Questions

Presented below is the trial balance of the Bonita Golf Club, Inc. as of December 31....

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||

In: Accounting

Revenue Management saves the business: the case of the National Car Rental The story: National Rental...

Revenue Management saves the business: the case of the National Car Rental

The story: National Rental Car faced disastrous possibilities.

In 1993, General Motors had considered liquidating or selling the

unprofitable business. National and their 7500 employees had just

one chance. They had to make the business profitable and prove that

the car rental business was worth saving.

National quickly brought in the help of specialists to assess the

situation, understand the business and quantify revenue potential.

Using the information gained from the evaluation, National began a

revenue management system that would centralize their capacity

management, pricing and reservations control.

The challenge: Before National began using the Revenue Management

System, it did not have the proper communication tools in place to

be able to react to the industry’s changing environment and faced

different issues

National did not pursue leisure weekend customers and remained

solely focused on the business and corporate renters who paid fixed

rates and only traveled during the week leaving most rental car

companies with large fleets of idol cars on the weekends thus

missing out on potential opportunities. National was not able to

adjust for increased or decreased car demand as It planned its car

fleet in one-year cycles as opposed to shorter cycles more often,

which led to failure in meeting changing customer demand and

tremendous number of missed opportunities. National’s pricing

strategy also was not dynamic and was often linked to competitors

pricing who were more flexible at making short-term pricing

changes.

By using revenue management system, National was able to create a

plan that would improve revenue per car, revenue per day, and

utilization levels, thus could realize and sustain revenue

improvements.

Questions:

1. Based on the above what are the problems National company had

before applying Revenue management system? (30pts)

2. What conditions of the car rental industry encourage National

company to implement revenue management practices? (35pts)

3. Using the information gained from the evaluation, how do you

think the implementation of the revenue management system solved

the problems of National and saved the company. (35 pts)

In: Operations Management

On June 15, 2021, Sanderson Construction entered into a long-term construction contract to build a baseball...

On June 15, 2021, Sanderson Construction entered into a

long-term construction contract to build a baseball stadium in

Washington, D.C., for $330 million. The expected completion date is

April 1, 2023, just in time for the 2023 baseball season. Costs

incurred and estimated costs to complete at year-end for the life

of the contract are as follows ($ in millions):

| 2021 | 2022 | 2023 | |||||||

| Costs incurred during the year | $ | 90 | $ | 70 | $ | 45 | |||

| Estimated costs to complete as of December 31 | 160 | 40 | — | ||||||

Required:

1. Compute the revenue and gross profit will

Sanderson report in its 2021, 2022, and 2023 income statements

related to this contract assuming Sanderson recognizes revenue over

time according to percentage of completion.

2. Compute the revenue and gross profit will

Sanderson report in its 2021, 2022, and 2023 income statements

related to this contract assuming this project does not qualify for

revenue recognition over time.

3. Suppose the estimated costs to complete at the

end of 2022 are $160 million instead of $40 million. Compute the

amount of revenue and gross profit or loss to be recognized in 2022

assuming Sanderson recognizes revenue over time according to

percentage of completion.

Compute the revenue and gross profit will Sanderson report in its 2021, 2022, and 2023 income statements related to this contract assuming Sanderson recognizes revenue over time according to percentage of completion. (Enter your answers in millions. Loss amounts should be indicated with a minus sign. Use percentages as calculated and rounded in the table below to arrive at your final answer.)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

Assume Nortel Networks contracted to provide a customer with Internet infrastructure for $2,450,000. The project began...

Assume Nortel Networks contracted to provide a customer with

Internet infrastructure for $2,450,000. The project began in 2018

and was completed in 2019. Data relating to the contract are

summarized below:

| 2018 | 2019 | |||||

| Costs incurred during the year | $ | 336,000 | $ | 1,870,000 | ||

| Estimated costs to complete as of 12/31 | 1,344,000 | 0 | ||||

| Billings during the year | 446,000 | 1,710,000 | ||||

| Cash collections during the year | 268,000 | 1,795,000 | ||||

Required:

1. Compute the amount of revenue and gross profit

or loss to be recognized in 2018 and 2019 assuming Nortel

recognizes revenue over time according to percentage of

completion.

