Questions

Suppose that a random sample of 50 bottles of a particular brand of cough syrup is...

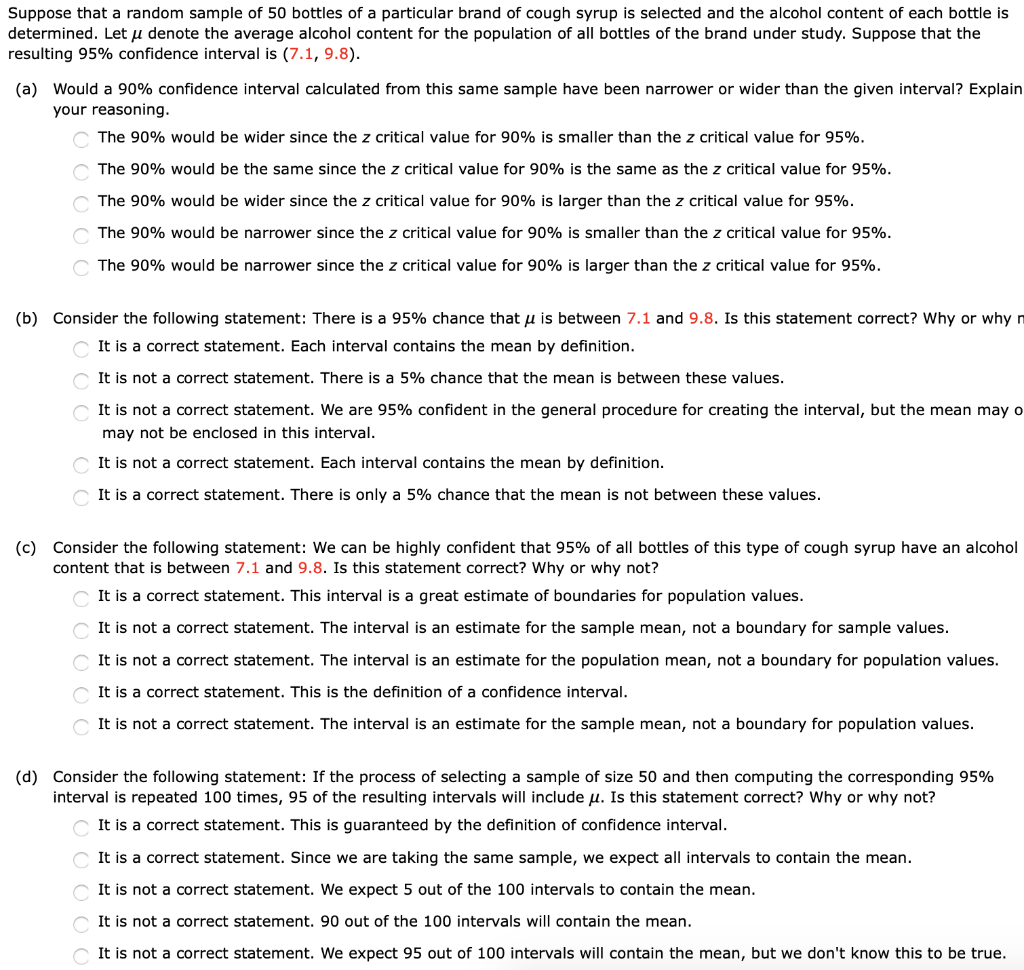

Suppose that a random sample of 50 bottles of a particular brand of cough syrup is selected and the alcohol content of each bottle is determined. Let u denote the average alcohol content for the population of all bottles of the brand under study. Suppose that the resulting 95% confidence interval is (7.1, 9.8).

(a) Would a 90% confidence interval calculated from this same sample have been narrower or wider than the given interval? Explain your reasoning.

The 90% would be wider since the z critical value for 90% is smaller than the z critical value for 95%.

The 90% would be the same since the z critical value for 90% is the same as the z critical value for 95%.

The 90% would be wider since the z critical value for 90% is larger than the z critical value for 95%.

