Questions

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement,...

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement, up to six months after services commence. Alsup recognizes service revenue for financial reporting purposes when the services are performed. For tax purposes, revenue is reported when fees are collected. Service revenue, collections, and pretax accounting income for 2015–2018 are as follows:

| Service Revenue | Collections |

Pretax Accounting Income |

|||||||

| 2015 | $ | 624,000 | $ | 599,000 | $ | 160,000 | |||

| 2016 | 720,000 | 730,000 | 225,000 | ||||||

| 2017 | 685,000 | 660,000 | 195,000 | ||||||

| 2018 | 670,000 | 690,000 | 175,000 | ||||||

|

There are no differences between accounting income and taxable income other than the temporary difference described above. The enacted tax rate for each year is 40%. |

|

(Hint: You may find it helpful to prepare a schedule that shows the balances in service revenue receivable at December 31, 2015–2018.) |

| Required: |

| 1. |

Prepare the appropriate journal entry to record Alsup's 2016 income taxes, Alsup’s 2017 income taxes and Alsup’s 2018 income taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands.) |

In: Accounting

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement,...

Alsup Consulting sometimes performs services for which it

receives payment at the conclusion of the engagement, up to six

months after services commence. Alsup recognizes service revenue

for financial reporting purposes when the services are performed.

For tax purposes, revenue is reported when fees are collected.

Service revenue, collections, and pretax accounting income for

2017–2020 are as follows:

| Service Revenue | Collections | Pretax Accounting Income |

|||||||

| 2017 | $ | 687,000 | $ | 662,000 | $ | 230,000 | |||

| 2018 | 790,000 | 795,000 | 295,000 | ||||||

| 2019 | 755,000 | 725,000 | 265,000 | ||||||

| 2020 | 740,000 | 760,000 | 245,000 | ||||||

There are no differences between accounting income and taxable

income other than the temporary difference described above. The

enacted tax rate for each year is 40%.

(Hint: You may find it helpful to prepare a schedule that shows the

balances in service revenue receivable at December 31,

2017–2020.)

Required:

1. Prepare the appropriate journal entry to record

Alsup's 2018 income taxes, Alsup’s 2019 income taxes and Alsup’s

2020 income taxes. (If no entry is required for a

transaction/event, select "No journal entry required" in the first

account field. Enter your answers in thousands.)

In: Accounting

Carlisle State College had the following account balances for the year ended and as of June...

Carlisle State College had the following account balances for the year ended and as of June 30, 2018. Debits are not distinguished from credits, so assume all accounts have a “normal” balance.

| Additions to permanent endowments | 400,000 |

| Auxiliary enterprise revenue | 4,200,000 |

| Capital grants and gifts | 300,000 |

| Depreciation expense | 1,400,000 |

| Employee Benefits | 1,975,000 |

| Federal grants and contracts revenue | 2,000,000 |

| Gifts | 700,000 |

| Interest on capital-related debt | 450,000 |

| Investment income | 220,000 |

| Net position, beginning of year | 11,450,000 |

| Nonexempt wages | 1,500,000 |

| Other operating expenses | 900,000 |

| Salaries-exempt staff | 2,300,000 |

| Salaries-faculty | 6,500,000 |

| Scholarship tuition and fee contra revenue | 300,000 |

| Scholarships and fellowships expense | 315,000 |

| State and local grants and contracts revenue | 900,000 |

| State appropriation for operations | 4,970,000 |

| State appropriations for capital additions | 250,000 |

| Student tuition and fee revenue | 8,450,000 |

Required

Prepare, in good form, a Statement of Revenues, Expenses, and Changes in Net Position for Carlisle State College for the year ended June 30, 2017.

PLEASE DO IN EXCELL AND START WITH OPERATING REVENUES.

In: Accounting

From the following models - subscriptions (usually all you can eat), a la carte (pay for...

From the following models - subscriptions (usually all you can eat), a la carte (pay for what you use) and “freemium” (uses advertising revenue to provide content for free), make TWO recommendations on ways to start generating more revenue via the eCommerce website.

