Questions

Sales Tax Far and Wide Broadband provides Internet connection services to customers living in remote areas....

Sales Tax

Far and Wide Broadband provides Internet connection services to customers living in remote areas. During February 2020, it billed a customer a total of $295,000 before taxes. Weston also must pay the following taxes on these charges:

- State of Kansas sales tax of 6%

- Federal excise tax of 0.2%

- State of Kansas excise tax of 0.4%

Required:

Assuming Far and Wide collects these taxes from the customer, what journal entry would Far and Wide make when the customer pays their bill? If an amount box does not require an entry, leave it blank.

| Accounts Receivable | |||

| Sales Taxes Payable (State) | |||

| Excise Taxes Payable (Federal) | |||

| Excise Taxes Payable (State) | |||

| Sales Revenue | |||

| (Record sale) |

In: Accounting

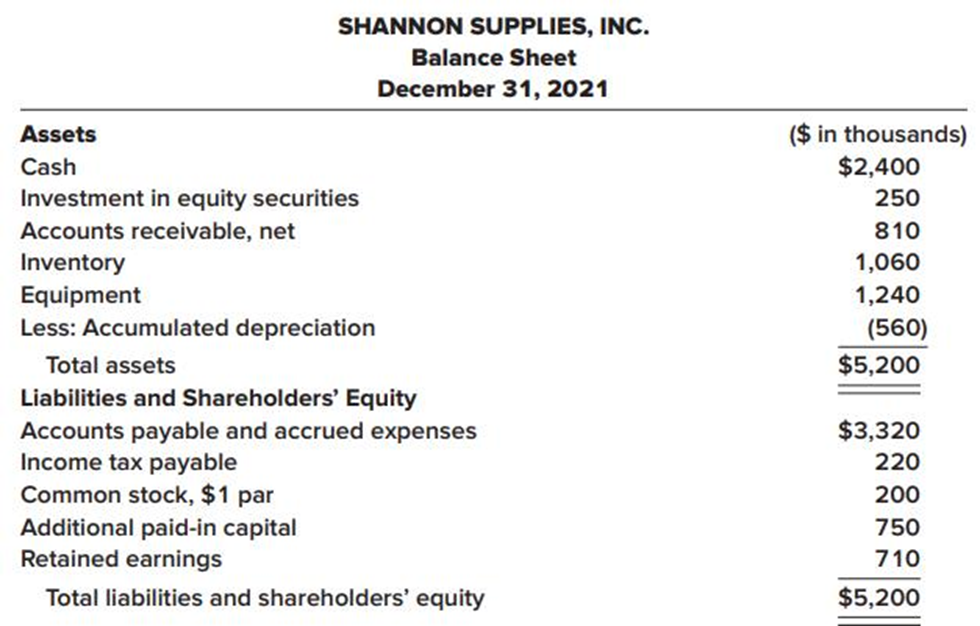

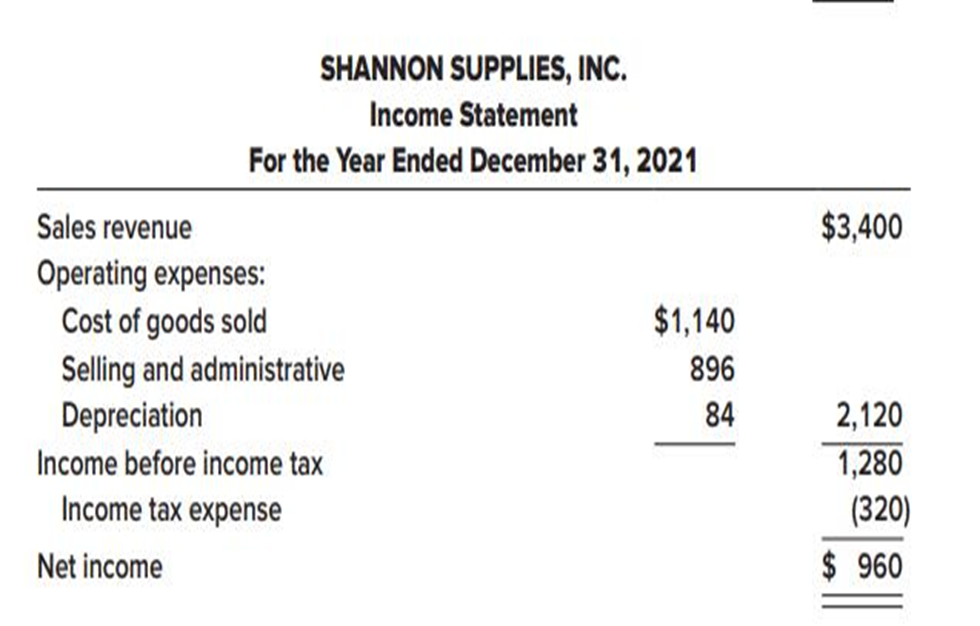

You are internal auditor for Shannon Supplies, Inc., and are reviewing the company’s

