Questions

Pretend that you own a small business in a highly competitve. You're facing a significant amount...

In: Economics

Transaction takes place when one party exchanges or promise to exchange good or service with another...

Transaction takes place when one party exchanges or promise to exchange good or service with another party for money. Identify the difference between revenue expenditure and capital expenditure and provide the examples

In: Accounting

Revenue Cost Profit Budget 168,000 120,000 40% Actuals 157,000 125,500 25% Variance -11,000 5,500 -15% do...

|

Revenue |

Cost |

Profit |

|

|

Budget |

168,000 |

120,000 |

40% |

|

Actuals |

157,000 |

125,500 |

25% |

|

Variance |

-11,000 |

5,500 |

-15% |

do analysis with this table, and give an advice to make business better

In: Finance

In the cap and trade component of the Waxman-Markey bill, what was the objective behind many...

- In the cap and trade component of the Waxman-Markey bill, what was the objective behind many of the details about how permits (or allowances) and the revenue from auctioning some of the permits would be allocated? Explain.

In: Economics

Analyzing, Forecasting, and Interpreting Both Income Statement and Balance Sheet Following are the income statements and...

Analyzing, Forecasting, and Interpreting Both Income Statement

and Balance Sheet

Following are the income statements and balance sheets of Best Buy

Co., Inc.

| Income Statement, Fiscal Years Ended ($ millions) |

Feb. 26, 2011 | Feb. 27, 2010 |

|---|---|---|

| Revenue | $ 50,272 | $ 49,694 |

| Cost of goods sold | 37,611 | 37,534 |

| Restructuring charges - cost of goods sold | 24 | -- |

| Gross profit | 12,637 | 12,160 |

| Selling, general and administrative expenses | 10,325 | 9,873 |

| Restructuring charges | 198 | 52 |

| Goodwill and tradename impairment | -- | -- |

| Operating income | 2,114 | 2,235 |

| Other income (expenses) | ||

| Investment income and other | 51 | 54 |

| Interest expense | (87) | (94) |

| Earnings before income tax expense and equity in income of affiliates | 2,078 | 2,195 |

| Income tax expense | 714 | 802 |

| Equity in income of affiliates | 2 | 1 |

| Net earnings including noncontrolling interests | 1,366 | 1,394 |

| Net earnings attributable to noncontrolling interests | (89) | (77) |

| Net earnings attributable to Best Buy Co., Inc. | $ 1,277 | $ 1,317 |

| Balance Sheet ($ millions) |

Feb. 26, 2011 | Feb. 27, 2010 |

|---|---|---|

| Assets | ||

| Cash and cash equivalents | $ 1,103 | $ 1,826 |

| Short-term investments | 22 | 90 |

| Receivables | 2,348 | 2,020 |

| Merchandise inventories | 5,897 | 5,486 |

| Other current assets | 1,103 | 1,144 |

| Total current assets | 10,473 | 10,566 |

| Property and equipment | ||

| Land and buildings | 766 | 757 |

| Leasehold improvements | 2,318 | 2,154 |

| Fixtures and equipment | 4,701 | 4,447 |

| Property under capital lease | 120 | 95 |

| Gross property and equipment | 7,905 | 7,453 |

| Less accumulated depreciation | 4,082 | 3,383 |

| Net property and equipment | 3,823 | 4,070 |

| Goodwill | 2,454 | 2,452 |

| Tradenames, Net | 133 | 159 |

| Customer Relationships, Net | 203 | 279 |

| Equity and Other Investments | 328 | 324 |

| Other assets | 435 | 452 |

| Total assets | $ 17,849 | $ 18,302 |

| Liabilities and Equity | ||

| Accounts payable | $ 4,894 | $ 5,276 |

| Unredeemed giftcard liabilities | 474 | 463 |

| Accrued compensation and related expenses | 570 | 544 |

| Accrued liabilities | 1,471 | 1,681 |

| Accrued income taxes | 256 | 316 |

| Short-term debt | 557 | 663 |

| Current portion of long-term debt | 441 | 35 |

| Total current liabilities | 8,663 | 8,978 |

| Long-term liabilities | 1,183 | 1,256 |

| Long-term debt | 711 | 1,104 |

| Contingencies and Commitments (Note 13) | ||

| Best Buy Co., Inc. Shareholders' Equity | ||

| Preferred stock, $ 1.00 par value: Authorized-400,000 shares; Issued and outstanding-none |

