Questions

Briefly summarize the history of Sanskrit Language and its impact on Indian culture since the ancient...

- Briefly summarize the history of Sanskrit Language and its impact on Indian culture since the ancient time. Give at least one example of its impact(s) in the following areas: religion, music, dance, theater, and literature.

In: Psychology

Scenario Suppose that a movie theater faces a downward sloping demand curve for popcorn and it...

Scenario Suppose that a movie theater faces a downward sloping demand curve for popcorn and it increases the price of a container of popcorn from $4.00 to $4.80, which causes the count of containers sold to fall from 100 to 90.

Questions 1. What is the elasticity coefficient?

2. Is the demand relatively elastic or relatively inelastic?

3. Should the theater consider raising the price of popcorn further?

4. When a firm faces a downward sloping demand curve, should it ever price its product in the inelastic range of the demand curve (if it has such a range)? Explain why or why not.

5. When a firm is a monopolist (or the only seller of a product), should it price its product in the elastic or inelastic range of its demand curve? Explain.

In: Economics

Pecan Theater Inc. owns and operates movie theaters throughout Florida and Ga. Pecan Theater has declared...

Pecan Theater Inc. owns and operates movie theaters throughout Florida and Ga. Pecan Theater has declared the following annual dividends over a six-year period ending December 31 of each year, the outstanding stock of the company was composed of 30,000 shares of cumulative, 4% preferred stock, $100 par, and 100,000 shares of common stock, $25 par.

1. Determine the total dividends and the per share

dividends declared on each class of stock for each of the six

years. There were no dividends in arrears at the beginning of Year

1. Summarize the data in tabular form. If required, round your

answers to two decimal places. If the amount is zero, please enter

"0".

Year. Total Dividends. Preferred/Common

1.

48,000

total? per share?

2.

144,000

3.

288,000

4.

276,000

5.

336,000

6.

420,000

2. Determine the average annual dividend per share for each class

of stock for the six-year period. If required, round your answers

to two decimal places.

Average annual dividend for preferred_____ per share

Average annual dividend for common_____per share

3. Assuming a market price per share of $253 for the preferred

stock and $31 for the common stock, determine the average annual

percentage return on initial shareholders' investment, based on the

average annual dividend per share for preferred stock and for

common stock.

Preferred stock______%

Common stock______%

In: Accounting

Suppose the United States decides to reduce export subsidies on U.S. agricultural products, but it does...

Suppose the United States decides to reduce export subsidies on U.S. agricultural products, but it does not decrease taxes or increase any other government spending.

Initially, a reduction in export subsidies decreases net exports at any given real exchange rate, causing the demand for dollars in the foreign exchange market to decrease. This leads to a decrease in the real exchange rate, which, in turn, decreases imports to negate any decrease in exports, leaving the equilibrium quantity of net exports and the trade deficit unchanged at this point.

1. However, the reduction in expenditure on export subsidies (Increases/Decreases) the fiscal deficit, thereby (Increasing/Decreasing) public saving.

2. Indicate the effect this has on the U.S. market for loanable funds. (Supply and demand shift?)

3. Given the change in the real interest rate, show the effect this has on net capital outflow.

4. This causes the supply of dollars in the foreign exchange market to (Increase/Decrease), the real exchange rate to (Rise/Fall) , and the equilibrium level of net exports to (Rise/Fall).

In: Economics

Since the onset of Covid-19 in the United States a significant amount of attention has been...

Since the onset of Covid-19 in the United States a significant amount of attention has been paid to nurses. Some nurses work in union situations and others do not. Some nurses have been fired because of their activities, and others have been disciplined for speaking to the media, or refusing to work in situations they feel are unsafe for them. Discuss your thoughts on belonging to a union and if the decision were to strike, how would you balance your duty to care as outlined in the Code of Ethics for Nurses with interpretive statements, and the recommendations of leadership to strike or take collective action? Hoping to gain some insight from someone that has experience with nursing unions.

In: Nursing

How many bushels of corn, if any, will the United States export or import at the prices below

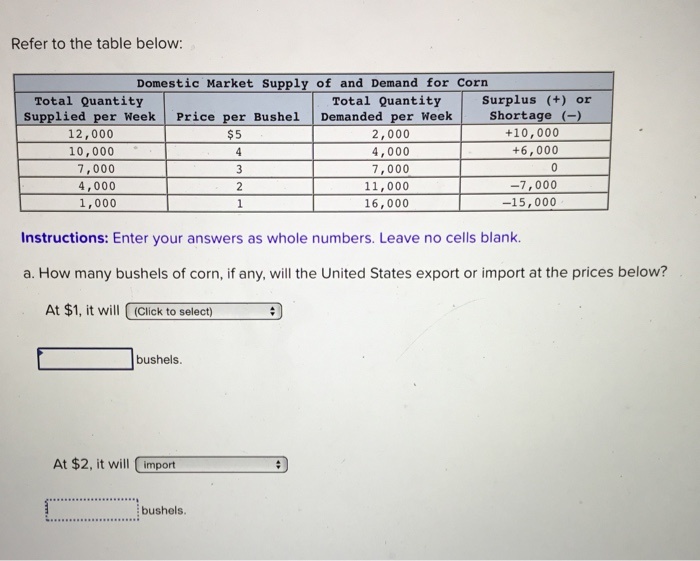

Refer to the table below:

