Questions

Create CSS code 4.3. Change/update the CSS to display multiple blocks/courses per line, in a way...

Create CSS code

4.3. Change/update the CSS to display multiple blocks/courses per line, in a way that responds to the width of the browser window and reduces the number of elements per line appropriately.

4.3.1. You may add IDs or classes to the XML file as desired.

<InformationSystems>

<Classes>

<CourseHeader>

<CourseNumber>CIS 145</CourseNumber>

<CourseName>Introduction to Relational

Database</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces relational database

concepts and practices using business-related examples. OFTEC 111

or 108 recommended, or comparable competencies. Prerequisite: OFTEC

141 or MATH 097 with a "C" or

better.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 160</CourseNumber>

<CourseName>Programming Fundamentals</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces programming structures,

concepts, techniques and terminology using visual studio

development environment and the c# programming

language.Prerequisite: MATH 097. Distribution: AA, AS,

DTA.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 166</CourseNumber>

<CourseName>Programming Business

Objects</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces concepts and techniquies

of object oriented programming,validation and storage of business

data sets, and user interfaces. Prerequisite:CIS

160.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 169</CourseNumber>

<CourseName>Requirements Analysis</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces planning,analysis and

design of software with an emphasis on development methodologies,

design process and communication techniques. Prerequisite: CIS: 145

and CIS 166.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 182</CourseNumber>

<CourseName>SQL Fundamentals</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces Structured Query Language

(SQL). Emphasizes techniques for writing efficient SQL queries

using a common commercial implementation of SQL. Prerequisite: CIS

145 and CIS 160 or instructor's

permission.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 185</CourseNumber>

<CourseName>HTML, CSS, JavaScript</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces creating web pages with

HTML5 and CSS. Covers JavaScript coding to create, test, debug, and

document programs. Prerequisite: CIS

166.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 218</CourseNumber>

<CourseName>PowerShell, Cybersecurity,

Ethics</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces PowerShell scripting,

basic cybersecurity concepts, and ethical issues for software

development. Prerequisite: CIS 166 and "C" or better in ENGL&

101.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 245</CourseNumber>

<CourseName>Business Information

Systems</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces business information

systems. Explores the role of software developers and database

managers in developing, refining, and supporting these systems.

Prerequisite: CIS 266.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 266</CourseNumber>

<CourseName>Introduction to Business

Applications</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Explores how to edit, present, and

store data using object-oriented programming and relational

databases. Prerequisite: CIS 166 and CIS

182.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 282</CourseNumber>

<CourseName>SQL Programming</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Continues development of relational

databases and associated services using Structured Query Language

(SQL) in Microsoft SQL Server. Introduces transaction processing,

stored procedures, indices, constraints, triggers, and views.

Prerequisite: CIS 182 and CIS 166.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

<Classes>

<CourseHeader>

<CourseNumber>CIS 284</CourseNumber>

<CourseName>Web Application

Development</CourseName>

<Credits>5</Credits>

</CourseHeader>

<Description><![CDATA[Introduces development of

interactive web pages using ASP.NET server-side programming. Web

programming with SQL databases, addresses security issues, develops

web services, and introduces deployment to cloud services.

Prerequisite: CIS 166, CIS 182, and CIS

185.]]></Description>

<AdditionalInfo>Additional

Notes</AdditionalInfo>

</Classes>

</InformationSystems>

In: Computer Science

1) Determine the number of moles of Br2 in a sample consisting of: 8.02×1022 Br2 molecules...

1) Determine the number of moles of Br2 in a sample consisting of:

8.02×1022 Br2 molecules

2.23×1024 Br atoms

11.0 kg bromine

Determine the mass percent H in the hydrocarbon isopentane, CH3CH(CH3)CH2CH3?

Determine the empirical formula of:

benzo[a]pyrene, a suspected carcinogen found in cigarette smoke, consisting of 95.21% C and 4.79% H, by mass

hexachlorophene, used in germicidal soaps, which consists of 38.37% C, 1.49% H, 52.28% Cl, and 7.86% O by mass.