-- | -- |

| Common stock $0.10 par value: Authorized-1.0 billion shares; Issued and outstanding-392,590,000 and 418,815,000 shares, respectively |

39 | 42 |

| Additional paid-in capital | 18 | 441 |

| Retained earnings | 6,372 | 5,797 |

| Accumulated other comprehensive income | 173 | 40 |

| Total Best Buy Co., Inc. shareholders' equity | 6,602 | 6,320 |

| Noncontrolling interests | 690 | 644 |

| Total equity | 7,292 | 6,964 |

| Total liabilities and shareholders' equity | $ 17,849 | $ 18,302 |

Forecast Best Buy's fiscal 2012 income statement using the following relations (assume "no change" for accounts not listed).

| Revenue growth | 3.0% |

| Cost of good sold/Revenue | 74.8% |

| Restructuring charges - cost of good sold | $-- |

| Selling, general and administrative expenses/Revenue | 20.5% |

| Restructuring charges | $-- |

| Goodwill and trademark impairment | $-- |

| Investment income and other | $51 |

| Investment impairment | $-- |

| Interest expense | $(87) |

| Income tax expense/Pretax income | 34.4% |

| Equity in income of affiliates | $2 |

| Net earnings attributable to noncontrolling interests/Net earnings including noncontrolling interests | 7.5% |

Round all answers to the nearest whole number.

Do not use negative signs with your answers in the income statement.

| Income Statement, Fiscal Years Ended ($ millions) | 2012 Estimated |

|---|---|

| Revenue | $Answer |

| Cost of goods sold | Answer |

| Restructuring charges - cost of goods sold | Answer |

| Gross profit | Answer |

| Selling, general and administrative expenses | Answer |

| Restructuring charges | Answer |

| Goodwill and tradename impairment | Answer |

| Operating income | Answer |

| Other income/expenses | |

| Investment income and other | Answer |

| Interest expense | Answer |

| Earnings before income tax expense and equity in income of affiliates | Answer |

| Income tax expense | Answer |

| Equity in income of affiliates | Answer |

| Net earnings including noncontrolling interests | Answer |

| Net earnings attributable to noncontrolling interests | Answer |

| Net earnings attributable to Best Buy Co., Inc. | $Answer |

Forecast Best Buy's fiscal 2012 balance sheet using the following relations (assume "no change" for accounts not listed). Assume that all capital expenditures are purchases of property and equipment.

| Short-term investments | No change |

| Receivables/Revenue | 4.7% |

| Merchandise inventories/Revenue | 11.7% |

| Other current assets/Revenue | 2.2% |

| CAPEX (Increase in gross Property and equipment)/Revenue | 1.5% |

| Goodwill | No change |

| Amortization expense for Tradenames | $25 |

| Amortization expense for Customer relationships | $38 |

| Equity and Other Investments | No change |

| Other Assets/Revenue | 0.9% |

| Accounts payable/Revenue | 9.7% |

| Unredeemed gift card liabilities/Revenue | 0.9% |

| Accrued compensation and related expenses/Revenue | 1.1% |

| Accrued liabilities/Revenue | 2.9% |

| Accrued income taxes/Revenue | 0.5% |

| Long-term liabilities | No change |

| Noncontrolling interests | * |

| Depreciation/Prior year gross PPE | 12.0% |

| Amortization/Prior year intangible asset balance | 18.7% |

| Dividends/Net income | 18.6% |

| Long-term debt payments required in fiscal 2013 | $37 |

| *increase by net income attributable to noncontrolling interests and assume no dividends |

Round answers to the nearest whole number.