You are internal auditor for Shannon Supplies, Inc., and are reviewing the company’s preliminary financial statements. The statements, prepared after making the adjusting entries, but before closing entries for the year ended December 31, 2021, are as follows:

Shannon’s income tax rate was 25% in 2021 and previous years. During the course of the audit, the following additional information (not considered when the above statements were prepared) was obtained:

a. Shannon’s investment portfolio consists of blue chip stocks held for long-term appreciation. To raise working capital, some of the shares with an original cost of $180,000 were sold in May 2021. Shannon accountants debited cash and credited investment in equity securities for the $220,000 proceeds of the sale.

b. At December 31, 2021, the fair value of the remaining equity securities in the investment portfolio was $274,000.

c. The state of Alabama filed suit against Shannon in October 2019, seeking civil penalties and injunctive relief for violations of environmental regulations regulating emissions. Shannon’s legal counsel previously believed that an unfavorable outcome of this litigation was not probable, but based on negotiations with state attorneys in 2021, now believes eventual payment to the state of $130,000 is probable, most likely to be paid in 2024.

d. The $1,060,000 inventory total, which was based on a physical count at December 31, 2021, was priced at cost. Based on your conversations with company accountants, you determined that the inventory cost was overstated by $132,000.

e. Electronic counters costing $80,000 were added to the equipment on December 29, 2020. The cost was charged to repairs.

f. Shannon’s equipment, on which the counters were installed, had a remaining useful life of four years on December 29, 2020, and is being depreciated by the straight-line method for both financial and tax reporting.

g. A new tax law was enacted in 2021 which will cause Shannon’s income tax rate to change from 25% to 20% beginning in 2022.

Required:

Prepare journal entries to record the effects on Shannon’s accounting records at December 31, 2021, for each of the items described above.

In: Accounting

The following information is for all three questions. Suppose the country of Coventry is joining a...

The following information is for all three questions. Suppose the country of Coventry is joining a customs union (CU). It can buy Product S from the country of Plata or the country of Soyuz. Plata is not in the CU, while Soyuz is in the CU. Before joining the CU, Coventry has a tariff on all imports of Product S. After joining the CU, Coventry does not have a tariff on the Product S imported from other countries in the CU, but maintains its tariff on the Product S imported from countries outside the CU. The tariff, when applicable, is $7. (Use the Basic Tariff Model in this analysis and assume no foreign retaliation on this product.)

1. The price of Product S from Plata is $62 and the price of Product S from Soyuz is $73. Suppose Coventry changes from not being in the CU to being in the CU.

(a) Who is Coventry's supplier of Product S before joining the CU? After joining the CU?

(b) Is there a trade creation effect in this case?

(c) Is there a trade diversion effect in this case? Why?

(d) What happens to the Coventry Total Surplus for Product S because it joined the CU? Why?

2. The price of Product S from Plata is $62 and the price of Product S from Soyuz is $65. Suppose Coventry changes from not being in the CU to being in the CU.

(a) Who is Coventry's supplier of Product S before joining the CU? After joining the CU?

(b) Is there a trade creation effect in this case?

(c) Is there a trade diversion effect in this case? Why?

(d) What happens to the Coventry Total Surplus for Product S because it joined the CU? Why?

In: Economics

A manager wishes to see if the time (in minutes) it takes for their workers to...

A manager wishes to see if the time (in minutes) it takes for

their workers to complete a certain task will decrease when they

are allowed to wear ear buds at work. A random sample of 10

workers' times were collected before and after wearing ear buds.

Assume the data is normally distributed.

Perform a Matched-Pairs hypothesis test for the claim that the time

to complete the task has decreased at a significance level of

α=0.01α=0.01.

If you wish to copy this data to a spreadsheet or StatCrunch, you

may find it useful to first copy it to Notepad, in order to remove

any formatting.

Round answers to 4 decimal places.

