Questions

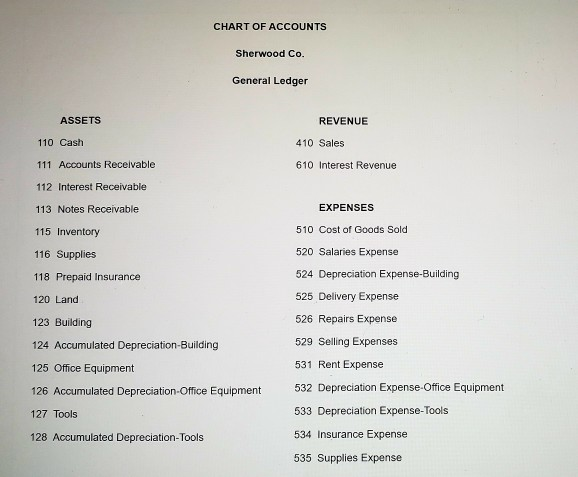

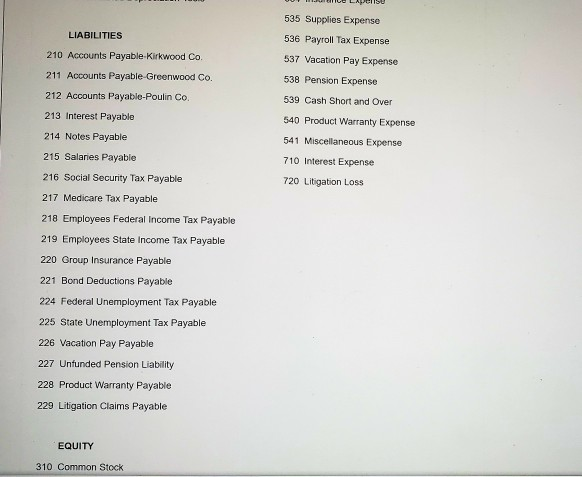

The following items were selected from among the transactions completed by Sherwood Co during the current...

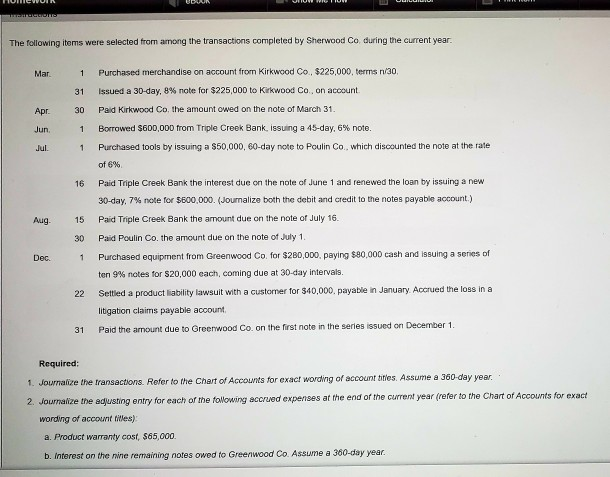

The following items were selected from among the transactions completed by Sherwood Co. during the current year:

| Mar. | 1 | Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. |

| 31 | Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. | |

| Apr. | 30 | Paid Kirkwood Co. the amount owed on the note of March 31. |

| Jun. | 1 | Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. |

| Jul. | 1 | Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. |

| 16 | Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) | |

| Aug. | 15 | Paid Triple Creek Bank the amount due on the note of July 16. |

| 30 | Paid Poulin Co. the amount due on the note of July 1. | |

| Dec. | 1 | Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for $20,000 each, coming due at 30-day intervals. |

| 22 | Settled a product liability lawsuit with a customer for $40,000, payable in January. Accrued the loss in a litigation claims payable account. | |

| 31 | Paid the amount due to Greenwood Co. on the first note in the series issued on December 1. |

| Required: | |

| 1. | Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. |

| 2. | Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):a. Product warranty cost, $65,000.b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year. |

In: Accounting

The following items were selected from among the transactions completed by Sherwood Co. during the current...

