Questions

Oriole Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of...

Oriole Company began operations on January 1, 2019, adopting the

conventional retail inventory system. None of the company’s

merchandise was marked down in 2019 and, because there was no

beginning inventory, its ending inventory for 2019 of $38,300 would

have been the same under either the conventional retail system or

the LIFO retail system.

On December 31, 2020, the store management considers adopting the

LIFO retail system and desires to know how the December 31, 2020,

inventory would appear under both systems. All pertinent data

regarding purchases, sales, markups, and markdowns are shown below.

There has been no change in the price level.

|

Cost |

Retail |

|||||

|---|---|---|---|---|---|---|

|

Inventory, Jan. 1, 2020 |

$38,300 | $59,400 | ||||

|

Markdowns (net) |

13,300 | |||||

|

Markups (net) |

21,900 | |||||

|

Purchases (net) |

132,900 | 179,100 | ||||

|

Sales (net) |

169,500 | |||||

Determine the cost of the 2020 ending inventory under both (a) the

conventional retail method and (b) the LIFO retail method.

(Round ratios for computational purposes to 2 decimal

place, e.g. 78.72% and final answers to 0 decimal places, e.g.

28,987.)

| (a) |

Ending inventory using conventional retail method |

$enter a dollar amount rounded to 0 decimal places |

||

|---|---|---|---|---|

| (b) |

Ending inventory LIFO retail method |

$enter a dollar amount rounded to 0 decimal places |

In: Accounting

Sheridan Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of...

Sheridan Company began operations on January 1, 2019, adopting

the conventional retail inventory system. None of the company’s

merchandise was marked down in 2019 and, because there was no

beginning inventory, its ending inventory for 2019 of $37,500 would

have been the same under either the conventional retail system or

the LIFO retail system.

On December 31, 2020, the store management considers adopting the

LIFO retail system and desires to know how the December 31, 2020,

inventory would appear under both systems. All pertinent data

regarding purchases, sales, markups, and markdowns are shown below.

There has been no change in the price level.

|

Cost |

Retail |

|||||

|---|---|---|---|---|---|---|

|

Inventory, Jan. 1, 2020 |

$37,500 | $59,600 | ||||

|

Markdowns (net) |

13,000 | |||||

|

Markups (net) |

21,700 | |||||

|

Purchases (net) |

128,400 | 175,600 | ||||

|

Sales (net) |

170,100 | |||||

Determine the cost of the 2020 ending inventory under both (a) the

conventional retail method and (b) the LIFO retail method.

(Round ratios for computational purposes to 2 decimal

place, e.g. 78.72% and final answers to 0 decimal places, e.g.

28,987.)

| (a) |

Ending inventory using conventional retail method |

$enter a dollar amount rounded to 0 decimal places |

||

|---|---|---|---|---|

| (b) |

Ending inventory LIFO retail method |

$enter a dollar amount rounded to 0 decimal places |

In: Accounting

Sweet Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of...

Sweet Company began operations on January 1, 2019, adopting the

conventional retail inventory system. None of the company’s

merchandise was marked down in 2019 and, because there was no

beginning inventory, its ending inventory for 2019 of $38,100 would

have been the same under either the conventional retail system or

the LIFO retail system.

On December 31, 2020, the store management considers adopting the

LIFO retail system and desires to know how the December 31, 2020,

inventory would appear under both systems. All pertinent data

regarding purchases, sales, markups, and markdowns are shown below.

There has been no change in the price level.

|

Cost |

Retail |

|||||

|---|---|---|---|---|---|---|

|

Inventory, Jan. 1, 2020 |

$38,100 | $59,000 | ||||

|

Markdowns (net) |

13,000 | |||||

|

Markups (net) |

21,800 | |||||

|

Purchases (net) |

132,200 | 176,200 | ||||

|

Sales (net) |

166,800 | |||||

Determine the cost of the 2020 ending inventory under both (a) the

conventional retail method and (b) the LIFO retail method.

(Round ratios for computational purposes to 2 decimal

place, e.g. 78.72% and final answers to 0 decimal places, e.g.

28,987.)

| (a) |

Ending inventory using conventional retail method |

$enter a dollar amount rounded to 0 decimal places |

||

|---|---|---|---|---|

| (b) |

Ending inventory LIFO retail method |

$enter a dollar amount rounded to 0 decimal places |

In: Accounting

Tamarisk Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of...

Tamarisk Company began operations on January 1, 2019, adopting

the conventional retail inventory system. None of the company’s

merchandise was marked down in 2019 and, because there was no

beginning inventory, its ending inventory for 2019 of $38,900 would

have been the same under either the conventional retail system or

the LIFO retail system.

On December 31, 2020, the store management considers adopting the

LIFO retail system and desires to know how the December 31, 2020,

inventory would appear under both systems. All pertinent data

regarding purchases, sales, markups, and markdowns are shown below.

