintenance (RPM) Act in Britain prohibited large retailers from pricing goods below a price agreed upon by the suppliers. To overcome this obstacle to price reduction, Tesco introduced trading stamps. These were given to customers when they purchased products and could be traded for cash or other gifts. RPM was abolished in 1964, and from then on, Tesco was able to offer competitively priced products to its customers in a more direct manner. The first Tesco superstore, with an area of 90,000 square feet, was opened in 1967.

TESCO’S GLOBAL EXPANSION

Tesco’s global expansion began in 1979, when it entered Ireland by

acquiring a 51% equity stake in ‘3 Guys stores’. In 1986, Tesco

divested itself of the stores after it found that it could not

sustain its operations in the country as customers were rejecting

the British products that it sold. During the late 1980s and the

early 1990s, Tesco examined the options available in the US and

European countries after the British government introduced new

regulations on ‘out-of-town’ stores. In December 1992, Tesco

entered France by acquiring an 85% equity holding in Catteau

supermarkets, which operated under the Cedico brand with 72

superstores, 7 hypermarkets, and 24 small stores. However, Tesco

failed to sustain itself in the market due to competition from

French retailers like Carrefour and Promodès. In 1995, a law was

passed in France which prohibited the opening of new large retail

stores. Moreover, the company failed to adapt its products to suit

local tastes and lost market share. In 1996, in spite of investing

an additional £ 300 million in France, sales in the country grew by

a mere 1%. In the year 1997, Tesco sold its operations in France to

Prom odes.

TESCO IN SOUTH KOREA

In the early 1990s, there was a growing demand from consumers in

South Korea for a modern shopping experience owing to rapid

economic growth and increasing disposable incomes. The government

had adopted protectionist policies and the retail sector was not

open for foreign direct investment (FDI). Tesco

entered South Korea in 1999 through a joint venture with Homeplus, a unit of the country’s biggest business group Samsung Corporation (Samsung) . In the next few years, Tesco became the most successful international retailer in the country. Its success was attributed to its ability to localize its products and stores to appeal to the South Korean consumers; its operating through local management; and its strong presence through different store formats. South Korea went on to become Tesco’s most successful international business in terms of revenue. As of 2014, it operated d 140 hypermarkets, 609 supermarkets, and 326 convenience stores.

TESCO’S STRATEGIES IN SOUTH KOREA

Immediately after entering into the joint venture, Tesco went about

upgrading the store layouts. The stores were modified to resemble

department stores, which were spacious and clean. Tesco’s stores in

Korea did not resemble its stores in the UK or in other European

locations like Hungary, Poland, the Czech Republic, and

Ireland.

CHANGES IN THE OPERATING ENVIRONMENT

In October 2012, when Tesco posted its first fall in profits in 20

years, the company also announced that its profits in South Korea

would take a £ 100 million hit due to the "retail market

development bill” that had been passed by the government in

November 2010. However, changes in the operating environment in

South Korea due to new laws that were enforced beginning 2010 to

protect small retailers and merchants started to impact Tesco and

other large retailers. These laws placed restrictions on the

locations where supermarkets could be opened. The Distribution

Industry Development Act passed in 2012 imposed restrictions on the

time for which the stores could remain open and also specified that

on two weekends every month the large retail stores should be

closed. As most Koreans shopped during the weekends, these

restrictions started to impact Tesco, which made losses in 2015.

Under the impact of the global recession, the private spending in

South Korea fell. Another factor that impacted Tesco in South Korea

was its UK business, which was not doing well.

TESCO’S EXIT FROM SOUTH KOREA

On September 07, 2015, Tesco PLC (Tesco), a British multinational

grocery and general merchandise retailer, announced that it had

sold its South Korean business, operated under the name Homeplus,

for £4.2 billion to a consortium of companies led by MBK Partners,

a South Korean buyout firm. The consortium included Canada Pension

Plan Investment Board, Public Sector Pension Investment Board, and

Temasek Holdings (Private) Limited

Question - Case study

Use the case study above to answer the question

What do you think did not work well for Tesco?