The following items were selected from among the transactions completed by Sherwood Co. during the current year:

| Mar. | 1 | Purchased merchandise on account from Kirkwood Co., $175,000, terms n/30. |

| 31 | Issued a 30-day, 6% note for $175,000 to Kirkwood Co., on account. | |

| Apr. | 30 | Paid Kirkwood Co. the amount owed on the note of March 31. |

| Jun. | 1 | Borrowed $400,000 from Triple Creek Bank, issuing a 45-day, 5% note. |

| Jul. | 1 | Purchased tools by issuing a $45,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. |

| 16 | Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6% note for $400,000. (Journalize both the debit and credit to the notes payable account.) | |

| Aug. | 15 | Paid Triple Creek Bank the amount due on the note of July 16. |

| 30 | Paid Poulin Co. the amount due on the note of July 1. | |

| Dec. | 1 | Purchased equipment from Greenwood Co. for $260,000, paying $40,000 cash and issuing a series of ten 9% notes for $22,000 each, coming due at 30-day intervals. |

| 22 | Settled a product liability lawsuit with a customer for $50,000, payable in January. Accrued the loss in a litigation claims payable account. | |

| 31 | Paid the amount due to Greenwood Co. on the first note in the series issued on December 1. |

| Required: | |||||

| 1. | Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. | ||||

| 2. | Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):

|

In: Accounting

Prepare journal entries to record the following merchandising transactions of Cabela’s, which uses the perpetual inventory...

Prepare journal entries to record the following merchandising

transactions of Cabela’s, which uses the perpetual inventory system

and the gross method. (Hint: It will help to identify each

receivable and payable; for example, record the purchase on July 1

in Accounts Payable—Boden.)

| July | 1 | Purchased merchandise from Boden Company for $6,100 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. | ||

| 2 | Sold merchandise to Creek Co. for $950 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $508. | |||

| 3 | Paid $120 cash for freight charges on the purchase of July 1. | |||

| 8 | Sold merchandise that had cost $1,400 for $1,800 cash. | |||

| 9 | Purchased merchandise from Leight Co. for $3,000 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. | |||

| 11 | Received a $1,000 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9. | |||

| 12 | Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. | |||

| 16 | Paid the balance due to Boden Company within the discount period. | |||

| 19 | Sold merchandise that cost $1,000 to Art Co. for $1,500 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. | |||

| 21 | Issued a $250 credit memorandum to Art Co. for an allowance on goods sold on July 19. | |||

| 24 | Paid Leight Co. the balance due, net of discount. | |||

| 30 | Received the balance due from Art Co. for the invoice dated July 19, net of discount. | |||

| 31 | Sold merchandise that cost $4,900 to Creek Co. for $7,400 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. |

In: Accounting

The following items were selected from among the transactions completed by Pioneer Co. during the current...

The following items were selected from among the transactions completed by Pioneer Co. during the current year:

| Mar. | 1 | Purchased merchandise on account from Galston Co., $414,000, terms n/30. | ||||

| 31 | Issued a 30-day, 4% note for $414,000 to Galston Co., on account. | |||||

| Apr. | 30 | Paid Galston Co. the amount owed on the note of March 31. | ||||

| Jun. | 1 | Borrowed $180,000 from Pilati Bank, issuing a 45-day, 4% note. | ||||

| Jul. | 1 | Purchased tools by issuing a $228,000, 60-day note to Zegna Co., which discounted the note at the rate of 6%. | ||||

| 16 | Paid Pilati Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $180,000. (Journalize both the debit and credit to the notes payable account.) | |||||

| Aug. | 15 | Paid Pilati Bank the amount due on the note of July 16. | ||||

| 30 | Paid Zegna Co. the amount due on the note of July 1. | |||||

| Dec. | 1 | Purchased office equipment from Taylor Co. for $520,000, paying $90,000 and issuing a series of ten 4% notes for $43,000 each, coming due at 30-day intervals. | ||||

| 22 | Settled a product liability lawsuit with a customer for $315,000, payable in January. Pioneer accrued the loss in a litigation claims payable account. | |||||

| 31 |

Paid the amount due Taylor Co. on the first note in the series issued on December 1 Required:1.Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. Round your answers to the nearest dollar.2.Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):

|

In: Accounting

The following items were selected from among the transactions completed by Sherwood Co. during the current...