2. Compute the amount of revenue and gross profit

or loss to be recognized in 2018 and 2019 assuming this project

does not qualify for revenue recognition over time.

3. Prepare a partial balance sheet to show how the

information related to this contract would be presented at the end

of 2018 assuming Nortel recognizes revenue over time according to

percentage of completion.

4. Prepare a partial balance sheet to show how the

information related to this contract would be presented at the end

of 2018 assuming this project does not qualify for revenue

recognition over time.

Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the amount of revenue and gross profit or loss to be recognized in 2018 and 2019 assuming Nortel recognizes revenue over time according to percentage of completion. (Loss amounts should be indicated with a minus sign. Use percentages as calculated and rounded in the table below to arrive at your final answer.)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % complete to date | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ss profit (loss)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

Should college athletes be paid? Explain your answer, addressing the impact on the universities, their athletic...

Should college athletes be paid? Explain your answer, addressing the impact on the universities, their athletic departments, and athletes in the revenue and non-revenue sports.(Sports Economics)

In: Economics

Footnote 9 of Microsoft’s 2017 annual report discloses how much revenue Microsoft consolidated from LinkedIn in...

Footnote 9 of Microsoft’s 2017 annual report discloses how much revenue Microsoft consolidated from LinkedIn in the year of the acquisition, fiscal year 2017. It also discloses pro-forma consolidated revenues for 2017 and 2016 had the acquisition closed seventeen months earlier, on July 1, 2015.

|

NOTE 9 — BUSINESS COMBINATIONS On December 8, 2016, we completed our acquisition of all issued and outstanding shares of LinkedIn Corporation, the world’s largest professional network on the Internet, for a total purchase price of $27.0 billion. The financial results of LinkedIn have been included in our consolidated financial statements since the date of the acquisition. Our consolidated income statement includes the following revenue and operating loss attributable to LinkedIn since the date of acquisition:

Following are the supplemental consolidated financial results of Microsoft Corporation on an unaudited pro forma basis, as if the acquisition had been consummated on July 1, 2015:

|

||||||||||||||||||||||||||||||||||||||||||||||||

By analyzing the revenue disclosures in the footnote in conjunction with the revenue reported in the income statement, we can gain quick insights into why Microsoft purchased LinkedIn. The next two Work Schedules will walk you through some basic analysis of the information disclosed in the footnote and in the financial statements themselves. The first Work Schedule asks you to gather information from the 2017 “five-year summary” and Footnote 9 to analyze what percentage of Microsoft’s 2017 revenue was generated by the newly acquired LinkedIn.

Please see the Excel file with the formula already entered to calculate percentage changes.

|

Work Schedule 1. Microsoft 2017 revenue with and without LinkedIn |

|

|

Microsoft 2017 revenue (in millions), including seven months during which it owned LinkedIn (source: income statement or 5-year summary) |

|

|

LinkedIn revenue included by Microsoft in 2017 (in millions; source: Footnote 9) |

|

|

Percentage of 2017 Microsoft revenue consisting of LinkedIn revenue (Answer as a percentage X.X%) |

|

|

Microsoft 2017 revenue (in millions), excluding LinkedIn |

|

|

Work Schedule 2. Microsoft growth rate (reported, pro-forma, organic) and LinkedIn growth rate |

||||

|

2017 (millions) |

2016 (millions) |

Growth (X.X%) |

||

|

a |

Microsoft reported revenues, which includes seven months of LinkedIn for 2017 source: income statement or 5-year summary |

|||

|

b |

Microsoft pro-forma revenues, including twelve months of LinkedIn source: Footnote 9 |

|||

|

c |

Microsoft revenues excluding LinkedIn 2017 source: last line of Schedule 1 above 2016 source: income statement or 5-year summary |

|||

|

d |

Twelve-month LinkedIn revenue calculation: b minus c |

|||

4a Insert your answer from Work Schedule 1 here.

|

LinkedIn revenue included by Microsoft in 2017 (in millions; source: Footnote 9) |

|

4b. Insert your answer from Work Schedule 2 here. |

2017 |

|

Twelve-month LinkedIn revenue calculation: b minus c |

4c. Explain why your answers in 4a and 4b are different.