Do not use negative signs with your answers in the balance sheet.

| Balance Sheet ($ millions) |

2012 Estimated |

|---|---|

| Assets | |

| Cash and cash equivalents | $Answer |

| Short-term investments | Answer |

| Receivables | Answer |

| Merchandise inventories | Answer |

| Other current assets | Answer |

| Total current assets | Answer |

| Property and equipment | |

| Gross property and equipment | Answer |

| Less accumulated depreciation | Answer |

| Net property and equipment | Answer |

| Goodwill | Answer |

| Tradenames, Net | Answer |

| Customer Relationships, Net | Answer |

| Equity and Other Investments | Answer |

| Other assets | Answer |

| Total assets | $Answer |

| Liabilities and equity | |

| Accounts payable | $Answer |

| Unredeemed gift card liabilities | Answer |

| Accrued compensation and related expenses | Answer |

| Accrued liabilities | Answer |

| Accrued income taxes | Answer |

| Short-term debt | Answer |

| Current portion of long-term debt | Answer |

| Total current liabilities | Answer |

| Long-term liabilities | Answer |

| Long-term debt | Answer |

| Contingencies and Commitments (Note 13) | |

| Best Buy Co., Inc. Shareholders' Equity | |

| Preferred stock, $1.00 par value: Authorized - 400,000 shares; Issued and outstanding - none | Answer |

| Common stock, $0.10 par value: Authorized - 1.0 billion shares;

Issued and outstanding - 392,590,000 and 418,815,000 shares, respectively |

Answer |

| Additional paid-in capital | Answer |

| Retained earnings | Answer |

| Accumulated other comprehensive income | Answer |

| Total Best Buy Co., Inc. shareholders' equity | Answer |

| Noncontrolling interests | Answer |

| Total equity | Answer |

| Total liabilities and Equity | $ Answer |

In: Accounting

Woodland Hotels Inc. operates four resorts in the heavily wooded areas of northern California. The resorts...

Woodland Hotels Inc. operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows: Front office personnel (desk, clerks, etc.) $ 9,000 Administrative and executive salaries 4,500 Interest on resort purchase 3,500 Advertising 600 Housekeeping 2,500 Depreciation on reservations computer 80 Room maintenance 900 Carpet-cleaning contract 50 Contract to repaint rooms 450 $ 21,580 Pine Valley Oak Glen Mimosa Birch Glen Total Revenue (000s) $ 6,350 $ 9,490 $ 10,515 $ 7,775 $ 34,130 Square feet 58,065 80,190 43,720 87,560 269,535 Rooms 86 122 66 174 448 Assets (000s) $ 96,660 $ 143,160 $ 75,730 $ 60,175 $ 375,725

Required: 1. Based on annual revenue, what amount of the central office costs are allocated to each resort?

Woodland Hotels Inc. operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows:

| Front office personnel (desk, clerks, etc.) | $ | 9,000 | |

| Administrative and executive salaries | 4,500 | ||

| Interest on resort purchase | 3,500 | ||

| Advertising | 600 | ||

| Housekeeping | 2,500 | ||

| Depreciation on reservations computer | 80 | ||

| Room maintenance | 900 | ||

| Carpet-cleaning contract | 50 | ||

| Contract to repaint rooms | 450 | ||

| $ | 21,580 | ||

| Pine Valley | Oak Glen | Mimosa | Birch Glen | Total | |||||||||||

| Revenue (000s) | $ | 6,350 | $ | 9,490 | $ | 10,515 | $ | 7,775 | $ | 34,130 | |||||

| Square feet | 58,065 | 80,190 | 43,720 | 87,560 | 269,535 | ||||||||||

| Rooms | 86 | 122 | 66 | 174 | 448 | ||||||||||

| Assets (000s) | $ | 96,660 | $ | 143,160 | $ | 75,730 | $ | 60,175 | $ | 375,725 | |||||

Required:

1. Based on annual revenue, what amount of the central office costs are allocated to each resort?

solve for allocated cost for each: pine valley, oak glen, mimosa, birch glen, and total

2. Suppose that the current methods were replaced with a system of four separate cost pools with costs collected in the four pools allocated on the basis of revenues, assets invested in each resort, square footage, and number of rooms, respectively. Which costs should be collected in each of the four pools?