The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $396,000, terms n/30. 31 Issued a 30-day, 4% note for $396,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $174,000 from Triple Creek Bank, issuing a 45-day, 4% note. Jul. 1 Purchased tools by issuing a $258,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $174,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $400,000, paying $114,000 cash and issuing a series of ten 4% notes for $28,600 each, coming due at 30-day intervals. 22 Settled a product liability lawsuit with a customer for $311,500, payable in January. Accrued the loss in a litigation claims payable account. 31 Paid the amount due to Greenwood Co. on the first note in the series issued on December 1. Required: 1. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. Round your answers to the nearest dollar. 2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles): a. Product warranty cost, $28,000. b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year.

In: Accounting

The following items were selected from among the transactions completed by Sherwood Co. during the current...

The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $396,000, terms n/30. 31 Issued a 30-day, 4% note for $396,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $174,000 from Triple Creek Bank, issuing a 45-day, 4% note. Jul. 1 Purchased tools by issuing a $258,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $174,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $400,000, paying $114,000 cash and issuing a series of ten 4% notes for $28,600 each, coming due at 30-day intervals. 22 Settled a product liability lawsuit with a customer for $311,500, payable in January. Accrued the loss in a litigation claims payable account. 31 Paid the amount due to Greenwood Co. on the first note in the series issued on December 1. Required: 1. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. Round your answers to the nearest dollar. 2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles): a. Product warranty cost, $28,000. b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year.

In: Accounting

The following items were selected from among the transactions completed by Sherwood Co. during the current...

The following items were selected from among the transactions completed by Sherwood Co. during the current year:

| Mar. | 1 | Purchased merchandise on account from Kirkwood Co., $396,000, terms n/30. |

| 31 | Issued a 30-day, 4% note for $396,000 to Kirkwood Co., on account. | |

| Apr. | 30 | Paid Kirkwood Co. the amount owed on the note of March 31. |

| Jun. | 1 | Borrowed $174,000 from Triple Creek Bank, issuing a 45-day, 4% note. |

| Jul. | 1 | Purchased tools by issuing a $258,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. |

| 16 | Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $174,000. (Journalize both the debit and credit to the notes payable account.) | |

| Aug. | 15 | Paid Triple Creek Bank the amount due on the note of July 16. |

| 30 | Paid Poulin Co. the amount due on the note of July 1. | |

| Dec. | 1 | Purchased equipment from Greenwood Co. for $400,000, paying $114,000 cash and issuing a series of ten 4% notes for $28,600 each, coming due at 30-day intervals. |

| 22 | Settled a product liability lawsuit with a customer for $311,500, payable in January. Accrued the loss in a litigation claims payable account. | |

| 31 | Paid the amount due to Greenwood Co. on the first note in the series issued on December 1. |

| Required: | |||||

| 1. | Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. Round your answers to the nearest dollar. | ||||

| 2. | Journalize the adjusting entry

for each of the following accrued expenses at the end of the

current year (refer to the Chart of Accounts for exact wording of

account titles):

|

In: Accounting

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System The following were selected from among the transactions...

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System

The following were selected from among the transactions completed by Babcock Company during November of the current year:

| Nov. 3. | Purchased merchandise on account from Moonlight Co., list price $82,000, trade discount 25%, terms FOB destination, 2/10, n/30. |

| 4. | Sold merchandise for cash, $40,180. The cost of the goods sold was $22,910. |

| 5. | Purchased merchandise on account from Papoose Creek Co., $50,750, terms FOB shipping point, 2/10, n/30, with prepaid freight of $800 added to the invoice. |

| 6. | Returned $15,000 ($20,000 list price less trade discount of 25%) of merchandise purchased on November 3 from Moonlight Co. |

| 8. | Sold merchandise on account to Quinn Co., $16,430 with terms n/15. The cost of the merchandise sold was $9,180. |

| 13. | Paid Moonlight Co. on account for purchase of November 3, less return of November 6. |

| 14. | Sold merchandise on VISA, $248,350. The cost of the goods sold was $143,390. |

| 15. | Paid Papoose Creek Co. on account for purchase of November 5. |

| 23. | Received cash on account from sale of November 8 to Quinn Co. |

| 24. | Sold merchandise on account to Rabel Co., $55,300, terms 1/10, n/30. The cost of the goods sold was $30,870. |

| 28. | Paid VISA service fee of $3,260. |

| 30. | Paid Quinn Co. a cash refund of $5,750 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,000. |