In: Operations Management

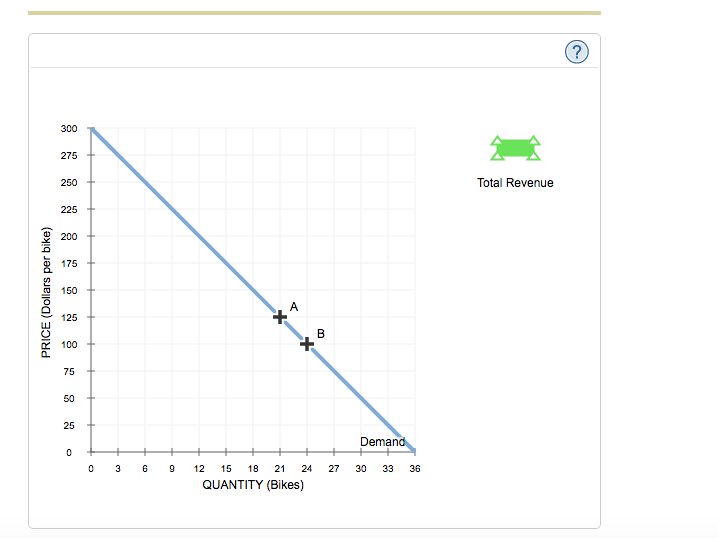

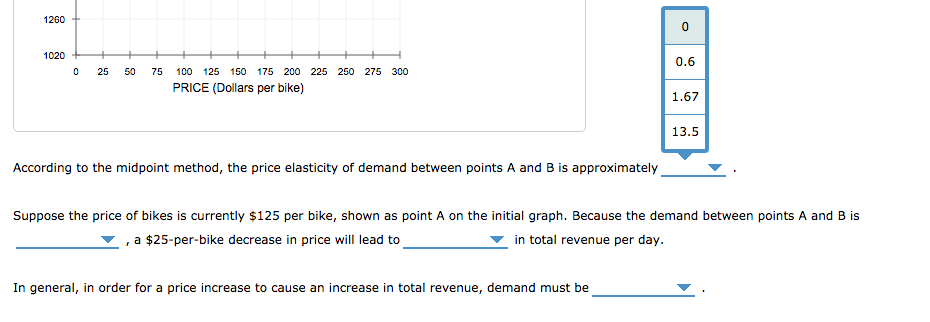

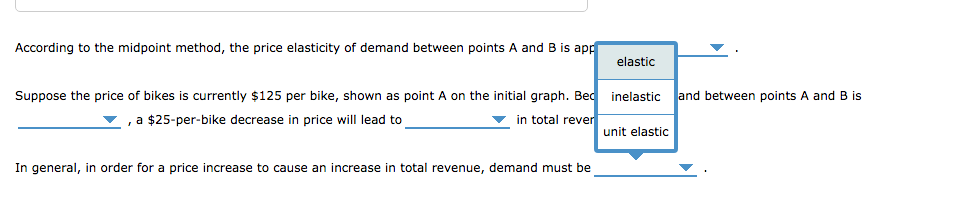

Use the green rectangle (triangle symbols) to compute total revenue at various prices along the demand curve.

6. Elasticity and total revenue

The following graph shows the daily demand curve for bikes in San Diego.

Use the green rectangle (triangle symbols) to compute total revenue at various prices along the demand curve.

Note: You will not be graded on any changes made to this graph.

In: Economics

Units Demanded: Q = 500-40P Total Cost = 300 + Q Price Per Unit = 6...

Units Demanded: Q = 500-40P Total Cost = 300 + Q Price Per Unit = 6 Find: Q, Revenue, and Profit Negative Externality Unit Cost = 2 Recalculate Revenue and Profit if Costs are Internalized and i) passed on to consumers, or they are ii) absorbed by the firm.

In: Finance

1.Discuss what was viewed as the major criticisms of Generally Accepted Accounting Principles as it relates...

1.Discuss what was viewed as the major criticisms of Generally Accepted Accounting Principles as it relates to Revenue Recognition. In addition, identify the five steps in the revenue recognition process.

2. Discuss how companies satisfy a performance obligation? In addition, identify the indicators of satisfaction of a performance obligation.

In: Accounting

If demand for the price searching-firm (e.g. monopoly) is q=20-p and total cost is 2+4q^2. A)Compute...

If demand for the price searching-firm (e.g. monopoly) is q=20-p

and total cost is 2+4q^2.

A)Compute the marginal revenue function. To check it what is

marginal revenue from selling 4 units of output?

B)What is the profit for this price searching firm?

In: Economics

Auditing - Fraud through Misappropriation of Assets or Fraudulent financial reporting State one type of fraud...