For the context of this problem, μd=μAfterμd=μAfter -

μμ_Before,

where the first data set represents "after" and the second data set

represents "before".

Ho:μd=0Ho:μd=0

Ha:μd<0Ha:μd<0

This is the sample data:

| After | Before |

|---|---|

| 60.5 | 63.2 |

| 40.5 | 41.3 |

| 49.3 | 61.8 |

| 42.6 | 59 |

| 24.4 | 40.2 |

| 51.1 | 55.1 |

| 53.4 | 64.4 |

| 34.4 | 47.6 |

| 41.2 | 54.7 |

| 57.9 | 46.9 |

What is the mean difference for this sample?

Mean difference (¯dd¯) =

What is the standard deviation difference for this

sample?

standard deviation difference ( sdsd) =

What is the test statistic for this test?

test statistic =

This P-value leads to a decision to... Select an answer fail to

reject the null reject the claim reject the null accept the

null

As such, the final conclusion is that... Select an answer There is

not sufficient evidence to support the claim that the time to

complete the task has decreased There is sufficient evidence to

support the claim that the time to complete the task has

decreased.

In: Statistics and Probability

A manager wishes to see if the time (in minutes) it takes for their workers to...

A manager wishes to see if the time (in minutes) it takes for

their workers to complete a certain task will change when they are

allowed to wear ear buds to listen to music at work.

A random sample of 9 workers' times were collected before and after

wearing ear buds. Assume the data is normally distributed.

Perform a Matched-Pairs hypotheis T-test for the claim that the

time to complete the task has changed at a significance level of

α=0.01α=0.01.

(If you wish to copy this data to a spreadsheet or StatCrunch, you

may find it useful to first copy it to Notepad, in order to remove

any formatting.)

Round answers to 3 decimal places.

For this problem, μd=μAfterμd=μAfter - μμ_Before,

where the first data set represents "after" and the second data set

represents "before".

Ho:μd=0Ho:μd=0

Ha:μd≠0Ha:μd≠0

This is the sample data:

| Before | After |

|---|---|

| 57.7 | 53.8 |

| 74.7 | 69.5 |

| 59.8 | 56.1 |

| 61.8 | 61.5 |

| 52.9 | 56.7 |

| 54 | 51.1 |

| 34.7 | 24.3 |

| 39.9 | 37.6 |

| 54.3 | 54.7 |

What is the mean difference for this sample?

Mean difference (¯dd¯) =

What is the standard deviation difference for this

sample?

standard deviation difference ( sdsd) =

What is the test statistic for this test?

test statistic =

This P-value leads to a decision to... Select an answer reject the

null reject the claim fail to reject the null accept the

null

As such, the final conclusion is that... Select an answer There is

sufficient evidence to support the claim that the time to complete

the task has changed. There is not sufficient evidence to support

the claim that the time to complete the task has changed

In: Statistics and Probability

The Anxiety Correlation Coefficient is a number that determines the level of anxiety that a person...

The Anxiety Correlation Coefficient is a number that determines the level of anxiety that a person has toward stressful situations. Scores in the range: (5,7.5) are considered normal and do not impede performance on the job among Federation members. Scores below this range indicate possible pathological tendencies, and scores above this range indicate excessive anxiety which may impede job performance and over-all mental health.

The random sample of 10 crew members were given the Anxiety Correlation Coefficient test before their journey to the nebulae and again 2 weeks after they returned from their journey. The following are the results of the two tests:

before:

| 5.2 | 5.6 | 6.6 | 7.0 | 6.7 | 6.1 | 7.0 | 6.5 | 7.1 | 6.9 |

after

| 6.7 | 8.3 | 7.2 | 7.6 | 6.6 | 5.9 | 8.0 | 7.9 | 7.1 | 7.4 |

Use the Classical Method, with α= .002, to determine if there is a difference between the pre-and-post test scores.

- List all computer/calculator steps used in calculations

- State the conclusion of the experiment. Is there sufficient statistical evidence to support the claim that the difference between pre and post-tests were different?

iii. Find the correlation coefficient, the Least Squares Regression Line, and sketch a scatterplot for the pre and post test scores for the sample of 10 crew members. Describe whether the correlation is weak, moderate, strong, or zero, and if it is negative or positive. Interpret what this correlation tells us about differences in individual reactions to stressful situations before and after the trip to the nebulae?

In: Statistics and Probability

A 155 lb., 60-year-old man had a chronic productive cough, exertional dyspnea, mild cyanosis, and marked...

