Questions

4.2 Question 4.2.1 to 4.2.3 is based on the excerpt below: SA Household Finances are in...

4.2 Question 4.2.1 to 4.2.3 is based on the excerpt below:

SA Household Finances are in Dire Straits The South African Reserve Bank (Sarb) yesterday painted a bleak picture of household finances, saying household expenditure had tanked for the first time in three years. In its quarterly bulletin for June, published yesterday, the central bank said consumption expenditure by households had fallen by 0.8% in the first quarter of 2019 following a 3.2% increase in the fourth quarter of 2018 as the economy wanes. The economy is on a downward spiral with gross domestic product contracting by 3.2% in the first quarter of 2019 – the largest contraction since the first quarter of 2009 when it contracted by 6.1%, at the height of the global financial crisis. The Sarb said the deterioration in the household consumption was in line with the decline in consumer confidence in the first quarter of 2019, as measured by the First National Bank/Bureau for Economic Research Consumer Confidence Index.The Sarb said consumers’ finances had been under pressure due to the prolonged period of weak economic activity, rising unemployment, an increased tax burden and successive fuel price increases. Growth in the real disposable income of households was weighed down by lacklustre employment growth and slower wage growth.

4.2.1 The article states that “the economy is on a downward spiral……first quarter of 2019.” Explain which phase of the business cycle this represents. (5)

4.2.2 The article further states that “growth in the real disposable income……and slower wage growth.” In terms of this statement, discuss the type of fiscal policy that government can implement to remedy this situation, paying specific attention in your answer to the tool that needs to be targeted. (5)

4.2.3 Discuss a demand side policy that can be implemented by government to reduce unemployment mentioned in the article.

In: Economics

To test Upper H 0H0: muμequals=100 versus Upper H 1H1: muμnot equals≠100, a simple random sample...

In: Statistics and Probability

Property Flask 1 Flask 2 Flask 3 Flask 4 Contents 100 ml water 100 ml water...

|

Property |

Flask 1 |

Flask 2 |

Flask 3 |

Flask 4 |

|

Contents |

100 ml water |

100 ml water |

74ml acetic acid,1.1g sodium acetate, 26ml water |

74ml acetic acid, 1.1g sodium acetate,26 ml water |

|

Initial pH |

7.00 |

7.00 |

5.01 |

5.01 |

|

pH after adding strong acid(HCL) |

2.32 |

4.97 |

||

|

pH after adding strong base(NAOH) |

11.68 |

5.06 |

1. Compare what happen to the pH of flask 1 to what happened to the pH of flask 3 when HCl was added.

2. Which substance, water or the buffer does a better job of maintaining pH when small amounts of strong acid are added?

3. Compare what happen to the pH of flask 2 to what happened to the pH of flask 4 when NaOH was added.

4. Which substance, water or the buffer does a better job of maintaining pH when small amounts of strong base are added?

5. Write equations for the reactions taking place in each of the flasks. For an equilibrium arrow use equals sign (=) ( use H2O for water, A- for acetate ion, HA for acetic acid, H+ for hydrogen ion, H3O+ for hydronium ion, Na+ for sodium ion, and OH- for hydroxide ion.

a. Reaction in flask 1

b. Reaction in flask 2

c. Reaction in flask 3.

d. Reaction in flask 4.

6. In your own words, tell how this experiment is related to the buffer systems in the blood.

In: Chemistry

Composition Melting Point Range (C) Benzoic Acid (100%) 123 C Maleic Acid (100%) 135 C Benzoic:Maleic...

| Composition | Melting Point Range (C) |

| Benzoic Acid (100%) | 123 C |

| Maleic Acid (100%) | 135 C |

| Benzoic:Maleic (75:25) |

113-116 C |

| Benzoic:Maleic (50:50) | 113-118 C |

| Benzoic:Maleic (25:75) | 123-129 C |

A) Summarize the data (melting point ranges of the 3 mixed samples)

B) What conclusions can be made about the effect of impurities on the melting point range?

C) How did you reach that conclusion?