The element X forms the compound XOCl2containing 59.6% Cl.

What is element X?

Dimethylhydrazine is a carbon-hydrogen-nitrogen compound used in

rocket fuels. When burned in an excess of oxygen, a 0.312 g sample

yields 0.458 gCO2 and 0.374 g H2O.

The nitrogen content of a 0.486 g sample is converted to 0.226 g

N2.

The organic solvent thiophene is a carbon–hydrogen–sulfur compound that yields CO2, H2O, and SO2 on complete combustion. When subjected to combustion analysis, a 1.3020−gsample of thiophene produces 2.7224 g CO2, 0.5575 g H2O, and 0.9915 g SO2.

What is the empirical formula of thiophene?

In: Chemistry

1.)In a mid-size company, the distribution of the number of phone calls answered each day by...

1.)In a mid-size company, the distribution of the number of phone calls answered each day by each of the 12 receptionists is bell-shaped and has a mean of 51 and a standard deviation of 4. Using the empirical rule (as presented in the book), what is the approximate percentage of daily phone calls numbering between 43 and 59?

2.)A company has a policy of retiring company cars; this policy looks at number of miles driven, purpose of trips, style of car and other features. The distribution of the number of months in service for the fleet of cars is bell-shaped and has a mean of 38 months and a standard deviation of 3 months. Using the empirical rule (as presented in the book), what is the approximate percentage of cars that remain in service between 41 and 47 months?

3.)he physical plant at the main campus of a large state university recieves daily requests to replace florecent lightbulbs. The distribution of the number of daily requests is bell-shaped and has a mean of 60 and a standard deviation of 8. Using the 68-95-99.7 rule, what is the approximate percentage of lightbulb replacement requests numbering between 52 and 60?

In: Statistics and Probability

The University of Miami bookstore stocks textbooks inpreparation for sales each semester. It normally relies...

The University of Miami bookstore stocks textbooks in preparation for sales each semester. It normally relies on departmental forecasts and preregistration records to determine how many copies of a text are needed. Preregistration shows 95 operations management students enrolled, but bookstore manager Vaidy Jayaraman has second thoughts, based on his intuition and some historical evidence. Vaidy believes that the distribution of sales may range from 75 to 95 units, according to the following probability model:

Demand | 75 | 80 | 85 | 90 | 95 |

Probability | 0.05 | 0.20 | 0.20 | 0.20 | 0.35 |

This textbook costs the bookstore $82 and sells for $107. Any unsold copies can be returned to the publisher, less a restocking fee and shipping, for a net refund of $36.

a) Based on the given information, Vaidy's conditional profits table for the bookstore is:

| Demand | |||||

| 75 | 80 | 85 | 90 | 95 | |

| Stock | p=0.05 | p=0.20 | p=0.20 | p=0.20 | p=0.35 |

| 75 | 1875 | 1875 | 1875 | 1875 | 1875 |

| 80 | 1645 | 2000 | 2000 | 2000 | 2000 |

| 85 | 1415 | 1770 | 2125 | 2125 | 2125 |

| 90 | |||||

| 95 |

b) How many copies should the bookstore stock to achieve highest expected value?

c) The EMV of stocking this number of copies is

In: Operations Management

A. Caspian Sea Drinks is considering the purchase of a new water filtration system produced by...

A. Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $12.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.72 million per year and increased operating costs of $644,288.00 per year. Caspian Sea Drinks' marginal tax rate is 32.00%. If Caspian Sea Drinks uses a 9.00% discount rate, then the net present value of the RGM-7000 is _____.

B. Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.66 million and create incremental cash flows of $532,580.00 each year for the next five years. The cost of capital is 11.13%. What is the internal rate of return for the J-Mix 2000?

C. Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.90 million and create incremental cash flows of $642,799.00 each year for the next five years. The cost of capital is 11.97%. What is the profitability index for the J-Mix 2000?

