Questions

Subject: innovation and technology mangement Case 2 – Mobile Ads According to eMarketer, mobile ads will...

Subject: innovation and technology mangement

Case 2 – Mobile Ads

According to eMarketer, mobile ads will top 100 and it accounts for about 16.5 percent of total advertising spending in 2016. The top five spenders of mobile ads are the United States, China, the United Kingdom, Japan and Germany. This number is expected to increase as the worldwide adoption of smartphones continue to grow. In 2015, there were about 2.6 billion smartphone users. This number is expected to top 6.1 billion globally by 2020.

Businesses are

increasingly using mobile ads. Location data from mobile devices is

the key element for a successful mobile ad campaign. Facebook and

Google are two biggest players that generate the highest revenue

from mobile ads. PlaceIQ, a technology form headquartered in New

York city collects billions of data points from mobile devices and

other sources and is able tract potential customers as they move

from one retail location to another retail location – such as from

one car dealership to another. PlaceIQ is also able to help

businesses find out if the ads can translate to an actual visit by

a customer. In addition to its huge data set for business, PlaceIQ

also offers location data and analytics tools to businesses and

allows them to do their own advertising.

Audi is using the Place IQ data to measure how many potential

customers will visit its dealerships before and after they have

seen ads. They also want to target potential customers who are

visiting their competitors’ showrooms. Stacom Media Group is using

PlaceIQ in order to find out how mobile location data can be

helpful and eventually attract more customers to a business.

Questions:

a) By 2020 how many smartphones will be existing globally?

b) Who are the two leading companies that generate the biggest revenue from mobile ads?

c) How PlaceIQ impact businesses?

d) Why is Audi using the services offered by PlaceIQ?

e) Your overall observation and learning from the above case study.

In: Computer Science

You are graduating in May 2020 with a B.S. and want to attend graduate school full...

You are graduating in May 2020 with a B.S. and want to attend graduate school full time for two years for an MBA. Though scholarships, support from your parents, and savings, you don’t have any debt for your undergraduate education, and you've agreed to pay for graduate school on your own. You estimate that you will need to borrow about $40,000 in each of the next two years: $40,000 in August 2020 and $42,000 in August 2021. The term of each loan will be 15 years, paid monthly. Your first payment will be due October 1, 2020 and the first payment of the second loan will be due October 2, 2021. You’ve researched student loans and found the following rates that are guaranteed not to be any higher over the next 20 years: Direct unsubsidized loans – capped at $20,500 @6.08% for fifteen years Direct PLUS loans @ 7.08% for fifteen years There are also origination fees – that are subtracted from the loan amount you receive but does not affect the principal or monthly payment. The rates are: Direct unsubsidized loans: 1.059% Direct PLUS loans: 4.236% Question 1 1 Point How much money do you expect to receive in August 2020? Question 2 1 Point How much money do you expect to receive in August 2021? Question 3 1 Point What will be the remaining principal in October 2020? Question 4 1 Point What will be the remaining principal in November 2021? Question 5 1 Point What is the total monthly payment in August 2020? Question 6 1 Point What is the total monthly payment in July 2025? Question 7 1 Point What is the remaining principal in August 2028? Question 8 1 Point How much do you expect to pay in total for both loans? Question 9 1 Point What is the effective simple interest rate for the Direct unsubsidized loans: (interest + Origination fees)/(Loans)? Question 10 1 Point What is the effective simple interest rate for the Direct PLUS loans (interest + Origination fees)/(Loans)

In: Accounting

which of the following is not related to genetic drift? neutral variation sexual selection non darwinian...

which of the following is not related to genetic drift?

neutral variation

sexual selection

non darwinian evolution

bottleneck effect

founder effect

In: Biology

Mackenzie Dell graduated from university six years ago with an undergraduate degree in finance. Although she...