In: Chemistry

Final_exam assignment_grade Tutorial_attend 100 90 5 100 75 5 90 75 5 85 85 5 85...

| Final_exam | assignment_grade | Tutorial_attend |

| 100 | 90 | 5 |

| 100 | 75 | 5 |

| 90 | 75 | 5 |

| 85 | 85 | 5 |

| 85 | 100 | 5 |

| 80 | 95 | 5 |

| 70 | 80 | 5 |

| 60 | 95 | 5 |

| 60 | 80 | 5 |

| 55 | 95 | 5 |

| 55 | 25 | 4 |

| 50 | 80 | 5 |

| 45 | 90 | 5 |

| 40 | 65 | 5 |

| 40 | 65 | 4 |

| 35 | 0 | 3 |

| 30 | 70 | 4 |

| 30 | 55 | 4 |

| 25 | 85 | 5 |

| 25 | 90 | 4 |

| 15 | 5 | 3 |

| 15 | 80 | 5 |

| 15 | 50 | 5 |

| 15 | 45 | 3 |

| 5 | 75 | 3 |

| 5 | 70 | 4 |

| 100 | 100 | 5 |

| 95 | 75 | 5 |

| 90 | 100 | 5 |

| 85 | 85 | 5 |

| 80 | 95 | 5 |

| 70 | 45 | 5 |

| 70 | 100 | 5 |

| 65 | 90 | 5 |

| 60 | 100 | 5 |

| 55 | 65 | 4 |

| 55 | 90 | 5 |

| 55 | 80 | 4 |

| 50 | 50 | 5 |

| 45 | 50 | 4 |

| 45 | 75 | 3 |

| 40 | 75 | 5 |

| 40 | 70 | 5 |

| 35 | 90 | 4 |

| 30 | 95 | 5 |

| 30 | 55 | 5 |

| 25 | 75 | 4 |

| 25 | 20 | 3 |

| 25 | 65 | 2 |

| 15 | 60 | 4 |

| 15 | 60 | 4 |

| 15 | 80 | 5 |

| 10 | 55 | 4 |

| 10 | 80 | 2 |

| 0 | 0 | 2 |

| SUMMARY OUTPUT | ||||||||

| Regression Statistics | ||||||||

| Multiple R | 0.612917385 | |||||||

| R Square | 0.375667721 | |||||||

| Adjusted R Square | 0.351654941 | |||||||

| Standard Error | 22.82783542 | |||||||

| Observations | 55 | |||||||

| ANOVA | ||||||||

| df | SS | MS | F | Significance F | ||||

| Regression | 2 | 16305.00365 | 8152.501823 | 15.64449105 | 4.79524E-06 | |||

| Residual | 52 | 27097.72363 | 521.1100697 | |||||

| Total | 54 | 43402.72727 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

| Intercept | -35.7528379 | 15.54695813 | -2.299667729 | 0.025513459 | -66.95009176 | -4.555584041 | -66.95009176 | -4.555584041 |

| assignment_grade | 0.218051561 | 0.153416203 | 1.421307252 | 0.161197169 | -0.089800572 | 0.525903695 | -0.089800572 | 0.525903695 |

| Tutorial_attend | 15.33752081 | 4.29606168 | 3.570135151 | 0.000778134 | 6.716842368 | 23.95819925 | 6.716842368 | 23.95819925 |

7. Using your multiple regression results to predict Final_exam for a student with the mean assignment_grade and tutorial_attend equal to (i) 2 tutorials, (ii) 3, (iii) 4 and (iv) 5 tutorials. (Hint this means you will have 4 distinct predictions for Final_exam) Carefully interpret your results.

In: Statistics and Probability

Group Sample Size Sample Mean Sample Standard Deviation Atlanta 100 29.11 20.72 St. Louis 100 21.97...

|

Group |

Sample Size |

Sample Mean |

Sample Standard Deviation |

|

Atlanta |

100 |

29.11 |

20.72 |

|

St. Louis |

100 |

21.97 |

14.23 |

A. Use the six step hypothesis testing procedure to determine if there is evidence that the mean commute times are different in the populations of Atlanta and St. Louis residents.