There has been no change in the price level.

|

Cost |

Retail |

|||||

|---|---|---|---|---|---|---|

|

Inventory, Jan. 1, 2020 |

$38,900 | $61,100 | ||||

|

Markdowns (net) |

12,900 | |||||

|

Markups (net) |

21,600 | |||||

|

Purchases (net) |

129,600 | 177,000 | ||||

|

Sales (net) |

170,100 | |||||

Determine the cost of the 2020 ending inventory under both (a) the

conventional retail method and (b) the LIFO retail method.

(Round ratios for computational purposes to 2 decimal

place, e.g. 78.72% and final answers to 0 decimal places, e.g.

28,987.)

| (a) |

Ending inventory using conventional retail method |

$enter a dollar amount rounded to 0 decimal places |

||

|---|---|---|---|---|

| (b) |

Ending inventory LIFO retail method |

$enter a dollar amount rounded to 0 decimal places |

In: Accounting

Sony Very few companies can claim to be globally successful, but Sony, which brought us the...

Sony

Very few companies can claim to be globally successful, but Sony, which brought us the Walkman and co-developed the CD and the DVD, has the numbers to prove it. In 2009, the company’s $76.361 billion in revenues were evenly distributed across mainly three markets: Japan, the United States, and Europe.

Headquartered in Japan, Sony is best known for its high- quality consumer electronics, which account for 61 percent of total revenues, but the firm also produces games, music, and pictures. Consumers might not own a Sony electronic system, but the movie they watched last night or the CD they listen to while jogging may be the intellectual property of a Sony company. Sony’s strategy boils down???? to product electrical gadgets?????? and controlling the content that goes through them much in the same way as its successful PlayStation 2 game console?????provides the hardware necess- ary for the firm to capture the games market.

In the 1980s, Sony’s Betamax lost the VCR war to JVC’s???????? VHS????????. Both systems had been developed in the mid- 1970s and initially Sony’s Betamax was the clear winner. Indeed, all movies were originally released in Betamax format. General wisdom argues that Betamax lost the VCR war because it failed to license its software to rival manufacturers while Matsushita licensed to all. Today, the Betamax–VHS battle is often cited to argue the benefits of licensing new technology.

Yet, how could Sony have been so reckless as to ignore the benefits of licensing? The answer is that it did not. In 1974, a year before the Betamax release, Sony approached JVC and Matsushita seeking to reach an agreement on standards for the new product. In doing so, it freely dis- closed Betamax’s patented specification and technology to its rivals. The VHS format developed by JVC used very similar technology, but, because of its different size, was incompatible with Betamax. Matsushita????was asked to choose between Sony’s and JVC’s product. Its decision came down to cost. It was cheaper to produce the VHS format because it had fewer components. With this, the players for the market were defined. The Betamax was to be manufactured by Toshiba, Sanyo Electric, NEC, Aiwa, and Pioneer. Matsushita, Hitachi, Mitsubishi Electric, Sharp, and Akai Electric manufactured JVC’s VHS.

Perhaps more important than the size of the VCR disks of the two formats was that the VHS format allowed record- ing for two hours, twice that of Betamax. This would have allowed consumers to record an entire movie while away for the night. Sony was close to integrating technology into its format that would have increased the recording time to that of the VHS. If this was what tilted????the balance, then all Sony would have needed is a bit of time. Potentially, at least, it could have bought itself some time if it owned the rights of the movies and refused to release them in anything but Betamax format. And so it is that Sony’s latest technological bets, the CD and DVD, have Sony Music Entertainment Inc????. and Sony Pictures Entertainment to back them up.

In today’s market, however, this type of vertical inte- gration can hamper???? the ability of the consumer electronics division to develop the products that consumers want. Practically every major development in the consumer elec- tronics industry in recent years has been developed by, or with the help of, Sony. Yet, very recently, Apple introduced the iPod, a very small and light device that can store up to 10,000 music files. The iPod is based on a small hard drive equipped with an audio function. Since similar memory cards are available across product lines in the industry and no other firm has Sony’s reputation in the audio market, why, then, did Sony not come up with its own version? One argument is that the conglomerate????must now weigh the benefits of developing a product in one division that may increase piracy???? of its music in another division.

If that is so, Sony is walking a fine line. Its electronics branch has ceased to produce stand-alone products and is instead integrating new products with others, which is likely to make piracy even easier than it is now. Soon, Sony hopes, your computer will be able to communicate with your television, stereo, and DVD player wirelessly, creating an integrated network of consumer electronics. And, if it all goes according to plan, Sony’s media content will flow within these networks.

With PlayStation 2, Sony’s dominance in the market for games was assured, at least in the short term, because it managed to capture most of the market and a games con- sole creates??????a barrier to other game marketers because of lack of compatibility and intellectual property owned by the firm. Other forms of entertainment, however, are not as easily monopolized. Indeed, most new products, like the iPod, are based on technology that is standardized or can be adapted to work with that of competitors. If products do not do this, they might suffer the fate of the Betamax.

1 Is Sony a multinational enterprise?

2 If the vast majority of Sony’s consumer electronics business is based and developed in Japan and the vast majority of Sony’s music and movie business is based in the United States, does Sony make decisions that are best for the entire company regardless of location?