The 90% would be narrower since the z critical value for 90% is smaller than the z critical value for 95%.

The 90% would be narrower since the z critical value for 90% is larger than the z critical value for 95%.

(b) Consider the following statement: There is a 95% chance that u is between 7.1 and 9.8. Is this statement correct?

It is a correct statement. Each interval contains the mean by definition.

It is not a correct statement. There is a 5% chance that the mean is between these values.

It is not a correct statement. We are 95% confident in the general procedure for creating the interval, but the mean mayo may not be enclosed in this interval.

It is not a correct statement. contains the mean by definition.

It is a correct statement. There is only a 5% chance that the mean is not between these values.

(c) Consider the following statement: We can be highly confident that 95% of all bottles of this type of cough syrup have an alcohol content that is between 7.1 and 9.8. Is this statement correct? Why or why not?

It is a correct statement. This interval is a great estimate of boundaries for population values.

It is not a correct statement. The interval is an estimate for the sample mean, not a boundary for sample values.

It is not a correct statement. The interval is an estimate for the population mean, not a boundary for population values.

It is a correct statement. This is the definition of a confidence interval.

It is not a correct statement. The interval is an estimate for the sample mean, not a boundary for population values.

(d) Consider the following statement: If the process of selecting a sample of size 50 and then computing the corresponding 95% interval is repeated 100 times, 95 of the resulting intervals will include u. Is this statement correct? Why or why not?

It is a correct statement. This is guaranteed by the definition of confidence interval.

It is a correct statement. Since we are taking the same sample, we expect all intervals to contain the mean.

It is not a correct statement. We expect 5 out of the 100 intervals to contain the mean.

It is not a correct statement. 90 out of the 100 intervals will contain the mean.

It is not a correct statement. We expect 95 out of 100 intervals will contain the mean, but we don't know this to be true.

In: Math

Modernization of NTUC Income Sources: Melanie Liew, Computerworld, July 2004; “NTUC Income of Singapore Successfully Implemented...

Modernization of NTUC Income

Sources: Melanie Liew, Computerworld, July 2004; “NTUC Income of Singapore Successfully Implemented eBaoTech Lifesystem,” ebaotech.com, accessed November 2008; Neerja Sethi & D G Allampallai, “NTUC Income of Singapore (A): Re-architecting Legacy Systems,” asiacase.com, October 2005

NTUC Income (“Income”), one of Singapore’s largest insurers, has over 1.8 million policy holders with total assets of S$21.3 billion. The insurer employs about 3,400 insurance advisors and 1,200 office staff, with the majority located across an eight-branch network. On June 1, 2003, Income succeeded in the migration of its legacy insurance systems to a digital webbased system. The Herculean task required not only the upgrading of hardware and applications, it also required Income to streamline its decade-old business processes and IT practices.

Until a few years ago, Income’s insurance processes were very tedious and paper-based. The entire insurance process started with customers meeting an agent, filling in forms and submitting documents. The agent would then submit the forms at branches, from where they were sent by couriers to the Office Services department. The collection schedule could introduce delays of two to three days. Office Services would log documents, sort them, and then send them to departments for underwriting. Proposals were allocated to underwriting staff, mostly at random. Accepted proposals were sent for printing at the Computer Services department and then redistributed. For storage, all original documents were packed and sent to warehouses where, over two to three days, a total of seven staff would log and store the documents. In all, paper policies comprising 45 million documents were stored in over 16,000 cartons at three warehouses. Whenever a document needed to be retrieved, it would take about two days to locate and ship it by courier. Refiling would again take about two days.

In 2002, despite periodic investments to upgrade the HP 3000 mainframe that hosted the core insurance applications as well as the accounting and management information systems, it still frequently broke down. When a system breakdown did occur, work had to be stopped while data was restored. Additionally, the HP 3000 backup system could only restore the data to the version from the previous day. This meant that backups had to be performed at the end of every day in a costly and tedious process, or the company would risk losing important data. In one of the hardware crashes, it took several months to recover the lost data. In all, the HP 3000 system experienced a total of three major hardware failures, resulting in a total of six days of complete downtime.

