Questions

Recognition of amortization of an intangible asset illustrates which principle of accounting?

Recognition of amortization of an intangible asset illustrates which principle of accounting?

Expense recognition

Full disclosure

Revenue recognition

Historical cost

In: Accounting

Given the results after running the simulations, describe how simulations can be used in estimating profits...

In: Statistics and Probability

What audit program-or audit steps can the auditor take to ensure that the proper amount of...

What audit program-or audit steps can the auditor take to ensure that the proper amount of revenue is recognized in the income statements? -Discuss

In: Accounting

What is unit elastic? When the price of a god goes up and demand is unit...

What is unit elastic? When the price of a god goes up and demand is unit elastic, what would happen to the total revenue?

In: Economics

List and explain the four common strategies which have been developed to improve the efficiency and...

List and explain the four common strategies which have been developed to improve the efficiency and effectiveness of cash collection in the revenue cycle

In: Accounting

For the following exercises, the revenue generated by selling x items is given by R(x) = 2x2 + 10x. Find R′(10) and interpret.

For the following exercises, the revenue generated by selling x items is given by R(x) = 2x2 + 10x.

Find R′(10) and interpret.

In: Advanced Math

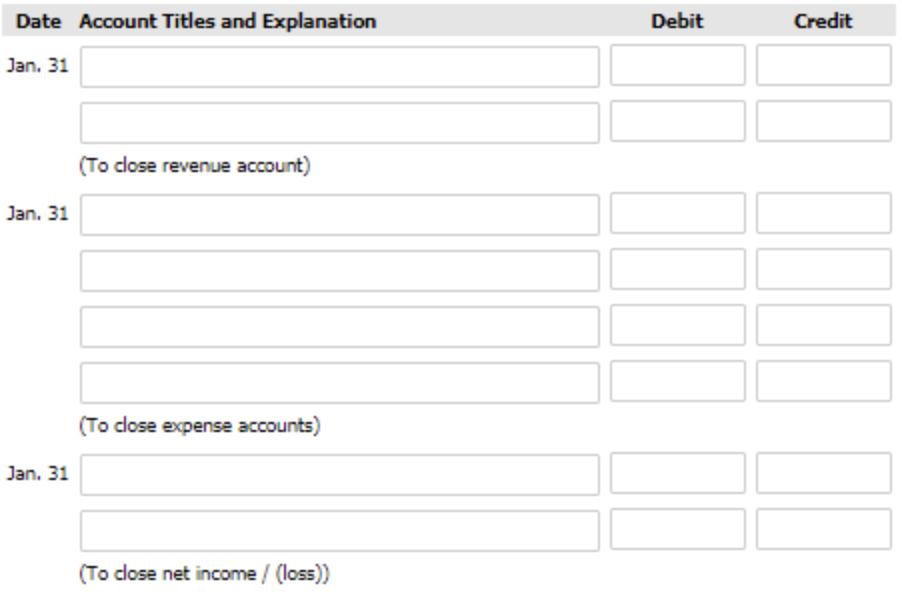

This is a partial adjusted trial balance of Sandhill Co..

This is a partial adjusted trial balance of Sandhill Co..

SANDHILL CO. Adjusted Trial Balance January 31, 2022

| Supplies | Debit Credit |

|---|---|

| Prepaid Insurance | $880 |

| Salaries and Wages Payable | 1,620 |

| Unearned Service Revenue | $1,010 |

| Supplies Expense | 860 |

| Insurance Expense | 540 |

| Salaries and Wages Expense | 1,800 |

| Service Revenue | 870 |

Prepare the closing entries at January 31, 2022. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

In: Accounting

The demand for a monopolist’s product is: P = 40 -2Q; the monopolist’s total cost function...

The demand for a monopolist’s product is: P = 40 -2Q; the monopolist’s total cost function is: TC = 8Q + 0.5Q^2.(a)Under free monopoly, what is the numerical value of the dead-weight loss (DWL)? (b) Compute the monopolist’s break-even points and graph in the same diagram, demand (D), marginal revenue (MR), marginal cost (MC) and average cost (AC); in diagrams directly below, graph total revenue (TR), total cost (TC) and profit (pi).(c) Under short-run regulation, what are the market gains?

In: Economics

The demand for a monopolist’s product is: P = 40 -2Q; the monopolist’s total cost function...

The demand for a monopolist’s product is: P = 40 -2Q; the monopolist’s total cost function is: TC = 8Q + 0.5Q^2.(a)Under free monopoly, what is the numerical value of the dead-weight loss (DWL)? (b) Compute the monopolist’s break-even points and graph in the same diagram, demand (D), marginal revenue (MR), marginal cost (MC) and average cost (AC); in diagrams directly below, graph total revenue (TR), total cost (TC) and profit (pi).(c) Under short-run regulation, what are the market gains?

In: Economics

On January 1, a company purchased 3%, 20-year corporate bonds for $69,057,808 as an investment. The...

On January 1, a company purchased 3%, 20-year corporate bonds for $69,057,808 as an investment. The bonds have a face amount of $80 million and are priced to yield 4%. Interest is paid semiannually. Prepare a partial amortization table at the effective interest rate on June 30 and December 31. Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31.

|

|||||||||||||||||||||

In: Accounting