Questions

LIFO METHOD

| Month | Amount | Price Paid |

| Nov 7 | 100 books | $18.00 per |

| Nov 21 | 100 books | $18.00 per |

| Nov 28 | 125 books | $18.25 per |

| Dec 4 | 150 books | $18.50 per |

| Dec 7 | 150 books | $19.25 per |

| Dec 15 | 150 books | $20.00 per |

In: Accounting

A 3-year maturity semiannual floating rate note is priced at 102.50 per 100 par value. Its...

- A 3-year maturity semiannual floating rate note is priced at 102.50 per 100 par value. Its coupon payments are based on LIBOR + 100 bps. Payment is made semiannually. The current LIBOR is 3%.

a) Calculate the discount margin on this FRN.

b) What would be the price of the FRN if the discount margin becomes 200 bps?

In: Finance

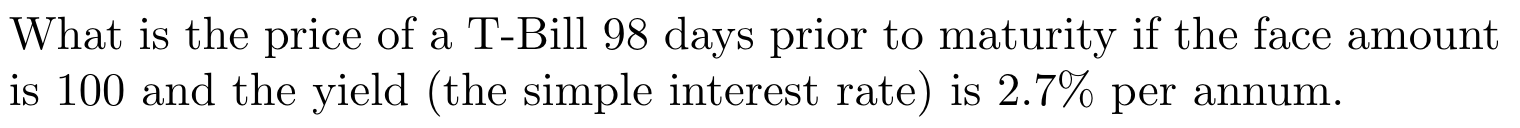

Price of T-Bill

What is the price of a T-Bill 98 days prior to maturity if the face amount is 100 and the yield (the simple interest rate) is 2.7% per annum.

In: Math

You own goods A and B. You are considering increasing price of good A by 10%....

You own goods A and B. You are considering increasing price of good A by 10%. Here is the information you have

Pa = 20

Qa = 1000

For each $1 increase in Pa, Qa will decrease by 100.

Pb = 12

Qb = 750

For each $1 increase in Pa, Qb will increase by 100.

(The point of this exercise is to have you do everything the long way then use the delta r formula so you can see the difference)

a . What is Total revenue of A before the price change?

b. What is total revenue of A after the price change?

c . What is Total revenue of B before the price change?

d. What is total revenue of B after the price change?

e. What is the change of revenue for A after the price changes?

f. What is the change or revenue for B after the price changes?

g. What is change in total revenue for both goods after price changes?

h. What is the own price elasticity for good A?

i. What is the cross price elasticity of A and B?

j. Calculate the change of revenue using the formula ∆ r =[ Rx (1 + EQx,Px) + Ry(EQy,Px)]%∆Px.

k. Explain why the two methods have different answers.

l. To calculate the change in total revenue from the price change, which method do you prefer? Doing parts a-g or doing part h-j? Briefly explain.

Only h-l

In: Economics

You own goods A and B. You are considering increasing price of good A by 10%....

You own goods A and B. You are considering increasing price of good A by 10%. Here is the information you have Pa = 20 Qa = 1000 For each $1 increase in Pa, Qa will decrease by 100. Pb = 12 Qb = 750 For each $1 increase in Pa, Qb will increase by 100. (The point of this exercise is to have you do everything the long way then use the delta r formula so you can see the difference) a . What is Total revenue of A before the price change? b. What is total revenue of A after the price change? c . What is Total revenue of B before the price change? d. What is total revenue of B after the price change? e. What is the change of revenue for A after the price changes? f. What is the change or revenue for B after the price changes? g. What is change in total revenue for both goods after price changes? h. What is the own price elasticity for good A? i. What is the cross price elasticity of A and B? j. Calculate the change of revenue using the formula provided in class. k. Explain why the two methods have different answers. l. To calculate the change in total revenue from the price change, which method do you prefer? Doing parts a-g or doing part h-j? Briefly explain.

In: Economics

Suppose the current stock price is $120 and the stock price in a year can be...

Suppose the current stock price is $120 and the stock price in a year can be either $150 or $100. The risk-free rate is 2% per year, compounded annually. Compute the price of a European put option that expires in a year. The strike price is K=$130 (Hint: This is a put option case, not a call option. Be careful when you compute the cash-flow at expiration date. All other calculations should be the same as call option case.)

In: Finance

2) The current price of a stock is $84. A one-month call option with a strike...

2) The current price of a stock is $84. A one-month call option with a strike price of $87 currently sells for $2.80. An investor who feels that the price of the stock will increase is trying to decide between two strategies that require the same upfront cost: Buying 100 shares or buying 3,000 call options (30 call option contracts). How high does the stock price have to rise for the option strategy to be more profitable?

In: Finance

Consider a long position of five July wheat contract futures contract each of which covers 5,000...

In: Finance

Assume you sold short 100 shares of common stock at $70 per share. The initial margin...

Assume you sold short 100 shares of common stock at $70 per share. The initial margin is 30%. What would be the maintenance margin if a margin call is made at a stock price of $85?

A) 40.5%

B) 20.5%

C) 35.5%

D) 23.5%

E) none of the above

53. You sold short 100 shares of common stock at $45 per share. The initial margin is 30%. At what stock price would you receive a margin call if the maintenance margin is 35%?

A) $50

B) $65

C) $35

D) $40

E) none of the above

In: Finance

Please show work. Alibaba is currently selling for $58 per share. In one year the price...

Please show work.

- Alibaba is currently selling for $58 per share. In one year the price will either be 114 or 42. The risk free rate is 5%. What is the premium of a call option on Alibaba with a strike price of 68 and one year until maturity?

-

- $0.71

- $6.50

- $3.90

- $11.50

- You purchased 100 shares of Pfizer at $16 and at the same time you bought a six-month put with a strike of $15 for $1.00. What is your profit or loss if you sell your shares and the put the day before expiration when Pfizer is at $12?

-

- -$200

- -$1,200

- $200

- $100

In: Finance