Step 1: Identify the population, comparison distribution, and assumptions [4 points]

Step 2: State the null and research hypotheses [4 points]

H0:

H1:

Step 3: Determine the characteristics of the comparison distribution (shape, mean, & standard error) [4 points]

Step 4: Determine the critical values [4 points]

Step 5: Calculate the test statistic [4 points]

Step 6: Make a decision (reject/fail to reject + real world conclusion) [4 points]

B. Compute Cohen’s d for the difference in sample means. [4 points]

In: Statistics and Probability

Consider the following substitution block cipher: Plain-text 000 110 001 100 010 111 011 001 100...

Consider the following substitution block cipher:

Plain-text

-

000 110

-

001 100

-

010 111

-

011 001

-

100 101

-

101 000

-

110 010

-

111 011

Cipher-text

[10]

Compute the cipher-text belonging to plaintext 001 110 000 101 110 (using a block size of 3 bits) for the Electronic Code Book (ECB) mode and Cipher Block Chaining (CBC) mode taking IV = 111. Show the intermediate steps.

In: Computer Science

1.When students apply for graduate studies (i.e. at the master’s or doctoral level), they are required...

1.When students apply for graduate studies (i.e. at the master’s

or doctoral level), they are

required to submit an official copy of their transcript, mailed

directly from the Registrar’s

Office at their academic institution. The customer service division

of the Registrar’s

Office at a large Canadian university is interested in determining

if they are more than

25% faster at processing transcripts than another university in the

area, which can process

transcripts in 16 business hours. The customer service manager

obtains a random sample

of 10 waiting times (in business hours), which are provided

below.

11 12 18 20 23

15 10 12 13 14

a. Conduct an appropriate hypothesis test. Use the critical value

method. Use a

population standard deviation of 2 hours. [9 marks]

HINT: You will first have to determine what it means to be 25%

faster, in terms

of hours.

b. Explain what a Type I Error means in this context. [1 mark]

2. A major keyboard manufacturer has a line of keyboards designed

for apartment dwellers.

These keyboards need to be light enough to be carried up flights of

stairs. The lead

engineer wants to use a new type of material. The engineer claims

that the new keyboards

will be lighter than the old keyboards.

They take a sample of 4 keyboards manufactured using the old

material and compute an

average weight of 21 kg with a standard deviation of 1 kg.

They take a sample of 8 keyboards manufactured using the new

material and compute an

average weight of 17 kg with a standard deviation of 2 kg.

a. Conduct an appropriate hypothesis test using the p-value method.

Use the old

material as population 1. [8 marks]

b. How much evidence is there against the null hypothesis in part

(a)? [1 mark]

c. Explain what a Type II Error means in this context. [1 mark

3.An insurance company is interested in estimating the

population mean cost of basic dental

cleaning at dentists in Saskatoon. Suppose there are only two

dentists in Saskatoon:

Dentist A and Dentist B. Suppose also that the cost of basic dental

cleaning varies only

depending on how well the patient practices regular dental hygiene,

so that the cost of

basic dental cleaning roughly follows a Normal distribution

regardless of the dentist.

The insurance company selects 8 sample patients and sends them to

both Dentist A and

Dentist B. They send the patients in random order, such that half

of the patients are seen

by Dentist A first, and half are seen by Dentist B first, so as not

to bias the results. The

cost of basic dental cleaning for these 8 patients seen by both

Dentists A and B are

provided below. The insurance company would like to determine

whether the population

mean cost of basic dental cleaning by Dentist A is different from

the population mean

cost of basic dental care by Dentist B. Let the population of costs

of basic dental care

from Dentist A be population 1.

Patient 1 2 3 4 5 6 7 8

Dentist A $100 $120 $125 $110 $95 $105 $120 $115

Dentist B $150 $100 $140 $100 $95 $105 $100 $120

Conduct an appropriate hypothesis test using the critical value

method. [10 marks]

In: Math

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

| Sales | $ | 6,600,000 |

| Variable costs (50% of sales) | 3,300,000 | |

| Fixed costs | 1,960,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,340,000 |

| Interest (10% cost) | 520,000 | |

| Earnings before taxes (EBT) | $ | 820,000 |

| Tax (35%) | 287,000 | |

| Earnings after taxes (EAT) | $ | 533,000 |

| Shares of common stock | 360,000 | |

| Earnings per share | $ | 1.48 |

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $3.6 million in additional financing. His investment banker has laid out three plans for him to consider:

- Sell $3.6 million of debt at 12 percent.