3 Why does Sony need to license its technology to competitors?

In: Operations Management

The following information is taken from the 2010 annual report to shareholders of Hewlett-Packard (HP) Co.

The following information is taken from the 2010 annual report to shareholders of Hewlett-Packard (HP) Co.

Required:

a/ What is the balance in HP's allowance for doubtful accounts at the end of the fiscal years 2010 and 2009, respectively?

b/ What kind of account is the provision for doubtful accounts in HP's financial statements? (Note: Provision for doubtful accounts is synonymous with bad debt expense; that is, the charge against income for estimated uncollectible accounts from credit sales in that period)

c/ Using a T-account for the allowance for doubtful accounts, identify the amounts written off during the year 2010.

In: Accounting

Question 3 [14] Consider the following prices and quantities: Price (per kg) &nb

Question 3 [14] Consider the following prices and quantities:

|

Price (per kg) |

Quantities produced |

|||||

|

|

||||||

|

2010 |

2012 |

2015 |

2010 |

2012 |

2015 |

|

|

Beans |

3.95 |

3.89 |

4.13 |

675 |

717 |

436 |

|

Onions |

61.50 |

62.20 |

59.70 |

117 |

115 |

115 |

|

Carrots |

34.80 |

35.40 |

38.90 |

77 |

74 |

82 |

1. Compute and interpret the Paasche’s Quantity Index number for the year 2012 with 2010 as the base year. (7)

2. Compute and interpret the Laspeyres Price Index number for the year 2015 with 2012 as the base year

In: Statistics and Probability

Helix Company purchased tool sharpening equipment in April 1, 2010 for $72,000. The equipment was expected...

Helix Company purchased tool sharpening equipment in April 1, 2010 for $72,000. The equipment was expected to have a useful life of four years, or 9,000 operating hours, and a residual value of $2,700. The equipment was used for 2,400 hours during 2010, 4,000 hours in 2011, 2,000 hours in 2012, and 600 hours in 2013.

Instructions: Determine the amount of depreciation expense for the years ended December 31, 2010, 2011, 2012, and 2013 by each of the following methods:

1. Straight-line

2. The units of activity method

3. Double Declining balance method

In: Accounting

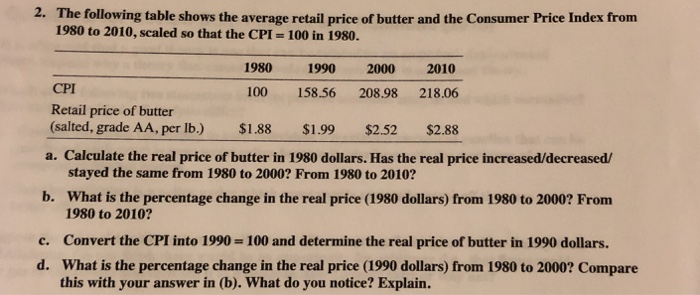

The following table shows the average retail price of butter and the Consumer Price Index from 1980 to 2010

The following table shows the average retail price of butter and the Consumer Price Index from 1980 to 2010, scaled so that the CPI 100 in 1980.

| 1980 | 1990 | 2000 | 2010 | |

|---|---|---|---|---|

| CPI | 100 | 158.56 | 208.98 | 218.06 |

| Retail price of butter (salted, grade AA, per lb.) | ||||

| $1.88 | $1.99 | $2.52 | $2.88 |

a. Calculate the real price of butter in 1980 dollars. Has the real price increased/decreased/ stayed the same from 1980 to 2000? From 1980 to 2010?

b. What is the percentage change in the real price (1980 dollars) from 1980 to 2000? From 1980 to 2010?

c. Convert the CPI into 1990- 100 and determine the real price of butter in 1990 dollars.

d. What is the percentage change in the real price (1990 dollars) from 1980 to 2000? Compare this with your answer in (b). What do you notice? Explain.

In: Economics

The following data give the average price received by fishermen for several species of fish in...

The following data give the average price received by fishermen for several species of fish in 2000 and 2010. The price is in cents per pound.

| Fish | Year 2000 Price (x) | Year 2010 Price (y) |

|---|---|---|

| COD | 13.1 | 56.0 |

| FLOUNDER | 15.3 | 166.7 |

| HADDOCK | 25.8 | 105.5 |

| MENHADEN | 1.8 | 41.3 |

| PERCH | 4.9 | 104.2 |

| CHINOOK | 55.4 | 236.8 |

| COHO | 39.3 | 135.6 |

| ALBACORE | 26.7 | 84.6 |

| SOFT SHELLED CLAMS | 47.5 | 222.6 |

| LOBSTERS AMERICAN | 94.7 | 374.7 |

| SEA SCALLOPS | 135.6 | 432.6 |

| SHRIMP | 47.6 | 225.4 |

- Create a regression equation for the data.

ˆy=y^= Round to 2 decimal places. - What is the correlation coefficient between the 2000 and 2010

prices.

Round to 2 decimal places. - If a type of fish was 41.3 cents per pound in 2000, how much would you expect to pay for it in 2010?

In: Statistics and Probability