Questions

ABC is looking at purchasing a new machine. The new machine installed cost is $60,000 and...

ABC is looking at purchasing a new machine. The new machine installed cost is $60,000 and requires minimal increase in NWC (net working capital). It will be sold at the end of year 3 for an anticipated $5,000. Use MACRS 3 yr. (Remember to add the terminal cash flow in when calculating year 3 OCF) Anticipated cash savings prior to depreciation: Year 1$20,000, Year 2 $30,000, Year 3 $20,000 Calculate the operating cash flows for each year. Tax Rate is 40%

In: Finance

An investment in the Bosworth Closed-end Fund produced the following results: Date Value per share Dividend...

An investment in the Bosworth Closed-end Fund produced the following results:

| Date | Value per share | Dividend paid to investors | ||

| End of Year 0 | $20 | |||

| End of Year 1 | $23 | $1.5 | ||

| End of Year 2 | $23 | $1 | ||

| End of Year 3 | $23 | $1.9 |

What is the time-weighted rate of return on an investment in this fund if you bought the investment at the end of Year 0 and held it until the end of Year 3? Report your answer to four decimal places (e.g., 1.234% report as 0.0123)

In: Finance

An investment project will cost the firm $200,000 now. The additional cash flows earned as a...

An investment project will cost the firm $200,000 now. The additional cash flows earned as a result of the investment are $30,000 in the first year; $50,000 in the second year; $75,000 in the third year; $90,000 in the fourth year; and $120,000 in the fifth year. After that, the investment results in no further increases in cash flows. Assuming cash flows are evenly distributed throughout the year, the payback period for this investment is ______.

A. five years

B. four years

C. three and a half years

D. We cannot answer this question without knowing the cost of capital.

In: Finance

You started your investment with an opening deposit of $1,000. Your portfolio grew as follows: Beg Year...

- You started your investment with an opening deposit of

$1,000. Your portfolio grew as follows:

|

Beg Year 1 |

Beg Year 2 |

Beg Year 3 |

Beg Year 4 |

Beg Year 5 |

EndYear 5 |

|

$1,000 |

$1,074 |

$1,201 |

$1,109 |

$1,175 |

$1,214 |

- What was your average return? (Arithmetic average)

- What was your actual return? (Geometric average)

- Use the TVOM to calculate the Rate (R) using the End year 5 as your Future Value.

PLEASE SHOW HOW THIS IS DONE IN EXCEL

In: Finance

Columbia Sportswear is an outdoor and active lifestyle apparel and footwear company. Assume that last year...

Columbia Sportswear is an outdoor and active lifestyle apparel and footwear company. Assume that last year Columbia reported cost of goods sold of $941 million. This year, cost of goods sold was $1,146 million. Accounts payable was $174 million at the end of last year and $214 million at the end of this year.

Required:

1. For this year, compute the average number of days that Columbia's accounts payable are outstanding. (Assume 365 days in a year. Do not round intermediate calculations. Round your final answer to nearest whole number.)

Number of days______

In: Finance

The price of a home is $200,000. The bank requires a 15% down payment. The buyer...

The price of a home is $200,000. The bank requires a 15% down payment. The buyer is offered two mortgage options: 15-year fixed at 8% or 30-year fixed at 8%. Calculate the amount of interest paid for each option. How much does the buyer save in interest with the 15-year option?

find the monthly payment for the 15-year option

find the monthly payment for the 30-year

Calculate the total cost of interest for both mortgage options. How much does the buyer save in interest with the 15-year option?

In: Finance

A drill press is purchased for $12,000. It is anticipated that its market value at the...

A drill press is purchased for $12,000. It is anticipated that its market value at the end of any year will be 18% less than its market value at the end of that year. In other words, its market value is reduced by 18% each year. The repair costs are covered by the warranty in Year 1. However, the repair cost in Year 2 is $500 and increases by $500 each year. This machining company has an MARR of 15%. State here on Blackboard the minimum EUAC (to the closest penny) of this drill press and its economic life (in years).