In: Finance

1.) Company Zeta bought new office furniture in the year 2000. The purchase cost was 62426...

1.) Company Zeta bought new office furniture in the year 2000. The purchase cost was 62426 dollars and in addition it had to spend 14941 dollars for installation. The furniture has been in use since April 21st, 2000. Zeta forecasted that in 2015 the office furniture would have a net salvage value of $1000. Using the US Accelerated Depreciation Schedule, estimate the value of depreciation recorded in the accounting books in the year 2004 if the company decided to sell the furniture on June 5th (of 2004). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

ANSWER: 3454.44

2.) Company Omega bought new petroleum refining equipment in the year 2000. The purchase cost was 174324 dollars and in addition it had to spend 14582 dollars for installation. The refining equipment has been in use since February 1st, 2000. Omega forecasted that in 2030 the equipment would have a net salvage value of $10,000. Using the US Straight Line Depreciation Schedule, estimate the value of depreciation recorded in the accounting books in the year 2004 if the company decided to sell the equipment on August 5th (of 2004). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

ANSWER: 9445.3

In: Accounting

Consider each of the following scenarios for profit maximizing firms operating in perfectly competitive markets. For...

- Consider each of the following scenarios for profit maximizing

firms operating in perfectly competitive markets. For each firm,

state whether the firm should produce nothing, or increase,

decrease, or maintain its output level.

- XYZ Corp. has output of 2000 units, market price = $64, average total cost = $62, average variable cost = $48, and marginal cost = $67.

- XYZ Corp. has output of 2000 units, market price = $64, average total cost = $70, average variable cost = $66, and marginal cost = $64.

- XYZ Corp. has output of 2000 units, market price = $64, average total cost = $64, average variable cost = $62, and marginal cost = $64.

- XYZ Corp. has output of 2000 units, market price = $64, average total cost = $62, average variable cost = $48, and marginal cost = $67.

- UVW Corp. has output of 6000 units, market price = $10, total costs = $72 000, total variable costs = $66 000, and marginal cost = $9.

- UVW Corp. has output of 10 000 units, market price = $4, total costs = $50 000, total variable costs = $30 000, and marginal cost = $4.

In: Economics

Select two data values from your raw data – one that is inside of the confidence...

Select two data values from your raw data – one that is inside of the confidence interval and one that is outside – one must be at the high end of the data and one at the low end – and construct two hypothesis tests, one for each value. One of the tests should be a “less than”, the other should be a “greater than”, depending on the value being tested. Use a 95% level of confidence.

Songs

250

5

800

500

850

430

200

600

0

130

1000

1000

400

1500

20

1500

872

150

115

90

252

2345

200

200

300

200

650

1500

600

500

800

400

930

400

10000

456

200

1200

0

500

30

0

950

180

450

1000

730

10

10

55

260

500

0

1327

0

250

0

35

100

1000

10

35

0

1200

2000

200

1813

15

90

5

100

300

1400

200

22

800

300

1000

15

75

200

700

167

200

183

678

50

350

150

400

2000

2000

900

1

400

300

100

150

300

150

100

1200

1500

200

100

1500

300

300

3000

2000

150

100

200

4000

200

500

1500

500

3600

1567

350

181

400

500

0

250

100

50

300

300

500

2000

60

200

0

100

350

400

1000

40

250

1750

0

0

400

840

200

300

500

0

800

200

400

15

45

170

150

0

2409

350

2100

200

200

25

25

0

200

0

0

1200

450

400

2750

300

300

1869

970

300

2900

1140

40

100

2000

500

1000

0

500

30

0

500

812

0

In: Statistics and Probability

Murphy Delivery Service completed the following transactions during December 2018

Murphy Delivery Service completed the following transactions during December 2018

Dec.1 Murphy Delivery Service began operations by receiving $ 13,000 cash and Dec. a truck with a fair value of $ 9,000 from Russ Murphy. The business issued Murphy shares of common stock in exchange for this contribution.