Using the Tesco Case discuss the need for companies to consider push and pull factors for international expansion.

In: Economics

Tesco Exits South Korea Tesco was founded in 1919 by Jack Cohen (Cohen), who invested his...

Tesco Exits South Korea

Tesco was founded in 1919 by Jack Cohen (Cohen), who invested his serviceman’s gratuity of £30 in a grocery stall. The first private label product introduced by Cohen was Tesco Tea. The name Tesco was a combination of the initials of the tea supplier TE Stockwell, and the first two letters of Cohen’s name. Tesco opened its first store in 1929 in Edgware, London. In 1947, Tesco Stores (Holdings) Limited was floated on the Stock Exchange with a share price of 25 pence and the first supermarket was opened in 1956 in Maldon, Essex, England. The first superstore was opened in 1968 in Crawley, West Sussex. In the 1960s, Tesco went on an expansion spree and acquired several store chains. The Retail Price Maintenance (RPM) Act in Britain prohibited large retailers from pricing goods below a price agreed upon by the suppliers. To overcome this obstacle to price reduction, Tesco introduced trading stamps. These were given to customers when they purchased products and could be traded for cash or other gifts. RPM was abolished in 1964, and from then on, Tesco was able to offer competitively priced products to its customers in a more direct manner. The first Tesco superstore, with an area of 90,000 square feet, was opened in 1967.

TESCO’S GLOBAL EXPANSION

Tesco’s global expansion began in 1979, when it entered Ireland by

acquiring a 51% equity stake in ‘3 Guys stores’. In 1986, Tesco

divested itself of the stores after it found that it could not

sustain its operations in the country as customers were rejecting

the British products that it sold. During the late 1980s and the

early 1990s, Tesco examined the options available in the US and

European countries after the British government introduced new

regulations on ‘out-of-town’ stores. In December 1992, Tesco

entered France by acquiring an 85% equity holding in Catteau

supermarkets, which operated under the Cedico brand with 72

superstores, 7 hypermarkets, and 24 small stores. However, Tesco

failed to sustain itself in the market due to competition from

French retailers like Carrefour and Promodès. In 1995, a law was

passed in France which prohibited the opening of new large retail

stores. Moreover, the company failed to adapt its products to suit

local tastes and lost market share. In 1996, in spite of investing

an additional £ 300 million in France, sales in the country grew by

a mere 1%. In the year 1997, Tesco sold its operations in France to

Prom odes.

TESCO IN SOUTH KOREA

In the early 1990s, there was a growing demand from consumers in

South Korea for a modern shopping experience owing to rapid

economic growth and increasing disposable incomes. The government

had adopted protectionist policies and the retail sector was not

open for foreign direct investment (FDI). Tesco

entered South Korea in 1999 through a joint venture with Homeplus, a unit of the country’s biggest business group Samsung Corporation (Samsung). In the next few years, Tesco became the most successful international retailer in the country. Its success was attributed to its ability to localize its products and stores to appeal to the South Korean consumers; its operating through local management; and its strong presence through different store formats. South Korea went on to become Tesco’s most successful international business in terms of revenue. As of 2014, it operated d 140 hypermarkets, 609 supermarkets, and 326 convenience stores.

TESCO’S STRATEGIES IN SOUTH KOREA

Immediately after entering into the joint venture, Tesco went about

upgrading the store layouts. The stores were modified to resemble

department stores, which were spacious and clean. Tesco’s stores in

Korea did not resemble its stores in the UK or in other European

locations like Hungary, Poland, the Czech Republic, and

Ireland.

CHANGES IN THE OPERATING ENVIRONMENT

In October 2012, when Tesco posted its first fall in profits in 20

years, the company also announced that its profits in South Korea

would take a £ 100 million hit due to the "retail market

development bill” that had been passed by the government in

November 2010. However, changes in the operating environment in

South Korea due to new laws that were enforced beginning 2010 to

protect small retailers and merchants started to impact Tesco and

other large retailers. These laws placed restrictions on the

locations where supermarkets could be opened. The Distribution

Industry Development Act passed in 2012 imposed restrictions on the

time for which the stores could remain open and also specified that

on two weekends every month the large retail stores should be

closed. As most Koreans shopped during the weekends, these

restrictions started to impact Tesco, which made losses in 2015.