A 155 lb., 60-year-old man had a chronic productive cough, exertional dyspnea, mild cyanosis, and marked slowing of forced expiration. His pulmonary function and laboratory tests follow: Frequency 15 breaths/min Alveolar ventilation 4.1 L/min Vital capacity (VC) 2.2 L Functional residual capacity (FRC) 4.0 L Total lung capacity (TLC) 5.2 L Maximum inspiratory flow rate 252 L/min Maximum expiratory flow rate 21 L/min PaO2 63 mm Hg PaCO2 38 mm Hg Pulmonary function tests after bronchodilator therapy: Frequency 15 breaths/min Alveolar ventilation 4.25 L/min VC 2.4 L FRC 4.0 L TLC 5.2 L Maximum inspiratory flow rate 252 L/min Maximum expiratory flow rate 24 L/min PaO2 63 mm Hg PaCO2 37 mm Hg

6. What is the cause of this altered RV?

7. Calculate the tidal volume (TV) for this person before and after the bronchodilator therapy. TV = AV/f + patient body weight. Hint: TV is calculated in mL, so you will need to convert L to mL before completing the equation.

8. Is each TV normal or altered?

9. Calculate the minute ventilation (MV) for this person before and after the bronchodilator therapy. MV = TV × f

10. Is each MV normal or altered?

In: Anatomy and Physiology

Your 21 year old client just graduated from college and started a job with monthly salary...

Your 21 year old client just graduated from college and started a job with monthly salary of $5,000 per month. He wants to retire when he is 60 years old and wants to start saving for retirement right away. We cannot be sure of how long we live after retirement, but the client wants to be extra careful and save for 30 years of after retirement life. Market expectation for average annual inflation for the future is 1.7% (Let’s assume inflation to be 0 after retirement period). Because of inflation, he will need substantially higher retirement monthly income to maintain the same purchasing power. He plans to purchase a lifetime annuity from an insurance company one month before he retires, where the retirement annuity will begin in exactly 39 years (468 months). The insurance company will add a 2.00 percent premium to the pure premium cost of the purchase price of the annuity. The pure premium is an actuarial cost of his anticipated lifetime annuity. He has just learned the concept of time value of money and never saved anything earlier. He will make the first payment in a month from now and the last payment one month before he retires (a total of 467 monthly payments).

1) Given a rate of return of 4% for the foreseeable future, how much does he need to save each month until the month before he retires?

In: Finance

Andy and Currie met in Tax class and were married. They have five children: Miranda age...

Andy and Currie met in Tax class and were married. They have five children: Miranda age 6, Savannah age 10, Wenbo age 12, Rachel age 15, and Luke age 20. Luke has his own apartment but he works in the family business, he earned $25,000 last year. Andy works for a CPA firm. In 2020 he earned $77,000, $12,000 of federal income tax was withheld, and $3,000 of state income tax was withheld. In addition, they earned $300 of interest on their joint savings account, they received dividends of $1,200 on stock that they own (all the dividends are qualified), and they sold 100 shares of stock for $20 a share (they paid $10 a share three years ago).

Currie operates a welding shop in a facility that she rents. The business motto is “Still not as fun as Tax Class”. She operates as a sole proprietor, she has one part-time employee, plus Luke who does most of the welding (the rest of the children have to clean up the shop each evening before they get their supper).

Income and expenses of the welding business in 2020 were:

Gross revenues $248,000

Employee salaries 54,000

Employee payroll taxes 5,400

Building Insurance 16,000

Welding supplies 55,000

Rent 18,900

Currie paid estimated State income tax of $4,300 during the year, and estimated federal income tax of $15,000.

In addition the family also had the following expenses:

Family medical and dental expenses $19,000

Real estate taxes 3,400

Home mortgage interest 9,000 (their mortgage is $300,000)

Credit card finance charges 2,600

Sales tax 4,200

Cash donations to their church 4,000

Assume that there is no Alternative Minimum Tax (AMT) for them.

What is their taxable income? taxes before tax credits? total tax liability? refund?

In: Accounting

Spike purchased on 6/15/2020 and placed in service on 9/1/2020 a new warehouse for $5,000,000. (a)...

Spike purchased on 6/15/2020 and placed in service on 9/1/2020 a new warehouse for $5,000,000.

(a) Determine the cost recovery deduction for 2020.

(b) Spike sold the warehouse on March 22, 2028. Determine the cost recovery deduction for 2028.

In: Accounting