Questions

According to a particular marketing corporation, the per capita consumption of bottled water is 3.8 gallons...

According to a particular marketing corporation, the per capita consumption of bottled water is 3.8 gallons per month. Assume the standard deviation for this population is 0.85 gallons per month. Consider a random sample of 36 people.

a. What is the probability that the sample mean will be less than 3.6 gallons per month?

b. What is the probability that the sample mean will be more than 4.1 gallons per month?

c. Identify the symmetrical interval that includes 83% of the sample means if the true population mean is 3.8 gallons per month.

In: Statistics and Probability

Greenlands, Inc. began the year with three units of finished goods inventory that cost $6 each...

Greenlands, Inc. began the year with three units of finished goods inventory that cost $6 each to manufacture. Greenlands also established a $6 per unit standard product cost for the upcoming accounting period. The company actually incurred unit costs of $4 for direct materials, $2 for direct labor, and $1 for factory overhead for the ten units it produced in the current period. Greenlands sold 11 units at $10 each during the accounting period. The firm accounted for inventory on a first-in, first-out (FIFO) basis.

Required: Compute Greenlands’ cost of goods manufactured, cost of goods sold, and gross profit.

Cost of Goods Manufactured

|

Direct materials |

|

|

+ direct labor |

|

|

+ factory overhead |

|

|

Cost of goods manufactured |

Cost of Goods Sold

|

Beginning inventory of finished goods |

|

|

+ Cost of goods manufactured |

|

|

Finished goods available for sale |

|

|

- Ending inventory of finished goods |

|

|

Cost of goods sold |

Income Statement

|

Sales revenue |

|

|

Cost of goods sold |

|

|

Gross profit |

Balance Sheet

|

Finished goods inventory |

In: Accounting

The Jarrad Corporation's management team is getting ready to prepare its master budget for one its...

The Jarrad Corporation's management team is getting ready to prepare its master budget for one its product lines for the year 2019. The company produces caramel lollipops which are basically cooked down sugar on a stick, a diabetics nightmare along with many other sweet treats.

Budgeted sales of the lollipops for each quarter of 2019 are as follows:

1st Quarter-12,500 cases , 2nd Quarter-14,000 cases , 3rd Quarter-25,500 cases , 4th Quarter-34,900 cases

There are 100 lollipops in a case and each sells for $200. Jarrad is budgeting a 5% sales price increase effective July 1,2019

The 4th Quarter 2018 sales have been budgeted at 32,000 cases and Jarrad wants to have an ending inventory carried over into 2019 of 2,000 cases.

At the end of 2019 they desire an ending inventory of 2,250 cases. Each quarter an additional 10% of that quarter's sales is to be produced as an ending inventoy to be carried over into the following quarter.

Budget amount of sales revenue for 2019:

1st Quarter $2,500,000 , 2nd Quarter $2,800,000 , 3rd Quarter $5,100,000 , 4th Quarter $6,980,000

Budget sales for 2019: $17,380,000

Cases of lollipop produced in 2019:

1st Quarter $1,175,000 , 2nd Quarter $1,415,000 , 3rd Quarter $2,665,000 , 4th Quarter $3,460,000

Budget cost of the sugar which is required to produce the total number of lollipops to be produced in 2019: $3,486,000

Budget cost of the chocolate which is required to produce the total number of lollipops budgeted in 2019: $305,025

Budget cost of the lollipop sticks which are required to produce the lollipop in 2019: $261,450

Budget direct labor hours required to produce the total number of cases of lollipops for 2019: $21,787.50

Budget direct labor cost for 2019: $239,662.50

Manufacturing Overhead Costs:

Budget amount of machine-maintenance and operational cost for 2019: $39,375

The other budgeted overhead costs include

Supervisors salaries are $40,000 per quarter (there are 2 plant supervisors)

Insurance on the factory-$22,700 annually

Rent on the warehouse-$2,000 per month

Quality Control Inspections-$5 per each case produced

Depreciation of factory equipment=$6,000 per year

Janitorial and Maintenance staff wages are budgeted at $15,000 per quarter

Total budget overhead cost for 2019: $44,047,075

Total budget manufacturing cost for the units to be produced in 2019: $48,339,212.50

Budget cost per unit to be produced: $5.55

Budget cost of goods to be sold in 2019: $4,695,162.5

Selling and Administrative Expenses:

Sales Salaries are budgeted at $50,000 per quarter

Sales Commissions are budgeted at 7% of sales

Advertising is budgeted at 5% of sales

Officers and Administrative Salaries are budgeted at $110,000 per quarter

Rent on the corporate and sales offices is $2,700 per month

Depreciation on selling and office furniture and equipment=$4,200 per year

Other corporate expenses are budgeted at $7,500 per quarter

Other Nonoperating Income, Expenses, Gains and Losses:

Jarrad has an outstanding banl loan of $500,000 and it pays 8% interest each year with the principal coming due in 2020.