In: Accounting

Determine the payback period using the accumulated and average cash flows approaches.

Baird Company has an opportunity to purchase a forklift to use in its heavy equipment rental business. The forklift would be leased on an annual basis during its first two years of operation. Thereafter, it would be leased to the general public on demand. Baird would sell it at the end of the fifth year of its useful life. The expected cash inflows and outflows follow:

| Year | Nature of Item | Cash Inflow | Cash Outflow | |||||

| Year 1 | Purchase price | $ | 79,800 | |||||

| Year 1 | Revenue | $ | 31,000 | |||||

| Year 2 | Revenue | 31,000 | ||||||

| Year 3 | Revenue | 26,000 | ||||||

| Year 3 | Major overhaul | 8,200 | ||||||

| Year 4 | Revenue | 17,000 | ||||||

| Year 5 | Revenue | 15,000 | ||||||

| Year 5 | Salvage value | 7,000 | ||||||

Required

-

a.&b. Determine the payback period using the accumulated and average cash flows approaches. (Round your answers to 1 decimal place.)

In: Accounting

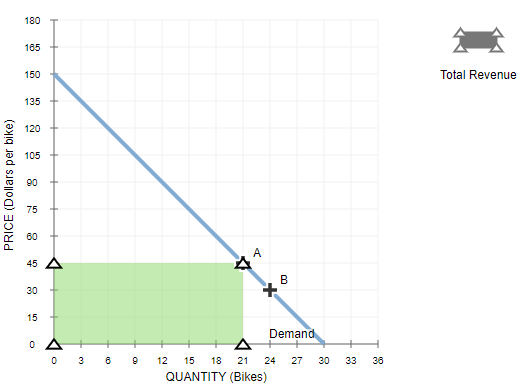

According to the midpoint method, the price elasticity of demand between points A and B is approximately _______ .

6. Elasticity and total revenue

The following graph shows the daily demand curve for bikes in San Diego.

Use the green rectangle (triangle symbols) to compute total revenue at various prices along the demand curve. Note: You will not be graded on any changes made to this graph.

On the following graph, use the green point (triangle symbol) to plot the annual total revenue when the market price is $30, $45, $60, $75, $90, $105, and $120 per bike.

According to the midpoint method, the price elasticity of demand between points A and B is approximately _______ .

Suppose the price of bikes is currently $30 per bike, shown as point B on the initial graph. Because the demand between points A and B is _______ , a $15-per-bike increase in price will lead to _______

in total revenue per day.

In general, in order for a price decrease to cause a decrease in total revenue, demand must be _______ .

In: Accounting

The demand for goods and services is called ____ demand, while the demand for resources is...

The demand for goods and services is called ____ demand, while the demand for resources is called ____ demand.

derived; derived

final; final

final; derived

derive; final

Which statement is true?

A change in derived demand brings about a change in final demand.

A change in final demand brings about a change in derived demand.

A rise in final demand is associated with a decline in derived demand.

None of these statements are true.

The additional revenue obtained by selling the output produced by one more unit of a resource is its

marginal physical product.

marginal revenue product.

final demand.

average revenue product.

Productivity is _________ per unit of __________.

output; input

input; output

labor; capital

None of these choices are true.

The additional output produced by one more unit of input is called:

Marginal revenue product

Marginal physical product

Average revenue product

Average physical product

In: Economics

A large national bank charges local companies for using their services. A bank official reported the...

A large national bank charges local companies for using their services. A bank official reported the results of a regression to predict the bank charges (Y) -- measured in dollars per month-- for services rendered to local companies. One independent variable used to predict service charges is the company's sales revenue (X) -- measured in millions of dollars. Data for 21 companies who use the bank's services were used to fit the simple linear regression model and the results are provided below:

Y = -2,700 + 20X

p value = .034

Interpret the p value

There is sufficient evidence to conclude that sales revenue is a useful linear predictor of service charge

There is insufficient evidence to conclude that sales revenue is a useful linear predictor of service charge

Sales revenue is a poor predictor of service charge

For every 1 million increase in revenue, you expect the service charge to increase .034

In: Statistics and Probability