Suppose that the current methods were replaced with a system of four separate cost pools with costs collected in the four pools allocated on the basis of revenues, assets invested in each resort, square footage, and number of rooms, respectively. Which costs should be collected in each of the four pools? (Enter your answers in thousands of dollars.)

solve chart below

|

3. Using the cost pool system in requirement 2, how much of the

central office costs would be allocated to each resort?

Using the cost pool system in requirement 2, how much of the central office costs would be allocated to each resort? (Do not round intermediate calculations. Enter your answers in thousands rounded to the nearest dollar.)

solve chart below

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

The Covid-19 crisis led to a sharp drop in revenue and, as a result, the depletion of cash, debt servicing problems and, in some cases, bankruptcy.

The Covid-19 crisis led to a sharp drop in revenue and, as a result, the depletion of cash, debt servicing problems and, in some cases, bankruptcy. If you could invest $100,000 in one company, based only on the five ratios below, which stock would be the most suitable to buy?

| a. | Stock D: P/E = 25.0; cash ratio = 0.2x; EBIT/Interest = 2.1x; Debt/equity = 70%; ROIC = 8% | |

| b. | Stock B: P/E = 17.5; cash ratio = 0.4x; EBIT/Interest = 7x; Debt/equity = 45%; ROIC = 12% | |

| c. | Stock A: P/E = 15.0; cash ratio = 0.6x; EBIT/Interest = 10x; Debt/equity = 30%; ROIC = 14% | |

| d. | Stock C: P/E = 20.0; cash ratio = 0.9x; EBIT/Interest = 15x; Debt/equity = 25%; ROIC = 16% |

In: Finance

Initial Investment: $1,000,000 WACC: 10% Revenue: 850,000 COGS: $540,000 Operating Expenses: $50,000 Depreciation Expense: $125,000 Tax...

Initial Investment: $1,000,000

WACC: 10%

Revenue: 850,000

COGS: $540,000

Operating Expenses: $50,000

Depreciation Expense: $125,000

Tax Expense: $28,350

What is the cumulative Net Cash Flow for the first year?

In: Finance

Initial Investment: $1,000,000 WACC: 10% Revenue: 850,000 COGS: $540,000 Operating Expenses: $50,000 Depreciation Expense: $125,000 Tax...

Initial Investment: $1,000,000

WACC: 10%

Revenue: 850,000

COGS: $540,000

Operating Expenses: $50,000

Depreciation Expense: $125,000

Tax Expense: $28,350

Time: 1 year

What is the Net Present Value?

In: Finance

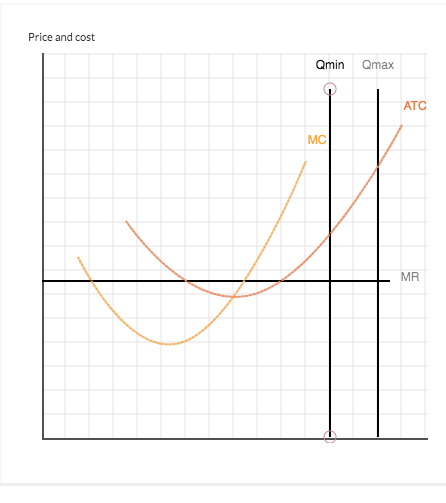

The graph below shows a particular firm's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves

The graph below shows a particular firm's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves, where the market is competitive. Suppose that a new management team is brought in and that this team is initially less concerned about maximizing profits than it is simply about making a profit. What range of production quantities will allow the firm to operate while earning a profit?

Give your answer by dragging the Qmin to Qmax lines into their correct positions. The output will need to lie somewhere betwen those limits.

To refer to the graphing tutorial for this question type, please click here.

In: Economics