Jarrad is planning to replace some outdated equipment which has an estimated residual value of $32,000 in 2019. Another cpompany has offered to purchase it for $45,000 in March after all depreciation will have been taken.

Jarrad budgets income taxes based on its income before taxes at the rate of 35%.

Budget selling and administrative expenses of 2019: $2,791,600

Budget Income from Operations for the Jarrad Corporation for 2019: $10,493,237

Jarrad forescasted 13,700 cases of lollipop to be sold in the 4th quarter of 2018 at $185 per case. All of its sales are on account with 75% collected in the same quarter the sales are made and the other 25% in the following quarter.

-Question : Based on this how much cash will be collected from customers in

1st Quarter 2019? .................................

2nd Quarter 2019?..................................

3rd Quarter 2019?..................................

4th Quarter 2019?.................................

Question: Total cash collections from Customers in 2019?...................................

The materials are all purchased on account and 80% of the purchases are paid for in the quarter they are made, with 20% being paid in the following quarter. The accounts payable forecasted for 12-31-18 is $109,500.

-Question: Based on this how much cash is to be paid out for costs and expenses in 2019? Assume all of the labor, overhead (excluding depreciation) and selling and administrative expenses (excluding depreciation) are paid during 2019. 75% of the budgeted income taxes for 2019 will be paid in 2019 in April, August and December and $112,000 of income taxes remaining from 2018 are to be paid when the 2018 corporate tax return in filed in March 2019.

$.....................................................................

Jarrad is plannning to have a $80,000 cash balance at the beginning 2019 and should its cash balance fall bellow $50,000 at any time during 2019, it has a bank line of credit which it can borrow on to restore the balance to the minimum $50,000. In the 3rd quarter old equipment is budgeted for replacement at a cost of $275,000. The company is also planning to acquire real estate for use as a factory, warehouse and office facility. The property is 9,100 square feet and a pending offer of $5,250,000 has been made. A cash down payment of 40% of the purchase price will be made during June. Interest only payments on the borrowed funds (60%) will be made on a monthly basis beginning 8-1-19 at an annual rate of 6.5%.

-Question: Based on the info above, what is the budgeted amount of cash to be on hand at the end of the 1st quarter of 2019? If borrowing on the line of credit is required the interest rate is 3% per quarter until the funds are repaid? $...........................................................

-Question: Based on the above info, what is the budgeted about of cash on hand at the end of the year 2019?..................

-Question: What will be the budgeted Non-Operating Income for Jarrad Corporation for 2019?......................

-Question: What will be the budgeted Income after taxes for the Jarrad Corporation for 2019?......................

In: Accounting

I am wondering however, how you feel about 'knowing' there were a large number of resistors....

I am wondering however, how you feel about 'knowing' there were a large number of resistors. Typical distribution does not have a huge percentage of people falling under the resistors grouping, and most people are actually found in the neutral grouping. Does this not mean that the majority of people should be able to be moved across quadrants, and if so then should we not attempt to save as many as possible? Not saying that Bob does not need to have a strategy towards his change management but don't we have some ethical and social responsibility to attempt to rehabilitate when the change is always a need for the business and not the employees?

Don't we need to at least consider the physiological contracts that the business has written with these employees? This contracts were not written one sided, they were mutually written over time.

In: Operations Management

Analysis of the 4 Ps of the Marketing Mix based on Shoe Carnival, Inc. a. Product:...

Analysis of the 4 Ps of the Marketing Mix based on Shoe Carnival, Inc.

a. Product: i. List the company’s primary products or product lines (if there are numerous products falling into many product categories).ii. From which product line, or lines of business, does the company generate most of its revenue? Describe the primary target market of the business. What is the value proposition that the company offers this target market?

b. Price: What is the price (or price range) of the company’s products or product lines? State by product or product line.

c. Placement: What is the, apparent, placement (distribution) strategy for the products or product lines?

d. Promotion: How does the company promote its product or product line? How does it communicate with its customers?i. Describe the promotion mix.