That was not enough. The COBOL programs that were developed in the early 1980s and maintained by Income’s in-house IT team also broke multiple times, halted the systems, and caused temporary interruptions. In addition, the IT team found developing new products in COBOL to be quite cumbersome and the time taken to launch new products ranged from a few weeks to months.

At the same time, transaction processing for policy underwriting was still a batch process and information was not available to agents and advisors in real-time. As a result, when staff processed a new customer application for motor insurance, they did not know if the applicant was an existing customer of Income, which led to the loss of opportunities for cross-product sales, as staff had to pass physical documents between each other and there was no means of viewing an up-to-date report on a customer’s history on demand. Furthermore, compatibility issues between the HP 3000 and employees’ notebooks caused ongoing problems, especially with a rise in telecommuting.

All this changed in June 2003, when Income switched to the Java based eBao LifeSystem from eBao Technology. The software comprised three subsystems - Policy Administration, Sales Management and Supplementary Resources — and fulfilled many of the company’s requirements, from customerorientated design to barcode technology capabilities, and the ability to support changes in business processes.

Implementation work started in September 2002 and the project was completed in nine months. By May 2003, all the customization, data migration of Income’s individual and group life insurance businesses and training were completed.

The new system was immediately operational on a high-availability platform. All applications resided on two or more servers, each connected by two or more communication lines, all of which were “load balanced.” This robust architecture minimized downtime occurrence due to hardware or operating system failures.

As part of eBao implementation, Income decided to replace its entire IT infrastructure with a more robust, scalable architecture. For example, all servicing branches were equipped with scanners; monitors were changed to 20 inches; PC RAM size was upgraded to 128 MB; and new hardware and software for application servers, database servers, web servers, and disk storage systems were installed. Furthermore, the LAN cables were replaced with faster cables, a fibre-optic backbone, and wireless capability.

In addition, Income also revamped its business continuity and disaster-recovery plans. A real-time hot backup disaster-recovery center was implemented, where the machines were always running and fully operational. Data was transmitted immediately on the fly from the primary datacentre to the backup machines’ data storage. In the event of the datacentre site becoming unavailable, the operations could be switched quickly to the disaster recovery site without the need to rely on restoration of previous day data.

Moving to a paperless environment, however, was not easy. Income had to throw away all paper records, including legal paper documents. Under the new system, all documents were scanned and stored on “trusted” storage devices - secured, reliable digital vaults that enabled strict compliance with stringent statutory requirements. Income had to train employees who had been accustomed to working with paper to use the eBao system and change the way they worked.

As a result of adopting eBao Life System, about 500 office staff and 3,400 insurance advisors could access the system anytime, anywhere. Staff members who would telecommute enjoyed faster access to information, almost as fast as those who accessed the information in the office.

This allowed Income to view a summary of each customer over different products and business areas. As a result, cross-selling became easier, and customer service could be improved. Simplified workflows cut policy processing time and cost by half, and greatly reduced the time required to design and launch new products from months to days.

Additionally, the systems allowed for online support of customers, agents and brokers.

CASE STUDY QUESTIONS

1. What were the problems faced by Income in this case? How were the problems resolved by the new digital system?

2. What types of information systems and business processes were used by Income before migrating to the fully digital system?

3. Describe the Information systems and IT infrastructure at Income after migrating to the fully digital system?

4. What benefits did Income reap from the new system?

5. How well is Income prepared for the future? Are the problems described in the case likely to be repeated?

In: Economics

In 2004, one county reported that among 3116 white women who had babies, 139 were multiple...

In 2004, one county reported that among 3116 white women who had babies, 139 were multiple births. There were also 23 multiple births to 607 black women. Does this indicate any racial difference in the likelihood of multiple births? a) Test an appropriate hypothesis and state your conclusion. b) If your conclusion is incorrect, which type of error did you commit? a) Let p1 be the proportion of multiple births for white women and p2 be the proportion of multiple births for black women. Choose the correct null and alternative hypotheses below.