Under the impact of the global recession, the private spending in

South Korea fell. Another factor that impacted Tesco in South Korea

was its UK business, which was not doing well.

TESCO’S EXIT FROM SOUTH KOREA

After several months of speculation, Tesco sold its South Korean

stores to Asian private equity firm MBK Partners for £4.2 billion

on September 07, 2015. On September 07, 2015, Tesco PLC (Tesco), a

British multinational grocery and general merchandise retailer,

announced that it had sold its South Korean business, operated

under the name Homeplus, for £4.2 billion to a consortium of

companies led by MBK Partners, a South Korean buyout firm. The

consortium included Canada Pension Plan Investment Board, Public

Sector Pension Investment Board, and Temasek Holdings (Private)

Limited.

Case study question

The extract above mentions changes in operating environment in

which Tesco functions.

Discuss in this context, the nuances of a Task environment.

In: Economics

Rainbow Company produces two types of monitors – regular and multifunction. The company has produced the...

Rainbow Company produces two types of monitors – regular and multifunction. The company has produced the regular monitor for years whereas the multifunction monitor was introduced in the year 2016 to exploit the military vessels market. However, since the introduction of the new monitor, the company’s profitability has not increased as expected. Therefore, the management has particularly focused its attention on the company’s costing method. The existing costing method allocates the company’s production support costs to the two products on the basis of direct labour hours. The company has estimated that it will incur Kr 2 400 000 worth production support costs and will produce 100 multifunction monitors and 1 000 regular monitors. Whilst a regular monitor requires 5 direct labour hours, a multifunction monitor requires 10 direct labour hours. Material and labour costs per unit and selling price per unit are as follows:

Item Regular Multifunction

Direct material cost (Kr) 4 000 5 000

Direct labour cost (Kr) 2 000 6 000

Selling price (Kr) 10 000 20 000

The management has decided to trace its production support costs to four activities. The production support costs are traceable to the four activities are as follows:

Activity Cost Driver Cost (Kr)

Purchasing orders Number of orders 200 000

Quality control Number of inspections 700 000

Product setups Number of setups 800 000

Machine maintenance Machine hours 700 000

The cost drivers with respect to the two products are as follows:

Cost Driver Regular Multifunction

Number of purchasing orders 40 10

Number of quality inspections 50 20

Number of production setups 100 100

Machine maintenance hours 300 400

- Estimate the production cost per unit and profitability of the two products using the traditional costing method and ABC method.

- Explain the management why the company’s profitability has not increased as expected.

In: Accounting

I have two questions that need to be answered, I can't figure them out: 1) Steve...

I have two questions that need to be answered, I can't figure them out:

1) Steve Coleman has just won the state lottery and has the following three payout options for

afterminus?tax

prize? money:1.

$ 152 comma 000$152,000

per year at the end of each of the next six years2.

$ 318 comma 000$318,000

?(lump sum) now3.

$ 500 comma 000$500,000

?(lump sum) six years from now

The annual discount rate is? 9%. Compute the present value of the second option.? (Round to nearest whole? dollar.)

Present value of? $1:

|

?8% |

?9% |

?10% |

|

|

1 |

0.926 |

0.917 |

0.909 |

|

2 |

0.857 |

0.842 |

0.826 |

|

3 |

0.794 |

0.772 |

0.751 |

|

4 |

0.735 |

0.708 |

0.683 |

|

5 |

0.681 |

0.650 |

0.621 |

|

6 |

0.630 |

0.596 |

0.564 |

|

7 |

0.583 |

0.547 |

0.513 |

A.

$ 100 comma 000$100,000

B.

$ 400 comma 000$400,000

C.

$ 652 comma 000$652,000

D.