In: Finance

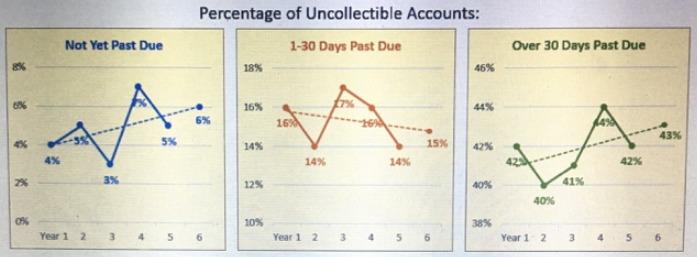

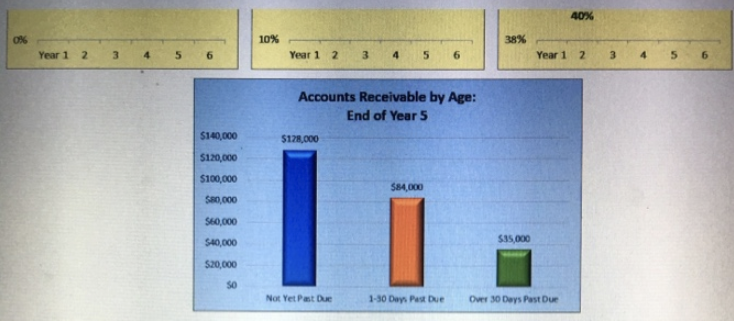

At the end of Year 5, your consulting firm has been hired by a local service firm to help forecast future uncollectible accounts.

At the end of Year 5, your consulting firm has been hired by a local service firm to help forecast future uncollectible accounts. For each of the prior five years, you ask the service firm to provide data on the age categories of year-end accounts receivable and the percentage of those accounts that eventually proved uncollectible. With these historical percentages, you estimate a trend line (dashed line) to predict the percentage of uncollectible accounts for Year 6, the upcoming year. Graphs were provided to management from your analysis of each of the three age categories, as well as balances of accounts receivable by age category at the end of Year 5 as follows:

Required:

1. Which age categories predicts the lowest percentage of uncollectible accounts for Year 6?

2. Which age categories predicts the highest percentage of uncollectible accounts for Year 6?

3. What is the dollar amount of accounts receivable that are 1-30 days past due at the end of year 5 (bottom graph)?

4. Calculate the total amount of estimated uncollectible accounts for Year 6 (Hint: Use all three age categories)?

5. Assume the balance of Allowance for Uncollectible Accounts is $4,850 (credit) at the end of Year 5 (before any adjustment). Prepare the adjusting entry at the end of Year 5.

6. Determine the amount of net accounts receivable the company would report at the end of Year 5.

In: Accounting

Large Ltd. purchased 80% of Small Company on January 1, Year 6, for $620,000, when the...

Large Ltd. purchased 80% of Small Company on January 1, Year 6, for $620,000, when the statement of financial position for Small showed common shares of $430,000 and retained earnings of $130,000. On that date, the inventory of Small was undervalued by $43,000, and a patent with an estimated remaining life of five years was overvalued by $64,000.

Small reported the following subsequent to January 1, Year 6:

| Profit (Loss) | Dividends | |

| Year 6 | 92,000 | 28,000 |

| Year 7 | (38,000) | 13,000 |

| Year 8 | 93,000 | 43,000 |

A test for goodwill impairment on December 31, Year 8, indicated a loss of $19,600 should be reported for Year 8 on the consolidated income statement. Large uses the cost method to account for its investment in Small and reported the following for Year 8 for its separate-entity statement of changes in equity:

| Retained earnings, beginning | 530,000 |

| Profit | 230,000 |

| Dividends | (67,000) |

| Retained earnings, end | 693,000 |

Required:

(a) Prepare the cost method journal entries of Large for each year (Years 6, 7, and 8).

(b) Compute the following on the consolidated financial statements for the year ended December 31, Year 8:

- (i) Goodwill

- (ii) Non-controlling interest on the statement of financial position

- (iii) Retained earnings, beginning of year

- (iv) Profit attributable to Large’s shareholders

- (v) Profit attributable to non-controlling interest

In: Accounting

Exercise 6-9 Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2, LO6-3] Walsh...

Exercise 6-9 Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2, LO6-3]

Walsh Company manufactures and sells one product. The following information pertains to each of the company’s first two years of operations:

| Variable costs per unit: | ||

| Manufacturing: | ||

| Direct materials | $ | 28 |

| Direct labor | $ | 16 |

| Variable manufacturing overhead | $ | 4 |

| Variable selling and administrative | $ | 3 |

| Fixed costs per year: | ||

| Fixed manufacturing overhead | $ | 320,000 |

| Fixed selling and administrative expenses | $ | 100,000 |

During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 40,000 units and sold 50,000 units. The selling price of the company’s product is $59 per unit.

Required:

1. Assume the company uses variable costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

2. Assume the company uses absorption costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

3. Reconcile the difference between variable costing and absorption costing net operating income in Year 1.

In: Accounting