Mackenzie Dell graduated from university six years ago with an undergraduate degree in finance. Although she is satisfied with her current job, her goal is to become aninvestment banker. She feels that an MBA degree would allow her to achieve her goal. After examining schools, she has narrowed her choice to either Maple Leaf University or Stars and Stripes University. Although internships are encouraged by both schools, to get class credit for the internship, no salary can be paid. Other than internships, neither school will allow its students to work while enrolled in its MBA program. Mackenzie currently works at the money management firm of Copper Sachs. Her annual salary at the firm is $68,000 per year, expected to increase at 2.5 percent per year until retirement. She is currently 28 years old and expects to work for 35 more years. Her current job includes a fully paid health insurance plan, and her current average tax rate is 26.5 percent. Mackenzie has a savings account with enough money to cover the entire cost of her MBA program. The Faculty of Management at Maple Leaf University is one of the top MBA programs in the country. The MBA degree requires two years of full-time enrollment at the university. The annual tuition is $55,000, payable at the beginning of each school year. Books and other supplies are estimated to cost $3,000 per year. Mackenzie expects that after graduation from Maple Leaf, she will receive a job offer for about $110,000 per year, with a $15,000 signing bonus. The salary at this job will increase at 4 percent per year. Because of the higher salary, her average income tax rate will increase to 30 percent. The School of Business at Stars and Stripes University began its MBA program 16 years ago and is less well known than Maple Leaf University's Faculty of Management. Stars and Stripes University offers an accelerated, one-year program, with a tuition cost of $85,000 to be paid upon graduation. Books and other supplies for the program are expected to cost $4,500. Mackenzie thinks that she will receive an offer of $90,000 per year upon graduation, with an $18,000 signing bonus. The salary at this job will increase at 3.25 percent per year. Her average tax rate at this level of income will be 28.5 percent. Both schools offer a health insurance plan that will cost $3,000 per year, payable at the beginning of the year. Mackenzie also estimates that room and board expenses will cost $2,000 more per year at both schools than her current expenses, payable at the beginning of each year. The appropriate discount rate is 6.5 percent. 1. What other, perhaps non-quantifiable, factors affect Mackenzie's decision to get an MBA? 2. Assuming all salaries are paid at the end of each year, which is the best option for Mackenzie—from a strictly financial standpoint. 3. Suppose, instead of being able to pay cash for her MBA, Mackenzie must borrow the money. The current borrowing rate is 4.8 percent. How would this affect her decision? It would be great help if excel exhibits could also be provided.

In: Finance

Ariel Sunnyvale graduated from university six years ago with an undergraduate degree in finance. Although she...

Ariel Sunnyvale graduated from university six years ago with an undergraduate degree in finance. Although she is satisfied with her current job, her goal is to become an investment banker. She feels that an MBA degree would allow her to achieve her goal. After examining schools, she has narrowed her choice to either Northern University or Southern University. Although internships are encouraged by both schools, to get class credit for the internship, no salary can be paid. Other than internships, neither school will allow its students to work while enrolled in its MBA program. Ariel currently works at the money management firm of Greyson Partners. Her annual salary at the firm is $64,000 per year, expected to increase at 2.75 percent per year until retirement. She is currently 30 years old and expects to work for 37 more years. Her current job includes a fully paid health insurance plan, and her current average tax rate is 25 percent. Ariel has a savings account with enough money to cover the entire cost of her MBA program. The Faculty of Management at Northern University is one of the top MBA programs in the country. The MBA degree requires two years of full-time enrollment at the university. The annual tuition is $50,000, payable at the beginning of each school year. Books and other supplies are estimated to cost $3,000 per year. Ariel expects that after graduation from Northern, she will receive a job offer for about $88,000 per year, with a $5,000 signing bonus. The salary at this job will increase at 3 percent per year. Because of the higher salary, her average income tax rate will increase to 27 percent. The School of Business at Southern University began its MBA program 16 years ago and is less well known than Northern University's Faculty of Management. Southern University offers an accelerated, one-year program, with a tuition cost of $80,000 to be paid upon graduation. Books and other supplies for the program are expected to cost $4,500. Ariel thinks that she will receive an offer of $100,000 per year upon graduation, with an $15,000 signing bonus. The salary at this job will increase at 3.5 percent per year. Her average tax rate at this level of income will be 28.5 percent. Both schools offer a health insurance plan that will cost $3,000 per year, payable at the beginning of the year. Ariel also estimates that room and board expenses will cost $2,000 more per year at both schools than her current expenses, payable at the beginning of each year. The appropriate discount rate is 6.5 percent.

1. What other, perhaps non-quantifiable, factors affect Ariel's decision to get an MBA?

2. Assuming all salaries are paid at the end of each year, which is the best option for Ariel—from a strictly financial standpoint.

3. Suppose, instead of being able to pay cash for her MBA, Ariel must borrow the money. The current borrowing rate is 3.75 percent. How would this affect her decision?

In: Finance

Ben Bates graduated from college six years ago with a finance undergraduate degree. Although he is...