Auditing - Fraud through Misappropriation of Assets or Fraudulent financial reporting

State one type of fraud that can occur for the accuracy objective of provision for warranty (liability account)

State one type of fraud that can occur for the sales occurrence objective of sales revenue (revenue account)

In: Accounting

1. What would the regression output (analysis) look like using this multiple regression equation and the...

1. What would the regression output (analysis) look like using this multiple regression equation and the following data?

Daily Gross Revenue= total daily income+b1*daily tour income+b2*number of tourists+b3*Friday+b4*Saturday

2. What's the multiple regression equation with the numbers from the output?

| Years | Weekend | Daily Tour Income | Number of Tourists | Daily Gross Revenue | Total Daily Income |

| 1 | Friday | 3378 | 432 | 4838.95 | 8216.95 |

| 1 | Saturday | 1198 | 139 | 3487.78 | 4685.78 |

| 1 | Sunday | 3630 | 467 | 4371.3 | 8001.3 |

| 2 | Friday | 4550 | 546 | 6486.48 | 11036.48 |

| 2 | Saturday | 2467 | 198 | 3437.39 | 5904.39 |

| 2 | Sunday | 3593 | 452 | 4571.43 | 8164.43 |

| 3 | Friday | 898 | 119 | 2515.15 | 3413.15 |

| 3 | Saturday | 2812 | 342 | 5462.11 | 8274.11 |

| 3 | Saturday | 2650 | 321 | 5498.89 | 8148.89 |

| 4 | Friday | 3230 | 402 | 5071.14 | 8301.14 |

| 4 | Saturday | 4798 | 523 | 8051.43 | 12849.43 |

| 4 | Sunday | 3253 | 353 | 4291.95 | 7544.95 |

| 5 | Friday | 2848 | 347 | 4545 | 7393 |

| 5 | Saturday | 4632 | 534 | 8865.01 | 13497.01 |

| 5 | Sunday | 3767 | 412 | 4710.64 | 8477.64 |

| 6 | Friday | 4499 | 529 | 10752.74 | 15251.74 |

| 6 | Saturday | 3868 | 422 | 6435.63 | 10303.63 |

| 6 | Sunday | 2489 | 288 | 3389.37 | 5878.37 |

| 7 | Friday | 3448 | 367 | 6129.58 | 9577.58 |

| 7 | Saturday | 3612 | 406 | 7357.12 | 10969.12 |

| 7 | Sunday | 1937 | 216 | 2121.76 | 4058.76 |

| 8 | Friday | 2548 | 294 | 4738.86 | 7286.86 |

| 8 | Saturday | 2833 | 317 | 4141.98 | 6974.98 |

| 8 | Sunday | 2214 | 284 | 4878.35 | 7092.35 |

| 9 | Friday | 1520 | 169 | 4102.49 | 5622.49 |

| 9 | Saturday | 4322 | 462 | 8639.55 | 12961.55 |

| 9 | Sunday | 1833 | 203 | 3946.71 | 5779.71 |

| 10 | Friday | 2271.63 | 235 | 4236.31 | 6507.94 |

| 10 | Saturday | 2407.88 | 266 | 5613.27 | 8021.15 |

| 10 | Sunday | 1772.17 | 182 | 5580.17 | 7352.34 |

| 11 | Friday | 1494 | 177 | 3833.52 | 5327.52 |

| 11 | Saturday | 1998 | 213 | 3986.57 | 5984.57 |

| 11 | Sunday | 1388 | 165 | 2721.56 | 4109.56 |

| 12 | Friday | 1925 | 190 | 3952.19 | 5877.19 |

| 12 | Saturday | 2695 | 243 | 6281.3 | 8976.3 |

| 12 | Sunday | 1525 | 172 | 3356.14 | 4881.14 |

| 13 | Friday | 1725 | 187 | 3822.59 | 5547.59 |

| 13 | Saturday | 2450 | 253 | 4141.75 | 6591.75 |

| 13 | Sunday | 1407.5 | 173 | 3312.41 | 4719.91 |

| 14 | Friday | 2394 | 242 | 4571.5 | 6965.5 |

| 14 | Saturday | 3012 | 311 | 6363.3 | 9375.3 |

| 14 | Sunday | 2058 | 239 | 3502.22 | 5560.22 |

| 15 | Friday | 2427 | 267 | 5881.13 | 8308.13 |

| 15 | Saturday | 3189 | 336 | 10409.13 | 13598.13 |

| 15 | Sunday | 2109 | 178 | 4955.05 | 7064.05 |

| 16 | Friday | 2244 | 184 | 4347.41 | 6591.41 |

| 16 | Saturday | 3195 | 274 | 4935.17 | 8130.17 |

| 16 | Sunday | 1017 | 114 | 3486.27 | 4503.27 |

| 17 | Friday | 3470 | 325 | 6290.99 | 9760.99 |

| 17 | Saturday | 5323 | 478 | 13132.55 | 18455.55 |

| 17 | Sunday | 2345 | 242 | 5014.45 | 7359.45 |

| 18 | Friday | 1671 | 177 | 2740.23 | 4411.23 |

| 18 | Saturday | 2321.94 | 246 | 4423.31 | 6745.25 |

| 18 | Sunday | 1542 | 182 | 2650.48 | 4192.48 |

In: Statistics and Probability