Required:

Journalize the transactions.

| Nov. 3 | |||

| Nov. 4-sale | |||

| Nov. 4-cost | |||

| Nov. 5 | |||

| Nov. 6 | |||

| Nov. 8 | |||

| Nov. 8 | |||

| Nov. 13 | |||

| Nov. 14-sale | |||

| Nov. 14-cost | |||

| Nov. 15 | |||

| Nov. 23 | |||

| Nov. 24-sale | |||

| Nov. 24-cost | |||

| Nov. 28 | |||

| Nov. 30-refund | |||

| Nov. 30-cost | |||

In: Accounting

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System The following were selected from among the transactions...

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System

The following were selected from among the transactions completed by Babcock Company during November of the current year:

| Nov. 3. | Purchased merchandise on account from Moonlight Co., list price $91,000, trade discount 20%, terms FOB destination, 2/10, n/30. |

| 4. | Sold merchandise for cash, $36,270. The cost of the goods sold was $23,850. |

| 5. | Purchased merchandise on account from Papoose Creek Co., $50,600, terms FOB shipping point, 2/10, n/30, with prepaid freight of $780 added to the invoice. |

| 6. | Returned $12,800 ($16,000 list price less trade discount of 20%) of merchandise purchased on November 3 from Moonlight Co. |

| 8. | Sold merchandise on account to Quinn Co., $15,950 with terms n/15. The cost of the merchandise sold was $10,050. |

| 13. | Paid Moonlight Co. on account for purchase of November 3, less return of November 6. |

| 14. | Sold merchandise on VISA, $215,830. The cost of the goods sold was $141,070. |

| 15. | Paid Papoose Creek Co. on account for purchase of November 5. |

| 23. | Received cash on account from sale of November 8 to Quinn Co. |

| 24. | Sold merchandise on account to Rabel Co., $55,100, terms 1/10, n/30. The cost of the goods sold was $33,880. |

| 28. | Paid VISA service fee of $3,690. |

| 30. | Paid Quinn Co. a cash refund of $6,130 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,570. |

Required:

Journalize the transactions.

| Nov. 3 | |||

| Nov. 4-sale | |||

| Nov. 4-cost | |||

| Nov. 5 | |||

| Nov. 6 | |||

| Nov. 8 | |||

| Nov. 8 | |||

| Nov. 13 | |||

| Nov. 14-sale | |||

| Nov. 14-cost | |||

| Nov. 15 | |||

| Nov. 23 | |||

| Nov. 24-sale | |||

| Nov. 24-cost | |||

| Nov. 28 | |||

| Nov. 30-refund | |||

| Nov. 30-cost | |||

In: Accounting

Prepare journal entries to record the following merchandising transactions of Cabela’s, which uses the perpetual inventory...

Prepare journal

entries to record the following merchandising transactions of

Cabela’s, which uses the perpetual inventory system and the gross

method. Hint: It will help to identify each receivable and

payable; for example, record the purchase on July 1 in Accounts

Payable—Boden.

| July | 1 | Purchased merchandise from Boden Company for $6,800 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. | ||

| 2 | Sold merchandise to Creek Co. for $950 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $567. | |||

| 3 | Paid $140 cash for freight charges on the purchase of July 1. | |||

| 8 | Sold merchandise that had cost $2,100 for $2,500 cash. | |||

| 9 | Purchased merchandise from Leight Co. for $2,300 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. | |||

| 11 | Returned $300 of merchandise purchased on July 9 from Leight Co. and debited its account payable for that amount. | |||

| 12 | Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. | |||

| 16 | Paid the balance due to Boden Company within the discount period. | |||

| 19 | Sold merchandise that cost $1,000 to Art Co. for $1,500 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. | |||

| 21 | Gave a price reduction (allowance) of $250 to Art Co. for merchandise sold on July 19 and credited Art's accounts receivable for that amount. | |||

| 24 | Paid Leight Co. the balance due, net of discount. | |||

| 30 | Received the balance due from Art Co. for the invoice dated July 19, net of discount. | |||

| 31 | Sold merchandise that cost $5,600 to Creek Co. for $7,100 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. |

In: Accounting