1 Paid $ 600 cash for a six-month insurance policy. The policy begins December 1 .

4 Paid $ 750 cash for office supplies.

12 Performed delivery services for a customer and received $ 2,200 cash.

15. Completed a large delivery job, billed the customer, $ 3,300, and received a Promise to collect the 53,300 within one week.

18 Paid employee salary. $ 800.

20 Received' 57,000 cash for performing delivery services.

22 Collected $ 2000 in advance for delivery service to be performed later.

25 Collected $ 3.300 cash from customer on account.

27 Purchased fuel for the truck, paying $ 150 on account, (Credit Accounts Payable)

28 Performed delivery services on account, $ 1,400.

29 Paid office rent, $ 1,400, for the month of becember.

30 Paid $ 150 an account.

31 Cash dividends of $ 2,500 were paid to stockholders.

Requirements

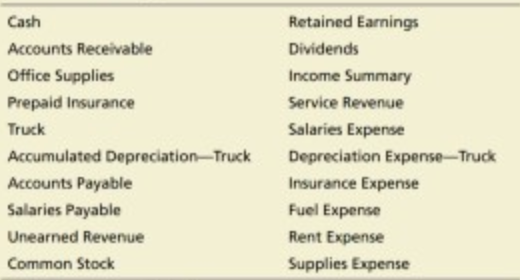

1. Recond each transaction in the journal using the following chart of accounts. Explanations are not required.

2. Post the transactions in the T-accounts.

3. Prepare an unadjusted trial balance as of December 31,2018 .

4. Prepare a worksheet as of December 31, 2018 (optional).

5. Journalize the adjusting entries using the following adjustment data and also by revising the journal entries prepared in Requirement 1 Post adjusting entries to the T-accounts.

In: Accounting

The following table provides the project annual budget, total number of projects, and total number of...

The following table provides the project annual budget, total number of projects, and total number of people working on the projects for City of Killingcovid annually:

|

Year |

Annual Budget (in millions) |

Number of Projects |

Number of People Working on the Projects |

|

1997 |

9.93 |

2 |

6 |

|

1998 |

7.34 |

8 |

47 |

|

1999 |

6.82 |

4 |

134 |

|

2000 |

7 |

2 |

291 |

|

2001 |

7.31 |

7 |

279 |

|

2002 |

7.86 |

6 |

82 |

|

2003 |

8.44 |

4 |

65 |

|

2004 |

7.61 |

5 |

34 |

|

2005 |

7.8 |

1 |

14 |

|

2006 |

8.6 |

4 |

249 |

|

2007 |

8.25 |

2 |

174 |

|

2008 |

8.7 |

3 |

346 |

|

2009 |

10.89 |

2 |

3 |

|

2010 |

10.53 |

1 |

8 |

|

2011 |

11.77 |

2 |

13 |

|

2012 |

11.44 |

4 |

24 |

|

2013 |

10.95 |

6 |

534 |

|

2014 |

11.12 |

2 |

6 |

|

2015 |

10.73 |

2 |

28 |

|

2016 |

11.39 |

1 |

18 |

|

2017 |

11.3 |

3 |

25 |

|

2018 |

11.27 |

2 |

54 |

For A to F, use the data between Yr 2006 and Yr 2015 to calculate the following:

A. The mean of the

Number of People Working on the Project.

B. The median of the Budget.

C. The range of Budget.

D. The variance (3 significant figures) of Number of

Projects.

E. The standard deviation (nearest integer) of Number of People

Working on the Project.

F. The 20% trimmed mean of Number of Projects.

G. Draw a dot plot

comparing the Number of People Working on the Project from Yr 1997

to Yr 2006 and those from Yr 2009 to Yr 2018.

H. Using the data for Annual Budget from Yr 2001 to Yr 2017, draw a double stem leaf plot, then calculate the relative frequency.

In: Economics