Ben Bates graduated from college six years ago with a finance undergraduate degree. Although he is satisfied with his current job, his goal is to become an investment banker. He feels that an MBA degree would allow him to achieve this goal. After examining schools, he has narrowed his choice to either Wilton University or Mount Perry College. Although internships are encouraged by both schools, to get class credit for the internship, no salary can be paid. Other than internships, neither school will allow its students to work while enrolled in its MBA program. Ben currently works at the money management firm of Dewey and Louis. His annual salary at the firm is $53,000 per year, and his salary is expected to increase at 3 percent per year until retirement. He is currently 28 years old and expects to work for 38 more years. His current job includes a fully paid health insurance plan, and his current average tax rate is 26 percent. Ben has a savings account with enough money to cover the entire cost of his MBA program. The Ritter College of Business at Wilton University is one of the top MBA programs in the country. The MBA degree requires two years of full-time enrollment at the university. The annual tuition is $58,000, payable at the beginning of each school year. Books and other supplies are estimated to cost $2,000 per year. Ben expects that after graduation from Wilton, he will receive a job offer for about $87,000 per year, with a $10,000 signing bonus. The salary at this job will increase at 4 percent per year. Because of the higher salary, his average income tax rate will increase to 31 percent. The Bradley School of Business at Mount Perry College began its MBA program 16 years ago. The Bradley School is smaller and less well known than the Ritter College. Bradley offers an accelerated one-year program, with a tuition cost of $75,000 to be paid upon matriculation. Books and other supplies for the program are expected to cost $4,200. Ben thinks that he will receive an offer of $78,000 per year upon graduation, with an $8,000 signing bonus. The salary at this job will increase at 3.5 percent per year. His average tax rate at this level of income will be 29 percent. Both schools offer a health insurance plan that will cost $3,000 per year, payable at the beginning of the year. Ben has also found that both schools offer graduate housing. His room and board expenses will decrease by $4,000 per year at either school he attends. The appropriate discount rate is 5.5 percent.

1.

A)How does Ben’s age affect his decision to get an MBA?

B) What other, perhaps nonquantifiable, factors affect Ben’s decision to get an MBA?

C) Assuming all salaries are paid at the end of each year, what is the best option for Ben from a strictly financial standpoint?

In: Finance

Suppose the United States decides to reduce export subsidies on U.S. agricultural products, but it does...

Suppose the United States decides to reduce export subsidies on U.S. agricultural products, but it does not decrease taxes or increase any other government spending.

Initially, a reduction in export subsidies decreases net exports at any given real exchange rate, causing the demand for dollars in the foreign exchange market to decrease. This leads to a decrease in the real exchange rate, which, in turn, decreases imports to negate any decrease in exports, leaving the equilibrium quantity of net exports and the trade deficit unchanged at this point.

1. However, the reduction in expenditure on export subsidies (Increases/Decreases) the fiscal deficit, thereby (Increasing/Decreasing) public saving.

2. Indicate the effect this has on the U.S. market for loanable funds. (Supply and demand shift?)

3. Given the change in the real interest rate, show the effect this has on net capital outflow.

4. This causes the supply of dollars in the foreign exchange market to (Increase/Decrease), the real exchange rate to (Rise/Fall) , and the equilibrium level of net exports to (Rise/Fall).

In: Economics

Since the onset of Covid-19 in the United States a significant amount of attention has been...

Since the onset of Covid-19 in the United States a significant amount of attention has been paid to nurses. Some nurses work in union situations and others do not. Some nurses have been fired because of their activities, and others have been disciplined for speaking to the media, or refusing to work in situations they feel are unsafe for them. Discuss your thoughts on belonging to a union and if the decision were to strike, how would you balance your duty to care as outlined in the Code of Ethics for Nurses with interpretive statements, and the recommendations of leadership to strike or take collective action? Hoping to gain some insight from someone that has experience with nursing unions.

In: Nursing

How many bushels of corn, if any, will the United States export or import at the prices below

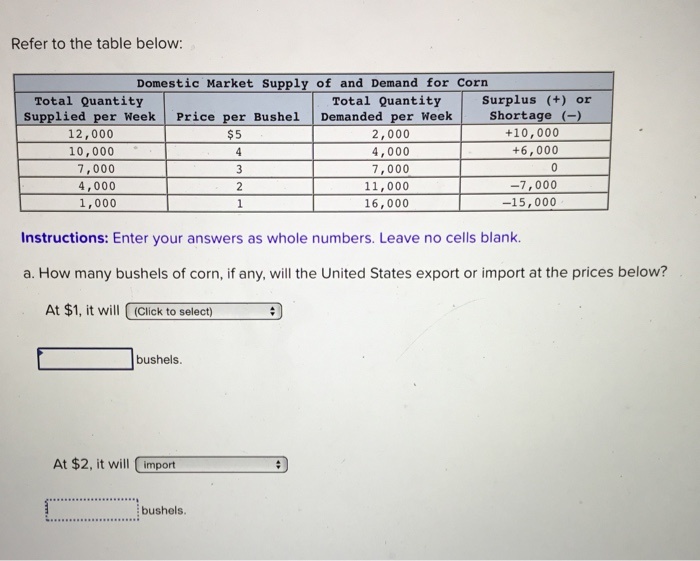

Refer to the table below:

