Questions

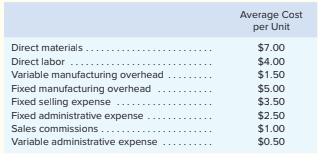

Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows:

Kubin Company’s relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows:

Required:

1. Assume the cost object is units of production:

a. What is the total direct manufacturing cost incurred to make 20,000 units?

b. What is the total indirect manufacturing cost incurred to make 20,000 units?

2. Assume the cost object is the Manufacturing Department and that its total output is 20,000 units.

a. How much total manufacturing cost is directly traceable to the Manufacturing Department?

b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department?

3. Assume the cost object is the company’s various sales representatives. Furthermore, assume that the company spent $50,000 of its total fixed selling expense on advertising and the remainder of the total fixed selling expense comprised the fixed portion of the company’s sales representatives’ compensation.

a. When the company sells 20,000 units, what is the total direct selling expense that can be readily traced to individual sales representatives?

b. When the company sells 20,000 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives?

4. Are Kubin’s administrative expenses always going to be treated as indirect costs in its internal management reports?

In: Accounting

Write a C++ program that asks the user to enter the monthly costs for the following...

Write a C++ program that asks the user to enter the monthly costs for the following expenses incurred from operating your automobile: loan payment, insurance, gas, oil, tires, and maintenance. The program should then display the total monthly cost of these expenses, and a projected total annual cost of these expenses.

Label each cost. The labels should be left aligned and have a column width of 30 characters. The cost should be aligned right and displayed with two decimal places with a column width of 15.

If the yearly total is greater than 1000 dollars, add 10 percent of the yearly total to the yearly total.

Sample Output:

Loan Payment $ 303.28

Insurance 75.00

Gas 125.00

Oil 45.00

Tires 0.00

Maintenance 15.00

Total $ 563.28

Yearly Total $ 6759.36

10% $ 675.93

Grand Total $ 7435.29

In: Computer Science

11) What is a fixed cost? 12) What is a variable cost? 13) Where does the...

11) What is a fixed cost?

12) What is a variable cost?

13) Where does the marginal cost curve intersect the average total cost curve?

14) What will be the impact on the total product of labor curve of an improvement in technology?

15) According to the Law of Diminishing Returns, what happens to total output as more of a variable input is used with fixed resources?

In: Economics

A firm has sold 55,555 bicycles in 2020 that has variable cost of $199.55 for $299.99 each. The company's fixed cost for the year was $3,000,000.

A firm has sold 55,555 bicycles in 2020 that has variable cost of $199.55 for $299.99 each. The company's fixed cost for the year was $3,000,000. Show your work here below. To find Profit, compute the following first.

1. Total Variable Cost (TVC) ______

2. Total Cost (TC) _____

3. Total Revenue (TR) ______

4. Profit = ____

In: Accounting

Company B is a retailer of mobile phones in Australia that works 250 days in a...

Company B is a retailer of mobile phones in Australia that works

250 days in a year. The

manager is determining a minimum-cost inventory plan for an

upcoming phone to be

launched in the market. She has collected the following

information:

• Annual demand: 900 phones

• Phone cost: $1,079 each

• Phone RRP: $1,199 each

• Net weight: 163 g each

• Tare weight: 277 g each

• Annual inventory holding cost: 15%

• Cost per order to replenish inventory: $75

• Annual in-transit holding cost: 10%

• Freight rate: $7.50 per kg

• Time to process order for freight: 1 days

• Freight transit time: 3 days

Solve this problem using a non-linear programming (NLP)

model to determine the followings:

a. Economic order quantity for the phone in units and in kg

b. The total cost for purchasing the phones

c. The total cost for ordering

d. The total cost for holding the inventory

e. The total cost for transportation

f. The total cost for holding the phones during transit

g. The total cost for this inventory plan

h. The number of orders

i. Ordering point

j. The profit from this inventory plan

Please explain word and excel calculation

In: Accounting

Company B is a retailer of mobile phones in Australia that works 250 days in a...

Company B is a retailer of mobile phones in Australia that works

250 days in a year. The

manager is determining a minimum-cost inventory plan for an

upcoming phone to be

launched in the market. She has collected the following

information:

• Annual demand: 900 phones

• Phone cost: $1,079 each

• Phone RRP: $1,199 each

• Net weight: 163 g each

• Tare weight: 277 g each

• Annual inventory holding cost: 15%

• Cost per order to replenish inventory: $75

• Annual in-transit holding cost: 10%

• Freight rate: $7.50 per kg

• Time to process order for freight: 1 days

• Freight transit time: 3 days

Solve this problem using a non-linear programming (NLP)

model to determine the followings:

a. Economic order quantity for the phone in units and in kg

b. The total cost for purchasing the phones

c. The total cost for ordering

d. The total cost for holding the inventory

e. The total cost for transportation

f. The total cost for holding the phones during transit

g. The total cost for this inventory plan

h. The number of orders

i. Ordering point

j. The profit from this inventory plan

Please explain word and excel calculation

In: Accounting

Lower-of-Cost-or-Market Inventory On the basis of the following data: Commodity Inventory Quantity Unit Cost Price Unit...