In: Statistics and Probability

Please type your answer, thank you. Google became a publicly-traded company in August 2004. Initially, the...

Please type your answer, thank you.

Google became a publicly-traded company in August 2004. Initially, the stock traded over 10 million shares each day! Since the initial offering, the volume of stock traded daily has decreased substantially. In 2010, the mean daily volume in Google stock was 5.44 million shares, according to Yahoo! Finance. A random sample of 35 trading days in 2014 resulted in a sample mean of 3.28 million shares with a standard deviation of 1.68 million shares. Does the evidence suggest that the volume of Google stock has changed since 2007? Use a 0.05 level of significance.

- State the null and alternative hypotheses.

- What type of hypothesis test is to be used?

- What distribution should be used and why?

- Is this a right, left, or two-tailed test?

- Compute the test statistic.

- Compute the p-value.

- Do you reject or not reject the null hypothesis? Explain why.

- What do you conclude?

In: Statistics and Probability

When Air Canada emerged from bankruptcy protection in 2004, its top management decided to replace some...

- When Air Canada emerged from bankruptcy protection in 2004, its top management decided to replace some of its older planes with new ones. In particular, several relatively small Embraer and Bombardier planes (with fewer than 90 seats) and several large Boeing 777 and 787 (with more than 200 seats) were ordered. These are much fuel efficient than the planes they replace.

However, Air Canada operations are still not as low as WestJet’s. An available Seat Mile costs Air Canada 16-17¢ whereas it costs WestJet 11-12¢. Recall that WestJet is non-unionized, runs only one type of plane (Boeing 737 which seats 100-150 passengers), and is financially stronger.

- Discuss five pros and cons of Air Canada’s decision.

- Identify five current trends in operation management and discuss how Air Canada can use them to improve their operations.

In: Operations Management

Wal-Mart is the second-largest retailer in the world. The data file (Wal-Mart Revenue 2004-2009 data.xlsx) is...

Wal-Mart is the second-largest retailer in the world. The data file (Wal-Mart Revenue 2004-2009 data.xlsx) is posted below the case study two file, and it holds monthly data on Wal-Mart’s revenue, along with several possibly related economic variables.

- Develop a multiple linear regression model to predict Wal-Mart's revenue, using CPI, Personal Consumption, and Retail Sales Index as the independent variables. You also need to create residual plots and scatter plots by selecting residual plots box and line fit plots box under “Residuals”. Note: Those plots are for the individual independent variables.

- To generate the residual plot for the entire model, you need to follow the instruction below. Check the Residuals box under “Residuals” and Excel will generate predicted values and residuals at the bottom of the output for the multiple regression model. Then, highlight these two output values to create the residual plot by Excel’s scatter chart (Insert tab > Charts > Scatter chart). Comment on what you see on the plot. Note: This residual plot is for the entire model.

- Does it seem that Wal-Mart’s revenue is closely related to the general state of the economy? Use all the plots and statistical criteria on the Regression Analysis output generated by Excel to explain it.

Identify and delete those five cases (rows) corresponding to December revenue. Then, use the new data set (without the December data) to complete the following problems.

- Develop a multiple linear regression model to predict Wal-Mart's revenue, using CPI, Personal Consumption, and Retail Sales Index as the independent variables. You also need to create residual plots and scatter plots by selecting residual plots box and line fit plots box under “Residuals”. Note: Those plots are for the individual independent variables.

- Check the Residuals box under “Residuals” and Excel will generate predicted values and residuals at the bottom of the output for the multiple regression model. Then, highlight these two output values to create the residual plot by Excel’s scatter chart (Insert tab > Charts > Scatter chart). Comment on what you see on the plot. Note: This residual plot is for the entire model.

- Does it seem that Wal-Mart’s revenue is closely related to the general state of the economy? Use all the plots and statistical criteria on the Regression Analysis output generated by Excel to explain it.

- Compare these two multiple regression models, and decide which of these two models is better? Use R-square values, adjusted R-square values, Significance F values, p-values, scatter plots and residual plots to explain your answer.