In: Operations Management

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of...

|

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. |

|

Since you are well trained in budgeting, you have decided to prepare comprehensive budgets for the upcoming second quarter in order to show management the benefits that can be gained from an integrated budgeting program. To this end, you have worked with accounting and other areas to gather the information assembled below. |

|

The company sells many styles of earrings, but all are sold for the same price—$14 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings): |

| January (actual) | 20,900 | June (budget) | 50,900 |

| February (actual) | 26,900 | July (budget) | 30,900 |

| March (actual) | 40,900 | August (budget) | 28,900 |

| April (budget) | 65,900 | September (budget) | 25,900 |

| May (budget) | 100,900 | ||

|

The concentration of sales before and during May is due to Mother's Day. Sufficient inventory should be on hand at the end of each month to supply 30% of the earrings sold in the following month. |

|

Suppliers are paid $8 for a pair of earrings. One-half of a month's purchases is paid for in the month of purchase; the other half is paid for in the following month. All sales are on credit, with no discount, and payable within 15 days. The company has found, however, that only 20% of a month's sales are collected in the month of sale. An additional 60% is collected in the following month, and the remaining 20% is collected in the second month following sale. Bad debts have been negligible. |

| Monthly operating expenses for the company are given below: |

| Variable: | ||

| Sales commissions | 4 | % of sales |

| Fixed: | ||

| Advertising | $ | 199,100 |

| Rent | $ | 17,100 |

| Salaries | $ | 105,100 |

| Utilities | $ | 6,100 |

| Insurance | $ | 2,100 |

| Depreciation | $ | 13,100 |

| Insurance is paid on an annual basis, in November of each year. |

| The company plans to purchase $15,300 in new equipment during May and $39,100 in new equipment during June; both purchases will be for cash. The company declares dividends of $10,500 each quarter, payable in the first month of the following quarter. |

| A listing of the company's ledger accounts as of March 31 is given below: |

| Assets | Liabilities and Stockholders' Equity | ||||

| Cash | $ | 150,000 | Accounts payable | $ | 193,600 |

| Accounts receivable ($75,320 February sales; $458,080 March sales) |

533,400 | Dividends payable | 10,500 | ||

| Inventory | 158,160 | Capital stock | 890,000 | ||

| Prepaid insurance | 21,900 | Retained earnings | 589,000 | ||

| Property and equipment (net) | 819,640 | ||||

| Total assets | $ | 1,683,100 | Total liabilities and stockholders' equity | $ | 1,683,100 |

|

The company maintains a minimum cash balance of $30,000. All borrowing is done at the beginning of a month; any repayments are made at the end of a month. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $30,000 in cash. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Prepare a master budget for the three-month period ending June 30. Include the following detailed budgets:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

Periodic inventory by three methods; cost of goods sold

Periodic inventory by three methods; cost of goods sold

The units of an item available for sale during the year were as follows:

| Jan. 1 | Inventory | 180 | units at $108 |

| Mar. 10 | Purchase | 224 | units at $110 |

| Aug. 30 | Purchase | 200 | units at $116 |

| Dec. 12 | Purchase | 196 | units at $120 |

There are 208 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods.

| Cost of Inventory and Cost of Goods Sold | ||

| Inventory Method | Ending Inventory | Cost of Goods Sold |

| First-in, first-out (FIFO) | $ | $ |

| Last-in, first-out (LIFO) | ||

| Weighted average cost | ||

In: Accounting

VND Ltd Ltd has borrowed $400,000 from Major Bank for a five-year period with loan repayments...

VND Ltd Ltd has borrowed $400,000 from Major Bank for a five-year period with loan repayments to be made on a quarterly basis. The fixed rate interest rate on the loan is 10% p.a. with interest compounded quarterly. The total principal repaid by VND Ltd in the first quarter is closest to:

In: Finance

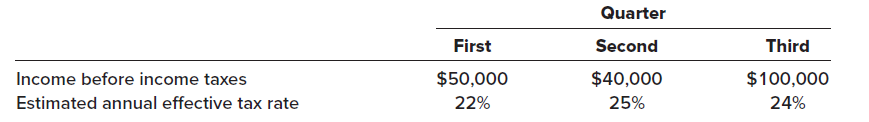

Joplin Laminating Corporation reported income before income taxes during the first three quarters

Joplin Laminating Corporation reported income before income taxes during the first three quarters, and management’s estimates of the annual effective tax rate at the end of each quarter as shown below:

Required:

Determine the income tax expense to be reported in the income statement in each of the three quarterly reports.

In: Accounting

explain why most goods/services that bring about negative externalities are overproduced in the market. in your...

explain why most goods/services that bring about negative externalities are overproduced in the market. in your explanation, include the terms "social cost" and "private cost"

In: Economics