$ 318 comma 000$318,000

2) Smash Company has? 4,000 machine hours available annually to manufacture badminton racquets. The following information is available for the two different racquets produced by? Smash:

|

Pro |

|

|

Unit sales price |

?$400 |

|

Unit variable costs |

?$100 |

|

Annual demand |

?2,000 units |

|

Machine time |

1.5 hours per unit |

|

Mid |

|

|

Unit sales price |

?$100 |

|

Unit variable costs |

?$70 |

|

Annual demand |

?5,000 units |

|

2 hours per unit |

How many units of each racquet should be manufactured for the company to maximize its operating? income?

A.

?2,000 units of Pro and 500 units of Mid

B.

?2,000 units of Pro and? 5,000 units of Mid

C.

?2,000 units of Pro and? 1,500 units of Mid

D.

?5,000 units of Mid and 500 units of Pro

In: Accounting

Create a ShoppingCart class in java that simulates the operation of a shopping cart. The ShoppingCart...

Create a ShoppingCart class in java that simulates the operation of a shopping cart. The ShoppingCart instance should contain a BagInterface implementation that will serve to hold the Items that will be added to the cart. Use the implementation of the Item object provided in Item.java. Note that the price is stored as the number of cents so it can be represented as an int (e.g., an Item worth $19.99 would have price = 1999).

Using the CLASSES BELOW Your shopping cart should support the following operations:

-

Add an item

-

Add multiple quantities of a given item (e.g., add 3 of Item __)

-

Remove an unspecified item

-

Remove a specified item

-

Checkout – should "scan" each Item in the shopping cart (and display its

information), sum up the total cost and display the total cost

-

Check budget – Given a budget amount, check to see if the budget is large

enough to pay for everything in the cart. If not, remove an Item from the shopping cart, one at a time, until under budget.

Write a driver program to test out your ShoppingCart implementation.

*Item Class*

/**

* Item.java - implementation of an Item to be placed in ShoppingCart

*/

public class Item

{

private String name;

private int price;

private int id;//in cents

//Constructor

public Item(int i, int p, String n)

{

name = n;

price = p;

id = i;

}

public boolean equals(Item other)

{

return this.name.equals(other.name) && this.price == other.price;

}

//displays name of item and price in properly formatted manner

public String toString()

{

return name + ", price: $" + price/100 + "." + price%100;

}

//Getter methods

public int getPrice()

{

return price;

}

public String getName()

{

return name;

}

}

BAG INTERFACE CLASS

/**

* BagInterface.java - ADT Bag Type

* Describes the operations of a bag of objects

*/

public interface BagInterface<T>

{

//getCurrentSize() - gets the current number of entries in this bag

// @returns the integer number of entries currently in the bag

public int getCurrentSize();

//isEmpty() - sees whether the bag is empty

// @returns TRUE if the bag is empty, FALSE if not

public boolean isEmpty();

//add() - Adds a new entry to this bag

// @param newEntry - the object to be added to the bag

// @returns TRUE if addition was successful, or FALSE if it fails

public boolean add(T newEntry);

//remove() - removes one unspecified entry from the bag, if possible

// @returns either the removed entry (if successful), or NULL if not

public T remove();

//remove(T anEntry) - removes one occurrence of a given entry from this bag, if possible

// @param anEntry - the entry to be removed

// @returns TRUE if removal was successful, FALSE otherwise

public boolean remove(T anEntry);

//clear() - removes all entries from the bag

public void clear();

//contains() - test whether this bag contains a given entry

// @param anEntry - the entry to find

// @returns TRUE if the bag contains anEntry, or FALSE otherwise

public boolean contains(T anEntry);

//getFrequencyOf() - count the number of times a given entry appears in the bag

// @param anEntry - the entry to count

// @returns the number of time anEntry appears in the bag

public int getFrequencyOf(T anEntry);

//toArray() - retrieve all entries that are in the bag

// @returns a newly allocated array of all the entries in the bag

// NOTE: if bag is empty, it will return an empty array

public T[] toArray();

}

In: Computer Science