In: Statistics and Probability

Bernard Haldane Associates conducted a survey in March 2004 of 1021 workers who held white-collar jobs...

Bernard Haldane Associates conducted a survey in March 2004 of 1021 workers who held white-collar jobs but who had changed jobs in the previous twelve months. Of these workers, 56% of the men and 35% of the women were paid more in their new positions when they changed jobs. Suppose that these percentages are based on random samples of 510 men and 511 women white-collar workers.

- Construct a 95% confidence interval for the difference between the two population proportions.

__________________

- Using the 2% significance level, can you conclude that the two population proportions are different? Use the p-value approach.

In: Math

High school seniors with strong academic records apply to the nation's most selective colleges in greater...

High school seniors with strong academic records apply to the nation's most selective colleges in greater numbers each year. Because the number of slots remains relatively stable, some colleges reject more early applicants. Suppose that for a recent admissions class, an Ivy League college received 2851 applications for early admission. Of this group, it admitted 1033 students early, rejected 854 outright, and deferred 964 to the regular admission pool for further consideration. In the past, this school has admitted 18% of the deferred early admisiion applicants during the regular admission process. Counting the students admitted early and the students admitted during the regular admission process, the total class size was 2375. Let E, R, and D represent the events that a student who applies for early admissions is admitted early, rejected outright, or deferred to the regular admissions pool. A) Use data to estimate P(E), P(R), and P(D). B) Are events E and D mutually exclusive? Find P(EUD). C) For the 2375 students who were admitted, what is the probability that a randomly selected student was accepted during early admission? D) SUppose a student applies for early admission. What is the probability that the students will be admitted for early admission or be deferred and later admitted during the regular admission process?

In: Statistics and Probability

An education researcher claims that stipends for PhD students have increased from one academic year to...

An education researcher claims that stipends for PhD students have increased from one academic year to the next. The table shows the PhD stipends (in dollars per year) for seven randomly chosen, different fields of study at various institutions in two consecutive years. Assume the populations are normally distributed. At α=0.05 , is there enough evidence to support the education researcher’s claim? Place commas between the 7 answers for parts a. and b. Field of Study 1 2 3 4 5 6 7 Stipend (First Year) 30,600 29,658 15,200 26,233 11,900 33,000 33,590 Stipend (Second Year) 32,850 30,770 19,800 27,100 11,000 33,000 30,312 d 〖b.) d〗^2 c.) Verify that the samples taken are random _____ and dependent._____ and that the populations are known to be normally distributed or n > 30. _____ Identify H_(0∶ _______________) and H_a: ____________ Find the mean of the differences, d ̅ and ∑▒d^2 . Place commas between the three answers. ∑▒d= __________________〖_〗d ̅ = (∑▒d)/n = _______________ ∑▒d^2 = _____________ Find the standard deviation of the diffe rences: s_d= √((∑▒〖〖d 〗^2- (∑▒d)^2/n〗)/n) Find the standardized test statistic, t. t = (d ̅- μ_d)/(s_d⁄√n) Find the number of degrees of freedom: d.f. = n - 1 For α=0.05, use Table 5 to identify t and find and shade the rejection region. Determine whether to reject or fail to reject H_(0 ). Interpret this decision in the context of the original claim.

In: Statistics and Probability

Ricardo and Malthus were two economists in the early 19th Century, who participated in academic discussions...

Ricardo and Malthus were two economists in the early 19th Century, who participated in academic discussions on various subjects. One subject they disagreed on was, the most likely way, the profit rate may go down in a capitalist economy, which would potentially end the growth of the output level within the system. According to Ricardo, the profit squeeze is the most likely way. For Malthus, growth rates are likely to go down because of a demand shortage. How do Ricardo and Malthus describe their views? Compare Ricardian and Malthusian Models described above. Do you think one of these two potential problems, mentioned by Ricardo and Malthus is more critical than the other? Do you think both are critical, or none of them is critical? Explain your answer.

In: Economics