Lower-of-Cost-or-Market Inventory

On the basis of the following data:

| Commodity |

Inventory |

Unit |

Unit |

|

| AL65 | 42 | $179 | $174 | |

| CA22 | 46 | 89 | 89 | |

| LA98 | 30 | 276 | 295 | |

| SC16 | 11 | 116 | 134 | |

| UT28 | 21 | 213 | 222 |

Determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10.

|

Inventory at the Lower of Cost or Market |

|||

|

Commodity |

Total Cost |

Total Market |

Total Lower of C or M |

|

AL65 |

|||

|

CA22 |

|||

|

LA98 |

|||

|

SC16 |

|||

|

UT28 |

|||

|

TOTAL |

|||

In: Accounting

Lower-of-Cost-or-Market Inventory On the basis of the following data: Commodity Inventory Quantity Unit Cost Price Unit...

Lower-of-Cost-or-Market Inventory

On the basis of the following data:

| Commodity |

Inventory |

Unit |

Unit |

|

| AL65 | 27 | $283 | $284 | |

| CA22 | 31 | 185 | 169 | |

| LA98 | 38 | 123 | 125 | |

| SC16 | 10 | 207 | 212 | |

| UT28 | 29 | 80 | 71 |

Determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10.

| Inventory at the Lower of Cost or Market | |||

| Commodity | Total Cost | Total Market | Total Lower of C or M |

| AL65 | $ | $ | $ |

| CA22 | |||

| LA98 | |||

| SC16 | |||

| UT28 | |||

| Total | $ | $ | $ |

In: Accounting

LIFO Perpetual Inventory The beginning inventory at Midnight Supplies and data on purchases and sales for...

LIFO Perpetual Inventory

The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows:

| Date | Transaction | Number of Units |

Per Unit | Total | ||||

|---|---|---|---|---|---|---|---|---|

| Jan. 1 | Inventory | 7,500 | $75.00 | $562,500 | ||||

| 10 | Purchase | 22,500 | 85.00 | 1,912,500 | ||||

| 28 | Sale | 11,250 | 150.00 | 1,687,500 | ||||

| 30 | Sale | 3,750 | 150.00 | 562,500 | ||||

| Feb. 5 | Sale | 1,500 | 150.00 | 225,000 | ||||

| 10 | Purchase | 54,000 | 87.50 | 4,725,000 | ||||

| 16 | Sale | 27,000 | 160.00 | 4,320,000 | ||||

| 28 | Sale | 25,500 | 160.00 | 4,080,000 | ||||

| Mar. 5 | Purchase | 45,000 | 89.50 | 4,027,500 | ||||

| 14 | Sale | 30,000 | 160.00 | 4,800,000 | ||||

| 25 | Purchase | 7,500 | 90.00 | 675,000 | ||||

| 30 | Sale | 26,250 | 160.00 | 4,200,000 | ||||

| Midnight Supplies Schedule of Cost of Goods Sold LIFO Method For the Three Months Ended March 31 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Purchases | Cost of Goods Sold | Inventory | |||||||

| Date | Quantity | Unit Cost | Total Cost | Quantity | Unit Cost | Total Cost | Quantity | Unit Cost | Total Cost |

| Jan. 1 | $ | $ | |||||||

| Jan. 10 | $ | $ | |||||||

| Jan. 28 | $ | $ | |||||||

| Jan. 30 | |||||||||

| Feb. 5 | |||||||||

| Feb. 10 | |||||||||

| Feb. 16 | |||||||||

| Feb. 28 | |||||||||

| Mar. 5 | |||||||||

| Mar. 14 | |||||||||

| Mar. 25 | |||||||||

| Mar. 30 | |||||||||

| Mar. 31 | Balances | $ | $ | ||||||

2. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period.

| Total sales | $ |

| Total cost of goods sold | $ |

| Gross profit | $ |

3. Determine the ending inventory cost as of

March 31.

$

In: Accounting

Bargain Rental Car offers rental cars in an off-airport location near a major tourist destination in California.

Exercise 5A-2 Least-Squares Regression [LO5-11]

Bargain Rental Car offers rental cars in an off-airport location near a major tourist destination in California. Management would like to better understand the variable and fixed portions of it car washing costs. The company operates its own car wash facility in which each rental car that is returned is thoroughly cleaned before being released for rental to another customer. Management believes that the variable portion of its car washing costs relates to the number of rental returns. Accordingly, the following data have been compiled:

| Month | Rental Returns | Car Wash Costs | |||

| January | 2,400 | $ | 10,800 | ||

| February | 2,500 | $ | 13,000 | ||

| March | 2,700 | $ | 11,600 | ||

| April | 3,000 | $ | 14,000 | ||

| May | 3,600 | $ | 16,000 | ||

| June | 5,000 | $ | 22,900 | ||

| July | 5,500 | $ | 22,000 | ||

| August | 5,400 | $ | 21,700 | ||

| September | 4,700 | $ | 22,600 | ||

| October | 3,900 | $ | 20,500 | ||

| November | 2,200 | $ | 10,500 | ||

| December | 2,700 | $ | 13,500 | ||

Exercise 5A-2 Part 2

2. Using least-squares regression, estimate the variable cost per rental return and the monthly fixed cost incurred to wash cars. (Round Fixed cost to the nearest whole dollar amount and the Variable cost per unit to 2 decimal places.)

In: Accounting