- Sell $3.6 million of common stock at $30 per share.

- Sell $1.80 million of debt at 11 percent and $1.80 million of common stock at $40 per share.

Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to $2,460,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates that sales will rise by $1 million per year for the next five years

Delsing is interested in a thorough analysis of his expansion plans and methods of financing.He would like you to analyze the following:

a. The break-even point for operating expenses before and after expansion (in sales dollars). (Enter your answers in dollars not in millions, i.e, $1,234,567.)

b. The degree of operating leverage before and after expansion. Assume sales of $6.6 million before expansion and $7.6 million after expansion. Use the formula: DOL = (S − TVC) / (S − TVC − FC). (Round your answers to 2 decimal places.)

c-1. The degree of financial leverage before expansion. (Round your answer to 2 decimal places.)

c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $7.6 million for this question. (Round your answers to 2 decimal places.)

d. Compute EPS under all three methods of financing the expansion at $7.6 million in sales (first year) and $10.5 million in sales (last year). (Round your answers to 2 decimal places.)

In: Finance

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as...

Delsing Canning Company is considering an expansion of its

facilities. Its current income statement is as follows:

| Sales | $ | 6,100,000 |

| Variable costs (50% of sales) | 3,050,000 | |

| Fixed costs | 1,910,000 | |

| Earnings before interest and taxes (EBIT) | $ | 1,140,000 |

| Interest (10% cost) | 420,000 | |

| Earnings before taxes (EBT) | $ | 720,000 |

| Tax (40%) | 288,000 | |

| Earnings after taxes (EAT) | $ | 432,000 |

| Shares of common stock | 310,000 | |

| Earnings per share | $ | 1.39 |

The company is currently financed with 50 percent debt and 50

percent equity (common stock, par value of $10). In order to expand

the facilities, Mr. Delsing estimates a need for $3.1 million in

additional financing. His investment banker has laid out three

plans for him to consider:

- Sell $3.1 million of debt at 13 percent.

- Sell $3.1 million of common stock at $20 per share.

- Sell $1.55 million of debt at 12 percent and $1.55 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales,

while fixed expenses will increase to $2,410,000 per year. Delsing

is not sure how much this expansion will add to sales, but he

estimates that sales will rise by $1 million per year for the next

five years.

Delsing is interested in a thorough analysis of his expansion plans

and methods of financing.He would like you to analyze the

following:

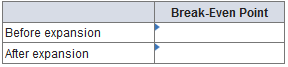

a. The break-even point for operating expenses

before and after expansion (in sales dollars). (Enter your

answers in dollars not in millions, i.e,

$1,234,567.)

Break-Even Point

Before expansion ___________

After expansion ___________

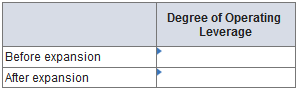

b. The degree of operating leverage before and

after expansion. Assume sales of $6.1 million before expansion and

$7.1 million after expansion. Use the formula: DOL = (S −

TVC) / (S − TVC − FC). (Round

your answers to 2 decimal places.)

Degree of Operating Leverage

Before expansion ________________

After expansion _________________

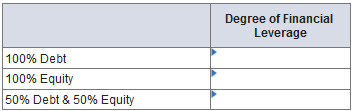

c-1. The degree of financial leverage before

expansion. (Round your answer to 2 decimal places.)

Degree of financial leverage ___________

c-2. The degree of financial leverage for all

three methods after expansion. Assume sales of $7.1 million for

this question. (Round your answers to 2 decimal

places.)

Degree of financial leverage

100% debt ___________________

100% equity ___________________

50% debt and 50% equity ________________

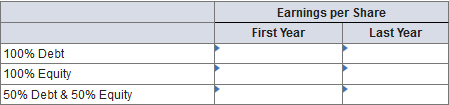

d. Compute EPS under all three methods of

financing the expansion at $7.1 million in sales (first year) and

$10.0 million in sales (last year). (Round your answers to

2 decimal places.)

Earnings per share

First Year Last Year

100% debt _________________________________

100% Equity _________________________________

50%debt and 50% equity ______________________________

In: Finance