| Domestic Market supply of and Demand for Corn | |||

|---|---|---|---|

| Total Quantity Supplied per Week | Price per Bushel | Total Quantity Demanded per week | Surplus (+) or Shortage (-) |

| 12,000 | $5 | 2,000 | +10,000 |

| 10,000 | 4 | 4,000 | +6,000 |

| 7,000 | 3 | 7,000 | 0 |

| 4,000 | 2 | 11,000 | -7,000 |

| 1,000 | 1 | 16,000 | -15,000 |

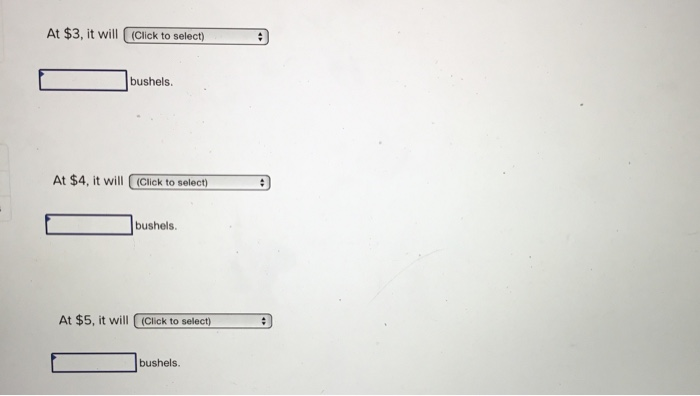

a. How many bushels of corn, if any, will the United States export or import at the prices below?

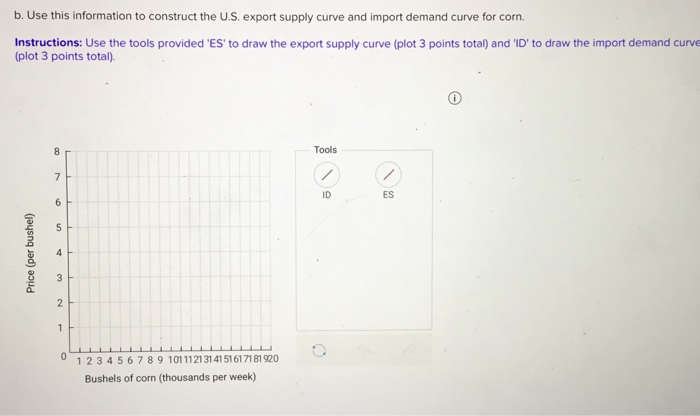

b. Use this information to construct the U.S. export supply curve and import demand curve for corn.

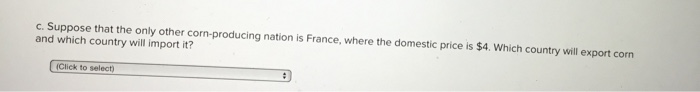

c. Suppose that the only other corn-producing nation is France, where the domestic price is $4. Which country will export corn and which country will import it?

In: Economics

In 2006, the five leading suppliers of digital cameras in the United States were: Canon, Sony,...

In 2006, the five leading suppliers of digital cameras in the United States were: Canon, Sony, Kodak, Olympus, and Samsung. The combined market share of these five firms was 60.9 percent. The leading firm was Canon, with a market share of 18.7 percent. The own-price elasticity for Canon’s cameras was -4.0 and the market elasticity of demand was -1.6. Suppose that in 2006, the average retail price of a Canon digital camera was $240 and that Canon’s marginal cost was $180 per camera.

Please answer the following questions:

- Is the market for digital cameras concentrated?

- What is the Rothschild index for Cannon? How would you interpret the Rothschild index you get?

- What is the Lerner index for Cannon? How would you interpret the Lerner index you get?

- Based on the information given in Question 1-3, what type of market structures (Perfect competition, Monopoly, monopolistic competition, or oligopoly) does these suggest? Why?

In: Economics