| Domestic Market supply of and Demand for Corn | |||

|---|---|---|---|

| Total Quantity Supplied per Week | Price per Bushel | Total Quantity Demanded per week | Surplus (+) or Shortage (-) |

| 12,000 | $5 | 2,000 | +10,000 |

| 10,000 | 4 | 4,000 | +6,000 |

| 7,000 | 3 | 7,000 | 0 |

| 4,000 | 2 | 11,000 | -7,000 |

| 1,000 | 1 | 16,000 | -15,000 |

a. How many bushels of corn, if any, will the United States export or import at the prices below?

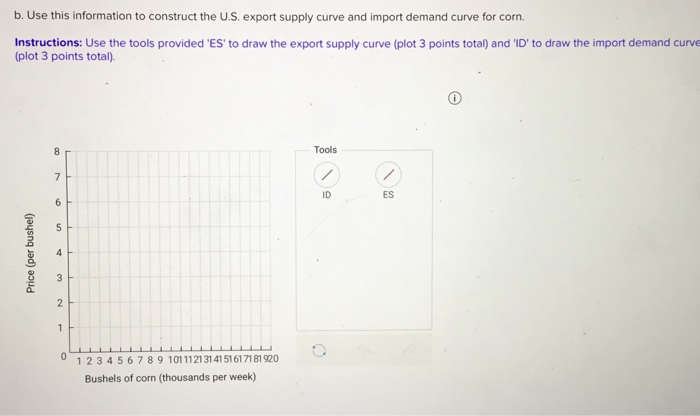

b. Use this information to construct the U.S. export supply curve and import demand curve for corn.

c. Suppose that the only other corn-producing nation is France, where the domestic price is $4. Which country will export corn and which country will import it?

In: Economics

Accounting for acquired goodwill has been a controversial issue for many years. In the United States

Accounting for acquired goodwill has been a controversial issue for many years. In the United States, the amount of acquired goodwill is capitalized and not amortized. Globally, the treatment of goodwill varies significantly, with some countries not recognizing goodwill as an asset. Professors Johnson and Petrone, in “Is Goodwill an Asset?” discuss this issue.

Required:

1. In your library or from some other source, locate the indicated article in Accounting Horizons, September 1998.

2. Does goodwill meet the FASB’s definition of an asset? 3. What are the key concerns of those that believe goodwill is not an asset?

In: Accounting

In 2006, the five leading suppliers of digital cameras in the United States were: Canon, Sony,...

In 2006, the five leading suppliers of digital cameras in the United States were: Canon, Sony, Kodak, Olympus, and Samsung. The combined market share of these five firms was 60.9 percent. The leading firm was Canon, with a market share of 18.7 percent. The own-price elasticity for Canon’s cameras was -4.0 and the market elasticity of demand was -1.6. Suppose that in 2006, the average retail price of a Canon digital camera was $240 and that Canon’s marginal cost was $180 per camera.

Please answer the following questions:

- Is the market for digital cameras concentrated?

- What is the Rothschild index for Cannon? How would you interpret the Rothschild index you get?

- What is the Lerner index for Cannon? How would you interpret the Lerner index you get?

- Based on the information given in Question 1-3, what type of market structures (Perfect competition, Monopoly, monopolistic competition, or oligopoly) does these suggest? Why?

In: Economics

Subscribe The United States has a variety of regulations to address the economic harm resulting from...

Subscribe

The United States has a variety of regulations to address the economic harm resulting from monopoly power in an industry. This includes the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts were aimed at restricting the formation of cartels and monopolies to protect consumers and ensure competition. The article The Oligopoly Problem argued that oligopolies fall through the cracks of these regulations and leave consumers unprotected from harmful business practices where industries are highly concentrated. Read the article and respond to the following in your initial post:

- What are examples of firms in an oligopolistic market that abuse their power? Explain how they abuse their power and describe the impact on consumers.

- Do you agree with the author's feelings about increased government oversight of such industries? Why or why not?

In: Economics

Assume that the United States has two sectors: the food sector has land as a specific...

Assume that the United States has two sectors: the food sector has land as a specific factor and the manufacturing sector uses capital as a specific factor. Labour is mobile across sectors. Suppose that exceptionally good weather enables several states to enjoy ‘bumper’ crops that lead to an 8 percent decline in the price of food.

- Illustrate the effect on the labour demand curves for food and manufactured goods and the impact on wages?

- How does the distribution of labour across sectors change? How does the output of each sector change?

- How does the decline in the relative price of food affect the income distribution across capitalists and landowners?

- What can be said about the impact on the earnings of workers? Could you provide a more definite response if you were told that food was by far the most important item in a worker’s consumption basket?

In: Economics